Currently Browsing: Principles of Management

Posted by Managementguru in Operations Management, Principles of Management, Technology

on May 12th, 2014 | 0 comments

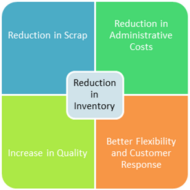

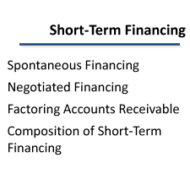

Just in Time Manufacturing Concept JIT Philosophy: With the progression in product-process technologies and the hybrid manufacturing systems, the Japanese have been perfecting a manufacturing system called ‘Just in Time’ or ‘JIT’. This JIT operating system is nothing but a production strategy that strives to improve business return on investment by reducing in-process inventory and associated carrying costs. The JIT purchasing system has emphasis on timing to supply materials just in time for use on the factory floor. Equally important emphasis is given to close and long term relationship with a few suppliers. The suppliers in JIT manufacturing are geographically closely located. Specifications: Producing and delivering finished goods ‘just in time’ to be sold Partly finished goods ‘just in time’ to be assembled into finished goods Parts ‘just in time’ to go into partly finished goods Materials ‘just in time’ to be made into parts. Loose specifications instead of rigid product specifications are used which leads to best use of supplier specialization and expertise for low cost and better quality. Frequent deliveries (daily deliveries) of small lots of exact quantities required are supplied directly to the shop floor avoiding large inventories, paper work and double inspection. The JIT system underlines the mutual confidence between buyer and supplier and long term relationship. This leads to investment by the supplier for the benefit of the buyer in terms of plant and equipment for improvement of quality, reduction of cost and shortening manufacturing lead times. Where does the responsibility lie? ‘The responsibility for the quality rests with the manufacturer of the part’ is the principle behind this Japanese practice. The primary responsibility for quality is transferred from quality control department to the production department. The quality control is considered a line function rather than staff function. The processes are designed to have less specialization on the part of workers. The physical layout is arranged in such a way that workers can operate two or three machines effectively and thereby become multifunctional. Good Quality First Time Every Time: Workers are organized in small closely linked groups thereby building team work. The production for each stage is planned in small lot sizes just meeting the needs of the subsequent stage. The system is such that even if one item produced is substandard, it would affect subsequent processes causing shortages and exposing the process or worker who has produced substandard item. This acts as a great motivator to produce good quality first time, every time. This also heightens the awareness among the workers about the inter dependence of processes. Taiichi Ohno, Father of the Toyota Production System saw this as an attribute rather than a problem. He used an analogy of lowering the water level in a river to expose the rocks to explain how reducing inventory showed where production flow was disrupted. Once bottle necks were exposed, they could be rectified or removed. Since one of the main barriers was rework, lowering inventory shoved each shop to improve its own quality. Just-in-time is a means to improving performance of the system, not an end. The result of the Japanese manufacturing system is quite pervasive in the areas of: Reduction in inventory Reduction in scrap Reduction in work Reduction in indirect costs Reduction in spare Reduction in administrative costs Increase in motivation of workers Increase in quality Better response to customers Better system flexibility and quicker response. What is kanban? Kanban is Japanese for “visual signal” or “card.” Toyota line-workers used a Kanban (i.e., an actual card) to signal steps in their manufacturing process. The system’s highly visual nature allowed teams to communicate more easily on what work needed to be done and when. It...

Posted by Managementguru in Decision Making, Entrepreneurship, International Business, Organisational behaviour, Principles of Management

