Posted by Managementguru in Accounting, Decision Making, Management Accounting, Project Management

on Apr 1st, 2014 | 0 comments

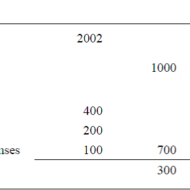

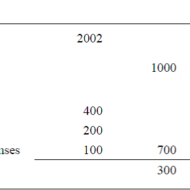

ACCOUNTING AND DECISION MAKING – IDENTIFYING THE PROBLEM SITUATION Learn accounting and finance basics so you can effectively analyze business data to make key management decisions. Business owners are faced with countless decisions every business day. Managerial accounting information provides data-driven input to these decisions, which can improve decision-making over the long term. Fig 1.1- ACCOUNTING INFORMATION FOR A SINGLE PRODUCT The above illustration clearly depicts that there has been a loss of Rs.100 in one year’s time for this particular product. The reason can be attributed to the increase in the “cost of goods” whereas other expenses have remained the same in both the years. For a single product manufactured, the problem is identifiable and solvable. But when the organization is producing a range of products, you need to apply some accounting technique by which the product losing money is identified and suitable measures are taken to cut down the escalating cost. Fig 1.2- Accouning Information for a Product Range The above illustration compares and contrasts the relationship of three products a company manufactures. It is seen that products P1 and P2 are doing well. Though the cost of sales has gone up for P1 and P2, the sales volume has also increased thus increasing the gross profit over the period of time. Here the product that has to be dealt with is P3 whose sales volume has drastically gone down, yet with the same cost of sales. When there is an increase in cost of sales, two things have to be considered. Identifying the problem-product Either cut down the production cost or increase the selling-price if the product has a real demand in the market. Uses of Accounting Data: Accounting information helps the management to arrive at make or buy decisions, to outsource production of certain components to cut down or control costs, to expand the production, to increase the sales volume or to downsize their project capacity. Techniques like Break-Even Analysis, Costing and Budgeting aid in going for the right production-mix, marketing-mix and sales target plans for the respective financial years. Aggregate Planning: As we all know planning is the key to the future and financial planning has to be given utmost importance for a production process. Aggregate planning involves translating long-term forecasted demand into specific production rates and the corresponding labor requirements for the intermediate term. It takes into consideration a period of 6 to 18 months, breaking it into work modules weekly or monthly and planning for the specific period in terms of men, material and...

Posted by Managementguru in Accounting

on Feb 21st, 2014 | 0 comments

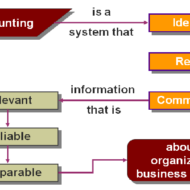

Functions of Accounting: a. Recording: Accounting records business transactions in terms of money. It is essentially concerned with ensuring that all business transactions of financial nature are properly recorded. Recording is done in journal, which is further subdivided into subsidiary books from the point of view of convenience. b. Classifying: Accounting also facilitates classification of all business transactions recorded in journal. Items of similar nature are classified under appropriate heads. The work of classification is done in a book called the ledger. c. Summarizing: Accounting summarizes the classified information. It is done in a manner, which is useful to the internal and external users. Internal users interested in these informations are the persons who manage the business. External users of information are the investors, creditors, tax authorities, labor unions, trade associations, shareholders, etc. d. Interpreting: It implies analyzing and interpreting the financial data embodied in final accounts. Interpretation of the data helps the management, outsiders and shareholders in decision making. Limitations of Accounting: Accounting information is expressed in terms of money. Non monetary events or transactions, however important, are completely omitted. Fixed assets are recorded in the accounting records at the original cost, that is, the actual amount spent on them plus all incidental charges. In this way the effect of inflation (or deflation) is not taken into consideration. The direct result of this practice is that balance sheet does not represent the true financial position of the business. Accounting information is sometimes based on estimates; estimates are often inaccurate. Accounting information cannot be used as the only test of managerial performance on the basis of more profits. Profit for a period of one year can readily be manipulated by omitting such costs as advertisement, research and development, depreciation and so on. Accounting information is not neutral or unbiased. Accountants calculate income as excess of revenues over expenses. But they consider only selected revenues and expenses. They do not, for example, include, cost of such items as water or air pollution, employee’s injuries, etc. Accounting Made Easy Accounting like any other discipline has to follow certain principles, which in certain cases are contradictory. For example current assets (e.g., stock of goods) are valued on the basis of cost or market price whichever is less following the principle of conservatism. Accordingly the current assets may be valued on cost basis in some year and at market price in another year. In this manner, the rule of consistency is not followed...

Posted by Admin in Accounting, Management Accounting

on Jan 29th, 2014 | 0 comments

Management accounting combines accounting, finance and management with the leading edge techniques needed to drive successful businesses. The process of preparing management reports and accounts that provide accurate and timely financial and statistical information required by managers to make day-to-day and short-term decisions