Currently Browsing: Management Accounting

Posted by Managementguru in Accounting, Financial Accounting, Management Accounting, Principles of Management

on Nov 27th, 2014 | 0 comments

Some Definitions of Cash Accounting: 1. An accounting method where receipts are recorded during the period they are received, and expenses are recorded in the period in which they are actually paid. Cash accounting is one of the two forms of accounting. The other is accrual accounting, where revenue and expenses are recorded when they are incurred. Small businesses often use cash accounting because it is simpler and more straightforward, and it provides a clear picture of how much money the business actually has on hand. Corporations, however, are required to use accrual accounting under generally accepted accounting principles. 2. An accounting system that doesn’t record accruals but instead recognizes income (or revenue) only when payment is received and expenses only when payment is made. There’s no match of revenue against expenses in a fixed accounting period, so comparisons of previous periods aren’t possible. 3. An accounting method in which income is recorded when cash is received, and expenses are recorded when cash is paid out. Cash basis accounting does not conform with the provisions of GAAP and is not considered a good management tool because it leaves a time gap between recording the cause of an action (sale or purchase) and its result (payment or receipt of money). It is, however, simpler than the accrual basis accounting and quite suitable for small organizations that transact business mainly in cash. Also called cash accounting. Cash Accounting Basics It is the simplest method of accounting. Transactions are recorded only on the actual flow of cash in or out of business. Revenue is recognized only when cash is received from the customer while expenses are recorded only when cash is paid. There cannot be any match of the revenue against expenses in an accounting period. Cash accounting is ideal for sole proprietors or businesses with no inventory. Cash basis is considered beneficial from the taxation point of view as recording income can be put off to the next year and expenses can be booked immediately. Advantages of Cash Basis of Accounting: It is very simple as adjustment entries are not required for prepaid and outstanding expenses. This approach is more objective as very few judgements are required. This is suitable for all organizations whose transactiona are on cash basis. Data can be taken from minimal sources – bank statements, cheque book, deposit book. People with limited accounting knowledge can more easily understand the financial reports,. Disadvantages of Cash Basis of Accounting: It ignores prepaid and outstanding expenses, accrued income and income received in advance. It does not follow the matching principle of accounting. This does not differentiate revenue and capital items, and as a result there is no consistency in the profits of consecutive years. Less insight into long term trends. No structure for invoicing. Does not conform to...

Posted by Managementguru in Management Accounting

on Oct 23rd, 2014 | 0 comments

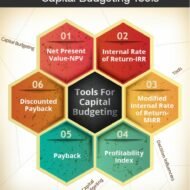

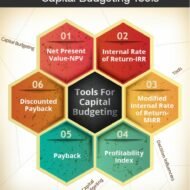

Capital Budgeting and Capital Accounting Systems These internal accounting systems facilitate and support decision-makers in assessing potential investments with respect to cost effectiveness. The purpose of capital accounting systems support decision-makers in monitoring and planning liquidity. What is Capital Budgeting? Capital budgeting is the planning process used to determine whether an organization’s long term investments such as new machinery, replacement machinery, new plants, new products, and research development projects are worth the funding of cash through the firm’s capitalization structure. Capital budgeting systems is a framework that support management in making decisions in the context of capital investment decisions. In particular, capital budgeting systems help to determine whether or not a capital investment will earn back the original expenditure and in addition provide a reasonable return. This type of decisions usually entails large amounts of organizational resources at risk and, at the same time, affects the future development of the organization . Capital budgeting systems usually focus on capital investment decisions that cover many years. This discriminates capital budgeting systems from income determination and planning which usually focus on the current period. Capital investment decisions usually encompass cash inflows and outflows that accrue at different points in time which are usually answered by adding accrued interest of discounting of cash-flows. Capital budgeting process consists of six steps: Project Generation Estimation Of Cash-Flows Progress Through The Organization Analysis And Selection Of Projects Authorization Of Expenditures And Post-Audit Investigations. In the step of (1) project generation, potential investments are chosen for which in step (2) potential cash-flows are estimated. In step (3), i.e., progress through the organization, certain projects require approval of top-management. In step (4), analysis and selection of projects, the selected projects are assessed with respect to the fact that cash inflows and outflows usually realize at different points in time. In Step (5), authorization of expenditures, captures the final decision (usually made by top management) on whether or not to invest into the selected project. Finally, in step (6) captures a post-audit investigation, i.e., after a certain period of time actual results might be gained which potentially provide input for control purposes. Capital budgeting systems particularly support management in step (4), i.e., the analysis and selection of projects. Capital accounting systems support management in planning and controlling liquidity. Courtesy: S. Leitner, Information Quality and Management Accounting, Lecture Notes in Economics and Mathematical...