on Apr 29th, 2014 | 0 comments

Sole Proprietorship – Features and Advantages Sole Proprietorship is a business owned and controlled by only one person. The proprietor who sows, reaps and harvests the output of his labor owns all the assets in his firm. This form of business organization is one of the most popular forms in India and the reason being the advantages it offers. Here, business can be started simply after obtaining necessary manufacturing license and permit. Setting up Process: Setting up a sole proprietorship entity is trouble-free as compared to other form of companies. Unlike Limited Liability Partnership (LLP) or any other private or public companies; in sole proprietorship you do not need to file an application to ROC- Registrar of Companies. You need to choose a name for your business, open a bank account and take license for varied services including Service Tax, VAT, IEC, Shops & Establishment license, PAN, Importer Exporter Code, ESI, Professional Tax, Central Excise Duty, CST Registration, Employee Provident Fund Registration etc. After acquiring the respective licenses one can commence with his her sole proprietorship firm in India. Some important licenses you may need for starting a sole proprietorship firm in India: PAN CARD Permanent Account Number (PAN) is a ten-digit alphanumeric number, issued in the form of a laminated card, by the Income Tax Department. It is mandatory to quote PAN on return of income, all correspondence with any income tax authority. A typical PAN is AABPS1205E. A complete overview of pancard can be seen at – http://www.incometaxindia.gov.in/pan/overview.asp New PAN CARD application – https://tin.tin.nsdl.com/pan/ TAN CARD Tax Deduction Account Number (TAN) is an alphanumeric number issued to individuals who are required to deduct tax on payments made by them under the Indian Income Tax Act, 1961. The Tax Deducted at Source on payments made by assessees has to be deposited under the following number to enable the assessees who have received the payments to claim the tax deducted in their income tax return. So TAN is the abbreviation for Tax deduction and collection Account Number. Application for tan card – https://tin.tin.nsdl.com/tan/ SERVICE TAX REGISTRATION Service tax has to be paid to the Government of India by the service provider who collects the same form his customers. As on 1st May, 2006, 95 services are identified as taxable services in India. Section 64 of the Finance Act, 1994, extends the levy of service tax to the whole of India, except the State of Jammu & Kashmir. The current rate is 12.36 % on the gross value of the service. Service tax can be paid online – https://www.aces.gov.in/ VAT AND CST VAT (Value Added Tax) is a form of indirect tax imposed only on goods sold within a particular state, which essentially means that the buyer and the seller exist in the same state. Only when tangible goods and products are sold, VAT can be imposed. VAT (Value Added Tax) is governed by respective state Acts. Every state has a separate and distinct VAT act reserved for their state. CST (Central Sales Tax) is a form of indirect tax imposed only on goods sold from one state to another state, which particularly takes into account that the buyer and the seller exist in two different states. CST (Central Sales Tax) is governed by Central Sales Tax Act, 1956. This tax is governed by a single central act, though the chargeability is state specific. Registration for VAT AND CST IN Tamil Nadu – http://www.tnvat.gov.in/English/NewDealerRegist.aspx THE BUSINESS VIABILITY CHECKLIST FOR ENTREPRENEURS IMPORT EXPORT CODE: DGFT – Directorate General of Foreign Trade runs various schemes for trade promotion and facilitation. Using this facility you may file, prepare and track online application in...

Posted by Managementguru in Business Management, Decision Making, Human Resource, Organisational behaviour, Principles of Management

