Currently Browsing: Startups

Posted by Managementguru in Business Management, How To, Social Media, Startups

on Oct 28th, 2023 | 0 comments

Business networking events are an integral part of expanding your professional network and allowing your business to grow. However, many such events can feel forgettable and unproductive. To stand out and make a lasting impression, it’s crucial to go the extra mile in creating memorable experiences. This article will explore effective strategies to make your business networking event unforgettable. Define Your Purpose Before diving into event planning, define the purpose and objectives of your networking event. Are you aiming to introduce new products, foster collaboration, or simply build relationships? Knowing your goals will guide every decision you make in the planning process. Choose the Right Venue The venue helps to set the tone for your event. Opt for a location that aligns with your objectives and will appeal to your target audience. A unique or historical venue can leave a lasting impression and provide excellent conversation starters. Create A Theme A well-thought-out theme can add a layer of interest to your event. Consider a theme that resonates with your industry or business. For example, if you’re in the tech industry, a futuristic theme could be a great fit. Thematic decorations, food, and activities can make your event more memorable. Engaging Activities A memorable networking event incorporates interactive and engaging activities. Icebreakers, workshops, or panel discussions can help attendees to connect and learn. Additionally, consider incorporating technology such as event apps to facilitate networking and interaction. Food and Beverages Delicious food and beverages can be a significant draw for attendees. Consider offering a diverse range of options, including dietary accommodations. A well-catered event that includes delicious dessert catering can be memorable for all the right reasons. Unique Giveaways Branded giveaways can be a powerful tool for making your event unforgettable. Choose items that are not only useful but also align with your brand and theme. Personalized, high-quality items like custom notebooks, tech gadgets, or eco-friendly products can leave a lasting impression. Stellar Speakers Invite influential speakers who can provide valuable insights to your attendees. High-quality presentations can be a major draw for participants and make your event memorable. Networking Opportunities The main aim of a networking event is to connect people. Encourage networking by providing ample opportunities for one-on-one and group interactions. Mixers, speed networking sessions, and designated networking areas can be instrumental in making meaningful connections. Entertainment Incorporating entertainment can set your event apart from the rest. Live music, interactive performances, or even a photo booth can add some fun and excitement to the proceedings. Entertainment can also break the ice and help attendees to relax. Follow Up To make sure that your event has a lasting impact, follow up with attendees after the event. Send thank-you emails, connect on social media, and ask for feedback. This shows that you value their participation and are interested in continuing the relationship. Post-Event Content Create content that captures the highlights of your event, such as videos, photos, and blog posts. Share these across your social media channels and website to keep the memory alive and promote future events. Sustainability In this environmentally conscious world, demonstrating a commitment to sustainability can leave a lasting impression. Consider eco-friendly event practices, such as recycling, minimal waste, and sustainable transportation...

Posted by Managementguru in Branding, Marketing, Startups

on Jun 20th, 2023 | 0 comments

Whether you have been running a successful online business for some time now and are looking to expand to a physical store or else have grand plans to start a retail business from scratch, then you have most definitely clicked on the right article. Here are the top four useful tips when planning to open a store to help you on your journey to success. 1. Your Name is Your Brand Firstly, even if you have already been operating under a business name online, when opening a store, your name becomes much more closely linked to the products and services you offer and represents your entire brand, so you need a strong business name moving forward. From the perspective of the customer, your brand name needs to hold meaning, and for branding purposes, you also need to ensure the name is short and snappy, making it much more memorable and easier to work with when designing advertising materials. Furthermore, make sure you conduct a thorough internet search before you finalize your name to ensure there is no similarly-named business, regardless of industry, in your local area and, ideally, in the country. 2. Hire a Professional Roof Contractor Even if you have already taken several personal tours around your new unit and have asked more than one expert to look at the space’s suitability, it is still strongly advisable to hire a professional contractor to take a look at the roof. Ask around for a reputable and established commercial roofing St. Louis company, who will not only talk you through any issues they find with the current roof but also advise you on aftercare and maintenance points should any work be conducted. 3. Focus on Vendor Business Relationships When opening a retail store, regardless of whether you are an experienced business owner or not, the more connected you are to the other companies and stores in and around your own store’s location, the better. As you will already know, there is a wide plethora of potential challenges that small business owners could face, especially in the first few weeks and months of opening and as such, the relationships you strive to build between your business and others can make a huge difference to your chances of success and longevity for the future. 4. Organize a Grand Opening No matter the nature of your business and, indeed, whether you plan to be open every day and for long business hours or else intend on a part-time opening basis to judge the number of customers you have, a grand opening is the only way to put your new store’s name on the map. Media coverage, including any neighborhood newsletters and your local newspaper, as well as the local radio, is a fantastic way of drumming up interest in your new store. Of course, publicizing your new store on social media is also another affordable and effective publicity...

