Posted by Managementguru in Business Management, Entrepreneurship, Financial Management, Project Management, Startups

on Jul 19th, 2014 | 0 comments

What is a Startup Cost? Non-recurring costs associated with setting up a business, such as accountant’s fees, legal fees, registration charges, as well as advertising, promotional activities, and employee training. Also called startup expenses, preliminary expenses, or pre-opening expenses. Let me clarify that this discussion pertains to small and medium size enterprise startup costs and not about capital budgeting. Any project that an entrepreneur wishes to undertake has four factors to be considered. Men Material Machine Money Finance is the lifeblood of any business and to be successful, one must, inject sufficient capital into it. Many businesses fail because of under-capitalization. Seed Money Requirements To determine how much seed money you need to start, you must estimate the costs of doing business at least for the first year. Expenses may be categorized as ‘one-time costs’ such as the fee for incorporating your business or the price of a sign for your building. Some will be ‘ongoing costs’, such as the cost of utilities, inventory, insurance, etc. There is a pressing need for you to bring enough working capital to run the day-to-day business affairs. Without a projected fund flow statement and proposal, no bank or financial institution shall offer you long term loans to run the business. First of all, you need to write the business plan and ask yourself the following questions. Ask yourself these 20 questions to make sure you’re thinking about the right key business decisions: Why am I starting a business? What kind of business do I want? Who is my ideal customer? What products or services will my business provide? Am I prepared to spend the time and money needed to get my business started? What differentiates my business idea and the products or services I will provide from others in the market? Where will my business be located? How many employees will I need? What types of suppliers do I need? How much money do I need to get started? Will I need to get a loan? How soon will it take before my products or services are available? How long do I have until I start making a profit? Who is my competition? How will I price my product compared to my competition? How will I set up the legal structure of my business? What taxes do I need to pay? What kind of insurance do I need? How will I manage my business? How will I advertise my business? Courtesy – http://www.sba.gov/ See ‘Short Term Financing’ to know more about financing your business. The term finance sanctioned in the form of ‘Term Loan’ is required for Land and site development Building and civil works Plant and Machinery Installation expenses and Miscellaneous fixed assets which comprise vehicles, furniture and fixtures, office equipment, workshop and laboratory equipment, distribution of power and water supply etc. Expenditure on infrastructure facilities like water supply, power connection, roads, transportation etc., has to be particularly considered if the units are located in economically backward areas. Startup...

Posted by Managementguru in Business Management, Decision Making, Human Resource, Organisational behaviour, Principles of Management

on Apr 19th, 2014 | 0 comments

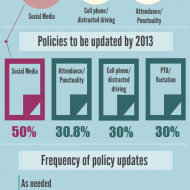

Business Policies – Framing and Execution Business policies are the keystone in the arch of management and the life-blood for the successful functioning of business, because without well-laid down policies, there cannot be lasting improvements in the economic condition of the firm and labor-management relations. A policy is a positive declaration and a command to its followers. It translates the goals of an organization into selected routes and provides the general guidelines that prescribe and proscribe programmes, which in turn, dictate practices and procedure. Attainment of Objectives: Buisness policies are general statement of principles for the attainment of objectives which serve as a guide to action for the executives at different levels of management. They pave a broad way in which the sub-ordinates tread along towards accomplishing their objectives. Hierarchy: For each set of objectives at each level, there is a corresponding set of policies. The Board of Directors determine the basic overall corporate policiesThe top management decides on the executive corporate policiesManagers decide on the departments / divisional policiesMiddle managers handle the sectional policies Consistent Decisions contributing to the Objectives: The policies delimit the area within which a decision has to be made; however, they do allow some discretion on the part of the man on the firing line, otherwise, they would be mere rules. At the same time too much of discretion in policy matters may prove harmful to the accomplishment of organizational objectives and hence it is generally within limits. Mutual Application: Policies in general are meant for mutual application by sub ordinates. They are fabricated to suit a specific situation in which they are applied, for they cannot apply themselves. Unified Structure: Policies tend to predefine issues, avoid repeated analysis and give a unified structure to other types of plans, thus permitting managers to delegate authority while maintaining control. Policies for all Functional Areas: In a well-structured and managed organization, policies are framed for all functional levels of management. Corporate planningMarketingResearch and DevelopmentEngineeringManufacturingInventoryPurchasePhysical DistributionAccountingFinanceCostingAdvertisingPersonal SellingSpecial Promotion, are some areas that require clear-cut policies. Clear-Cut Guidelines: Policies serve an extremely useful purpose in that they avoid confusion and provide clear-cut guidelines. This enables the business to be carried on smoothly and often without break. They lead to better and maximum utilization of resources, human, financial and physical, by adhering to actions for...

Posted by Managementguru in Accounting, Decision Making, Financial Management, Management Accounting, Principles of Management

