Currently Browsing: Personal Finance

Posted by Managementguru in Business Management, Financial Management, How To, Personal Finance

on Dec 13th, 2023 | 0 comments

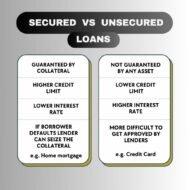

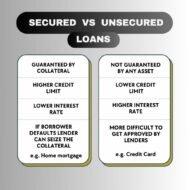

In today’s dynamic and fast-paced world, financial flexibility is often a key factor in achieving personal and professional goals. Loans play a crucial role in providing individuals and businesses with the necessary capital to make significant purchases, invest in education, or start and expand businesses. Understanding the nuances of loans is essential for making informed financial decisions. In this comprehensive guide, we’ll delve into everything you need to know about loans, from types and terms to the application process and the impact on credit. Types of Loans Loans come in various forms, each tailored to specific needs and circumstances. The two primary categories are secured and unsecured loans. Secured loans require collateral, such as a home or a car, which serves as a guarantee for the lender. Unsecured loans, on the other hand, don’t involve collateral but often come with higher interest rates. Types of loans include: Personal Loans: Unsecured loans are used for a wide range of purposes, from debt consolidation to unexpected expenses. They are typically based on the borrower’s creditworthiness. Mortgages: Secured loans for real estate purchases, with the property serving as collateral. Mortgages have varying terms and interest rates, and borrowers often make monthly payments over an extended period. Auto Loans: Secured loans for purchasing vehicles, where the vehicle itself acts as collateral. Auto loans have fixed or variable interest rates and terms. Student Loans: Designed for financing education expenses, student loans often have deferred payment options until after graduation. Interest rates may vary, and some loans are subsidized by the government. Business Loans: Tailored to meet the financial needs of businesses, these loans can cover startup costs, expansion, or operational expenses. Collateral requirements and terms depend on the type of business loan. Hard Money Loans: Often considered a niche within the lending landscape, they provide an alternative financing option for borrowers who may not qualify for traditional bank loans. Loan Terms Understanding loan terms is crucial for assessing the overall cost and feasibility of borrowing. Interest Rates: The cost of borrowing money, displayed as a percentage. Rates can be fixed or variable, with fixed rates providing stability and variable rates fluctuating based on market conditions. Loan Duration (Term): The period over which the borrower repays the loan. Shorter terms often come with higher monthly payments but lower overall interest costs. Amortization: The process of paying off a loan through regular payments that include both principal and interest. Amortization schedules show the breakdown of each payment over time. Application Process Applying for a loan involves several steps, and understanding the process can increase your chances of approval. Credit Score: Lenders assess your creditworthiness through your credit score. A higher score generally leads to better loan terms. Regularly check your credit report for accuracy and take steps to improve your score if needed. Documentation: Prepare necessary documents, such as proof of income, employment history, and details about existing debts. Lenders use this information to evaluate your ability to repay the loan. Comparison Shopping: Explore loan options from multiple lenders to find the best terms and interest rates. Online tools and platforms make it easier than ever to compare loan offers. Impact on Credit Borrowing money through loans can impact your credit in several ways. Individuals often wonder, ‘Do hard money loans show up on credit?‘ It’s worth noting that hard money loans typically do appear on credit reports, as lenders may conduct credit checks during the application process, impacting the borrower’s credit history. Credit Inquiries: Each loan application may result in a hard inquiry on your credit report, which can temporarily lower your score. Payment History: Timely payments contribute to a positive credit history, while late or missed payments can have adverse effects. Loans are powerful financial tools that...

