Posted by Managementguru in Financial Accounting, Financial Management

on Dec 29th, 2014 | 0 comments

Scope of Financial Management Facebook Buys WhatsApp: Boneheaded or Brilliant? This was the title of a Forbes Article when Mark Zuckerberg acquired Whatsapp for $19 billion dollars, the price that may exceed the GNP of some of those countries. Mark is said to be an unconventional thinker and the WhatsApp acquisition shows Facebook’s determination to follow the road not yet paved. It is a bold move, yet filled with risks along the way. This is one of the finest examples of the big investment decisions of recent times and the right course of action, if you measure the number of potential users of the mobile messaging service rather than the cost of acquiring each user and the potential for selling ads to each user today. Follow these mind blowing tips to become prosperous Picture Courtesy : YoungHstlrs Financial management is one of the important aspects of overall management, which is directly asscoiated with various functional departments like personnel, marketing and production. Financial management embraces wide area with multidimensional approaches. The following are the important scope of financial management. Some of the major scope of financial management are as follows: 1. Investment Decision 2. Financing Decision 3. Dividend Decision 4. Working Capital Decision. 1. Investment Decision: The investment decision involves Risk EvaluationMeasurement of cost of capital andEstimation of expected benefits from a project. Capital budgeting and liquidity are the other two major components of investment decision. Capital budgeting takes care of the distribution of capital and commitment of funds in permanent assets to harvest revenue in future. Capital budgeting is a very focal decision as it impacts the long-term success and growth of a firm. All the same it is a very tough decision because it encompasses the estimation of costs and benefits which are uncertain and unknown. Picture Courtesy: Crowdfundingheroes 2. Financing Decision: Financing decision is related to financing mix or financial structure of the firm. The raising of funds requires decisions regarding Methods and sources of financeRelative proportion and choice between alternative sourcesTime of floatation of securities, etc. In order to meet its investment needs, a firm can raise funds from various sources. Long Term Sources of Finance: Share Capital or Equity SharesPreference Capital or Preference SharesRetained Earnings or Internal AccrualsDebenture / BondsTerm Loans from Financial Institutes, Government, and Commercial BanksVenture FundingAsset SecuritizationInternational Financing by way of Euro Issue, Foreign Currency Loans, ADR, GDR etc. Picture Courtesy: Cash & Treasury Management file Medium Term Sources of Finance: Preference Capital or Preference SharesDebenture / BondsMedium Term Loans fromFinancial InstitutesGovernment, andCommercial BanksLease FinanceHire Purchase Finance Short Term Sources of Finance: Trade CreditShort Term Loans like Working Capital Loans from Commercial BanksFixed Deposits for a period of 1 year or lessAdvances received from customersCreditorsPayablesFactoring ServicesBill Discounting etc. 3. Dividend Decision: In order to accomplish the goal of wealth maximization, a proper dividend policy must be established. One feature of dividend policy is to decide whether to distribute all the profits in the form of dividends or to plough back the profit into business. While deciding the optimum dividend payout ratio (proportion of net profits to be paid out to shareholders), the finance manager should consider the following: Investment opportunities available to the firmPlans for expansion and growth,Dividend stabilityForm of dividends, i.e., cash dividends or stock dividends, etc. 4. Working Capital Decision: Working capital decision is related to the FINANCING in current assets and current liabilities. Current assets include cash, receivables, inventory, short-term securities, etc. Current liabilities consist of creditors, bills payable, outstanding expenses, bank overdraft, etc. Current assets are those assets which are convertible into cash within a year. Similarly, current liabilities are those liabilities, which are likely to mature for payment within...

Posted by Managementguru in Accounting, Business Management, Financial Accounting

