Posted by Managementguru in Business Management, Decision Making, Human Resource, Organisational behaviour, Principles of Management

on Apr 19th, 2014 | 0 comments

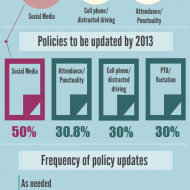

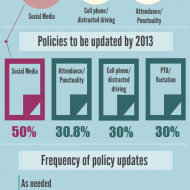

Business Policies – Framing and Execution Business policies are the keystone in the arch of management and the life-blood for the successful functioning of business, because without well-laid down policies, there cannot be lasting improvements in the economic condition of the firm and labor-management relations. A policy is a positive declaration and a command to its followers. It translates the goals of an organization into selected routes and provides the general guidelines that prescribe and proscribe programmes, which in turn, dictate practices and procedure. Attainment of Objectives: Buisness policies are general statement of principles for the attainment of objectives which serve as a guide to action for the executives at different levels of management. They pave a broad way in which the sub-ordinates tread along towards accomplishing their objectives. Hierarchy: For each set of objectives at each level, there is a corresponding set of policies. The Board of Directors determine the basic overall corporate policiesThe top management decides on the executive corporate policiesManagers decide on the departments / divisional policiesMiddle managers handle the sectional policies Consistent Decisions contributing to the Objectives: The policies delimit the area within which a decision has to be made; however, they do allow some discretion on the part of the man on the firing line, otherwise, they would be mere rules. At the same time too much of discretion in policy matters may prove harmful to the accomplishment of organizational objectives and hence it is generally within limits. Mutual Application: Policies in general are meant for mutual application by sub ordinates. They are fabricated to suit a specific situation in which they are applied, for they cannot apply themselves. Unified Structure: Policies tend to predefine issues, avoid repeated analysis and give a unified structure to other types of plans, thus permitting managers to delegate authority while maintaining control. Policies for all Functional Areas: In a well-structured and managed organization, policies are framed for all functional levels of management. Corporate planningMarketingResearch and DevelopmentEngineeringManufacturingInventoryPurchasePhysical DistributionAccountingFinanceCostingAdvertisingPersonal SellingSpecial Promotion, are some areas that require clear-cut policies. Clear-Cut Guidelines: Policies serve an extremely useful purpose in that they avoid confusion and provide clear-cut guidelines. This enables the business to be carried on smoothly and often without break. They lead to better and maximum utilization of resources, human, financial and physical, by adhering to actions for...

Posted by Managementguru in Business Management, Financial Accounting, Financial Management, Principles of Management

on Apr 8th, 2014 | 0 comments

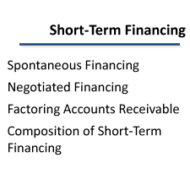

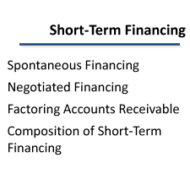

Interest Free Sources and Unsecured Interest Bearing Sources A firm obtains its funds from a variety of sources. Some capital is provided by suppliers, creditors, and owners, while other funds arise from earnings retained in business. In this segment, let me explain to you the sources of short-term funds supplied by creditors. Characteristics of short-term financing: Cost of Funds: Some forms of short-term financing may prove to be expensive than that of intermediate and long-term financing while some short-term sources like Accruals and Payables provide funds at no cost to the firm. Rollover Effect: Short-term finance as the name indicates must be repaid within a period of one year – though some sources provide funds that are constantly rolled over. The funds provided by payables, may remain relatively constant because, as some accounts are paid, other accounts are created. Clean-up: This happens when commercial banks or other lenders demand the firm to pay-off its short term obligation at one point in a financial year. Goals of Short-Term Financing: Funds are needed to finance inventories during a production period. Short term funds facilitate flexibility wherein, it meets the fluctuating needs for funds over a given cycle, commonly 1 year. To achieve low-cost financing due to interest free loans. Cash flow from operations may not be sufficient to keep up with growth-related financing needs Interest Free Sources: Accounts Payable Accounts payable are created when the firm purchases raw material, supplies, or goods for resale on credit terms without signing a formal note for the liability. These purchases on “open account” are, for most firms, the single largest source of short-term financing. Payables represent an unsecured form of financing since no specific assets are pledged as collateral for the liability. Even though no formal note is signed, an accounts payable is a legally binding obligation of a firm. Postponing payment beyond the end of the net (credit) period is known as “stretching accounts payable” or “leaning on the trade.” Possible costs of “stretching accounts payable” are Cost of the cash discount (if any) forgone Late payment penalties or interest Deterioration in credit rating Accruals: These are short term liabilities that arise when services are received but payment has not yet been made. The two primary accruals are wages payable and taxes payable. Employees work for a week, 2 weeks or a month before receiving a paycheck. The salaries or wages, plus the taxes paid by the firm on those wages, offer a form of unsecured short-term financing for the firm. The Government provides strict rules and procedures for the payment of withholding and social security taxes, so that the accrual of taxes cannot be readily manipulated. It is however, possible to change the frequency of paydays to increase or decrease the amount of financing through wages accrual. Wages — Benefits accrue via no direct cash costs, but costs can develop by reduced employee morale and efficiency. Taxes — Benefits accrue until the due date, but costs of penalties and interest beyond the due date reduce the benefits. Unsecured Interest Bearing Sources: Self-Liquidating Bank Loans The bank provides funds for a seasonal or cyclic business peak and the money is used to finance an activity that will generate cash to pay off the loan. Borrowed Funds → Finance Inventory → Peak Sales Season → Receivables → Cash → Pay Off the Loan. Three types of unsecured short-term bank loans: Single payment note – A short-term, one-time loan made to a borrower who needs funds for a specific purpose for a short period of time. Line of Credit – An informal arrangement between a bank and its customer specifying the maximum amount of...