Posted by Managementguru in Financial Management, How To, Personal Finance

on Nov 25th, 2023 | 0 comments

In a world where financial stability often feels like an elusive dream, achieving true financial freedom remains a priority for many. This journey is a combination of disciplined personal finance, strategic debt management, prudent investment, and mindful savings. Key steps to help you pave the way towards financial independence. 1️⃣ Understanding and Managing Debt: The first step towards financial freedom involves addressing and managing existing debts. Begin by creating a detailed list of all outstanding debts, including credit cards, loans, and other financial obligations. Develop a realistic repayment plan, prioritizing high-interest debts to minimize long-term financial strain. Utilize debt consolidation strategies where appropriate and consider negotiating with creditors for more favorable terms. 2️⃣ Mastering Personal Finance: Successful financial management starts with a clear understanding of personal income and expenses. Create a comprehensive budget that outlines your monthly income, fixed expenses, and discretionary spending. Identify areas where you can cut back and allocate the surplus towards debt repayment or savings. Regularly review and adjust your budget to accommodate changes in income or expenses. 3️⃣ Strategic Financial Management: Explore ways to optimize your financial management by leveraging tools and resources. Consider automating bill payments to avoid late fees and penalties. Embrace digital financial apps that offer insights into your spending habits and help you stay on track with your financial goals. Establish an emergency fund to cover unforeseen expenses, providing a financial safety net. 4️⃣ The Power of Investment: Financial freedom is not solely about cutting expenses; it’s also about growing your wealth. Explore different investment avenues, such as stocks, bonds, real estate, and retirement accounts. Diversify your investment portfolio to mitigate risks and maximize returns over the long term. Take advantage of compound interest to accelerate wealth accumulation. 5️⃣ Prioritizing Savings: Cultivating a savings mindset is crucial on the road to financial freedom. Allocate a portion of your income towards savings, whether for short-term goals or long-term plans. Establish specific savings goals, such as an education fund, a home purchase, or retirement. Automate contributions to your savings accounts to ensure consistency and discipline. 6️⃣ Building and Managing Credit: A healthy credit history is fundamental to financial freedom. Regularly monitor your credit score and report, addressing any discrepancies promptly. Use credit responsibly, paying off balances in full and on time. Understand the terms of credit agreements, and be cautious about taking on new debt unless absolutely necessary. Relatable stories that highlight the struggles, triumphs, and lessons learned by individuals striving for financial independence. 1. Debt Liberation Journey: Meet Sarah, a young professional burdened by student loans and credit card debt. Determined to break free, she adopted the “snowball method” advocated by financial guru Dave Ramsey. Starting with the smallest debt, she made extra payments while maintaining minimum payments on others. The psychological boost from paying off the smallest debt fueled her motivation, creating a momentum that eventually led to debt liberation. The ultimate Notion dashboard to track all your finances Juggling your finances can feel like a full-time job. Our Notion template makes it easy to manage all your finances in one place. Grab It Today !⏳ Anecdote: Sarah celebrated each debt payoff by treating herself to a modest reward, turning a challenging process into a series of small victories. 2. Budgeting Wisdom from the Elders: John and Emily, a retired couple, share a timeless lesson. In their early years, they struggled with finances until a wise elder in their community advised them to create a budget. Armed with envelopes labeled for various expenses, they diligently allocated cash. This simple yet effective budgeting method transformed their financial landscape, providing a stable foundation for the future. Get Your Life Organized with a...

Posted by Managementguru in Financial Management, How To, Personal Finance

on Aug 23rd, 2023 | 0 comments

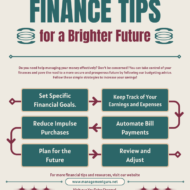

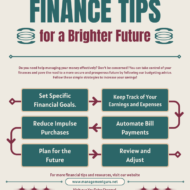

Managing personal finances is crucial for achieving financial stability and building wealth. Here are ten best personal finance tips to help you make smart decisions and improve your financial situation. Create a Budget Develop a budget to track your income and expenses. Allocate your money to cover necessary expenses, savings, and debt repayment, and be mindful of discretionary spending. Save and Invest Make saving a priority. Aim to save a portion of your income each month and invest it wisely to grow your wealth over time. Consider diversifying your investments and seek professional advice if needed. Minimize Debt Avoid excessive debt and work on reducing existing debt. Prioritize high-interest debts, such as credit card debt, and consider strategies like debt consolidation or negotiation to lower interest rates. Emergency Fund Build an emergency fund to cover unexpected expenses, such as medical bills or car repairs. Aim to save three to six months’ worth of living expenses to provide a safety net during challenging times. Track Your Expenses Monitor your spending habits and identify areas where you can cut back. Use personal finance apps or spreadsheets to track your expenses and gain insights into your financial behavior. Plan for Retirement Start saving for retirement as early as possible. Contribute to employer-sponsored retirement plans, like 401(k) or IRA, and take advantage of any matching contributions. Explore other retirement savings options available to you. Insurance Coverage Assess your insurance needs and ensure you have adequate coverage for health, life, home, and auto insurance. Insurance can protect you from unexpected financial setbacks. Avoid Impulsive Purchases Before making a purchase, especially big-ticket items, consider if it aligns with your financial goals. Avoid impulsive buying and practice mindful spending. Continuous Learning Invest in financial literacy. Read books, follow reputable personal finance blogs, or take online courses to enhance your knowledge about money management, investing, and financial planning. Seek Professional Advice If you’re overwhelmed or unsure about your financial decisions, consult with a certified financial planner or advisor. They can provide guidance tailored to your circumstances and help you create a comprehensive financial plan. Remember, personal finance is a long-term game. Consistency, discipline, and ongoing evaluation of your financial strategies are essential for achieving your...

