Posted by Managementguru in Business Management, Decision Making, Marketing, Strategy

on Jul 7th, 2014 | 0 comments

What is Portfolio Analysis ? Portfolio Planning is best advised for diversified companies than the more product coherent ones. Portfolio analysis plays a vital role in planning and implementation of various #strategic business units of the organization as a whole. Portfolio planning recognizes that diversified companies are a collection of businesses, each of which makes a distinct contribution to the overall corporate performance and which should be managed accordingly. Companies dealing with a wide #product range and divisions are expected to redefine their strategies for each of the SBU’s or Strategic Business Units. Then they classify these units on a portfolio grid according to the competitive position and attractiveness of a particular product market. What are strategic business units? A strategic business unit is a fully functional and discrete unit of the business that builds its own strategic vision and direction. Within large companies there are smaller specialized divisions that work towards specific projects and #objectives. The strategic business unit, often referred to as an SBU, remains an important element of the company and is accountable to their head office about their operational status. Typically they will operate as an independent organization with a specific focus on target markets and are large enough to maintain internal divisions such as finance, HR, and so forth. Being Strategic: Thinking and Acting with Impact Types of Portfolio Planning: Analytical Planning: Planning is only at the initial level where traditional administrative tools are used. Process Planning: Here planning is a central part of the ongoing #management process and strategic mission is explicit in activities. Advantages of Portfolio Planning: It promotes substantial improvement in the quality of strategies formulated both at the business and corporate levels.It provides a guideline for adopting their overall management process to the needs of each business.It provides selective #resource allocation to the various SBUs.It furnishes companies with a greatly improved capacity for strategic control when portfolio planning is applied intelligently and with attention to its limitations and problems. Since the road to portfolio planning is a long one, companies often face difficulties trying to implement it and cannot realize the full potential of the approach. In implementing portfolio planning, there is a tendency for the focus to be shifted towards #capital investment rather than resource allocation. #Resource Development is the key: Become a Product Manager | Learn the Skills & Get the Job Implementing Corporate Level and Business Level Strategies: Corporate level #strategy is concerned with the strategic decisions a business makes that affect the entire organization. Financial performance, mergers and acquisitions, #human resource management and the allocation of resources are considered part of corporate level strategy.Business level strategy focuses on how to compete in a particular product/market segment or industry. Competitive advantages and distinctive competencies thus become dominant strategic concerns at this level.At the functional level, the primary focus of strategy is efficiency. Boston Consulting Group Matrix: The business policy portfolio models are most popular and useful to understand the firm’s strategic concerns and choices. They define the firm’s scope or domain by highlighting the inter-relatedness of the diverse factors, such as: #Market Growth#Market ShareCash and Cash flow patternsCapital Intensity#Product Maturity BCG Matrix #Stars– Star category represents high growth and high market share– High investments are needed to maintain the share– High cash flow outward movement in this category to maintain status– Usually in the end of the ‘Growth’ #Product Life Cycle stage– Represents emerging and good business for the company, though they need alot of attention and priority #Cash Cows– Represents low growth, high market share– This is the best quadrant of the portfolio as the company basically enjoy the ‘milk’ of success– This is where the...

Posted by Managementguru in Business Management, Financial Accounting, Financial Management, Principles of Management

on Apr 8th, 2014 | 0 comments

Interest Free Sources and Unsecured Interest Bearing Sources A firm obtains its funds from a variety of sources. Some capital is provided by suppliers, creditors, and owners, while other funds arise from earnings retained in business. In this segment, let me explain to you the sources of short-term funds supplied by creditors. Characteristics of short-term financing: Cost of Funds: Some forms of short-term financing may prove to be expensive than that of intermediate and long-term financing while some short-term sources like Accruals and Payables provide funds at no cost to the firm. Rollover Effect: Short-term finance as the name indicates must be repaid within a period of one year – though some sources provide funds that are constantly rolled over. The funds provided by payables, may remain relatively constant because, as some accounts are paid, other accounts are created. Clean-up: This happens when commercial banks or other lenders demand the firm to pay-off its short term obligation at one point in a financial year. Goals of Short-Term Financing: Funds are needed to finance inventories during a production period. Short term funds facilitate flexibility wherein, it meets the fluctuating needs for funds over a given cycle, commonly 1 year. To achieve low-cost financing due to interest free loans. Cash flow from operations may not be sufficient to keep up with growth-related financing needs Interest Free Sources: Accounts Payable Accounts payable are created when the firm purchases raw material, supplies, or goods for resale on credit terms without signing a formal note for the liability. These purchases on “open account” are, for most firms, the single largest source of short-term financing. Payables represent an unsecured form of financing since no specific assets are pledged as collateral for the liability. Even though no formal note is signed, an accounts payable is a legally binding obligation of a firm. Postponing payment beyond the end of the net (credit) period is known as “stretching accounts payable” or “leaning on the trade.” Possible costs of “stretching accounts payable” are Cost of the cash discount (if any) forgone Late payment penalties or interest Deterioration in credit rating Accruals: These are short term liabilities that arise when services are received but payment has not yet been made. The two primary accruals are wages payable and taxes payable. Employees work for a week, 2 weeks or a month before receiving a paycheck. The salaries or wages, plus the taxes paid by the firm on those wages, offer a form of unsecured short-term financing for the firm. The Government provides strict rules and procedures for the payment of withholding and social security taxes, so that the accrual of taxes cannot be readily manipulated. It is however, possible to change the frequency of paydays to increase or decrease the amount of financing through wages accrual. Wages — Benefits accrue via no direct cash costs, but costs can develop by reduced employee morale and efficiency. Taxes — Benefits accrue until the due date, but costs of penalties and interest beyond the due date reduce the benefits. Unsecured Interest Bearing Sources: Self-Liquidating Bank Loans The bank provides funds for a seasonal or cyclic business peak and the money is used to finance an activity that will generate cash to pay off the loan. Borrowed Funds → Finance Inventory → Peak Sales Season → Receivables → Cash → Pay Off the Loan. Three types of unsecured short-term bank loans: Single payment note – A short-term, one-time loan made to a borrower who needs funds for a specific purpose for a short period of time. Line of Credit – An informal arrangement between a bank and its customer specifying the maximum amount of...

