Posted by Managementguru in Decision Making, Entrepreneurship, International Business, Organisational behaviour, Principles of Management

on Apr 29th, 2014 | 0 comments

Sole Proprietorship – Features and Advantages Sole Proprietorship is a business owned and controlled by only one person. The proprietor who sows, reaps and harvests the output of his labor owns all the assets in his firm. This form of business organization is one of the most popular forms in India and the reason being the advantages it offers. Here, business can be started simply after obtaining necessary manufacturing license and permit. Setting up Process: Setting up a sole proprietorship entity is trouble-free as compared to other form of companies. Unlike Limited Liability Partnership (LLP) or any other private or public companies; in sole proprietorship you do not need to file an application to ROC- Registrar of Companies. You need to choose a name for your business, open a bank account and take license for varied services including Service Tax, VAT, IEC, Shops & Establishment license, PAN, Importer Exporter Code, ESI, Professional Tax, Central Excise Duty, CST Registration, Employee Provident Fund Registration etc. After acquiring the respective licenses one can commence with his her sole proprietorship firm in India. Some important licenses you may need for starting a sole proprietorship firm in India: PAN CARD Permanent Account Number (PAN) is a ten-digit alphanumeric number, issued in the form of a laminated card, by the Income Tax Department. It is mandatory to quote PAN on return of income, all correspondence with any income tax authority. A typical PAN is AABPS1205E. A complete overview of pancard can be seen at – http://www.incometaxindia.gov.in/pan/overview.asp New PAN CARD application – https://tin.tin.nsdl.com/pan/ TAN CARD Tax Deduction Account Number (TAN) is an alphanumeric number issued to individuals who are required to deduct tax on payments made by them under the Indian Income Tax Act, 1961. The Tax Deducted at Source on payments made by assessees has to be deposited under the following number to enable the assessees who have received the payments to claim the tax deducted in their income tax return. So TAN is the abbreviation for Tax deduction and collection Account Number. Application for tan card – https://tin.tin.nsdl.com/tan/ SERVICE TAX REGISTRATION Service tax has to be paid to the Government of India by the service provider who collects the same form his customers. As on 1st May, 2006, 95 services are identified as taxable services in India. Section 64 of the Finance Act, 1994, extends the levy of service tax to the whole of India, except the State of Jammu & Kashmir. The current rate is 12.36 % on the gross value of the service. Service tax can be paid online – https://www.aces.gov.in/ VAT AND CST VAT (Value Added Tax) is a form of indirect tax imposed only on goods sold within a particular state, which essentially means that the buyer and the seller exist in the same state. Only when tangible goods and products are sold, VAT can be imposed. VAT (Value Added Tax) is governed by respective state Acts. Every state has a separate and distinct VAT act reserved for their state. CST (Central Sales Tax) is a form of indirect tax imposed only on goods sold from one state to another state, which particularly takes into account that the buyer and the seller exist in two different states. CST (Central Sales Tax) is governed by Central Sales Tax Act, 1956. This tax is governed by a single central act, though the chargeability is state specific. Registration for VAT AND CST IN Tamil Nadu – http://www.tnvat.gov.in/English/NewDealerRegist.aspx THE BUSINESS VIABILITY CHECKLIST FOR ENTREPRENEURS IMPORT EXPORT CODE: DGFT – Directorate General of Foreign Trade runs various schemes for trade promotion and facilitation. Using this facility you may file, prepare and track online application in...

Posted by Managementguru in Business Management, Change management, Human Resource, Training & Development