Posted by Managementguru in Business Management, Human Resource, Startups

on May 17th, 2023 | 0 comments

Outsourcing in business has been around for a while, and in fact, since the concept of flexible specialization or Post Fordism was initiated in the late 20th Century. The realization was that businesses could save huge amounts of money by using business function experts in their specific fields to contribute to business efficiency and effectiveness. Modern-day outsourcing is only different because it allows for a greater range of expertise and skills through the internet, and because a great deal of it can be done remotely and virtually. There are also some basic tips and insights that you should know about outsourcing, no matter what business you are in. The Tricks/Subtle Art of Outsourcing Here are the top aspects of all businesses that are outsourced in the modern world and how you too can ensure that your business benefits from the concept and the practice. Human Resources Hiring and firing are some of the most complicated, yet essential and necessary, aspects to get right if you intend to build a great business. You should be looking for an HR outsourcing option that is clear and offers the entire range of HR responsibilities. Snelling Talent partners are a perfect example, and will be able to all the functional aspects of HR, as well as provide the advice and templates should you still want to go it alone in some aspects of the business’s HR functions. The trick is to ensure that you have the right staff in place to build the kind of company culture that will make you a success, only the most professional HR will provide for this. Finance Many small and emerging businesses have argued to keep finance as close as possible, based on the need to remain liquid and be able to act decisively. However, the mindset has changed and finance is one of the top business functions to be outsourced to a professional. The ability to make the smallest savings and squeeze the most from your financial resources, and invest in the right shares and stocks to grow the business wealth, are all financial decisions that need focus and experience in the sector, and is something that an outsourced service will be best placed to provide. IT as a Service Hardware, software, infrastructure, and the maintenance of everything related to IT can now be accessed, resourced, and maintained predominantly from an online platform and system. There is now no longer any business sense in having an IT department or internal support when all hardware, software, and infrastructure issues can be dealt with in the cloud by the best professionals in their respective fields. The key is to have a clear understanding of what the business IT needs are and how to meet these or to have the professional provide a clear IT audit before they go ahead and outfit the organization. It’s then simply about the ongoing maintenance and development of these appropriate IT systems. Keep the core or business specialty close and do this yourself, keeping your focus on the thing that you went into business to do. This is the final outsourcing tip that many an advocate of outsourced business will not mention at all. It is the key to the business’s success, and around which all the other outsourced functions must be built and...

Posted by Managementguru in Business Management, Entrepreneurship, Financial Management, Project Management, Startups