Posted by Managementguru in Accounting, Financial Accounting, Management Accounting

on Jun 25th, 2014 | 0 comments

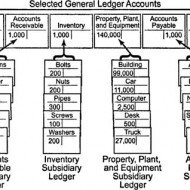

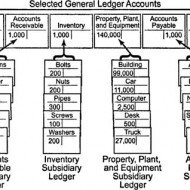

Ledger is a register with pages numbered consecutively. Each account is allotted one or more pages in the Ledger. If one page is completed, the account will be continued in the next page. An index of various accounts opened in the Ledger is given at the beginning of the Ledger for the purpose of easy reference. A general ledger is a complete record of financial transactions that holds account information needed to prepare financial statements, and includes accounts for assets, liabilities, owners’ equity, revenues and expenses. What is meant by Posting? Transactions recorded in the Journal and Subsidiary journal are transferred to the concerned accounts in the Ledger in a summarized and classified form. This process is called posting. “Interesting Statistics on Accounting The first book on double-entry accounting was written in 1494 by Italian mathematician and Franciscan friar Luca Bartolomeo de Pacioli. Although double-entry bookkeeping had been around for centuries, Pacioli’s 27-page treatise on the subject has earned him the title “The Father of Modern Accounting. Accounting plays a major role in law enforcement. The FBI counts more than 1,400 accountants among its special agents. The state of New York gave its first certified public accountant (CPA) exam in 1896. Rules for posting: Separate account should be opened in the Ledger for posting transactions relating to separate persons, assets, expenses or losses as shown in the journal. The account concerned which has been debited in the journal should also be debited in the Ledger. However, a reference must be made of the other account which is to be credited in the journal. In other words, in the account to be debited, the name of the other account to be credited is entered in the debit side for giving a meaning to this posting. The debit posting is prefixed by the word ‘To’. Similarly, the account concerned which has been credited in the journal has to be credited in the Ledger, but a reference should be made to the other account which has been debited in the journal. This posting is prefixed by the word ‘By’. Advantages of keeping a Ledger: Ledger provides information regarding all transactions of a particular account whether it is personal a/c, Real a/c or nominal a/c. The final effect, of a series of transactions of a certain customer or a certain property or a certain expense is known at a glance. Ledger provides immediately the totality of certain dealings. E.g., total purchases, Total sales, total expenditure, on a specified head. What is a Ledger account? Give a Proforma of a Ledger account. A Ledger account is nothing but a summary statement of all transactions relating to a person, asset, expense or income, which have taken place during a given period of time showing their net effect. Proforma of a Ledger account: What are the methods of balancing the Ledger account? At the end of the each month or year or any specific day it is essential to determine the balance in an account. To do that, add the totals of both sides (Debit and credit sides) and find out the difference in both the sides. The difference in both the sides is ‘Balance’. If the Debit is greater than the credit side, it is a Debit balance or vice-versa. There are two methods: The bigger total is taken first and is written on both sides of the account. On the smaller side, the balance is Witten above the total next to the last entry on that side. This method is more commonly used. In another method, the totals are written on both sides, one side showing smaller amount and the other showing bigger amount. The difference is...

Posted by Managementguru in Business Management, Financial Accounting, Management Accounting

