Posted by Managementguru in Business Management, Financial Accounting

on Apr 25th, 2015 | 0 comments

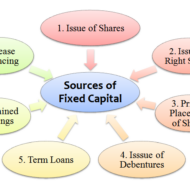

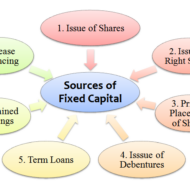

What is Long Term Financing? It is a form of financing that is provided for a period of more than a year to those business entities that face a shortage of capital. Before delving into the advantages of long term financing I would like to present you few fascinating facts on the economy that will blow your mind. Dell “has spent more money on share repurchases than it earned throughout its life as a public company,” writes Floyd Norris of The New York Times.According to Forbes, if a Google employee passes away, “their surviving spouse or domestic partner will receive a check for 50% of their salary every year for the next decade.”Start with a dollar. Double it every day. In 48 days you’ll own every financial asset that exists on the planet — about $200 trillion. Wow…According to Bloomberg, “Americans have missed out on almost $200 billion of stock gains as they drained money from the market in the past four years, haunted by the financial crisis.The “stock market” began in May 17th, 1792 when 24 stock brokers and merchants signed the Buttonwood Agreement.The Securities Exchange Act of 1934 creates the Securities and Exchange Commission, charged with the responsibility of preventing fraud and to require companies provide full disclosure to investors.Wall Street was laid out behind a 12-foot-high wood stockade across lower Manhattan in 1685. The stockade was built to protect the Dutch settlers from British and Native American attacks. Sources of Long Term Finance Long-term loans (External)Issue of shares or equitySale and leaseback (Internal)Retained profit Examples of long-term financing include – a 30 year mortgage or a 10-year Treasury note. Financial Markets and Securities Purpose of Long Term Finance To finance fixed assets.To finance the permanent part of working capital.Expansion of companies.Increasing facilities.Construction projects on a big scale.Provide capital for funding the operations. Factors determining Long-term Financial Requirements Nature of BusinessNature of Goods producedTechnology used Long term finance for businesses A Clear Perspective on Break Even Analysis Let us look at some of the Advantages of going for a Debt Financing Option Debt is the cheapest source of long-term financing. It is the least costly because interest on debt is tax-deductible, bondholders or creditors consider debt as a relatively less risky investment and require lower return.Debt financing provides sufficient flexibility in the financial/capital structure of the company. In case of over capitalization, the company can redeem the debt to balance its capitalization.Bondholders are creditors and have no interference in business operations because they are not entitled to vote.The company can enjoy tax saving on interest on debt. Disadvantages of Long Term Debt Financing Interest on debt is permanent burden to the company: Company has to pay the interest to bondholders or creditors at fixed rate whether it earns profit or not. It is legally liable to pay interest on debt.Debt usually has a fixed maturity date. Therefore, the financial officer must make provision for repayment of debt.Debt is the most risky source of long-term financing. Company must pay interest and principal at specified time. Non-payment of interest and principal on time take the company into bankruptcy.Debenture indentures may contain restrictive covenants which may limit the company’s operating flexibility in future.Only large scale, creditworthy firm, whose assets are good for collateral can raise capital from long-term debt. Financing through Debt Vs Equity There are a number of ways to finance a business using debt or equity. Though the first choice of many small-business owners would be equity, they may also prefer to utilize some type of debt to fund the business rather than take on additional investors. When done the right way, long-term debt financing provides a number of advantages to the business and its owner. Term Loans from Banks Most banks provide term loans,...

Posted by Managementguru in Business Management, Financial Accounting, Financial Management, Principles of Management

on Apr 8th, 2014 | 0 comments

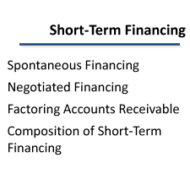

Interest Free Sources and Unsecured Interest Bearing Sources A firm obtains its funds from a variety of sources. Some capital is provided by suppliers, creditors, and owners, while other funds arise from earnings retained in business. In this segment, let me explain to you the sources of short-term funds supplied by creditors. Characteristics of short-term financing: Cost of Funds: Some forms of short-term financing may prove to be expensive than that of intermediate and long-term financing while some short-term sources like Accruals and Payables provide funds at no cost to the firm. Rollover Effect: Short-term finance as the name indicates must be repaid within a period of one year – though some sources provide funds that are constantly rolled over. The funds provided by payables, may remain relatively constant because, as some accounts are paid, other accounts are created. Clean-up: This happens when commercial banks or other lenders demand the firm to pay-off its short term obligation at one point in a financial year. Goals of Short-Term Financing: Funds are needed to finance inventories during a production period. Short term funds facilitate flexibility wherein, it meets the fluctuating needs for funds over a given cycle, commonly 1 year. To achieve low-cost financing due to interest free loans. Cash flow from operations may not be sufficient to keep up with growth-related financing needs Interest Free Sources: Accounts Payable Accounts payable are created when the firm purchases raw material, supplies, or goods for resale on credit terms without signing a formal note for the liability. These purchases on “open account” are, for most firms, the single largest source of short-term financing. Payables represent an unsecured form of financing since no specific assets are pledged as collateral for the liability. Even though no formal note is signed, an accounts payable is a legally binding obligation of a firm. Postponing payment beyond the end of the net (credit) period is known as “stretching accounts payable” or “leaning on the trade.” Possible costs of “stretching accounts payable” are Cost of the cash discount (if any) forgone Late payment penalties or interest Deterioration in credit rating Accruals: These are short term liabilities that arise when services are received but payment has not yet been made. The two primary accruals are wages payable and taxes payable. Employees work for a week, 2 weeks or a month before receiving a paycheck. The salaries or wages, plus the taxes paid by the firm on those wages, offer a form of unsecured short-term financing for the firm. The Government provides strict rules and procedures for the payment of withholding and social security taxes, so that the accrual of taxes cannot be readily manipulated. It is however, possible to change the frequency of paydays to increase or decrease the amount of financing through wages accrual. Wages — Benefits accrue via no direct cash costs, but costs can develop by reduced employee morale and efficiency. Taxes — Benefits accrue until the due date, but costs of penalties and interest beyond the due date reduce the benefits. Unsecured Interest Bearing Sources: Self-Liquidating Bank Loans The bank provides funds for a seasonal or cyclic business peak and the money is used to finance an activity that will generate cash to pay off the loan. Borrowed Funds → Finance Inventory → Peak Sales Season → Receivables → Cash → Pay Off the Loan. Three types of unsecured short-term bank loans: Single payment note – A short-term, one-time loan made to a borrower who needs funds for a specific purpose for a short period of time. Line of Credit – An informal arrangement between a bank and its customer specifying the maximum amount of...

