Posted by Managementguru in How To, Learning, Productivity, Time Management, Training & Development

on Dec 20th, 2017 | 0 comments

Tips to increase your learning efficiency This article is well crafted by Anish Passi, Director at Neostencil, an Ed-Tech startup. Neostencil is an online and unique platform for UPSC Test Preparations where you can access live classrooms from the comfort of your home. NeoStencil offers you expert guidance for Civil Services exams, from doyens in this field, top teachers from popular IAS coaching institutes in Delhi, who have had years of experience in successfully mentoring the candidates to develop a holistic approach to their preparation for the exams. Learning is a continuous process, and one should always be keen to explore and learn more, anytime and anywhere. There is no better investment you can make towards improving yourself than acquiring more knowledge. When you are eager to learn, it will automatically improve your learning efficiency. Many times we have to improve our focus to learn something specific. For example, if an individual is preparing for UPSC examination, then you have to learn or prepare in a structured manner. Your UPSC exam training is time-bound for one. So, no matter what your general approach to learning is, at this particular time, you will need to put in a directed effort to improve your chance of qualifying as an IAS officer. Monitor your routine Now that you are preparing for an exam, your focus and energy must be diverted to achieve more in the given time frame. But, that should not be a cause for worry. You can keep stress at bay if you focus on learning fast and quicker than usual. By that we mean, you should attune your mind to find the value-add at every stage of your preparation. If you start looking for something new or in addition to what you know, you will look for resources, people and interaction with a purpose. You know what you are looking for and this way, you can achieve more than you hoped for. Open your mind You can only learn more if you have an open mind to invite suggestions and guidance. If you think you can do it all on own and don’t need assistance from people around you, then, you are at the risk of enclosing yourself in a closed box. Don’t make learning claustrophobic. It is good to read books, gain insight, but it is equally important to put that knowledge in a practical and constructive framework. It can only happen if you share knowledge and invite feedback, discussions, debates and even healthy arguments. It will make you more confident, and it will help you learn from a fresh perspective as well. Start using online chats, discussion forums, etc. Discover a new learning platform every day. Be self-dependent Since it is you and only you who knows what exactly you need to learn, it is therefore vital for you to be a self-dependent person. Take the initiative to be a part of learning forums like virtual ‘live’ classrooms and do it with the intention of contributing and participating in the discussion. It is essential to be visible in the discussion, reflecting exuberance and confidence. Also, always be inquisitive and interested to find out more, whatever be your source. You can learn by listening to others, and at times, you can learn better by debating on the same topic with others. It is as simple as that. Read and Read more Reading can help you gain a competitive edge. If you have an insight on the topic, then only can you discuss or share your knowledge with others. Reading enables you to understand every subject in detail and takes you in-depth, posing new questions, points and a unique perspective on...