Posted by Managementguru in Financial Accounting, Financial Management, Management Accounting

on Apr 3rd, 2014 | 0 comments

Ratio Calculation From Financial Statement Profit and Loss a/c of Beta Manufacturing Company for the year ended 31st March 2010. Exercise Problem1 Kindly download this link to view the exercise. Given in pdf format. You are required to find out: a) #Gross Profit Ratio b) #Net Profit Ratio c) #Operating Ratio d) Operating #Net Profit to Net Sales Ratio a. GROSS FORFIT RATIO = Gross profit ÷ #Sales × 100 = 50,000 ÷ 1,60,000 × 100 = 31.25 % b. #NET PROFIT RATIO = Net profit ÷ Sales × 100 = 28,000 ÷ 1,60,000 × 100 = 17.5 % c. OPERATING RATIO = #Cost of goods sold + Operating expenses ÷ Sales × 100 Cost of goos sold = Sales – Gross profit = 1,60,000 – 50,000 = Rs. 1,10,000 Operating expenses = 4,000 + 22,800 + 1,200 = Rs. 28,000 Operating ratio = 1,10,000 + 28,000 ÷ 1,60,000 × 100 = 86.25 % d. OPERATING NET PROFIT TO NET SALES RATIO = Operating Profit ÷ Sales × 100 Operating profit = Net profit + Non-Operating expenses – Non operating income = 28,000 + 800 – 4,800 = Rs. 32,000 Operating Net Profit to Net Sales Ratio = 32,000 ÷ 1,60,000 × 100 = 20 % What is a Financial statement? It is an organised collection of data according to logical and consistent #accounting procedure. It combines statements of balance sheet, income and retained earnings. These are prepared for the purpose of presenting a periodical report on the program of investment status and the results achieved i.e., the balance sheet and P& L a/c. Objectives of Financial Statement Analysis: To help in constructing future plans To gauge the earning capacity of the firm To assess the financial position and performance of the company To know the #solvency status of the firm To determine the #progress of the firm As a basis for #taxation and fiscal policy To ensure the legality of #dividends Financial Statement Analysis Tools Comparative Statements Common Size Statements #Trend Analysis #Ratio Analysis Fund Flow Statement Cash Flow Statement Types of Financial Analysis Intra-Firm Comparison Inter-firm Comparison Industry Average or Standard Analysis Horizontal Analysis Vertical Analysis Limitations Lack of Precision Lack of Exactness Incomplete Information Interim Reports Hiding of Real Position or Window Dressing Lack of Comparability Historical...

Posted by Managementguru in Business Management, Decision Making, Financial Management, Human Resource, Principles of Management, Strategy