on Apr 25th, 2014 | 0 comments

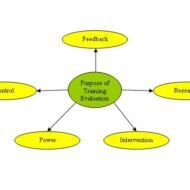

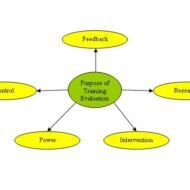

The process of Training Programme Evaluation Evaluation of training programme is basically critical examination of appraisal of training programmers. Appraisal of training programme is necessary for improvement and evaluation is a continuous process. “Learning from mistakes” and transforming them into experience and knowledge is the crux of training evaluation. Areas of Evaluation: The participant’s opinion about the programme Knowledge, attitude, skills learned during the training sessions Behavioral change, if any, as a result of training Pay off and benefits that accrue to the organization resulting from the change in behavior of the trainees. What should the evaluation process consider in the planning stage? Attributes of training programme to be evaluated Standard for evaluation Measuring various aspects of the programme and feedback on the effectiveness of the same Implementation of the programme results Scrutinizing the changes that need to be done in the training session Method of dealing with the change – Who will do it, how will the changes be made, how quickly the changes can be implemented. Steps in the Evaluation Process: Establish acceptable standards and bench marking Data collection Analysis of data, interpretation and drawing conclusions Feedback of the results 1. Establish acceptable standards Standards may be set in any one of the following methods; Setting standards through best practice Setting standards through bench marking 2. Data Collection Data may be collected using any one of the following techniques: Questionnaire Interview Written Test Observation 3. Analysis of Data and Interpretation Raw data should be tabulated – Histogram and frequency distribution yield basic information on the shape of dispersal of data around the mean and standard deviation. Relevant statistical tools must be employed depending upon the purpose of evaluation. 4. Evaluating and Feedback The steps involved in this process are: Design valuation – Includes clear objectives backed up by proper content Evaluation of content – Value and usefulness of the programme content may be measured by seeing the reaction of the trainees. An animated discussion in the classroom is a clear indication of the value the content offers. Usefulness may be known by interviewing the trainees and by comparing the performance impact of training with individual job descriptions. Evaluating the presenters – By taking feedback from the trainees the training quality of the presenter or lecturer may be evaluated. Evaluation of trainees – Three aspects that have to be considered on the part of the trainees are, feeling and opinion, learning and attitudinal changes. Evaluating on the job results and productivity changes – A number of factors affect productivity and pre and post measurement of some of the below mentioned aspects shall throw light on the effect of the training programme. Factors affecting Productivity: Cost Reduction ,grievance reduction, productivity after versus before training, work quality, quantitative results, accident rates, absenteeism, employee suggestions, supervisory rating, profits, sales volume, turnover rates, customer complaints, worker efficiency, training time required for proficiency, cost per untrained employee, new product development, new customers and public relations. Behavioral Factors: Some of the specific behavioral changes listed as follows can be observed before and after the training programme – application of new knowledge, use of new skills, high standards, courtesy, adherence to safety regulations, teamwork, perseverance, honesty, co-operation, quality of work, punctuality, effort, initiative. Useful Information: Sample Training Evaluation Questionnaire 5 evaluation methods to evaluate staff training...

Posted by Managementguru in Business Management, Financial Accounting, Management Accounting

on Apr 21st, 2014 | 0 comments

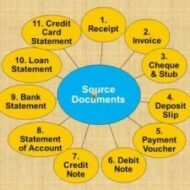

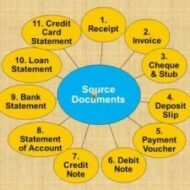

What are the Various Source Documents in Accounting? What is meant by source document? A source document is one used to record the transactions in the books of account. These documents stand as evidence for business transactions. These include Cash Memo Invoice Receipt Debit Note Credit Note Voucher Pay in Slip Cheque etc. 1. Cash Memo: When goods are sold or purchased for cash, the firm gives or receives cash memos with details regarding cash transactions. These documents become the basis for recording these transactions in the books of accounts. 2. Invoice: Invoice is prepared when goods are sold or purchased on credit. It contains the name of the party, quantity, price per unit and the total amount payable. The original copy is sent to the buyer and the duplicate copy is kept as proof of sale and for future reference. Types of Invoice: Inland Invoice – An invoice which is used in internal trade transaction is called as an Inland Invoice. When the goods are sold within a country, the invoice relating to such a transaction is called as an Inland Invoice. Foreign Invoice – An invoice which is prepared for covering an international trade transaction is called as a Foreign Invoice. A number of copies are prepared, maybe even 10 to 12, because a number of authorities require it. Inward Invoice – Inward invoice is received by the buyer from the seller, on receipt of invoice; the buyer stamps it with date of receipt. The inward invoice number is entered in the purchase journal. Outward Invoice – Outward Invoice is a seller’s bill. An invoice which is inward to the buyer is an outward for a seller. It is called outward invoice, because it is sent to the buyer. At least one copy of the invoice is retained by the seller for necessary action and reference. Proforma Invoice – Proforma Invoice is not a real invoice. It is prepared to give a clear idea regarding the amount that would be paid by the buyer if he places an order. This is prepared at the request of the buyer. 3. Receipt: When a firm receives cash from a customer it issues a receipt as a proof of receiving cash. The original copy is handed over to the party making payment and the duplicate is kept for future reference. This document contains date, amount, name of the party and the nature of payment. 5 Kinds of Receipts Small Businesses Should Take Extra Care to Keep Meal & Entertainment Receipts Receipts from Out of Town Business Travels Vehicle Related Receipts Receipts for Gifts Home Office Receipts 4 & 5. Debit and Credit Notes: These are prepared when goods are returned to supplier or when an additional amount is recoverable from a customer. When the purchaser returns the goods to the seller the Purchaser sends a Debit Note to the seller (i.e. the purchaser debits the seller in his books. Purchasers Books) and the Seller sends a Credit Note to the purchaser (i.e. the seller credits the Purchaser in his Books. Sellers Books). Following are the JVs to be passed:- Sales Return inward A/c Dr. To Debtor A/c (Being goods returned by the customer) Creditor A/c Dr. To Goods Return A/c (Being goods sent back to the seller) 6. Voucher: It is a written document in support of a transaction. It is a proof of a particular transaction taking place for the value stated in the voucher. This is necessary to audit the account. In book keeping, voucher is the first document to record an entry. Normally three types of vouchers are used. Receipt voucher Payment voucher Journal voucher RECEIPT VOUCHER Receipt voucher...

