Currently Browsing: Financial Management

Posted by Managementguru in Accounting, Financial Management, Human Resource, Marketing, Sales, Technology

on Jul 18th, 2024 | 0 comments

Outsourcing certain business functions can be an effective strategy for companies looking to reduce costs and improve efficiency. By outsourcing non-core activities, businesses can focus their efforts and resources on critical functions that deliver the most value. When done right, outsourcing enables access to world-class capabilities, technology and talent without the need for large investments. This article explores some of the critical business functions that are ideal candidates for outsourcing. 1. Accounting and Finance Accounting and finance functions like bookkeeping, invoicing, payroll and tax preparation are commonly outsourced by businesses today. Outsourcing routine finance activities to qualified accounting firms frees up bandwidth for strategic finance tasks. It also provides access to up-to-date knowledge on constantly evolving regulations. Top accounting providers leverage the latest software and automation to deliver added cost savings. For UK businesses, outsourcing accounting and finance makes sense, especially for small and mid-sized companies lacking in-house expertise. 2. Customer Service Providing exceptional customer service is critical for success, but managing customer interactions in-house requires significant investments in staffing and training. Outsourcing customer service to skilled providers gives access to trained agents and the latest technologies for omnichannel support. It also enables 24/7 coverage. Outsourced customer service teams act as an extension of an organisation to provide seamless experiences. UK firms can benefit from outsourced customer service and support delivered locally with expertise in the regional market. 3. Packing and Distribution Efficient packing and distribution operations are vital for UK businesses involved in manufacturing or e-commerce order fulfilment. However, managing packing, labelling, sorting and shipping in-house can be resource and cost-intensive. Outsourcing these activities to specialised logistics providers allows UK firms to tap into existing warehouses, technology, and resources to optimise their packing and distribution needs. For e-commerce sellers on Amazon, a great option is to partner with a UK FBA prep centre that provides dedicated FBA prep service UK to streamline inventory prep for fulfilment by Amazon. An FBA prep centre has extensive expertise in prepping products quickly while meeting Amazon’s strict requirements. Seeking out a regional UK FBA prep centre located close by can enable quicker turnaround times and avoid delays compared to overseas prep centres. The top FBA prep centres in the UK utilise advanced technologies like automation, conveyor systems and AI to deliver highly efficient, tech-enabled prep services that minimise costly errors. By outsourcing to a skilled local FBA prep centre, UK firms can accelerate growth on Amazon and focus their efforts on sales and marketing. 4. Information Technology Managing IT infrastructure, systems and services in-house can stretch limited resources for UK businesses. Outsourcing IT functions allows companies to tap into leading technologies and expertise without large capital investments. IT outsourcing includes services like cloud hosting, help desk support, cybersecurity, network management and software development. Partnering with managed IT service providers gives access to skilled technical talent and robust tools and infrastructure. It also enables UK firms to offload management of complex IT tasks. Identifying and outsourcing non-core business functions is an impactful strategy for UK firms looking to optimise operations. Outsourcing the tasks above can unlock significant benefits like reduced costs, flexibility, expertise and technology...

Posted by Managementguru in Career Management, Change management, Entrepreneurship, Financial Management