on Jul 2nd, 2014 | 0 comments

Understanding Working Capital: It is the life blood of business. Funds needed for the purchase of raw materials, payment of wages and other day-to-day expenses are known as working capital. It is part of the firm’s capital, which is being used for financing short-term operations. Hence, it may also be termed as Circulating Capital or Short-Term capital. “Working capital means current assets” –Mead, Malott and Field. “Any acquisition of funds which the current asset increases working capital, for, they are one and the same.” – J.S.mill Financial troubles and issues arise only when this entity called ‘working capital’ is not properly managed. Every successful company will hire a financial manager to deal with issues relating to finance while the CEO can look into matters relating to promotion of the product or service and the position of the company in the market. The ‘Sales Turnover or Sales Volume’ is the key issue you have to look into to gauge whether you have sufficient working capital to manage that big a volume for that particular period. You have to rotate your funds wisely keeping in mind the credit policies your company offers and the credits you may enjoy with your supplier, bank interest for the short-term loans etc. Concept of WC: Working capital implies excess of current assets over current liabilities. Funds invested in current assets is known as “Gross Working Capital.” The difference between current assets and current liabilities is known as “Net Working Capital.” What are the two types? Permanent or fixed: It is the minimum amount of current assets required for conducting the business operation. This capital will remain permanent in current assets and should be financed out of long-term funds. The amount varies from year to year, depending upon the growth of a company. Temporary or Variable: It is the amount of additional current assets required for a short period. It is needed to meet the seasonal demands at different times during a year. The capital can be temporary and should be financed out of short-term funds. The working capital starts decreasing when the peak season is over. Various Factors Influencing WC: Nature of business: Service oriented concerns like electricity; water supplies need limited working capital while a manufacturing concern requires sufficient working capital, since they have to maintain stock and debtors. Credit Policies: A company which allows credit to its customers shall need more amount while a company enjoying credit facilities from its suppliers will need lower amount of working capital. Manufacturing Process: Conversion of raw materials into finished goods is called manufacturing or production. Longer the process, higher the requirement of working capital. Rapidity of turnover: High rate of turnover requires low amount and lower and slow moving stocks need a larger amount of working capital. Say, jewelry shops have to maintain different types of designs calling for high working capital. Fast moving goods like grocery requires low working capital. Business cycle: Changes in economy has a say over the requirement of working capital. When a business is prosperous, it requires huge amount of capital; also during depression huge amount is needed for unsold stock and uncollected debts. Seasonal variation: Industries which are manufacturing and selling goods seasonally require large amount of working capital. Fluctuation of supply: Firms have to maintain large reserves of raw material in stores, to avoid uninterrupted production which needs large amount of working capital. Dividend policy: If a conservative dividend policy is followed by the management, the need for working capital can be met with the retained earnings, it consequently drains off large amounts from working capital pool. ...

Posted by Managementguru in Accounting, Decision Making, Financial Management, Management Accounting, Principles of Management

on Mar 30th, 2014 | 0 comments

TURNOVER RATIO OR ACTIVITY RATIO or ASSET MANAGEMENT RATIO Turnover ratios are also known as activity ratios or efficiency ratios with which a firm manages its current assets. The following turnover ratios can be calculated to judge the effectiveness of asset use. Inventory Turnover Ratio Debtor Turnover Ratio Creditor Turnover Ratio Assets Turnover Ratio 1. INVENTORY TURNOVER RATIO This ratio indicates whether investment in stock is efficiently used or not, in other words, the number of times the inventory has been converted into sales during the period. Thus it evaluates the efficiency of the firm in managing its inventory. It helps the financial manager to evaluate the inventory policy. It is calculated by dividing the cost of goods sold by average inventory. Inventory Turnover Ratio = Cost of goods sold / Average Inventory (or) Net Sales / Average Stock Cost of goods sold = Sales-Gross profit Average Stock =Opening stock + Closing stock/2 2. DEBTOR TURNOVER RATIO Debtors play a vital role in current assets and to a great extent determines the liquidity of a firm. This indicates the number of times average debtors have been converted into cash during a year. It is determined by dividing the net credit sales by average debtors. Debtor Turnover Ratio = Net Credit Sales / Average Trade Debtors (or) Net Credit Sales / Average Debtors – Average Bills Receivable Net credit sales = Total sales – (Cash sales + Sales return) Total debtors = [ Op.Dr. + Cl.Dr. / 2 + Op.B/R + Cl. B/R / 2] When the information about credit sales, opening and closing balances of trade debtors is not available then the ratio can be calculated by dividing total sales by closing balances of trade debtor Debtor Turnover Ratio = Total Sales / Trade Debtors Note: Bad and doubtful doubts and their provisions are not deducted from the total debtors. The higher ratio indicates that debts are being collected promptly. 3. CREDITOR TURNOVER RATIO This is also known as “Creditors Velocity”. It indicates the number of times sundry creditors have been paid during a year. It is calculated to judge the requirements of cash for paying sundry creditors. It is calculated by dividing the net credit purchases by average creditors. Creditor Turnover Ratio = Net Credit Purchases / Average Trade Creditor (or) Net Credit Purchases / Average Creditors + Average Bills Payable Net credit purchases = Total purchases – (Cash purchase + Purchase return) Total Creditors = [Op.Cr. + Cl.Cr. / 2 + Op. B/P + Cl. B/P / 2] The higher ratio should indicate that the payments are made promptly. Net credit purchases consist of gross credit purchases minus purchase return. When the information about credit purchases, opening and closing balances of trade creditors is not available then the ratio is calculated by dividing total purchases by the closing balance of trade creditors. Creditor Turnover Ratio = Total purchases / Total Trade Creditors 4. ASSETS TURNOVER RATIO The relationship between assets and sales is known as assets turnover ratio. Several assets turnover ratios can be calculated depending upon the groups of assets, which are related to sales. a) Total asset turnover. b) Net asset turnover c) Fixed asset turnover d) Current asset turnover e) Net working capital turnover ratio a. TOTAL ASSET TURNOVER This ratio shows the firms ability to generate sales from all financial resources committed to total assets. It is calculated by dividing sales by total assets. Total asset turnover = Total Sales / Total Assets b. NET ASSET TURNOVER This is calculated by dividing sales by net assets. Net asset turnover =Total Sales / Net Assets Net assets represent total assets minus current liabilities. Intangible and fictitious assets like goodwill, patents, accumulated losses, deferred expenditure may be excluded for...