on Mar 30th, 2014 | 0 comments

TURNOVER RATIO OR ACTIVITY RATIO or ASSET MANAGEMENT RATIO Turnover ratios are also known as activity ratios or efficiency ratios with which a firm manages its current assets. The following turnover ratios can be calculated to judge the effectiveness of asset use. Inventory Turnover Ratio Debtor Turnover Ratio Creditor Turnover Ratio Assets Turnover Ratio 1. INVENTORY TURNOVER RATIO This ratio indicates whether investment in stock is efficiently used or not, in other words, the number of times the inventory has been converted into sales during the period. Thus it evaluates the efficiency of the firm in managing its inventory. It helps the financial manager to evaluate the inventory policy. It is calculated by dividing the cost of goods sold by average inventory. Inventory Turnover Ratio = Cost of goods sold / Average Inventory (or) Net Sales / Average Stock Cost of goods sold = Sales-Gross profit Average Stock =Opening stock + Closing stock/2 2. DEBTOR TURNOVER RATIO Debtors play a vital role in current assets and to a great extent determines the liquidity of a firm. This indicates the number of times average debtors have been converted into cash during a year. It is determined by dividing the net credit sales by average debtors. Debtor Turnover Ratio = Net Credit Sales / Average Trade Debtors (or) Net Credit Sales / Average Debtors – Average Bills Receivable Net credit sales = Total sales – (Cash sales + Sales return) Total debtors = [ Op.Dr. + Cl.Dr. / 2 + Op.B/R + Cl. B/R / 2] When the information about credit sales, opening and closing balances of trade debtors is not available then the ratio can be calculated by dividing total sales by closing balances of trade debtor Debtor Turnover Ratio = Total Sales / Trade Debtors Note: Bad and doubtful doubts and their provisions are not deducted from the total debtors. The higher ratio indicates that debts are being collected promptly. 3. CREDITOR TURNOVER RATIO This is also known as “Creditors Velocity”. It indicates the number of times sundry creditors have been paid during a year. It is calculated to judge the requirements of cash for paying sundry creditors. It is calculated by dividing the net credit purchases by average creditors. Creditor Turnover Ratio = Net Credit Purchases / Average Trade Creditor (or) Net Credit Purchases / Average Creditors + Average Bills Payable Net credit purchases = Total purchases – (Cash purchase + Purchase return) Total Creditors = [Op.Cr. + Cl.Cr. / 2 + Op. B/P + Cl. B/P / 2] The higher ratio should indicate that the payments are made promptly. Net credit purchases consist of gross credit purchases minus purchase return. When the information about credit purchases, opening and closing balances of trade creditors is not available then the ratio is calculated by dividing total purchases by the closing balance of trade creditors. Creditor Turnover Ratio = Total purchases / Total Trade Creditors 4. ASSETS TURNOVER RATIO The relationship between assets and sales is known as assets turnover ratio. Several assets turnover ratios can be calculated depending upon the groups of assets, which are related to sales. a) Total asset turnover. b) Net asset turnover c) Fixed asset turnover d) Current asset turnover e) Net working capital turnover ratio a. TOTAL ASSET TURNOVER This ratio shows the firms ability to generate sales from all financial resources committed to total assets. It is calculated by dividing sales by total assets. Total asset turnover = Total Sales / Total Assets b. NET ASSET TURNOVER This is calculated by dividing sales by net assets. Net asset turnover =Total Sales / Net Assets Net assets represent total assets minus current liabilities. Intangible and fictitious assets like goodwill, patents, accumulated losses, deferred expenditure may be excluded for...

Posted by Managementguru in Economics, Principles of Management, Project Management, Strategy

on Mar 11th, 2014 | 0 comments

E-Commerce Business Models – Highly Recommended Internet User Statistics in India: 100 Million unique internet users 25 Million Facebook users 20 Million Youtube users 10 Million tweeters Ecommerce market size: 46520 Crores Role of Trade and Commerce: Trade and commerce play a decisive role in boosting up a country’s economy. An economy is said to expand only when a country concentrates on bringing a radical change in its commercial activities. Needless to say, the invention of computers and computer based services, has revolutionized the industry of commerce, where trading is done online. The emergence of “E-Commerce” is a real benefit bestowed on the traders to sell their merchandise in a popular platform called internet. E-commerce has overturned the history of retail selling market, due to the unanimous support of the consumers. Lifestyle Changes: The changing life styles of consumers have led to the evolution of e-commerce as an appealing alternative to terrestrial retail network. Everything has been made simple and easy. All kinds of services are available for the consumer at a mouse click’s distance. Internet gives him the privilege and liberty to happily surf through the net, from the cool confines of his house, to finalize and order a product or service of his choice. Payment systems are again made easy, through PayPal or credit or debit cards, electronically verified and authorized. So, why would consumers wait in a long queue to avail a specific service or drive down to the market place for purchasing their merchandise anymore, when e-commerce presents them all in a platter at their door steps? The Internet – Virtual Market Place: Internet serves as the virtual market place, where exchange of goods and services are quick and convenient. Many big corporate companies have started selling their products online, to manage the stiff competition posed by other competitors and small online vendors. Online presence is necessary to accelerate your profits and retain your market share. Through e-commerce, you also stand a chance to win over the interests of various sections of a society because of global internet penetration. The following list would give you a fair idea about the extensive penetration of e-commerce cutting through various economic layers. You can compete globally with other big merchants, as this is a virtual market arena, devoid of any geographical boundaries. Your prerequisite would be a computer terminal with high speed internet connection and a valid bank account. Electronic fund transfer through Real Time Gross Settlement and Net Banking, through which you are able to receive and transfer funds immediately. Online business works round the clock, so you are accessible 24/7, that really helps you to increase your sales and thus your profit margins. There is no need for credit sales, until and unless you have a dealer network to which you have to extend credit facilities. Payment of tax, electricity bills, telephone bills are now made online through the internet. Firms are able to cut down their costs, in terms of infrastructure, marketing, holding inventory, customer relationship management, information processing etc. , The highlight is, you also get instant feedback on the price and other features of your product or service, that helps you to employ pricing and promotional strategies. Travel industry, consumer electronics, shipping industry, Companies producing fast moving consumer goods, car rentals and so many other industries are thriving in the web market, thanks to e-commerce. Talking about the shortcomings, I must say that internet has not touched millions of people yet across the globe, to enable them to enjoy the benefits and privilege of this new economic system-commerce may not suit certain sectors of business like perishable food items, where time is an...