on Jul 10th, 2024 | 0 comments

The entrepreneurial spirit thrives on challenge and innovation. For many entrepreneurs, however, that spirit can extend beyond just building a business. Sometimes, the call to explore new horizons extends to entirely new industries. If you’re an entrepreneur looking to switch industries, this transition can be both exciting and daunting. The good news is that your entrepreneurial skills are valuable assets, and with careful planning and execution, you can successfully navigate this career shift. This article offers a roadmap to guide you through this exciting transition. We’ll explore key steps to take, from self-assessment and industry research to acquiring relevant skills and building a strong network. We’ll also address the financial realities of a career change and explore options like paid internships to bridge the gap. Step 1: Know Yourself, Know Your Goals A successful career change starts with introspection. Ask yourself some key questions: What are my transferable skills? Even if you’re leaving your current industry behind, you’ve likely acquired valuable skills in areas like communication, problem-solving, project management, and marketing. Identifying these transferable skills will be crucial for positioning yourself in your new field. What are my passions and interests? Entrepreneurs are often driven by a desire to make a difference or pursue a specific passion. Leveraging those same passions in your new career can lead to greater fulfillment and motivation. What are my long-term goals? Are you looking for a traditional full-time position, or do you still have the entrepreneurial itch and want to build a new business within your target industry? Step 2: Research, Research, Research Once you have a clearer picture of your goals and skills, it’s time to delve into your target industry. Here are some key areas to research: Industry Trends: What’s the current state of the industry? Is it growing or shrinking? Understanding industry trends will help you identify areas of opportunity. Skills in Demand: What skills are most sought-after in your target industry? There may be specific certifications, training, or educational programs you need to consider. Job Market: What kind of jobs are available in your target industry? Research salary ranges, job descriptions, and the typical career path within the industry. Networking Opportunities: Identify industry associations, conferences, and online communities. Building connections with professionals in your target field is crucial for gaining insights and potential leads. Step 3: Bridge the Skills Gap The skills you honed in your entrepreneurial journey will be valuable, but there may be a gap between your current skillset and what’s required in your new field. There are several ways to bridge this gap: Online Courses and Training: A plethora of online courses and training programs can equip you with the specific industry knowledge and skills you need. Consider MOOCs (Massive Open Online Courses) from platforms like Coursera or EdX, or invest in industry-specific certifications. Paid Internships: Paid internships offer valuable hands-on experience and allow you to learn from industry professionals. While you might take a temporary pay cut, internships provide a way to gain valuable experience that can make you a more attractive candidate for full-time positions. Volunteer Work: Volunteering with organizations within your target industry can help you gain relevant experience, build your network, and demonstrate your passion for the field. Mentorship: Seek out a mentor who works in your target industry. A mentor can provide valuable guidance, help you navigate the industry landscape, and connect you with key individuals. Step 4: Build Your Network Building a strong network is essential for any career change, but especially so when switching industries. Here are some strategies to expand your network: Attend Industry Events: Conferences, workshops, and networking events are excellent opportunities to meet professionals in your...

Posted by Managementguru in Business Management, Financial Management, How To, Personal Finance

on Dec 13th, 2023 | 0 comments

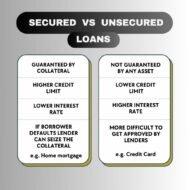

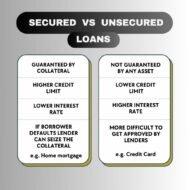

In today’s dynamic and fast-paced world, financial flexibility is often a key factor in achieving personal and professional goals. Loans play a crucial role in providing individuals and businesses with the necessary capital to make significant purchases, invest in education, or start and expand businesses. Understanding the nuances of loans is essential for making informed financial decisions. In this comprehensive guide, we’ll delve into everything you need to know about loans, from types and terms to the application process and the impact on credit. Types of Loans Loans come in various forms, each tailored to specific needs and circumstances. The two primary categories are secured and unsecured loans. Secured loans require collateral, such as a home or a car, which serves as a guarantee for the lender. Unsecured loans, on the other hand, don’t involve collateral but often come with higher interest rates. Types of loans include: Personal Loans: Unsecured loans are used for a wide range of purposes, from debt consolidation to unexpected expenses. They are typically based on the borrower’s creditworthiness. Mortgages: Secured loans for real estate purchases, with the property serving as collateral. Mortgages have varying terms and interest rates, and borrowers often make monthly payments over an extended period. Auto Loans: Secured loans for purchasing vehicles, where the vehicle itself acts as collateral. Auto loans have fixed or variable interest rates and terms. Student Loans: Designed for financing education expenses, student loans often have deferred payment options until after graduation. Interest rates may vary, and some loans are subsidized by the government. Business Loans: Tailored to meet the financial needs of businesses, these loans can cover startup costs, expansion, or operational expenses. Collateral requirements and terms depend on the type of business loan. Hard Money Loans: Often considered a niche within the lending landscape, they provide an alternative financing option for borrowers who may not qualify for traditional bank loans. Loan Terms Understanding loan terms is crucial for assessing the overall cost and feasibility of borrowing. Interest Rates: The cost of borrowing money, displayed as a percentage. Rates can be fixed or variable, with fixed rates providing stability and variable rates fluctuating based on market conditions. Loan Duration (Term): The period over which the borrower repays the loan. Shorter terms often come with higher monthly payments but lower overall interest costs. Amortization: The process of paying off a loan through regular payments that include both principal and interest. Amortization schedules show the breakdown of each payment over time. Application Process Applying for a loan involves several steps, and understanding the process can increase your chances of approval. Credit Score: Lenders assess your creditworthiness through your credit score. A higher score generally leads to better loan terms. Regularly check your credit report for accuracy and take steps to improve your score if needed. Documentation: Prepare necessary documents, such as proof of income, employment history, and details about existing debts. Lenders use this information to evaluate your ability to repay the loan. Comparison Shopping: Explore loan options from multiple lenders to find the best terms and interest rates. Online tools and platforms make it easier than ever to compare loan offers. Impact on Credit Borrowing money through loans can impact your credit in several ways. Individuals often wonder, ‘Do hard money loans show up on credit?‘ It’s worth noting that hard money loans typically do appear on credit reports, as lenders may conduct credit checks during the application process, impacting the borrower’s credit history. Credit Inquiries: Each loan application may result in a hard inquiry on your credit report, which can temporarily lower your score. Payment History: Timely payments contribute to a positive credit history, while late or missed payments can have adverse effects. Loans are powerful financial tools that...

