Currently Browsing: Decision Making

Posted by Managementguru in Decision Making, Entrepreneurship, Human Resource, Leadership

on Apr 21st, 2015 | 0 comments

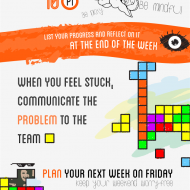

Top Ten Tips for First Time Managers Everybody wants to become a leader. You may vie for it, I might die for it; but in reality not everybody can make a good leader. Leadership does seek persons who are unique in their own way. One unique element which I’ve noticed in managers or leaders is that when they enter the work place, they bring along with them a kind of aura that has the power to make others submissive and polite. Not to say they are over-powering but definitely the sub-ordinates would love to greet their heads with such vigor so as to be in their good books combined with a sense of loyalty laced with respect. This session talks about “First Time Managers” who have reached the position by chance or choice and the etiquettes needed to be bestowed upon that position. 1. Learning is Eternal: “கற்றது கைமண் அளவு, கல்லாதது உலகளவு –This quote by the famous Tamil lady poet Avvaiyar who lived in 13th century reminds you “What you have learned is a mere handful; what you haven’t learned is the size of the world” and exhibited at NASA. It can also be written as “Known is a drop, unknown is an Ocean.” See how appropriate she is in indicating the finer points in our lives- just because you are a team leader or a manager does not mean that you are near perfect. You may be lacking the self-confidence to lead a team or you might be falling short in communicating clearly with the team down the line. It is always better to play along with the team, understand their psychology and at the same time exercise your rights at the right spots. You will stand to gain so much by being flexible and empathetic. 2. Communication is the Key: Here I want to take the help of the ManagementGuru Peter Drucker who prescribed the medicine for better management which is “Management by Objectives.” Keep your team fully informed of project goals, priorities, and all-important deadlines and also involve them to set short term goals. A periodical review of the goals and results would put them in place and make your work easy. Effective communication makes you trust worthy in the eyes of your team, also provides clear direction and a sense of belongingness. 3. Inspire your Team: Passion is one element that is infectious and the other being smile. If you are passionate and sincere in your work, the enthusiasm flows like honey on ice-cream all over the workplace. A good manager creates that “Feel-Good-Factor’ whenever he is around. It is his confidence, emotional stability, communication and determination that gets carried on facilitating effective accomplishment of the enterprise goals. An infographic from AN ETHICAL ISLAND– A great guide for leaders and managers… 4. Be a Friend: Efficient managers understand the pulse of work-force just from their body language and communicating styles. It becomes difficult sometimes to read between the lines when employees are hard nuts to crack and would not explicitly convey or talk about important issues that are bothering them. This may be due to fear, anxiety or peer pressure. These are the times when a manager has to behave like a friend in listening to them patiently to understand the crux of the problem so as to find a suitable solution. 5. Spontaneous appreciation and Mild Criticism: Think about the happiness you derive when somebody appreciates you for a good effort or achievement. The same applies to your team also, right! Appreciation for the sake of appreciating will fetch you only negative results, it has to be spontaneous. Even a mild nod of approval, a...

Posted by Managementguru in Change management, Decision Making, How To

on Mar 20th, 2015 | 0 comments

How to find a job you love and do it with passion (not for people who want to become billionaires) a. Self-Discovery: Try to find out what kind of activities you enjoy doing the most and explore if you could turn that hobby or free time activity into a revenue generating source. When you do something with the single aim of earning money or generating profit, an unnecessary pressure comes and sits on your shoulder and presses you down. Follow ManagementGuru Net’s board Interview Prep on Pinterest. For example, if you like music, you could set up a band with like-minded individuals. You may ask how you can even compare the sophistication of a blue collar job with this kind of free-lancing. The issue here is job satisfaction and ultimately the effect of job dis-satisfaction on your health physically or mentally (Of course both are inter-related). If you love gardening, you can always set up a nursery and serve your community. Procure unique saplings and educate the masses on how to keep a small garden. And believe me, people are longing for green atmospheres and there is always scope for you to extend your services into landscaping. Tags: To know the kind of person you are, the kinds of activities you enjoy doing, activities you are doing those are not satisfying to you. b. Personal Identity: The highlight of doing something that you love for a living is that, it reflects your personal identity. Try finding a way to make money doing the things you like to do. Quit doing a job that creates mental and /or physical problems and gauge whether it is directly associated to your job dis-satisfaction. Tags: Personal Identity, Job dissatisfaction. c. Simplify Your Life: Simplify your life so you need less money, allowing you to engage in activities that are satisfying to you, even if they make little or no money. This works out well if you are a single/unmarried person, but when you raise a family it becomes a tough task to make the ends meet and you may start doubting your own abilities to make money. Modern world with all the technological advancements has made man lethargic and technology-dependent. Your son/daughter may not go with your ideas and treat you as an alien if you want to be any different from others. Tags: Simple life, Satisfying work We are able to see a lot of people who work for the IT industry suffering due to their weird work-hours, mental pressure and work-life imbalance. People at one point want to break the hell loose and get out of the monotony. Our education system also plays a big role in shaping the destiny of the future generation. Youngsters must be encouraged to pursue something they are good at and are willing to do. This is all easier said than done. But you will know you have found the right path for yourself when you get up each morning eager to face the day to do the things you like doing and which financially support you. This article is written based on the publication of Prof. Sydney Ross Singer, Medical Anthropologist. To see his posts on academia.edu visit this link...

