Posted by Managementguru in Leadership, Online Biz Courses

on Mar 13th, 2016 | 0 comments

“If your action inspire others to dream more, learn more, do more and become more, you are a leader.” – John Quincy Adams. It is no longer sufficient if you are just a tech-savvy individual because most tasks are now structured around teams. It is no longer adequate to work long hours and hope for your boss to notice your sincerity. Whether you’re a working professional who strives to obtain a job promotion or a student participating in group projects, you will find that leadership skills play a huge role in your success. This X-factor decides the difference between you and any other soul willing to slave more hours than you. “Leadership has become an indispensable skill that is greatly appreciated and respected in every single industry.” Most believe that you need to be an inborn leader. Sure, some are born with that incredible charisma to lead, but does that mean confidence and beliefs cannot be changed or obtained? There is a leader within you, your neighbour, your gardener and your mother! It’s in everyone. But how many choose to hone it is the real question here? Before you can make a difference to the people in your life first, you need to choose to take a look inwards, to understand that leadership is a skill that can be acquired and improved upon. Steve Jobs, Mother Teresa, Martin Luther King and Mahatma Gandhi are examples of extraordinary and trasformational leaders who have touched the lives of many. All of them came from humble backgrounds, but they constantly pursued to improve themselves and overcome hurdles. Ready to Take This Course? Okay, now let me introduce you to a great course suitable for aspiring as well as experienced leaders offered by the content providers for STREET SMART UNIVERSITY. Practical Lessons in Leadership The short clips in this course will walk you through typical work scenarios where you can understand and learn to employ leadership techniques. Through this 22 video course, you will receive precious nuggets of advice on how to become a leader in your own right. Armed with these practical skills, you can now thrive in your organisation and make a positive difference! You can be a leader, and the time to take action is NOW! Other Interesting Courses for Your Purview: “A leader is someone who demonstrates what’s possible.” Leadership Skills Mastery Moving From A Cubicle To A Corner Office Disclaimer: This post contains affiliate links Courses are promoted based on authenticity and user review Personally I have been benefited by udemy courses on accounting, leadership and entrepreneurship Benefit obtained by the readers always is the focus and top priority of...

Posted by Managementguru in Financial Accounting, Financial Management, Startups

on Jan 22nd, 2016 | 0 comments

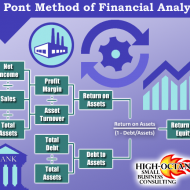

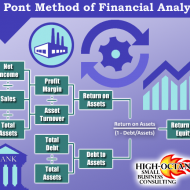

The Key Functions of a Finance Manager Finance manager is one of the important role-players in the domain of finance function. He must have a complete know-how on the areas of accounting, finance, economics and management. His position calls for judicious capability and analytical approach to solve various problems related to finance. A person who deals with finance related activities may be called finance manager. “Focus on a few key objectives … I only have three things to do. I have to choose the right people, allocate the right number of dollars, and transmit ideas from one division to another with the speed of light. So I’m really in the business of being the gatekeeper and the transmitter of ideas.” – Jack Welch The Finance Man Finance manager performs the following major functions Forecasting Financial Requirements It is the principal function of the Finance Manager where he is required to estimate the financial obligations of the business concern. He should evaluate how much finances are required to procure fixed assets and forecast the amount needed to meet the working capital requirements in future. Acquiring Necessary Capital The next step of a finance manager is to focus on how the finance is deployed and where it will be available. Investment Decision Best investment alternatives have to be considered to assure reasonable and stable return from the investment. He must be competent in the field of capital budgeting techniques to govern the effective utilization of investment. The finance manager must attach more importance to the principles of safety, liquidity and profitability while investing capital. Cash Management Cash management plays a major role in the area of finance because proper cash management also helps to meet the short-term liquidity position of the concern. Inter-relation With Other Departments Finance manager handles various functional departments such as marketing, production, personnel, system, research, development, etc. He must maintain a good rapport with all the functional departments of the business organization. “Rule No. 1 : Never lose money. Rule No. 2 : Never forget Rule No. 1.”― Warren...

Posted by Managementguru in Accounting, Entrepreneurship, Human Resource, Marketing