Posted by Managementguru in Financial Management

on Dec 19th, 2014 | 0 comments

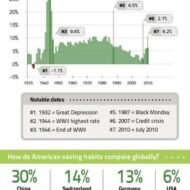

Meaning and Definition of Finance Meaning of Finance The science that describes the management, creation and study of money, banking, credit, investments, assets and liabilities. The financial systems include the public, private and government spaces, and the study of finance and financial instruments, which can relate to countless assets and liabilities. Finance is divided into three distinct categories: public finance, corporate finance and personal finance, all three consisting of many sub-categories. The one word which can easily substitute finance is “exchange.” Finance is nothing but an exchange of available resources. Finance is not restricted only to the exchange and/or management of money. A barter trading system is also a type of finance. Thus, we can say, Finance is an art of managing various available resources like money, assets, investments, securities, etc. Some Definitions of Finance The concept of finance includes capital, funds, money, and amount. But each word has its unique meaning. Studying and understanding the concept of finance becomes an important part of the business concern. Definition of Business Finance According to the Wheeler, “Business finance is that business activity which concerns with the acquisition and conversation of capital funds in meeting financial needs and overall objectives of a business enterprise”. According to the Guthumann and Dougall, “Business finance can broadly be defined as the activity concerned with planning, raising, controlling, administering of the funds used in the business”. In the words of Parhter and Wert, “Business finance deals primarily with raising, administering and disbursing funds by privately owned business units operating in non-financial fields of industry”. The term finance comes from the Latin “finis” which means end or finish . It is a term whose implications affect both individuals and businesses, organizations and states it has to do with obtaining and using or money management – Ivan Thompson According to Bodie and Merton, finance is the “study how scarce resources are allocated over time”. Corporate Finance Corporate finance is concerned with budgeting, financial forecasting, cash management, credit administration, investment analysis and fund procurement of the business concern and the business concern needs to adopt modern technology and application suitable to the global environment. Corporate finance is the area of finance dealing with the sources of funding and the capital structure of corporations and the actions that managers take to increase the value of the firm to the shareholders, as well as the tools and analysis used to allocate financial resources. The financial activities related to running a corporation. A division or department that oversees the financial activities of a company. Corporate finance is primarily concerned with maximizing shareholder value through long-term and short-term financial planning and the implementation of various strategies. Everything from capital investment decisions to investment banking falls under the domain of corporate finance. According to the Encyclopedia of Social Sciences, “Corporation finance deals with the financial problems of corporate enterprises. These problems include the financial aspects of the promotion of new enterprises and their administration during early development, the accounting problems connected with the distinction between capital and income, the administrative questions created by growth and expansion, and finally, the financial adjustments required for the bolstering up or rehabilitation of a corporation which has come into financial difficulties”. The core corporate finance principles can be stated as follows: The Investment Principle: It is better to invest in assets and projects that yield a return greater than the minimum acceptable hurdle rate. The hurdle rate should be higher for riskier projects and should reflect the financing mix used—owners funds (equity) or borrowed money (debt). Returns on projects should be evaluated based on cash flows generated and the timing of these cash flows; they should...

Posted by Managementguru in Business Management, Change management, Human Resource, Organisational behaviour, Principles of Management

on Mar 31st, 2014 | 0 comments

India often looks at Japanese or American models to comprehend the concepts of management. In reality, Indian scriptures can be considered as treasuries of management. The Bhagavat Gita, the Vedas and the Epics highlight the true spirit of working together and the need for de-stressing the self for enhanced performance levels. The idea of NISHKAMYAM (to perform one’s own work without expecting a result) is truly said to be the highest ideology preached by Lord Krishna. What Induces Stress? A dynamic condition in which an individual is presented with an opportunity or confronted with a demand, related to what she or he desires and for which the outcome is uncertain but important, can be called a stressful situation. The consequences of stress in an organizational set up express themselves in the form of physiological, psychological or behavioral symptoms, which are harmful to the individuals who experience high levels of stress. Symptoms of stress: AnxietyDepressionIncreased job dissatisfactionAbsenteeismDecline in productivityRapid turn overHigh blood pressureHeart diseasesHead aches Stress Can be Motivating: While long term stress is harmful to the individual and organization as well, it is said that short term stress serves the purpose of task accomplishment by individuals or groups, within the stipulated time. It serves as a motivation factor rather than a causative agent of frustration. It has been proved by scientists and medical researchers that stress has a direct effect on the metabolism of a person, that causes increase in heart and breathing rates, increase in blood pressure, thus inducing heart attacks. Equally important are the behavioral and attitudinal changes that are created by stress, which cannot be overlooked. Job Satisfaction: Psychological symptoms arise due to job-related dissatisfaction, boredom, work pressure, irritability and procrastination. Sometimes forceful involvement may also lead to decreased job satisfaction. The job to be carried out can be finished at the particular time if the individual is able to give one’s best shot. But when it is performed under stress, they complete the job with dissatisfaction. When the incumbent is asked to perform a task that lacks clarity, naturally ambiguity arises in his mind followed by anxiety. Behavioral Symptoms of Stress Changes in productivity levels, absence, and rapid staff turnover are stress symptoms of behavioral nature. It might be expressed even in the form of increased smoking, consumption of alcohol etc., Say for instance, in production department, when there is a need to supply a product in a very limited time, the workers may be active initially, but the performance slows down when they get totally tired or dissatisfied with the work. Again the demand by the superior adds additional stress that reaches unmanageable levels. Similarly, people taking care of administration, banking, marketing and other office related works fall a prey to stress. How to manage stress? From an organization view point, it is believed that a limited amount of stress may work wonders in terms of performance, with stress acting as a “positive stimulus”. But even low levels of stress are likely to be perceived as undesirable from an individual’s stand point. How could be the notion of management and individuals be different on the acceptable levels of stress? It does not solve the purpose. Individuals have to understand that, they have to live up to the expectations of the management in order to enhance their credit ratings, in terms of promotion and pay. They have to understand that challenges are to be perceived as opportunities to prove their mettle. Self and situational analysis, work analysis, time management and physical well- being are some techniques that practically solve problems of stress. “De-stressing the Self” Techniques for Employees Organisations can reduce stress of the employees...

