Posted by Managementguru in Accounting, Financial Accounting

on Aug 24th, 2014 | 0 comments

What is meant by Depreciation? It means reduction in the value of a fixed asset used in the business due to #wear and tear and effluxion of time. What is depreciation? Internal and External Causes of depreciation: i. Wear and tear: Caused mainly due to constant use, erosion, rust etc. ii. Efflux of time: Mere passage of time will cause a fall in the value of an asset, even if it is not used. iii. Obsolescence: A new invention or change in fashion or a permanent change in demand may render the asset useless. iv. Depletion: When raw materials or natural resources like mines, quarries and oil wells are extracted continuously, they deplete. v. Accident: An asset may reduce in value because of meeting with an accident, like fire accidents. vi. Fall in the market price. Watch this video on What Is Depreciation – How It Affects Profit And Cash Flow What is the necessity for providing depreciation? According to International Accounting Standard Committee (IASC) “Depreciation is the allocation of the depreciable amount of an asset over its estimated useful life. Depreciation for the accounting period is charged to income either directly or indirectly.” The need for depreciation arises because of the following reasons: To ascertain the true profit of the business for a particular periodTo show the asset at its true value in the balance sheetTo provide funds for replacement of the old asset with a new one Objectives of providing depreciation: To recover the cost incurred on fixed assets over its lifeTo facilitate the purchase of new asset, when the old asset is disposedTo find out the correct profit or loss for the particular periodTo find out correct financial position through balance sheet Factors to be considered while determining the amount of depreciation: I. The total cost of the asset including all freight, insurance and installation charges II. The estimated residual or scrap value at the end of its life III. Estimated number of years of its usefulness It is concerned with charging the cost of fixed assets to operations. But the term depletion refers to the cost allocation for natural resources, whereas the term amortization relates cost allocation for intangible assets. What are the various methods for depreciation? Fixed installment or Straight line or Original cost method.Diminishing Balance Method or Written down value method or Reducing Installment method.Annuity Method.Depreciation fund method or Sinking fund amortization fund method.Insurance policy method.Revaluation method.Sum of the year’s digits method (SYD).Double declining balance method.Depletion method. Related Posts : How to Manage Working Capital?Short Term...

Posted by Managementguru in Business Management, Financial Management, Marketing, Strategy

on Jul 15th, 2014 | 0 comments

What is Financial Capability? The availability, usage and management of funds have a bearing on the financial capability of an organization and ability to implement its strategies. A financial manager has to pool, deploy and allocate financial resources taking into consideration the capital or long term investments, working capital or short-term liabilities and repayment capacities. Factors that influence financial capability of an organization: 1. Factors related to source of funds: Capital structure, procurement of capital, controllership, financing pattern, working capital availability, borrowing, capital and credit availability, reserves and surplus, and relationship with lenders, banks and financial institutions. 2. Factors related to usage of funds: Capital investment, fixed asset acquisition, current assets, loans and advances, dividend distribution and relationship with shareholders. 3. Factors related to #management of funds: Financial accounting and budgeting systems, management control system, state of financial health, cash, inflation, return and risk management, cost reduction and control, and tax planning and advantages. Typical Strengths that Support Financial Capability: • Access to financial resources • Amicable relationship with financial institutions • High level of credit worthiness • Efficient capital budgeting system • Low cost of capital as compared to competitors • High level of shareholder’s confidence • Effective management control system • Tax benefits due to various government policies The examples given below show how strengths and weakness affect the financial capability of organizations: • A company faced many problems due to instability in the top management, an unfavorable public image, unfavorable government relations etc., but it had inherent strengths like a huge amount- to the tune of Rs.1000 crores invested in fixed assets which the company used for funding its diversification plans. Here we see one particular strength over-shadowing all other weaknesses which can be rectified in due course of time. • A scooter company had collected nearly Rs.1150 crores as advance for booking of scooters, but within five years, its cash position deteriorated owing to sudden and unforeseen cancellation of bookings and withdrawal of deposits, resulting in a huge interest burden. Had the company had a strong financial backup, it would have survived the trouble. Matching strengths and weaknesses with opportunities and threats requires that a firm should direct its strengths towards exploiting opportunities and blocking threats while minimizing exposure of its weaknesses at the same...