on Aug 8th, 2015 | 0 comments

Best New Business Ideas for 2020 Accountant Create a flier outlining your services. Before you do that, you need to know what those services will be. Do you want to simply do bookkeeping for a small business? A more involved level of accounting would be do actually work up balance sheets, income statements, and other financial reports on a monthly, quarterly, and/or annual basis, depending on the needs of the business. Other specializations can include tax accounting, a huge area of potential work. Many business owners don’t mind keeping their own day-to-day bookkeeping records but would rather get professional help with their taxes. Most small businesses don’t have a full-time accountant, so the task of record keeping often falls to the business owner. A highly organized, trustworthy, part-time bookkeeper can really alleviate the stress of sorting through receipts and tax returns. You’ll most likely only need to put in one or two days a month for each client, depending on how many sales and expenses they have. Knowledge of QuickBooks is a plus, but not necessarily a requirement for, this side business. And if you don’t already have a relevant degree, you can take bookkeeping classes at a local community college. You can also become a certified bookkeeper through organizations like the National Association of Certified Professional Bookkeepers. Read on: A well researched article on “Small business ideas that’ll make you money” by Dawn Matthews that throws light on realistic business ideas that’ll work out in the long run. It’s the year of the entrepreneur. Thanks, in part, to social media, crowdfunding and alternative lending options, and the constant evolution of technology, it’s a great time to start a business. Here is a great post on “Some very specific mistakes which can create big problems for Small Businesses“, compiled by John Hawthorne based on his research and experience. Read the Article for great insights on how branding has to be done the right way ! https://www.davidtaylordesign.com/youre-small-business-do-not-make-mistakes/ Attractive Business Ideas for Accountants Some of the most important business ideas for accountants are given as under. Bookkeeping: Bookkeeping is a lucrative business alternative for accountants. Both and small business firms require to maintain updated bookkeeping. With the availability of various software and computers equipped with the latest technology, bookkeeping has become easier than before. Accountants can engage themselves educational bookkeeping, this kind of business venture require both experience and education which the accountants usually have. Payroll Service: Payroll service which is a subsidiary of bookkeeping service is a very good business idea for accountants. Payroll services are necessary for most of the companies, and accountants can engage themselves into this kind of service which will help them earn good profits. Tax preparation: Tax preparation service can prove to be a very fruitful business idea for the accountants, for this kind of business grows very easily and appeals to numerous clients. Accountants taking tax preparation service as a business plan means that both individuals and firms will act as clients. Hope you found this article informative and useful…. Leave your feedback and...

Posted by Managementguru in Quiz Corner

on Aug 2nd, 2015 | 0 comments

Acronyms are inevitable components of business life and if you are not familiar with some of the important terms, life can become difficult. Try to unveil these 30 Business Acronyms Related to HR, Finance and Accounting: BKPR CAO SHRM CIPD CTO HCM HPWS CIO CPA BGT COGS EPS LC P&L ROA ROE ROI CIMS DRIFT B2B B2C CTC USP PR INC. IPO GDP EBITD ESO GASS Find the answers below the pic: 1. Book-Keeper 2. Chief Accounting Officer 3. Strategic Human Resource Management 4. Chartered Institute of Personnel and Development 5. Chief Technology Officer 6. High Commitment Management 7. High Performance Work System 8. Chief Information Officer 9. Certified Public Accountant 10. Budget 11. Cost of Goods Sold 12. Earnings Per Share 13. Letter of Credit 14. Profit and Loss 15. Return on Assets 16. Return on Equity 17. Return on Investment 18. Certified Investment Management Specialist 19. Do it Right the First Time 20. Business to Business 21. Business to Consumer 22. Cost to Company 23. Unique Selling Point 24. Public Relations 25. Incorporated 26. Initial Public Offering 27. Gross Domestic Product 28. Earnings Before Interest, Tax and Depreciation 29. Employee Stock Option 30. Generally Accepted Accounting Standards...

Posted by Managementguru in Management Accounting

on Mar 24th, 2015 | 0 comments

What are the advantages and limitations of ratio analysis? Advantages: It is an important and useful tool to determine the efficiency with which working capital is being managed in a business organization. It is a ‘health test‘ for a business firm in that it can gauge whether the firm is financially healthy or not. It aids the management of business concern in evaluating its financial position and performance efficiency. It clearly shows the trend of changes in the market position (upward, downward or static), as it covers a number of previous accounting (financial) periods. The progress or downfall of a firm is clearly indicated by this analysis. It assists in preparing financial estimates for the future (financial forecasting). It facilitates the task of managerial control to a great extent. It helps the credit suppliers and investors in deciding upon a business firm as a potential investment outlet or desirable debtor. Ideal or Standard ratios can be established which can be used as reference points of comparison for a firm’s progress over a period of time. It communicates important information with relation to financial strength, earning capacity, debt (borrowing) capacity, liquidity position, capacity to meet fixed commitments, solvency, capital gearing, working capital management, future prospects etc. of a business concern. This analysis is also useful for bench marking purpose- to compare the working result and efficiency of performance of a business enterprise with that of other firms engaged in the same industry (inter-firm comparison). It helps the management to discharge their basic functions of planning, coordinating, controlling etc. It serves as an instrument for testing management efficiency too. It acts as a useful tool for deciding on certain policy matters. Limitations: Accounting ratios calculated based on ratio analysis will be correct only if the accounting data on which they are based are correct. It is only an analysis of past financial data. In certain cases ratio analysis might prove to be misleading with regard to profits. Continuous fluctuation in price levels ( or, purchasing power of money) seriously affect the validity or comparison of accounting ratios calculated for different accounting periods and make such comparisons very difficult. Comparisons become difficult also on account of difference in the definition of several financial (accounting) terms like gross profit, operating profit, net profit etc. There is lot of diversity in practice as regards to the measurement of ratios. Different firms use different accounting methods and the validity of comparison is severely affected by window dressing in the basic financial statements. A single ratio will not be able to convey much information. This analysis only gives part of the total information required for proper decision-making. This should not be taken as a substitute for sound judgement. It should not be overlooked that business problems cannot be solved mechanically through ratio analysis or other types of financial analysis. Follow ManagementGuru Net’s board Accounting – Financial and Management Accounting on...