Posted by Managementguru in Video Lecturers

on Apr 20th, 2014 | 0 comments

Strategic Management Video Lecture by David Kryscynski This is the introduction lecture for Strategic Management. Very Innovative and Informative video. A List of Strategic Management Terms Business – A strategy that pertains to single departments or units within a company.Combination – A type of grand strategy that employs several different grand strategies at once.Concentration – A growth strategy that extends the sale of current products or services to a company’s current market.Differentiation – A business strategy that strives to make the company’s product or service unique.Diversification – A growth strategy that moves a company into a similar kind of business with new or different products or services.Divestiture – A type of defensive strategy in which a company sells some part of its business, often an unprofitable part.Evaluating – The process of continuously monitoring the company’s progress toward its long-range goals and mission.Focus – A business strategy that directs marketing and sales towards a small segment of the market.Formal – The type of planning that involves systematic studying of an issue and the preparation of a written document to deal with the problem.Formulating strategy – Developing the grand- and business-level strategies to be used by the company.Functional – A strategy which involves short-range operational plans which support business strategies by emphasizing practical implementation.Goal – A concise statement that provides direction for employees and set standards for achieving the company’s strategic planGrand – A type of strategy that provides overall direction for the company.Growth – A type of grand strategy developed when a company tries to expand sales, products, or number of employees.Implementing – Putting a strategy to work after it has been formulated.Intermediate – Covers the time span between short-range and long-range, usually 1-3 years or 1-5 yearsLiquidation – A type of defensive strategy in which the entire company is sold or dissolved.Long Term– A three-to-five year period of time, but possibly as far as 20 years into the future.Mission Statement – A brief summary explaining why a company exists.Operational – Short-range planning that focuses on forming ideas for dealing with specific functions in the company.Overall Cost Leadership – A business strategy that is designed to produce and deliver a product or service for a lower cost than the competition.Planning – The process that businesses use to decide the company’s goals for the future and the ways to achieve those goals.Policy – A broad general guide to action that establishes boundaries within which employees must operate.Procedure – A detailed series of related steps of tasks written to implement a policy.Retrenchment – A type of strategy that aims to reverse negative trends in a company, such as losses in sales.Rule – A specific and definite corporate action that employees must follow.Short Term– A one-year period of time.Stability – A type of strategy that aims to keep the company operating at the same level that it has for several years.Strategic – Long-range planning done by the highest management levels in the company.Strategic Management – The application of the basic planning process at the highest levels of the company.Strategy – An outline of the basic steps management is going to take to achieve a goal.SWOT Analysis – The most utilized process for determining a company’s overall health; it involves analyzing internal strengths, internal weaknesses, external opportunities, and external threats.Turnaround – A type of defensive strategy that is used to regain success.Vertical Integration – A growth strategy that moves a company into a market it previously served either as a supplier or as a customer. Take The Test to Check Your Strategic...