Posted by Managementguru in Business Management, Change management, Human Resource, Organisational behaviour, Principles of Management, Project Management

on Mar 30th, 2014 | 0 comments

Effective people are preferred to rather than efficient people as the former does the right thing and the latter does things right. Redesigning your workplace not only refers to the infrastructure but also the internal factors that might affect the productivity of your firm. Big corporate firms generally face challenges in the form of Lack of co-operation between subunitsIncreasing complaints from the customersRising Operating costsDip in the moraleMajor changes in technology All these signs are indications of a not so enterprising organizational climate. And it calls for quick decision making regarding introducing some changes that bring some positive development in terms of improved efficiency and increase in productivity. Redesigning Workplace in Response to Exogenous Factors Growth of Organizations The challenges mentioned above may make an organization’s existing structure, management practice or its culture obsolete for the new situation. Growth of an organization should be a result of collaborative effort of all the units of an organization and it is objective and not subjective. An organization is comprised of different elements which interact in deciding the organizational effectiveness. The task or goal, technology, structure, people and the internal and external environment of the firm; all these coexist and hold the firm together. Be it a school, a hospital, a union, a club or a business enterprise the interactive nature of these elements make the process of managing very difficult. Medical tourism and business travel are becoming more popular in Asian countries as it increases the scope of collaboration of industries that can coexist to enjoy a win-win situation. Who is an Effective Manager ? An effective manager anticipates these challenges and proactively initializes a planned change. He strategically prepares the organization to be subject to planned change by manipulating the structure, technology and behavior. Understanding the dimensions of change helps him to manage change better as people are always resistant to change. Modern enterprises right from the start have to install and implement “systems” that are technologically most modern and hire suitable people who are techno-savvy; Because technology rules the world and the development of new software programmes and hardware components feed on themselves every day. Developing an Organization as a Whole Behavior of people is unpredictable but controllable. Individually oriented training and development programmes does not prove much to the benefit of the organization as it creates apprehensions in the minds of the individual that are related to the culture and attitude of his superior and subordinates. The idea of developing the organization as a whole through team building is a better perspective as it renews the enthusiasm of people working for you and as a team they feel more cohesive and adhered. Synergy plays its role in improving the interpersonal relationship amongst the team members. Firms are becoming more modern in their outlook. For instance, a showroom whose purpose is to showcase your products also provides entertainment by its aesthetic value. Only if the customer is impressed by the artistic way of your exhibit, will he enter your showroom. Change is inevitable and it improves the health of an organization. The focus should be on “total system change” and the orientation is towards achieving desired results as a consequence of planned activities. Flat Organizational Structure You would have come across the latest buzz word “flat organizational structure”. This is designed in order to bridge the gap between front line employees and the executive level. If there is only few levels of management, the process of communication is more effective, the art of delegation becomes mandatory and need for participation in the decision making process involves all the employees which in turn reduces bureaucracy. There is no set pattern...

Posted by Managementguru in Financial Management, Management Accounting, Marketing, Principles of Management

on Mar 27th, 2014 | 0 comments

Costing and Profitability Analysis Relationship between Cost of Production and Sales Volume: The cost of production and volume of sales are the inter-dependent determinants of profit. The analysis of cost behavior in relation to the changing volume of sales and its impact on profit is very important to determine the break even level of a firm. The level at which total revenue equals total costs, is said to be the break even level where there is no-profit or no-loss. Sales beyond break-even volume bring in profits. Generally production is preceded by the process of demand forecasting, to decide on the volume of production, the produce of which will be absorbed by the market. Pricing and promotions come at a later stage. Costing is done to predict the costs of production and resultant profits at various levels of activity. Download this comprehensive power-point presentation on Break-Even Analysis. Cost Volume Profit or CVP Analysis: CVP analysis or Cost-Volume-Profit analysis helps a firm to study the interrelationship between these three factors and their effect on clean profit. The process also includes an analysis about the external factors that affect the volume of production, such as market demand, competitor threat and internal factors such as availability of infrastructure, capital and labor force. This CVP analysis is a boon to the managers to locate the bottlenecks that hinder the productivity and find a way out, by adjusting either the levels of activity or controlling the cost. Picture Courtesy : The Power of Break-Even Analysis Pricing: Pricing is the most important factor that makes your product competitive. The costs of production can be classified into fixed costs, variable costs and semi variable costs. Fixed costs remain constant and tend to be unaffected by the changes in volume of output; whereas variable costs vary directly with the volume of output and semi-variable as the name implies are partly fixed and partly variable. Cost accountants of the modern era fully support variable costing for the purpose of cost accounting, listing its merits as follows: Variable costing talks about contribution margin, which is the excess of sales over variable costs. If this is going to be high, sufficient enough to cover the fixed costs, then profit is assured for the firm. It is a key factor to determine the percentage of profit. Variable costing assigns only those costs to a product that varies directly with the changing levels of production, which is helpful in making a distinction of profit made from sales and those resulting from changes in production and inventory. Segregating the costs into fixed and variable is done for the purpose of providing information to reflect cost-volume-profit relationships and to facilitate management decision-making and control. Some applications of variable costing that facilitates management decision making: Profit planning: By increasing the volume of sales or decreasing the selling price of the product. Performance evaluation of profit centres:Like, sales division, marketing department, product line etc., Decide on product priorities: In view of market potential and profit potential Make or Buy Decisions: Depending on the production capacity and sales demand. Budgeting: Flexible budgeting and cost control are possible by variable costing technique and the striking feature is the treatment given to fixed costs, where it is treated as a period cost and not apportioned among all the departments and products that enable the firm to understand the movement of profits in the same direction as that of the sales. Although considered to be a controversial technique and weighed against the conventional methods of costing such as absorption costing, it is believed that it is to stay and exist as the next step in the evolutionary method of cost accounting....