Posted by Managementguru in Business Management, Human Resource, Organisational behaviour, Principles of Management, Training & Development

on Apr 5th, 2014 | 0 comments

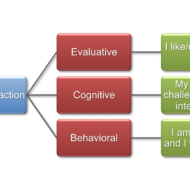

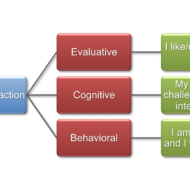

Attitude and Job Satisfaction What is attitude? Attitudes are evaluative statements or judgments concerning objects, people or events –Stephen Robbin. They also represent an ‘affective orientation towards an object.’ It simply means what one feels and thinks about something. Elements of attitude: Cognitive components – opinion or belief Affective components – emotion or feeling Behavioral components – intention to behave The interaction of these three components determines the way in which an individual develops an attitude towards something. Sources: Society Friends Teachers Family Members It also forms on the basis of the level of admiration we have over an object or persons. People also try to imitate others and attitudes are gradually formed on that basis also. In some attitudes formed are less stable, in some they even dominate the whole life. Types: Organizational behavior uses the concept of attitudes in relation to nature of the job and its influence on the performance of the persons. Accordingly, Job Satisfaction Job Involvement and Organizational Commitment, are the three kinds of attitude a person could have with respect his / her job or organization. Job Satisfaction: In “Job Satisfaction “, Stephen P. Robbins writes about five factors which make a person satisfied with his or her job. These factors are Mentally challenging work Equitable rewards Supportive working conditions Supportive colleagues and Personality-job fit. Cranny, Smith and Stone define job satisfaction as employees’ emotional state concerning the job, considering what they anticipated and what they actually got out of it. In fact, an employee with low expectations can be more satisfied with a certain job than someone who has high expectations. If one’s expectations are met or surpassed by the job, then one is happy and satisfied with the job. Job Involvement: Job involvement has been defined as an individual’s psychological identification or commitment to his / her job. As such individuals who display high involvement in their jobs consider their work to be a very important part of their lives- In other words for highly involved individuals performing well on the job is important for their self esteem. Organizational Commitment: Three important elements of a committed individual would be Identification with the organization’s goals and/or mission Long-term membership in the organization and intention to remain with the organization, often termed loyalty High levels of extra role behavior- behavior beyond required performance- Often denoted to as citizenship behavior or pro-social behavior. Cognitive Dissonance Theory: Leon Festinger developed this theory which explains the relationship between attitude and behavior. It refers to”any incompatibility that an individual might perceive between two or more of his or her attitudes, or between his or her behavior and attitudes.” Attitude Surveys: This is a tool that helps to collect information about the levels of attitude among the people. In most companies these kinds of surveys are conducted with the help of different rating scales like Likert scale offering five or seven alternative choices for each of the statement developed for attitude measurement. Summary: Research conducted on attitude and job satisfaction in Indian workers has made clear certain points as given below: Attitude is positively correlated with efficiency Absenteeism will bring down satisfaction levels Unions, negatively affect the employee attitude and job satisfaction Attitude researches and surveys will improve...

Posted by Managementguru in Financial Accounting, Financial Management, Management Accounting