Posted by Managementguru in Change management, Economics, International Business, Principles of Management

on Mar 15th, 2014 | 0 comments

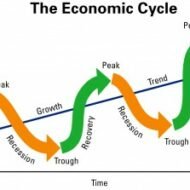

Factors That Influence Global Economy The industrial and business environment of developing countries has been subjected to a sea of changes owing to the economic reforms and policies in the light of globalization, privatization and liberalization. A long term economic vision is necessary for these countries to establish themselves in the global market which facilitates the process of becoming self sufficient in due course of time. Let me present you with a synopsis of how this change can happen and how countries are adapting themselves in lieu of the global economic boom. Multi Brand Retail Markets: Many multinational companies have acquired and are trying to acquire a major part of equity in multibrand retail markets of the host country and sometimes they opt for Joint ventures to factorize the economy of scale which also proves to be a win-win situation for both the parties. Developing countries have altered their economic views on foreign direct investment and are very liberal in their attitude in providing with the necessary licenses. The entry of multinational companies and their potential investment has even altered core sectors like power, oil and telecommunications. Moreover, the benefit of cheap labor, economic subsidies for the start of operations in economically backward regions lures foreign investors. Rush of Entrepreneurship: There is a rush of entrepreneurship in the developing countries, in the form of setting up of small scale industries, cottage industries for which liberal subsidies are provided by the governments to encourage the act of entrepreneurialism. Also people want to go for diversification, mergers and acquisitions in the wake of global competition. Capital Markets’ Role: Capital markets have gained new buoyancy. The rapid growth of stock market and its influence over the international economic scenario have made foreign brokers to keenly follow the market changes for potential investment. The one striking feature of the economy of developing countries is that, it is a self made economy and withstands the pressures of the business cycle, such as recession and inflation, unlike foreign markets that have failed to stabilize their markets owing to what is called sub prime lending, a plan that has failed to achieve the desired economic growth. Instead of making the capital market alive with fresh infusions of funds, it has left many banks and financial institutions bankrupt. Banking Sector: Banking sector has scaled to greater heights and has come under a competitive environment. Deregulation of interest rates to attract potential investors, new technology, products and aggressive marketing usher in new competition; disinvestment of government equity in nationalized banks have made banks to operate as commercial institutions and their services get marketed as branded consumer products. Financial services have emerged as a new business and funding options are aplenty increasing the chances of raising capital. This has evolved as a separate and major source of business fetching revenue to the service providers. Private Sector: Private sector is gaining importance in countries like India, where they have entered all the core industries like oil, mining, telecommunications, road building, railways, ports, civil aviation etc. This serves as a revenue source for the government and this kind of economic restructuring has brought a wave of enthusiasm amongst the potential investors. Imports have become an entrepreneurial activity and are out of the government domain and this has been facilitated by relaxation of licensing hassles. These are some of the recent trends in the developing countries that have captured the interest of multinational...