on Feb 1st, 2023 | 0 comments

Business loan becomes necessary when you plan to start up your own venture. Many of us are unaware of the loan schemes our government has been offering for small businesses to assist them in jump starting their plan of action. Given the importance of the MSME sector in India, the government provides numerous credit schemes to help both organised and unorganised businesses in the economy. These programmes provide much-needed financial assistance to small and medium-sized businesses, assisting with operations and driving growth at low Business Loan interest rates. These are critical for easy access to capital, assisting in the conversion of profitable business ideas into profitable ventures. Coaching Workbook – Build Your Self Confidence to Reach Your Goals | Best Seller Business Loans and Their Uses Purchase of raw material Upgrade machinery or equipment Build working capital Pay salaries and other financial obligations Expand the workplace Invest in marketing Entering new market Launch new products or services Hire or train employees Social Media Holiday Calendar – The Complete List of Social Media Holidays | Best Seller Popular Business Loan Schemes by the Indian Government It is estimated that there are 633.9 lakh MSMEs in India. The Micro sector includes 630.5 lakh enterprises, accounting for over 99% of the country’s total number of MSMEs. Source – India’s MSME Sector – IBEF 1. MSME Loan Scheme in India In India, the MSME loan scheme is a government initiative that provides financial assistance to small and medium-sized businesses. This loan programme is intended to provide businesses with access to capital so that they can expand their operations and increase their productivity. All registered MSMEs, including sole proprietorships, partnerships, and companies with an annual turnover of up to Rs. 2 crore, are eligible for the scheme. Depending on the eligibility criteria, the loan amount can range from Rs. 10 lakhs to Rs. 1 crore. Loan rates are typically very competitive, and repayment terms can range from one to seven years. The MSME loan scheme is an excellent way for businesses to obtain the capital they require to expand and develop their operations. 2. MUDRA Loan Scheme The Indian Government launched the MUDRA (Micro Units Development and Refinance Agency) Loan Scheme in 2015. This programme gives small and micro businesses access to financing to help them grow and become profitable. Shishu (up to Rs. 50,000), Kishore (up to Rs. 5 lakhs), and Tarun loans are available (up to Rs. 10 lakhs). Public and private sector banks, regional rural banks, and microfinance institutions all offer MUDRA loans. Loan terms differ from one institution to the next, but they may include flexible repayment options, collateral-free loans, and low interest rates. MUDRA loans have assisted millions of Indian entrepreneurs and small businesses in starting and growing their businesses. 3. Credit-Linked Capital Subsidy Scheme The Credit-Linked Capital Subsidy Scheme (CLCSS) is a scheme launched by the Government of India in 2000 to make capital more accessible to small and medium-sized businesses (SMEs). The scheme’s goal is to provide capital subsidies to these businesses in order for them to modernise their manufacturing processes, resulting in increased productivity and competitiveness. The Ministry of Micro, Small, and Medium Enterprises oversees the scheme (MSME). The CLCSS provides SMEs with a 15% capital subsidy when they purchase new machinery and equipment to modernise their production processes. The subsidy is provided to eligible SMEs in the form of a one-time credit-linked subsidy at the time of purchase of new machinery and equipment. The scheme has aided SMEs in modernising their production processes, resulting in increased productivity and competitiveness. 4. Support Schemes from the National Small Industries Corporation (NSIC) The National Small Industries Corporation (NSIC)...

Posted by Managementguru in E Commerce, Entrepreneurship, How To, Startups, Technology, Website Design

on Jan 25th, 2022 | 0 comments

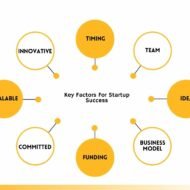

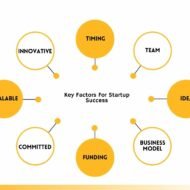

There are so many tech start-ups emerging, as digital technology moves on in leaps and bounds, with the Internet of Things on the horizon. Perhaps you are a good front-end developer who has access to a great team and with the right things in place, there’s no reason why you can’t compete in this huge market that is growing exponentially. Here are a few tips to help make it happen. Funding – Of course, you need to crunch the numbers and come up with a figure you need to turn your vision into reality and if you come up short, there are several ways that you can fund your start-up. You could crowdfund, as many digital entrepreneurs do successfully, or you could put together a presentation and invite potential investors. Another idea is to approach another developer with a view to setting up a partnership; your partner naturally comes up with 50% of the start-up funding, which eases the burden. If you have a good working relationship with your bank, they might be interested in checking out your business plan, while there are online lenders that specialise in start-up funding. Global market – Take advantage of the unique services at www.globalcitizenstranslation.com, the leading global translation provider with more than 500 language pairs to choose from. Having the ability to communicate with non-English speaking people is a real game-changer and it couldn’t be easier to use the on-demand service; simply book your translator and they will be ready to join your Zoom call at the agreed time. You can set up a business meeting with that Chinese client, without worrying about language issues and with more than 500 language pairs, you are not limited in any way. Web portal – This is very much your shop window and a chance to show some stunning code; invest in professional web design and create a brand that will become known for creativity and quality. You might want to think about digital marketing, with ongoing SEO to get your brand known. Here are a few key roles that your start-up needs. Tech recruitment – If you need to put together a team asap, you should create accounts with the best tech recruitment agencies. When the need arises, a quick search will find developers and code writers who are ready to go at the drop of a hat, so to speak. Time is of the essence when you have a client who wants your product and if you can’t meet their deadline, they will use another outfit. Where to base your company – As you know, delivering digital products means you can be based anywhere and some countries offer great incentives for foreign investors. If you are looking at Ireland as a potential venue for your start-up, here is some important information, while many entrepreneurs prefer to be based in Southeast Asia. The marketplace is highly competitive, as you already know and if you do your networking and invest in some SEO, there’s every reason to expect...