on Mar 30th, 2014 | 0 comments

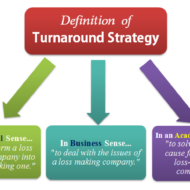

What is Turnaround Strategy Distress signals start flying around when a particular company, whether multinational, corporate or medium sized, is subjected to financial pressure and is at the brink of bankruptcy. What was happening all along? No body knows and nobody wants to be held responsible. The CEO has to bear the brunt and alas, extermination! Aim of Turn-around Strategy: The overall aim of a turn around strategy is to bring back a firm to normalcy which has been under distress in terms of acceptable levels of profitability, solvency, liquidity and cash flow. Turn around strategies should be very carefully formulated so as to stabilize the firm in distress, i.e., to bring the company out of the hole and then go for long term planning. Turn around can be in the form of operational efficiency management, financial restructuring, marketing management or savings in the form of cost reduction or liquidity in the form of asset reduction. Facebook Marketing: A Step-by-Step to Your First 1000 Fans! Turn around to see what is around: We have seen so many such occurrences at the global level and micro level. Some companies rejuvenate like a phoenix bird from the ashes, some go haywire, and some dissolve into thin air. It all depends how well you handle the situation with either the help of an external expert consultant or you might want to go for joint venture or collaboration in order to save you skin from mounting interest payments or you right royally sell the company if somebody is ready to takeover. Either way you have to do something! “Turn around to see what is around”. Don’t see what you want to see See what has to be seen Change the CEO (He is the Ideal Victim!) Resurrect your employees’ confidence Cut down costs Look for Alternatives Lie low for Sometime(till the situation favors) Slowly capture the market by innovative Campaigns and ads Paint a new picture about your company Review your Mission and Vision statements Work on targets Bang on the right target customers and clients Strengthen your Channel of Distributors Go smooth with the bankers (You need them always!) Have confidence in yourself Crisis management is necessary Stress busters like yoga and meditation mandatory Evolve Strategies One step at a time (Slow and steady) Fear and Panic grips the organization in situations of crisis. So the first step would be to stay cool to assess the situation by calmly reviewing the damage with all the concerned people. The next step would be to stop the bleeding by cutting all unwanted costs, unnecessary overheads, and the final stage would be renaissance, recovery, renewal or by whatever name you want to call it, even if it means negative investment or profit. Proper Planning, Inventory Control, Strategic prepositions, Renewal of old strategies in accordance with the situation, Tightening finance controls, Defining the credit management limits, all these are precautionary measures which will hold you from falling into the danger of handling a crisis situation, as” recovery of damaged integrity is going to cost you more than ploughing back your profits....

Posted by Managementguru in Financial Management, Management Accounting, Marketing, Principles of Management

on Mar 27th, 2014 | 0 comments

Costing and Profitability Analysis Relationship between Cost of Production and Sales Volume: The cost of production and volume of sales are the inter-dependent determinants of profit. The analysis of cost behavior in relation to the changing volume of sales and its impact on profit is very important to determine the break even level of a firm. The level at which total revenue equals total costs, is said to be the break even level where there is no-profit or no-loss. Sales beyond break-even volume bring in profits. Generally production is preceded by the process of demand forecasting, to decide on the volume of production, the produce of which will be absorbed by the market. Pricing and promotions come at a later stage. Costing is done to predict the costs of production and resultant profits at various levels of activity. Download this comprehensive power-point presentation on Break-Even Analysis. Cost Volume Profit or CVP Analysis: CVP analysis or Cost-Volume-Profit analysis helps a firm to study the interrelationship between these three factors and their effect on clean profit. The process also includes an analysis about the external factors that affect the volume of production, such as market demand, competitor threat and internal factors such as availability of infrastructure, capital and labor force. This CVP analysis is a boon to the managers to locate the bottlenecks that hinder the productivity and find a way out, by adjusting either the levels of activity or controlling the cost. Picture Courtesy : The Power of Break-Even Analysis Pricing: Pricing is the most important factor that makes your product competitive. The costs of production can be classified into fixed costs, variable costs and semi variable costs. Fixed costs remain constant and tend to be unaffected by the changes in volume of output; whereas variable costs vary directly with the volume of output and semi-variable as the name implies are partly fixed and partly variable. Cost accountants of the modern era fully support variable costing for the purpose of cost accounting, listing its merits as follows: Variable costing talks about contribution margin, which is the excess of sales over variable costs. If this is going to be high, sufficient enough to cover the fixed costs, then profit is assured for the firm. It is a key factor to determine the percentage of profit. Variable costing assigns only those costs to a product that varies directly with the changing levels of production, which is helpful in making a distinction of profit made from sales and those resulting from changes in production and inventory. Segregating the costs into fixed and variable is done for the purpose of providing information to reflect cost-volume-profit relationships and to facilitate management decision-making and control. Some applications of variable costing that facilitates management decision making: Profit planning: By increasing the volume of sales or decreasing the selling price of the product. Performance evaluation of profit centres:Like, sales division, marketing department, product line etc., Decide on product priorities: In view of market potential and profit potential Make or Buy Decisions: Depending on the production capacity and sales demand. Budgeting: Flexible budgeting and cost control are possible by variable costing technique and the striking feature is the treatment given to fixed costs, where it is treated as a period cost and not apportioned among all the departments and products that enable the firm to understand the movement of profits in the same direction as that of the sales. Although considered to be a controversial technique and weighed against the conventional methods of costing such as absorption costing, it is believed that it is to stay and exist as the next step in the evolutionary method of cost accounting....