on Apr 21st, 2014 | 0 comments

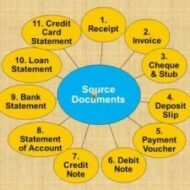

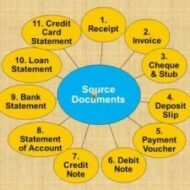

What are the Various Source Documents in Accounting? What is meant by source document? A source document is one used to record the transactions in the books of account. These documents stand as evidence for business transactions. These include Cash Memo Invoice Receipt Debit Note Credit Note Voucher Pay in Slip Cheque etc. 1. Cash Memo: When goods are sold or purchased for cash, the firm gives or receives cash memos with details regarding cash transactions. These documents become the basis for recording these transactions in the books of accounts. 2. Invoice: Invoice is prepared when goods are sold or purchased on credit. It contains the name of the party, quantity, price per unit and the total amount payable. The original copy is sent to the buyer and the duplicate copy is kept as proof of sale and for future reference. Types of Invoice: Inland Invoice – An invoice which is used in internal trade transaction is called as an Inland Invoice. When the goods are sold within a country, the invoice relating to such a transaction is called as an Inland Invoice. Foreign Invoice – An invoice which is prepared for covering an international trade transaction is called as a Foreign Invoice. A number of copies are prepared, maybe even 10 to 12, because a number of authorities require it. Inward Invoice – Inward invoice is received by the buyer from the seller, on receipt of invoice; the buyer stamps it with date of receipt. The inward invoice number is entered in the purchase journal. Outward Invoice – Outward Invoice is a seller’s bill. An invoice which is inward to the buyer is an outward for a seller. It is called outward invoice, because it is sent to the buyer. At least one copy of the invoice is retained by the seller for necessary action and reference. Proforma Invoice – Proforma Invoice is not a real invoice. It is prepared to give a clear idea regarding the amount that would be paid by the buyer if he places an order. This is prepared at the request of the buyer. 3. Receipt: When a firm receives cash from a customer it issues a receipt as a proof of receiving cash. The original copy is handed over to the party making payment and the duplicate is kept for future reference. This document contains date, amount, name of the party and the nature of payment. 5 Kinds of Receipts Small Businesses Should Take Extra Care to Keep Meal & Entertainment Receipts Receipts from Out of Town Business Travels Vehicle Related Receipts Receipts for Gifts Home Office Receipts 4 & 5. Debit and Credit Notes: These are prepared when goods are returned to supplier or when an additional amount is recoverable from a customer. When the purchaser returns the goods to the seller the Purchaser sends a Debit Note to the seller (i.e. the purchaser debits the seller in his books. Purchasers Books) and the Seller sends a Credit Note to the purchaser (i.e. the seller credits the Purchaser in his Books. Sellers Books). Following are the JVs to be passed:- Sales Return inward A/c Dr. To Debtor A/c (Being goods returned by the customer) Creditor A/c Dr. To Goods Return A/c (Being goods sent back to the seller) 6. Voucher: It is a written document in support of a transaction. It is a proof of a particular transaction taking place for the value stated in the voucher. This is necessary to audit the account. In book keeping, voucher is the first document to record an entry. Normally three types of vouchers are used. Receipt voucher Payment voucher Journal voucher RECEIPT VOUCHER Receipt voucher...

Posted by Managementguru in Financial Accounting, Financial Management, Management Accounting

on Apr 3rd, 2014 | 0 comments

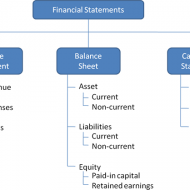

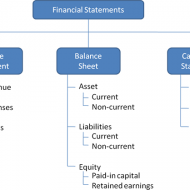

Ratio Calculation From Financial Statement Profit and Loss a/c of Beta Manufacturing Company for the year ended 31st March 2010. Exercise Problem1 Kindly download this link to view the exercise. Given in pdf format. You are required to find out: a) #Gross Profit Ratio b) #Net Profit Ratio c) #Operating Ratio d) Operating #Net Profit to Net Sales Ratio a. GROSS FORFIT RATIO = Gross profit ÷ #Sales × 100 = 50,000 ÷ 1,60,000 × 100 = 31.25 % b. #NET PROFIT RATIO = Net profit ÷ Sales × 100 = 28,000 ÷ 1,60,000 × 100 = 17.5 % c. OPERATING RATIO = #Cost of goods sold + Operating expenses ÷ Sales × 100 Cost of goos sold = Sales – Gross profit = 1,60,000 – 50,000 = Rs. 1,10,000 Operating expenses = 4,000 + 22,800 + 1,200 = Rs. 28,000 Operating ratio = 1,10,000 + 28,000 ÷ 1,60,000 × 100 = 86.25 % d. OPERATING NET PROFIT TO NET SALES RATIO = Operating Profit ÷ Sales × 100 Operating profit = Net profit + Non-Operating expenses – Non operating income = 28,000 + 800 – 4,800 = Rs. 32,000 Operating Net Profit to Net Sales Ratio = 32,000 ÷ 1,60,000 × 100 = 20 % What is a Financial statement? It is an organised collection of data according to logical and consistent #accounting procedure. It combines statements of balance sheet, income and retained earnings. These are prepared for the purpose of presenting a periodical report on the program of investment status and the results achieved i.e., the balance sheet and P& L a/c. Objectives of Financial Statement Analysis: To help in constructing future plans To gauge the earning capacity of the firm To assess the financial position and performance of the company To know the #solvency status of the firm To determine the #progress of the firm As a basis for #taxation and fiscal policy To ensure the legality of #dividends Financial Statement Analysis Tools Comparative Statements Common Size Statements #Trend Analysis #Ratio Analysis Fund Flow Statement Cash Flow Statement Types of Financial Analysis Intra-Firm Comparison Inter-firm Comparison Industry Average or Standard Analysis Horizontal Analysis Vertical Analysis Limitations Lack of Precision Lack of Exactness Incomplete Information Interim Reports Hiding of Real Position or Window Dressing Lack of Comparability Historical...