Posted in Financial Accounting, Financial Management

on Feb 21st, 2014 | 0 comments

Applications of fund

- Purchase of fixed assets – leads to outflow of funds, but at the same time adding assets to your organization always improves the financial position of your firm. You can also use these assets as “collaterals” for availing loans in banks.

- Redemption of preference shares – you have to apportion your operating profit in order to satisfy the preference share holders with interest. This will give you a clear idea of the earnings available for the equity share holders.

- Fund that is lost during business operations – Due to wrong investments and credit policies, sometimes your funds get sticky and recovery becomes next to impossible.

- Repayment of loans – although the fund goes out, you free yourself from further interest burden and reduce your credit limit with the bank. Remember,it is better to repay the loans from your profit.

- Redemption of debentures – It is easy to raise money from debentures, because people are rest assured of their payment at a fixed date. But the cost of servicing the debt might sometime exceed the concessional advantages on raising such securities.

https://gumroad.com/l/wqbu

A systematic study of fund flow facilitates in ascertaining the soundness of your firm’s financial condition and it also helps to formulate the right kind of dividend policies.

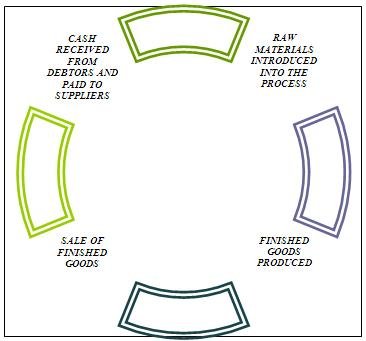

Net working capital is the life line of a firm’s day-to-day operations and we can surely say that a company is prosperous if it has a surplus of net working capital at any given point of time.

The financial manager of your company should have the vision to predict changes in the stock market and play the cards accordingly. It needs an in-depth understanding and analysis of the market conditions with a wider perspective.