Posted by Managementguru in Financial Management, How To, Personal Finance

on Nov 25th, 2023 | 0 comments

In a world where financial stability often feels like an elusive dream, achieving true financial freedom remains a priority for many. This journey is a combination of disciplined personal finance, strategic debt management, prudent investment, and mindful savings. Key steps to help you pave the way towards financial independence. 1️⃣ Understanding and Managing Debt: The first step towards financial freedom involves addressing and managing existing debts. Begin by creating a detailed list of all outstanding debts, including credit cards, loans, and other financial obligations. Develop a realistic repayment plan, prioritizing high-interest debts to minimize long-term financial strain. Utilize debt consolidation strategies where appropriate and consider negotiating with creditors for more favorable terms. 2️⃣ Mastering Personal Finance: Successful financial management starts with a clear understanding of personal income and expenses. Create a comprehensive budget that outlines your monthly income, fixed expenses, and discretionary spending. Identify areas where you can cut back and allocate the surplus towards debt repayment or savings. Regularly review and adjust your budget to accommodate changes in income or expenses. 3️⃣ Strategic Financial Management: Explore ways to optimize your financial management by leveraging tools and resources. Consider automating bill payments to avoid late fees and penalties. Embrace digital financial apps that offer insights into your spending habits and help you stay on track with your financial goals. Establish an emergency fund to cover unforeseen expenses, providing a financial safety net. 4️⃣ The Power of Investment: Financial freedom is not solely about cutting expenses; it’s also about growing your wealth. Explore different investment avenues, such as stocks, bonds, real estate, and retirement accounts. Diversify your investment portfolio to mitigate risks and maximize returns over the long term. Take advantage of compound interest to accelerate wealth accumulation. 5️⃣ Prioritizing Savings: Cultivating a savings mindset is crucial on the road to financial freedom. Allocate a portion of your income towards savings, whether for short-term goals or long-term plans. Establish specific savings goals, such as an education fund, a home purchase, or retirement. Automate contributions to your savings accounts to ensure consistency and discipline. 6️⃣ Building and Managing Credit: A healthy credit history is fundamental to financial freedom. Regularly monitor your credit score and report, addressing any discrepancies promptly. Use credit responsibly, paying off balances in full and on time. Understand the terms of credit agreements, and be cautious about taking on new debt unless absolutely necessary. Relatable stories that highlight the struggles, triumphs, and lessons learned by individuals striving for financial independence. 1. Debt Liberation Journey: Meet Sarah, a young professional burdened by student loans and credit card debt. Determined to break free, she adopted the “snowball method” advocated by financial guru Dave Ramsey. Starting with the smallest debt, she made extra payments while maintaining minimum payments on others. The psychological boost from paying off the smallest debt fueled her motivation, creating a momentum that eventually led to debt liberation. The ultimate Notion dashboard to track all your finances Juggling your finances can feel like a full-time job. Our Notion template makes it easy to manage all your finances in one place. Grab It Today !⏳ Anecdote: Sarah celebrated each debt payoff by treating herself to a modest reward, turning a challenging process into a series of small victories. 2. Budgeting Wisdom from the Elders: John and Emily, a retired couple, share a timeless lesson. In their early years, they struggled with finances until a wise elder in their community advised them to create a budget. Armed with envelopes labeled for various expenses, they diligently allocated cash. This simple yet effective budgeting method transformed their financial landscape, providing a stable foundation for the future. Get Your Life Organized with a...