Posted by Managementguru in Financial Management, Principles of Management

on Feb 20th, 2014 | 0 comments

Capital Budgeting- Long Term Resource Planning What is Capital Budgeting? Capital Budgeting refers to the process of planning expenditures that give rise to revenues or returns over a number of years. The process of investment analysis is essential to have a sustainable advantage in the competitive market and to stabilize the profits through resourceful strategic business units. The firm’s management must be on the alert to explore the opportunities present in the market. Obsolete product lines and changes in consumer tastes may present additional problems to a business enterprise affecting the profitability and growth. When a firm decides to venture into projects that demand huge investments, the management has to scrutinize the economic feasibility of such projects. The process of capital investment is also crucial because the projects are for the most part irreversible. Say, for example, if a business firm purchases a special type of machinery, and after installation, if the firm reverses its decision to sell the merchandise due to some technical reasons, it will have only a very small second hand value. Business firms based on the cash flow of the project and the capital recovery period do long-term investment. Why do firms opt for capital budgeting. The reasons may be: To replace worn out equipments that will affect the production efficiency To replace obsolete equipments to install new and more efficient ones To expand production facilities in lieu of increasing demand for the firm’s products and to capture new markets To divest the surplus funds from other business units and to rotate the funds, as idle funds will not generate any revenue To develop new products Research and development Investments made to comply with government regulations, such as projects undertaken to meet government’s health and safety regulations, pollution control and to satisfy other legal requirements. People Involved The proposals for new projects come from the internal environment, such as department heads, executives, employees and of course the management. Experts in product development, marketing research, industrial engineering examine the investment proposals and they may regularly meet with the heads of other divisions in brainstorming sessions to zero in on the proposals. This free course from Udemy is Ideal for people interested in entrepreneurship, fintech, big data, startups, finance, private equity, VCs, & investing. https://www.udemy.com/crowdfund-investing-101-the-basics-of-equity-crowdfunding/ Departments Involved While the firm’s top management makes the final say or decision to undertake or not a major investment project, the process is likely to involve most of the firm’s divisions. Each department has to present its view on the feasibility and viability of the project. The marketing department- on the demand for the new or modified products that the firm plans to sell The production, engineering, personnel and purchasing departments- on the estimation and cost of the investment projects The financing department on- how the required investments funds have to be raised. Thus, the process of expenditure analysis can truly be said to integrate the operation of all the major divisions of the...

Posted by Managementguru in Accounting, Management Accounting

on Feb 14th, 2014 | 0 comments

Advantages of Management Accounting It helps to increase the efficiency of all functions of management.It helps in target-fixing, decision-making, price-fixing, selection of product-mix and so onForecasting and Budgeting help the concern to plan the future and financial activities.Various tools and techniques provide reliability and authenticity to carry out the business functions.It is useful in controlling wastage and defects.It helps in complete communication between all levels of management.It helps in controlling the cost of production thus increasing the profit percentage.It is proactive-analyses the governmental policies and socio-economic scenario which helps to assess the external environmental impacts on the organization. Limitations of Management Accounting It is concerned with financial and cost accounting. If these records are not reliable, it will affect the effectiveness of management accounting.Decisions taken by the management accountant may or may not be executed by the management..It is very expensive. Only big concerns can adopt this method of accounting.New rules and regulations are to be framed, hence there is a possibility of opposition from the employees.It is only in the developing stage.It provides only data and not decisions.It is a tool to the management and not an alternative of management. These are the advantages and limitations of management accounting. Characteristics of management accounting Following are the characteristic features of management accounting: First and foremost characteristic is that it provides the necessary information to the management. It might be any data- numbers, gross profit, net profit, comaparitive financial statements, profit and loss account etc.,It is purely analytical.The interpretations help the management in timely decision-making.It adopts a selective technique to arrive at the results.Helps to chart-out the future course of action.Also helps to know the present financial condition of the firm and the respective implications on the stake holders. Various tools of management accounting: MARGINAL COSTINGSTANDARD COSTINGBUDGETARY CONTROLRATIO ANALYSISFUND FLOW ANALYSISCASH FLOW ANALYSIS...