Posted by Managementguru in Accounting, Financial Accounting, Financial Management, Principles of Management

on Mar 27th, 2014 | 0 comments

An Analysis to Understand the Art of Accounting Objectives of an Accountant: The pure objective of an accountant would be to record all business transactions that are monetary in nature, in order to ascertain if the company has earned profit or suffered loss during a financial year. The financial position of the company as on a particular date can thus be understood from the accounting journals and ledgers. We are talking about the conventional purpose of accounting. But with the lapse of time, more and more is being expected from accounting, in that, it has to meet the demands and requirements of tax authorities for the purpose of income tax and sales tax returns, government regulations, investors, owners and the management. Thus it can be aptly defined as the art of recording, classifying and summarizing events in a significant manner, that involve money transactions and/ or events that are of financial character, for interpretation. Systematic records for future reference: Book keeping is an accounting practice that tells us how to keep a record of financial transactions. A firm deals with its customers and suppliers, where numerous business transactions take place every day. It is not possible for us to remember every transaction, which we might need it for our reference at a future date. Especially, if it happens to be a credit sale, definitely the necessity of systematic book keeping arises. The owner would like to know, what amount is due from whom, from time to time. To know the financial position of the firm: Every merchant is in business to earn profits. So systematic recording of factual and financial information will facilitate the owner to understand where he stands financially at the end of a financial year, what is his net profit and to pull the ropes tight if credit margin is wide. Further more, he can also understand the nature of his business growth by comparing the accounting records of two consecutive years. Taxation purposes: Some people evade tax, but no one can avoid tax. The main source of revenue generation for government is tax payments from business merchants and corporate companies. You need to pay a percentage as tax, in accordance with profit arising from sales. The accounting records that you maintain contain facts that are taken into account by the taxation authorities as a basis for assessment. https://amzn.to/2sl5aL7 Good evidence in the court of law: To prove your genuinity, in case of some disputes between yourself and the customer or supplier, your records and vouchers, if authentic and valid, are going to speak for you in the court of law as solid evidence. Accounting also answers some of these questions: How well the different departments of business have performed all along? What is the most profitable product line? What are the products whose production has to be increase and what is to be stopped in order to avoid losses? Is the cost of production reasonable or excessive? Is there a need to revise policy decisions to improve the profitability? What will be the future plans of business in the wake of existing results presented to the management? Overall, is the firm proceeding towards the right direction in terms of productivity, profitability and growth? Accounting is not only about recording and classifying, the interesting features being analysis and interpretation, which are the key factors for the development of the organization as a whole. Note: The Comptroller and Auditor General of India (CAG),is the head of the Supreme Audit Institution of India (SAI) CAG is the sole auditor of the accounts of the Central (Union) Government and the State Governments. CAG is also responsible for the audit...

Posted by Managementguru in Business Management, Change management, Principles of Management, Project Management, Technology