Posted by Managementguru in Accounting, Financial Management, Management Accounting, Principles of Management

on Mar 30th, 2014 | 0 comments

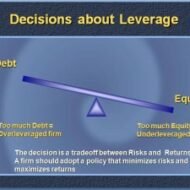

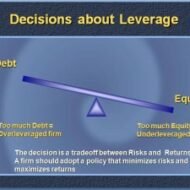

SOLVENCY OR LEVERAGE RATIOS Long-term solvency ratios analyze the long-term financial position of the organization. Bankers and creditors are interested in the liquidity of the firm, whereas shareholders, debenture holders and financial institutions are concerned with the long term prosperity of the firm. There are thus two aspects of the long-term solvency of a firm. Ability to repay the principal amount when due Regular payment of the interest. The ratio is based on the relationship between borrowed funds and owner’s capital it is computed from the balance sheet, the second type is calculated from the profit and loss a/c. The various solvency ratios are Debt equity ratio Debt to total capital ratio Proprietary (Equity) ratio Fixed assets to net worth ratio Fixed assets to long term funds ratio Debt service (Interest coverage) ratio 1. DEBT EQUITY RATIO OR EXTERNAL – INTERNAL EQUITY RATIO Debt equity ratio shows the relative claims of creditors (Outsiders) and owners (Interest) against the assets of the firm. The relationship between borrowed fund and capital is shown in debt-equity ratio. It can be calculated by dividing outsider funds (Debt) by shareholder funds (Equity) Ebt equity ratio = Outsider Funds (Total Debts) / Shareholder Funds or Equity (or) Long-term Debts / Shareholders funds Shareholders fund = Preference capital + Equity capital + Reserves & Surplus – Goodwill & Preliminary expenses Outsiders funds = Current liabilities + Debentures + Loans The ideal ratio is 2:1. High ratio means, the claim of creditors is greater than owners and vice-versa 2. DEBT TO TOTAL CAPITAL RATIO Debt to total capital ratio = Total Debts / Total Assets 3. PROPRIETARY (EQUITY) RATIO This ratio indicates the proportion of total assets financed by owners. It is calculated by dividing proprietor (Shareholder) funds by total assets. Proprietary (equity) ratio = Shareholder funds / Total Tangible assets The ideal ratio is 1:3. A ratio below 50% may be alarming for creditors, because they incur loss during winding up. 4. FIXED ASSETS TO NET WORTH RATIO This ratio establishes the relationship between fixed assets and shareholder funds. It is calculated by dividing fixed assets by shareholder funds. Fixed assets to net worth ratio = Fixed Assets X 100 / Net Worth The shareholder funds include equity share capital, preference share capital, reserves and surplus including accumulated profits. However fictitious assets like accumulated deferred expenses etc should be deducted from the total of these items to shareholder funds. The shareholder funds so calculated are known as net worth of the business. 5. FIXED ASSETS TO LONG TERM FUNDS RATIO Fixed assets to long term funds ratio establishes the relationship between fixed assets and long-term funds and is calculated by dividing fixed assets by long term funds. Fixed assets to long term funds ratio = Fixed Assets X 100 / Long-term Funds 6. DEBT SERVICE (INTEREST COVERAGE) RATIO This shows the number of times the earnings of the firms are able to cover the fixed interest liability of the firm. This ratio therefore is also known as Interest coverage or time interest earned ratio. It is calculated by dividing the earnings before interest and tax (EBIT) by interest charges on loans. Debt Service Ratio = Earnings before interest and tax (EBIT) / Interest...