Posted by Managementguru in Construction, Financial Management, How To, Real Estate Investment

on Sep 21st, 2023 | 0 comments

With their unique financial situations, entrepreneurs may encounter differences and challenges when obtaining a mortgage compared to traditional salaried individuals. However, with the right approach and preparation, entrepreneurs can secure a mortgage to purchase their dream home. With that in mind, here are some key steps and considerations for entrepreneurs looking to get mortgages. Documentation of Income One of the main challenges entrepreneurs face is demonstrating a consistent income to lenders. Unlike salaried individuals, entrepreneurs often have varying income sources, which can make it more difficult to prove their ability to repay a mortgage. It’s essential to provide thorough documentation of your income, including tax returns, profit and loss statements, and bank statements. Lenders typically assess your income over the past two years to determine your financial stability. Maintain Good Credit Your credit score is important in mortgage approval and the interest rate you’ll receive. Keep a close eye on your credit report, address any discrepancies, and work on improving your credit score if needed. A higher credit score should improve your chances of getting approved and securing more favorable terms. Debt-to-Income Ratio Lenders evaluate your debt-to-income (DTI) ratio, which compares any monthly debt payments to your monthly income. Keeping your DTI ratio low demonstrates your ability to manage your financial obligations. Pay off high-interest debts and avoid taking on new debt in the months leading up to your mortgage application. Organize Financial Records Having organized and up-to-date financial records is crucial. Lenders will want to see clear records of your business income, expenses, and taxes. Being able to present this information in a well-organized manner can help lenders understand your financial situation better. Seek Professional Advice Consider working with an experienced mortgage broker specializing in working with self-employed individuals. They can provide personalized guidance and connect you with lenders who are more flexible with their lending criteria. Then, choose mortgage lenders experienced in working with self-employed individuals and entrepreneurs. They will understand the unique financial complexities you face and can offer guidance on the best mortgage options for your situation. Show Consistency Demonstrate consistent income and business stability. Lenders often prefer entrepreneurs who have been running their businesses for a few years and have a steady income history. Consistency can instill confidence in lenders about your ability to continue making mortgage payments. Build a Healthy Savings A healthy savings account demonstrates your financial stability and ability to cover unexpected expenses. It can also serve as a great safety net in case your business experiences fluctuations in income. Consider a Larger Down Payment If you can gather together a larger down payment, it can improve your loan-to-value (LTV) ratio, which is the loan amount compared to the property’s value. A lower LTV ratio can lower your risk profile in the eyes of lenders and potentially lead to better terms. Get Pre-approved Before house hunting, get pre-approved for a mortgage. This shows sellers that you are a serious buyer and have taken the necessary steps to secure financing. Pre-approval also gives you a clear understanding of your budget, saving you time by focusing on homes within your price range. Provide a Detailed Business Plan & Be Transparent For entrepreneurs, presenting a detailed business plan can showcase your future earning potential and demonstrate your commitment to your business’s growth and success. Honesty and transparency are vital throughout the mortgage application process, but particularly when it comes to your business plan. Disclose all financial information accurately and answer any inquiries from lenders truthfully. In conclusion, entrepreneurs can secure mortgages by effectively showcasing their financial stability, income consistency, and responsible financial management. By understanding the unique challenges and requirements that come with self-employment,...