on Mar 25th, 2014 | 0 comments

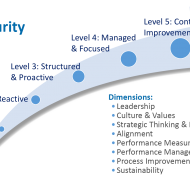

Technology and Society Perhaps the most striking influence of technology is found on society. Practically every area of social life and the life of every individual has been, in some sense or the other, changed by the development in technology. Technology reaches people through business: Preferences of people are constantly changing and this has pushed the business firms to the point, where innovation has become the need of the hour. The new discoveries would remain idle as mere ideas if there were no laboratories to transform the ideas into creations. Technology reaching people through business is one part of the theory. The economic prosperity of a nation depends on technology. The Non-Technical Person’s guide to building products & apps High expectations of consumers: People are used to technological innovations and breakthroughs and they want variety in every kind of purchase they make. New varieties of products, more safe and comfortable, free from pollution, are to be produced and supplied to affluent sections. This calls for a massive investment in research and development. In countries like Japan, much importance is attached to product design, quality, sophistication, delivery schedules and prices. High expectations need not be considered as problems by business persons but treated as an opportunity to satisfy their customer group. System complexity: Technology has resulted in complexity. Modern machines work faster and better, no doubt. However, if there is a technical problem, the presence of an expert is needed to repair the machinery. Again, investment in machinery adds to the cost of capital and hence the merchandise has to be purchased form reliable sources. Social change: The change in the technological process undoubtedly has its effect on the society. First, there is a change in the social life, with mobile populations drifting about in search of new centers of employment. If it happens to be an agricultural economy, the result of such a drift would prove disastrous, with society being socially uprooted. Sometimes such a drift may result in new geographical distribution of population. Technological change also brings considerable changes in the family, life style and attitude. The way we cook, communicate, use media and work are all affected by technology. Technological phases and the social systems they create: There are five stages of technological development. Each stage leaves a distinct influence on work and on social system. Sequential progress is made from the lowest level to the highest level, in such a way that these five stages roughly represent the progress of civilization throughout history. Although one phase of technology tends to dominate a nation’s activities at a particular time, other phases will be often practiced at the same time. Technology means change and more change. It forces changes on people whether they are prepared for it or not. In modern history, it has created what is called future shock, which means that change comes so fast and furious that it approaches the limits of human tolerance and people lose their ability to cope with it...

Posted by Managementguru in Business Management, Decision Making, Organisational behaviour, Principles of Management, Strategy

on Mar 24th, 2014 | 0 comments

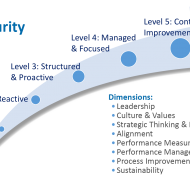

STRATEGIC PLANNING Strategic planning is the primary step in the process of strategic management [Strategic management is a comprehensive topic that covers almost all the functional aspects of the organization] which can be outlined from at least two perspectives: First, strategy is the “broad programme for defining and achieving the objectives of an organization and implementing its mission”. Secondly, “It is the pattern of the organization’s response to the external environment over a period of time”. A strategy that takes a broad and typically long range focus is called strategic planning. MBA Application Strategies for Top Business Schools Strategic planning is the process that classifies the long range goals of the organization and opts for the precise means (strategies and polices) for achieving these goals, allocates resources, and develops long range plans to reach the destination. Watch this Video to Understand the Overview of Strategic Planning Process Time-Horizon: Strategic planning takes into account the extended time horizon. There may not be any immediate impact out of strategic planning, but the consequences in the long-run prove to be gradual and significant as well. It provides with the necessary action plans to make a difference in vital areas concerning development. You can always associate innovativeness with strategy since it explores new paradigms and tries to enhance the impact. When the size of organizations expands, they are broken down into strategic business units (SBU’S) for the purpose of functional excellence. These units are expected to operate as if they were relatively independent businesses. WHY STRATEGIC LEADERSHIP IS IMPORTANT A Tailor Made Approach: A tailor made approach is essential when it comes to strategy development the systematic analysis of the factors associated with customers and competitors (the external environment) helps the organization to meet the challenges of modern society. More and more organizations are focusing on formal approaches and concepts for planning their long range process. Specifically these challenges are a result of increasing rate of change, the complexity of manager’s jobs, the increasing importance of fitting the organization into external environment, and the increasing lag between the preparation of plans and their implementation in future. Resource Allocation: Strategic planning is an organization’s process of defining its strategy or course, and making decisions on resource allocations to pursue this strategy. Managers must be adequately geared up for strategic planning. The goals of the organization must be made plain and not unclear. Each business unit should be categorized based on its performance level to decide on the resource share to be allocated. You need to infuse cash flow into ineffectual units and divest funds from dying units into other profitable ones. The ultimate aim is to build up star performers that will be the perennial source of income or revenue generation. There should be a strong linkage between planning and control. The assessment of strategic plans of the business units must be made periodically and effectively. TOP FIVE REASONS WHY STRATEGIC PLANS FAIL SWOT Analysis: SWOT analysis is a strategic planning technique used to evaluate the Strengths, Weaknesses/Limitations, Opportunities, and Threats. Planning is the primary step for control as it provides several standards and benchmarks of control. Planning extracts commitment. Some times planning highlights the objectives only and the planning premises may not be fully reliable. Threats are to be considered as challenges and must be converted into opportunities. Two heads are better than one is the philosophy of brain storming where a group of people with knowledge and expertise assemble to lay out clear plans that will steer the organization smoothly even in times of rough...