on Apr 3rd, 2014 | 0 comments

Ratio Calculation From Financial Statement Profit and Loss a/c of Beta Manufacturing Company for the year ended 31st March 2010. Exercise Problem1 Kindly download this link to view the exercise. Given in pdf format. You are required to find out: a) #Gross Profit Ratio b) #Net Profit Ratio c) #Operating Ratio d) Operating #Net Profit to Net Sales Ratio a. GROSS FORFIT RATIO = Gross profit ÷ #Sales × 100 = 50,000 ÷ 1,60,000 × 100 = 31.25 % b. #NET PROFIT RATIO = Net profit ÷ Sales × 100 = 28,000 ÷ 1,60,000 × 100 = 17.5 % c. OPERATING RATIO = #Cost of goods sold + Operating expenses ÷ Sales × 100 Cost of goos sold = Sales – Gross profit = 1,60,000 – 50,000 = Rs. 1,10,000 Operating expenses = 4,000 + 22,800 + 1,200 = Rs. 28,000 Operating ratio = 1,10,000 + 28,000 ÷ 1,60,000 × 100 = 86.25 % d. OPERATING NET PROFIT TO NET SALES RATIO = Operating Profit ÷ Sales × 100 Operating profit = Net profit + Non-Operating expenses – Non operating income = 28,000 + 800 – 4,800 = Rs. 32,000 Operating Net Profit to Net Sales Ratio = 32,000 ÷ 1,60,000 × 100 = 20 % What is a Financial statement? It is an organised collection of data according to logical and consistent #accounting procedure. It combines statements of balance sheet, income and retained earnings. These are prepared for the purpose of presenting a periodical report on the program of investment status and the results achieved i.e., the balance sheet and P& L a/c. Objectives of Financial Statement Analysis: To help in constructing future plans To gauge the earning capacity of the firm To assess the financial position and performance of the company To know the #solvency status of the firm To determine the #progress of the firm As a basis for #taxation and fiscal policy To ensure the legality of #dividends Financial Statement Analysis Tools Comparative Statements Common Size Statements #Trend Analysis #Ratio Analysis Fund Flow Statement Cash Flow Statement Types of Financial Analysis Intra-Firm Comparison Inter-firm Comparison Industry Average or Standard Analysis Horizontal Analysis Vertical Analysis Limitations Lack of Precision Lack of Exactness Incomplete Information Interim Reports Hiding of Real Position or Window Dressing Lack of Comparability Historical...

Posted by Managementguru in Business Management, Change management, Human Resource, Organisational behaviour, Principles of Management

on Mar 31st, 2014 | 0 comments

India often looks at Japanese or American models to comprehend the concepts of management. In reality, Indian scriptures can be considered as treasuries of management. The Bhagavat Gita, the Vedas and the Epics highlight the true spirit of working together and the need for de-stressing the self for enhanced performance levels. The idea of NISHKAMYAM (to perform one’s own work without expecting a result) is truly said to be the highest ideology preached by Lord Krishna. What Induces Stress? A dynamic condition in which an individual is presented with an opportunity or confronted with a demand, related to what she or he desires and for which the outcome is uncertain but important, can be called a stressful situation. The consequences of stress in an organizational set up express themselves in the form of physiological, psychological or behavioral symptoms, which are harmful to the individuals who experience high levels of stress. Symptoms of stress: AnxietyDepressionIncreased job dissatisfactionAbsenteeismDecline in productivityRapid turn overHigh blood pressureHeart diseasesHead aches Stress Can be Motivating: While long term stress is harmful to the individual and organization as well, it is said that short term stress serves the purpose of task accomplishment by individuals or groups, within the stipulated time. It serves as a motivation factor rather than a causative agent of frustration. It has been proved by scientists and medical researchers that stress has a direct effect on the metabolism of a person, that causes increase in heart and breathing rates, increase in blood pressure, thus inducing heart attacks. Equally important are the behavioral and attitudinal changes that are created by stress, which cannot be overlooked. Job Satisfaction: Psychological symptoms arise due to job-related dissatisfaction, boredom, work pressure, irritability and procrastination. Sometimes forceful involvement may also lead to decreased job satisfaction. The job to be carried out can be finished at the particular time if the individual is able to give one’s best shot. But when it is performed under stress, they complete the job with dissatisfaction. When the incumbent is asked to perform a task that lacks clarity, naturally ambiguity arises in his mind followed by anxiety. Behavioral Symptoms of Stress Changes in productivity levels, absence, and rapid staff turnover are stress symptoms of behavioral nature. It might be expressed even in the form of increased smoking, consumption of alcohol etc., Say for instance, in production department, when there is a need to supply a product in a very limited time, the workers may be active initially, but the performance slows down when they get totally tired or dissatisfied with the work. Again the demand by the superior adds additional stress that reaches unmanageable levels. Similarly, people taking care of administration, banking, marketing and other office related works fall a prey to stress. How to manage stress? From an organization view point, it is believed that a limited amount of stress may work wonders in terms of performance, with stress acting as a “positive stimulus”. But even low levels of stress are likely to be perceived as undesirable from an individual’s stand point. How could be the notion of management and individuals be different on the acceptable levels of stress? It does not solve the purpose. Individuals have to understand that, they have to live up to the expectations of the management in order to enhance their credit ratings, in terms of promotion and pay. They have to understand that challenges are to be perceived as opportunities to prove their mettle. Self and situational analysis, work analysis, time management and physical well- being are some techniques that practically solve problems of stress. “De-stressing the Self” Techniques for Employees Organisations can reduce stress of the employees...