on Apr 19th, 2014 | 0 comments

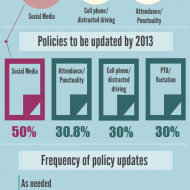

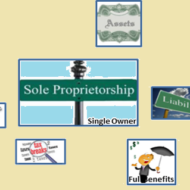

Business Policies – Framing and Execution Business policies are the keystone in the arch of management and the life-blood for the successful functioning of business, because without well-laid down policies, there cannot be lasting improvements in the economic condition of the firm and labor-management relations. A policy is a positive declaration and a command to its followers. It translates the goals of an organization into selected routes and provides the general guidelines that prescribe and proscribe programmes, which in turn, dictate practices and procedure. Attainment of Objectives: Buisness policies are general statement of principles for the attainment of objectives which serve as a guide to action for the executives at different levels of management. They pave a broad way in which the sub-ordinates tread along towards accomplishing their objectives. Hierarchy: For each set of objectives at each level, there is a corresponding set of policies. The Board of Directors determine the basic overall corporate policiesThe top management decides on the executive corporate policiesManagers decide on the departments / divisional policiesMiddle managers handle the sectional policies Consistent Decisions contributing to the Objectives: The policies delimit the area within which a decision has to be made; however, they do allow some discretion on the part of the man on the firing line, otherwise, they would be mere rules. At the same time too much of discretion in policy matters may prove harmful to the accomplishment of organizational objectives and hence it is generally within limits. Mutual Application: Policies in general are meant for mutual application by sub ordinates. They are fabricated to suit a specific situation in which they are applied, for they cannot apply themselves. Unified Structure: Policies tend to predefine issues, avoid repeated analysis and give a unified structure to other types of plans, thus permitting managers to delegate authority while maintaining control. Policies for all Functional Areas: In a well-structured and managed organization, policies are framed for all functional levels of management. Corporate planningMarketingResearch and DevelopmentEngineeringManufacturingInventoryPurchasePhysical DistributionAccountingFinanceCostingAdvertisingPersonal SellingSpecial Promotion, are some areas that require clear-cut policies. Clear-Cut Guidelines: Policies serve an extremely useful purpose in that they avoid confusion and provide clear-cut guidelines. This enables the business to be carried on smoothly and often without break. They lead to better and maximum utilization of resources, human, financial and physical, by adhering to actions for...

Posted by Managementguru in Business Management, Financial Accounting, Financial Management, Principles of Management

on Apr 10th, 2014 | 0 comments

Unsecured and Secured Short Term Sources Unsecured Non-Bank Short Term Sources Commercial Paper: Short-term, unsecured promissory notes, generally issued by large corporations, with maturities of a few days to 270 days. Usually issued in multiples of $100,000 or more. Commercial paper market is composed of the (1) dealer and (2) direct-placement markets. Advantage: Cheaper than a short-term business loan from a commercial bank. Dealers require a line of credit to ensure that the commercial paper is paid off. Private Loans: A short term unsecured loan may be taken from a wealthy shareholder, a major supplier, or other parties interested in assisting the firm through a short term difficulty. Cash Advances for Customers: A customer may pay for all or a portion of future purchases before receiving the goods. This aids the firm to purchase raw materials and produce the final goods. This form of financing is a special arrangement for expensive or custom-made items that would strain the financial resources of the manufacturing company. Secured Short-term Sources: Security (collateral) — Asset (s) is pledged by a borrower to ensure repayment of a loan. If the borrower defaults, the lender may sell the security to pay off the loan. Collateral value depends on: Marketability Life Riskiness Types of Inventory Backed Loans: Field Warehouse Receipt — A receipt for goods segregated and stored on the borrower’s premises (but under the control of an independent warehousing company) that a lender holds as collateral for a loan. Terminal Warehouse Receipt — A receipt for the deposit of goods in a public warehouse that a lender holds as collateral for a loan. Trust Receipt – This loan is secured by specific and easily identified collateral that remains in the control or physical possession of the borrower. A security device acknowledging that the borrower holds specifically identified inventory and proceeds from its sale in trust for the lender. Example: When automobile dealers use this kind of financing for the cars in their showrooms or in stock, it is called floor planning. As implied by the name, this kind of loan requires a considerable degree of trust in the honesty and integrity of the borrower. Once the inventory is sold or the receivable is collected, payment must be remitted to the lender. If there is a default, the loan is said to be secured by bogus collateral. These loans are common when the collateral is easily identified by description or serial number and then each item of collateral has relatively large dollar value. Floating Lien — A general, or blanket, lien against a group of assets, such as inventory or receivables, without the assets being specifically identified Chattel Mortgage — A lien on specifically identified personal property (assets other than real estate) backing a loan. Financial Institutions: Primary sources of secured short term financing are banks and financial institutions, including insurance companies, finance companies, and the financial subsidiaries of major corporations. The best mix of short-term financing depends on: Cost of the financing method Availability of funds Timing Flexibility Degree to which the assets are encumbered It is always better to go for bank loans or loans from established and long standing private institutions because there is a leverage for the debtors to sit for discussions to sort out issued in case of defaults. All banks in India are trying to close accounts labeled under NPA- Non Performing assets either by recovering the money through one time settlement (OTS) or by auctioning the collaterals pledged during the time of loan sanctioning. If you happen to take loans from individuals or third-parties, you cannot enjoy this comfort or breather. Some Finance Quotes and Sayings for You: A...