Posted by Managementguru in Business Management, Decision Making, Financial Management, Marketing, Sales, Startups, Strategy

on Mar 4th, 2015 | 0 comments

A popular “Corporate Portfolio Analysis” technique is the result of pioneering effort of General Electric Company along with McKinsey Consultants which is known as the GE NINE CELL MATRIX. GE Nine-Box Matrix This is a strategy tool that offers a systematic approach for the multi business enterprises. It helps them to prioritize their investments among the various business units. It is a framework that evaluates business portfolio and provides further strategic implications. Each business is appraised in terms of two major dimensions – Market Attractiveness and Business Strength. If one of these factors is missing, then the business will not produce desired results. Neither a strong company operating in an unattractive market, nor a weak company operating in an attractive market will do very well. The vertical axis denotes industry attractiveness, which is a weighted composite rating based on eight different factors. They are: Market size and growth rateIndustry profit margins Intensity of Competition Seasonality Product Life Cycle Changes Economies of scale Technology Social, Environmental, Legal and Human Impacts What Does the Horizontal Axis Represent? It indicates business strength or in other words competitive position, which is again a weighted composite rating based on seven factors as listed below: Relative Market ShareProfit margins Ability to compete on price and qualityKnowledge of customer and market Competitive strength and weakness Technological capability Caliber of management The two composite values for industry attractiveness and competitive position are plotted for each strategic business unit (SBU) in a COMPANY’S PORTFOLIO. The PIE chart (circles) denotes the proportional size of the industry and the dark segments denote the company’s respective market share. The green zone suggests you to ‘go ahead’, to grow and build, pushing you through expansion strategies. Businesses in the green zone attract major investment. Red indicates that you have to adopt turnover strategies of divestment and liquidation or rebuilding approach. Advantages Helps to prioritize the limited resources in order to achieve the best returns.The performance of products or business units becomes evident. It’s more sophisticated business portfolio framework than the BCG matrix. Determines the strategic steps the company needs to adopt to improve the performance of its business portfolio. Disadvantages Needs a consultant or an expert to determine industry’s attractiveness and business unit strength as accurately as possible.It is expensive to conduct. It doesn’t take into account the harmony that could exist between two or more business units. PORTER’S FIVE FORCES-INDUSTRY...

Posted by Managementguru in Business Management, Change management, Decision Making, Entrepreneurship, Human Resource, Leadership, Motivation