Posted by Managementguru in Financial Management, How To, Personal Finance

on Jul 4th, 2023 | 0 comments

Your 20s are an exciting time filled with new experiences and opportunities, and it’s also a crucial period for setting the stage for your financial future. By establishing smart money goals early on, you can build a solid foundation for financial success and achieve your long-term dreams. In this blog post, we will discuss five essential money goals that every twenty-something should consider pursuing. From budgeting and saving to investing and building credit, these goals will help you make the most of your finances and set you on a path towards a secure and prosperous future. Goal 1: Create and Stick to a Budget One of the most important money goals for your 20s is creating a budget and, more importantly, sticking to it. A budget allows you to gain control over your finances, track your expenses, and ensure that you’re living within your means. Start by listing your monthly income and categorizing your expenses. Identify areas where you can cut back and allocate your money towards savings, debt repayment, and essential expenses. Utilize budgeting apps and tools to streamline the process and stay on top of your financial health. By mastering the art of budgeting early on, you’ll develop responsible spending habits that will serve you well throughout your life. Goal 2: Build an Emergency Fund Life is full of unexpected twists and turns, and having a financial safety net in the form of an emergency fund is crucial. Aim to save three to six months’ worth of living expenses in a separate account that you can access in case of unexpected events like medical emergencies, car repairs, or job loss. Start small if necessary, but make consistent contributions to your emergency fund. Automate your savings by setting up direct deposits and make it a priority in your budget. Having an emergency fund will provide peace of mind and prevent you from falling into debt or relying on credit cards during challenging times. Goal 3: Start Investing Early While retirement may seem far off in your 20s, starting to invest early is a powerful tool for building long-term wealth. Take advantage of compound interest by investing in retirement accounts like a 401(k) or an Individual Retirement Account (IRA). If your employer offers a matching contribution, contribute at least enough to receive the full match—it’s essentially free money. Additionally, consider investing in low-cost index funds or exchange-traded funds (ETFs) to diversify your portfolio. The power of compounding will allow your investments to grow over time, giving you a significant advantage in reaching your financial goals. Goal 4: Manage Debt Responsibly Whether it’s student loans, credit card debt, or a car loan, managing your debt responsibly is crucial in your 20s. Start by understanding the terms and interest rates of your debts, and create a plan to pay them off strategically. Prioritize high-interest debt first, while making minimum payments on other obligations. Consider debt consolidation or refinancing options to reduce interest rates and make repayment more manageable. Avoid accruing new debt whenever possible, and use credit cards responsibly, paying off the balance in full each month. By tackling your debts head-on and developing healthy financial habits, you’ll set yourself up for a future free from the burden of excessive debt. Goal 5: Build and Maintain a Good Credit Score Your credit score plays a vital role in your financial life, influencing your ability to secure loans, rent an apartment, or even land a job. Building and maintaining a good credit score is an essential money goal for your 20s. Start by understanding the factors that impact your credit score, such as payment history, credit utilization, and length of credit history....

Posted by Managementguru in Business Management, Financial Management, Personal Finance, Strategy

on May 31st, 2023 | 0 comments

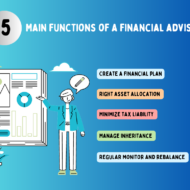

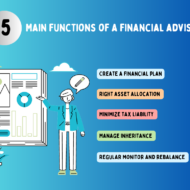

A lot of entrepreneurs are a little too prideful and controlling for their own good. They like to sort out and organize every aspect of their business to ensure it perfectly fits their vision. There’s just one issue: no single person is able to cover every element of their business to a sufficient standard. Even if they are capable in many different areas, a business owner doesn’t have the time to complete everything successfully. This can certainly be the case when it comes to organizing their finances and making future business decisions. This is why it makes sense to hire a local financial advisor. Not convinced? Here are five reasons to bring in this professional help for your business. 1. Expertise in a specialist area It’s no secret that finance is a tricky subject to delve into – particularly for those that are not well-versed in this area. Yes, looking at your revenue and expenses is a relatively easy task, but there’s a lot more to your financials than that. Think about your taxes, the laws you have to follow, judging investments, and so on. With a financial advisor on your side, you suddenly benefit from their expertise. This means your business finances can be maximized when an advisor reviews your situation on a frequent basis to ensure your money is being spent the right way. 2. Local knowledge and support As for why you should go locally with a financial advisor, there are various reasons why this is the case. Say your company is based in Stuart, Florida. Rather than picking a professional in a different state or even city, you can hire a financial advisor in Stuart, Florida to help your business. You will be able to easily meet up with your advisor in person, which really helps you to understand what is going on. Their knowledge on local laws and regulations, how items are enforced and so on can really help you to get the best advice available. 3. A long-term strategy A professional financial advisor is able to assist your business in numerous ways. One of the most valuable is how they can help you to map out a long-term strategy to follow. With a comprehensive plan in place, there’s no guesswork and ending up in the wrong location. An advisor can tell you the destination, how to get there, and what moves to make if any problems do occur. 4. Save money It’s true: you have to pay for the services of a local financial advisor. However, the long-term savings you gain justify this initial outlay. Ultimately, an advisor is there to improve your finances by suggesting the best financial decisions for your situation. That means you are more likely to maximize your profit margins. 5. Lower stress levels Stress is a natural part of running a business. That said, you can relieve at least some of that stress by bringing a financial advisor on board. You are safe in the knowledge your finances are receiving the right level of attention where the right investments are being made to support your company’s...