Posted by Managementguru in Accounting, Financial Accounting, Management Accounting

on Jun 25th, 2014 | 0 comments

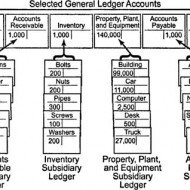

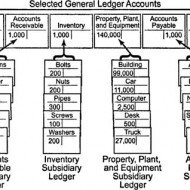

Ledger is a register with pages numbered consecutively. Each account is allotted one or more pages in the Ledger. If one page is completed, the account will be continued in the next page. An index of various accounts opened in the Ledger is given at the beginning of the Ledger for the purpose of easy reference. A general ledger is a complete record of financial transactions that holds account information needed to prepare financial statements, and includes accounts for assets, liabilities, owners’ equity, revenues and expenses. What is meant by Posting? Transactions recorded in the Journal and Subsidiary journal are transferred to the concerned accounts in the Ledger in a summarized and classified form. This process is called posting. “Interesting Statistics on Accounting The first book on double-entry accounting was written in 1494 by Italian mathematician and Franciscan friar Luca Bartolomeo de Pacioli. Although double-entry bookkeeping had been around for centuries, Pacioli’s 27-page treatise on the subject has earned him the title “The Father of Modern Accounting. Accounting plays a major role in law enforcement. The FBI counts more than 1,400 accountants among its special agents. The state of New York gave its first certified public accountant (CPA) exam in 1896. Rules for posting: Separate account should be opened in the Ledger for posting transactions relating to separate persons, assets, expenses or losses as shown in the journal. The account concerned which has been debited in the journal should also be debited in the Ledger. However, a reference must be made of the other account which is to be credited in the journal. In other words, in the account to be debited, the name of the other account to be credited is entered in the debit side for giving a meaning to this posting. The debit posting is prefixed by the word ‘To’. Similarly, the account concerned which has been credited in the journal has to be credited in the Ledger, but a reference should be made to the other account which has been debited in the journal. This posting is prefixed by the word ‘By’. Advantages of keeping a Ledger: Ledger provides information regarding all transactions of a particular account whether it is personal a/c, Real a/c or nominal a/c. The final effect, of a series of transactions of a certain customer or a certain property or a certain expense is known at a glance. Ledger provides immediately the totality of certain dealings. E.g., total purchases, Total sales, total expenditure, on a specified head. What is a Ledger account? Give a Proforma of a Ledger account. A Ledger account is nothing but a summary statement of all transactions relating to a person, asset, expense or income, which have taken place during a given period of time showing their net effect. Proforma of a Ledger account: What are the methods of balancing the Ledger account? At the end of the each month or year or any specific day it is essential to determine the balance in an account. To do that, add the totals of both sides (Debit and credit sides) and find out the difference in both the sides. The difference in both the sides is ‘Balance’. If the Debit is greater than the credit side, it is a Debit balance or vice-versa. There are two methods: The bigger total is taken first and is written on both sides of the account. On the smaller side, the balance is Witten above the total next to the last entry on that side. This method is more commonly used. In another method, the totals are written on both sides, one side showing smaller amount and the other showing bigger amount. The difference is...

Posted by Managementguru in Human Resource, Organisational behaviour, Principles of Management, Strategy

on May 24th, 2014 | 0 comments

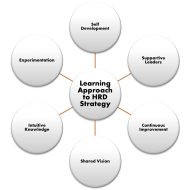

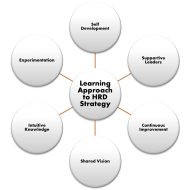

What are Learning Organizations? Need for Learning Organizations: The ever evolving, dynamic business environment and the complex relationship among various countries in the political and business arena necessitate the need for a learning organization. This becomes essential for organizations to be flexible and be able to respond to change which is the only enduring source of competitive strength. What is a learning organization? A learning organization is the term given to a company that facilitates the learning of its members and continuously transforms itself. Learning organizations develop as a result of the pressures facing modern organizations and enables them to remain competitive in the business environment. Learning is used to reach their goals and avoid repeating mistakes. Employees learn to link their personal goals to organizational goals and link rewards to key measures of performance. The managers learn to design systems and procedures to motivate learning process and to encourage employees to feel free to share information and take risks. Characteristics of a learning organization: It nurtures a climate of trust in the organization and people are encouraged to learn and develop their #knowledge and skill sets. It inspires human resources in the immediate external environment such as customers, suppliers, creditors etc., to learn as and when possible. The whole business policy revolves around #HRD strategy. The organization subjects itself to continuous transformation in which learning and working run hand-in-hand. Learning Based Techniques: Organizational learning concept is the latest OD (#Organizational Development) technique. #Ernst & Young, the largest #accounting firm has set the following procedures for learning purpose. Managers play a vital role in this transformational process of learning. They are responsible for choosing employees who are willing to and capable of learning, and must ensure that the participants in the program are trainable. They must get the support of #trainees and others. Trainees must be appraised about the benefits that will result from training and the managers also should enjoy the support of supervisors, #co-workers and their sub-ordinates. This is very essential to facilitate learning process, to ensure availing of honor and respect of peers and sub-ordinates. The opinion of trainees, supervisors, co-workers and sub-ordinates must be obtained on the content of training, the location and the time and duration of the training. Managers also play a key role in assisting others in goal-setting and meeting those goals. Goal setting is necessary to improve their performance and direct their attention to specific #behavior that needs to be changed. Managers may assist the sub-ordinates and peers to identify tools and resources for acquiring knowledge. Managers must also focus on providing performance feedback as it serves two objectives; it provides information on performance and serves as a motivating tool. Managers should urge their employees to analyze their performance, identify weaknesses and take action to overcome weaknesses. Managers may assist the employee to transfer the learned skills/knowledge to work. It will be a wiser move to design #training methods in such a way as to enable the trainees to practice skills on their jobs between training sessions. DOWNLOAD THE PDF VERSION...