on Oct 1st, 2014 | 0 comments

Helpful Tips for Young leaders Here’s a random list of practical advice for young leaders. If you can learn and practice these early in your career, it will help you avoid having to learn them by experience. Delegate, Trust People down the line and Take Advice: While a young business leader may have a flair for leading from the front, one should realize that limited experience is a limiting factor. People are far more likely to take a manager seriously only if he or she listens to and heeds advice. When you act as the sole proprietor of making decisions in your company, people working for you start losing faith in you. It creates what is called “NEGATIVE VIBES” which is not at all good for the overall development of an organization. It is a good practice to communicate and consult with your immediate sub-ordinates before going for big decisions. Learn to let go of control. It is but appropriate to include employees in decision making and you shall be definitely rewarded with more workable strategies. Set an Example: At the same time, one of the most effectual ways to display ability is to lead by example and work hard. A leader must be prepared to shoulder a fair share of the work-load and the #involvement and #commitment he exhibits is undoubtedly infectious and projects him a great team player. The most effective way to earn respect is to lead from the front and help others succeed. Be wary about your conduct, behavior and actions and deeply aware of how it may influence others. Show #conviction: A leader has to have conviction in his/her decisions. If the young manager has done proper ground work and research, then the decision may well be the right one and he/she might be able to stand by and justify the decisions made even when challenged by experienced people. I thoroughly go with this viewpoint “A ‘No‘ uttered from the deepest conviction is better than a ‘Yes‘ merely uttered to please, or worse, to avoid trouble.” Mahatma Gandhi A leader should learn to say ‘NO’ at the right time as indecisiveness is one of history’s greatest leadership killers. Top 25 Leadership Quotes Keep Your Cool in Crisis: Part of being a successful leader is how you handle pressure. In the dynamic business environment you may have to face more challenging and stressful situations and your employees’ judge you based on how you treat such pressure. If you are a man who can see things from the right perspective embracing rationale, your team members will feel reassured by your cool composure, which will in turn develop their trust and confidence in the leader. Manage expectations: Have you ever given a thought about what employees’ expect in you? Communication is a natural gift for leaders and you may very well notice that great leaders are excellent communicators. Here, communication isn’t just talking but a one-on-one, heart-to-heart talk as you would with your close family members. By opening the lines of communication and being accessible, a leader can build a team with people who understand the ##goals and #objectives with ultimate clarity. Present Yourself with Dignity: In Tamil language, there is an age old proverb, “Aal Paadhi Aadai Paadhi”, meaning “#Good Looks Make the Work Easy”. In this modern world, a professional look is mandatory to signify your culture and #personality. A professional, well-dressed businessperson, gives the impression that he thinks that the workplace and the people there are important.” Marilyn Monroe once rightly said “I don’t mind making jokes, but I don’t want to look like...

Posted by Managementguru in Business Management, Decision Making, Financial Management, Marketing, Strategy

on Sep 29th, 2014 | 0 comments

What is meant by Mergers and Acquisitions? This is a general term used to refer to the #amalgamation of companies. A merger is a combination of two companies to form a new company, while an acquisition is the purchase of one company by another in which no new company is formed. Mergers and acquisitions refers to the buying, selling and combining of different companies to aid a company in a specific industry to grow quickly without having to create another business entity. Growth due to Internal and #External Expansion: A business might grow either by #internal expansion or by external expansion. In the case of internal expansion, a firm grows progressively through procurement of new #assets, substitution of the technologically out-dated equipments and the setting up of new product line. But in external expansion, a firm secures a running business and grows overnight through corporate combinations. These combinations are in the form of mergers, acquisitions, amalgamations and takeovers and have now become important features of #corporate restructuring. Why Mergers & Acquisitions: Mergers and acquisitions are strategic decisions taken for boosting up company’s growth by augmenting its production and marketing operations. One of the main reasons that companies opt for a merger or acquisition is that, by conjoining business undertakings, performance will increase and costs will decrease. Essentially, a business will attempt to merge with another business that has complementary #strengths and weaknesses. Many M&A deals allow the #bidder to thrash future competition and gain a larger market share in its product’s market. Mergers or amalgamations may take two forms:- #Merger through Absorption:- An absorption is a combination of two or more companies into an ‘existing company’. All companies except one lose their identity in such a merger. Example: 1999 merger of Glaxo Wellcome and SmithKline Beecham, both firms ceased to exist and a new firm GlaxoSmithKline was created. #Merger through Consolidation:– A consolidation is a combination of two or more companies into a ‘new company’. In this form of merger, all companies are legally dissolved and a new entity is created. Here, the acquired company transfers its assets, #liabilities and shares to the acquiring company for cash or exchange of shares. A fundamental characteristic of merger is that the acquiring company (existing or new) assumes the #ownership of other companies and combines their operations with its own operations. Reverse Merger Is a deal facilitating a private company to become a public company. The deal enables private company by listing in a short time period. Occurs when a private company has strong prospects and is eager to raise financing, buys a publicly listed shell company. Usually the public one is one with, no business and limited assets Acquisitions and Takeovers #Reverse Takeover Acquisition usually refers to purchase of smaller firm by larger firm Sometimes, smaller firm acquire #management control of a larger / longer established company Keep its name for combined entity Friendly Acquisition Companies accomodate in negotiations Identical to merger of equals Cognizant to Acquire TriZetto, creating a fully-integrated healthcare technology and operations leadership. With more than $3 billion in combined healthcare revenue, Cognizant and TriZetto will serve nearly 245,000 healthcare providers. Hostile Acquisition Takeover target reluctant to be purchased If the #acquiree company has no prior knowledge of offer Hostile takeovers do turn friendly most of the times. Offer is usually upgraded for smooth acquisitions Benefits of Mergers and Acquisitions Greater Value Generation Generate Cost Efficiency #Economies of Scale Increase in Market Share Gain higher...