Posted by Managementguru in Business Management, Financial Accounting, Financial Management, Principles of Management

on Apr 8th, 2014 | 0 comments

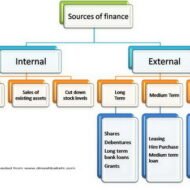

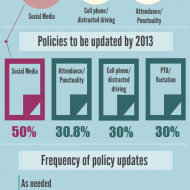

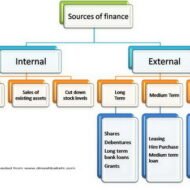

Interest Free Sources and Unsecured Interest Bearing Sources A firm obtains its funds from a variety of sources. Some capital is provided by suppliers, creditors, and owners, while other funds arise from earnings retained in business. In this segment, let me explain to you the sources of short-term funds supplied by creditors. Characteristics of short-term financing: Cost of Funds: Some forms of short-term financing may prove to be expensive than that of intermediate and long-term financing while some short-term sources like Accruals and Payables provide funds at no cost to the firm. Rollover Effect: Short-term finance as the name indicates must be repaid within a period of one year – though some sources provide funds that are constantly rolled over. The funds provided by payables, may remain relatively constant because, as some accounts are paid, other accounts are created. Clean-up: This happens when commercial banks or other lenders demand the firm to pay-off its short term obligation at one point in a financial year. Goals of Short-Term Financing: Funds are needed to finance inventories during a production period. Short term funds facilitate flexibility wherein, it meets the fluctuating needs for funds over a given cycle, commonly 1 year. To achieve low-cost financing due to interest free loans. Cash flow from operations may not be sufficient to keep up with growth-related financing needs Interest Free Sources: Accounts Payable Accounts payable are created when the firm purchases raw material, supplies, or goods for resale on credit terms without signing a formal note for the liability. These purchases on “open account” are, for most firms, the single largest source of short-term financing. Payables represent an unsecured form of financing since no specific assets are pledged as collateral for the liability. Even though no formal note is signed, an accounts payable is a legally binding obligation of a firm. Postponing payment beyond the end of the net (credit) period is known as “stretching accounts payable” or “leaning on the trade.” Possible costs of “stretching accounts payable” are Cost of the cash discount (if any) forgone Late payment penalties or interest Deterioration in credit rating Accruals: These are short term liabilities that arise when services are received but payment has not yet been made. The two primary accruals are wages payable and taxes payable. Employees work for a week, 2 weeks or a month before receiving a paycheck. The salaries or wages, plus the taxes paid by the firm on those wages, offer a form of unsecured short-term financing for the firm. The Government provides strict rules and procedures for the payment of withholding and social security taxes, so that the accrual of taxes cannot be readily manipulated. It is however, possible to change the frequency of paydays to increase or decrease the amount of financing through wages accrual. Wages — Benefits accrue via no direct cash costs, but costs can develop by reduced employee morale and efficiency. Taxes — Benefits accrue until the due date, but costs of penalties and interest beyond the due date reduce the benefits. Unsecured Interest Bearing Sources: Self-Liquidating Bank Loans The bank provides funds for a seasonal or cyclic business peak and the money is used to finance an activity that will generate cash to pay off the loan. Borrowed Funds → Finance Inventory → Peak Sales Season → Receivables → Cash → Pay Off the Loan. Three types of unsecured short-term bank loans: Single payment note – A short-term, one-time loan made to a borrower who needs funds for a specific purpose for a short period of time. Line of Credit – An informal arrangement between a bank and its customer specifying the maximum amount of...