Posted by Managementguru in Business Management, Financial Accounting, Management Accounting

on Apr 21st, 2014 | 0 comments

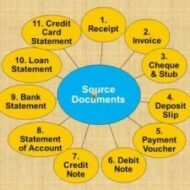

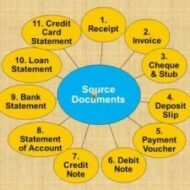

What are the Various Source Documents in Accounting? What is meant by source document? A source document is one used to record the transactions in the books of account. These documents stand as evidence for business transactions. These include Cash Memo Invoice Receipt Debit Note Credit Note Voucher Pay in Slip Cheque etc. 1. Cash Memo: When goods are sold or purchased for cash, the firm gives or receives cash memos with details regarding cash transactions. These documents become the basis for recording these transactions in the books of accounts. 2. Invoice: Invoice is prepared when goods are sold or purchased on credit. It contains the name of the party, quantity, price per unit and the total amount payable. The original copy is sent to the buyer and the duplicate copy is kept as proof of sale and for future reference. Types of Invoice: Inland Invoice – An invoice which is used in internal trade transaction is called as an Inland Invoice. When the goods are sold within a country, the invoice relating to such a transaction is called as an Inland Invoice. Foreign Invoice – An invoice which is prepared for covering an international trade transaction is called as a Foreign Invoice. A number of copies are prepared, maybe even 10 to 12, because a number of authorities require it. Inward Invoice – Inward invoice is received by the buyer from the seller, on receipt of invoice; the buyer stamps it with date of receipt. The inward invoice number is entered in the purchase journal. Outward Invoice – Outward Invoice is a seller’s bill. An invoice which is inward to the buyer is an outward for a seller. It is called outward invoice, because it is sent to the buyer. At least one copy of the invoice is retained by the seller for necessary action and reference. Proforma Invoice – Proforma Invoice is not a real invoice. It is prepared to give a clear idea regarding the amount that would be paid by the buyer if he places an order. This is prepared at the request of the buyer. 3. Receipt: When a firm receives cash from a customer it issues a receipt as a proof of receiving cash. The original copy is handed over to the party making payment and the duplicate is kept for future reference. This document contains date, amount, name of the party and the nature of payment. 5 Kinds of Receipts Small Businesses Should Take Extra Care to Keep Meal & Entertainment Receipts Receipts from Out of Town Business Travels Vehicle Related Receipts Receipts for Gifts Home Office Receipts 4 & 5. Debit and Credit Notes: These are prepared when goods are returned to supplier or when an additional amount is recoverable from a customer. When the purchaser returns the goods to the seller the Purchaser sends a Debit Note to the seller (i.e. the purchaser debits the seller in his books. Purchasers Books) and the Seller sends a Credit Note to the purchaser (i.e. the seller credits the Purchaser in his Books. Sellers Books). Following are the JVs to be passed:- Sales Return inward A/c Dr. To Debtor A/c (Being goods returned by the customer) Creditor A/c Dr. To Goods Return A/c (Being goods sent back to the seller) 6. Voucher: It is a written document in support of a transaction. It is a proof of a particular transaction taking place for the value stated in the voucher. This is necessary to audit the account. In book keeping, voucher is the first document to record an entry. Normally three types of vouchers are used. Receipt voucher Payment voucher Journal voucher RECEIPT VOUCHER Receipt voucher...