Posted by Managementguru in E Sale Point

on Jul 17th, 2014 | 0 comments

I thought it would be helpful to create resource pages on some of the wonderful ‘Online Courses’ available. I recommend bookmarking these pages for your reference and convenience. Enjoy! Since our niche pertains to MANAGEMENT & BUSINESS ADMINISTRATION, let me start with a list of courses on Human Resources, the indispensable organizational factor. Learn how to recruit, hire, train and manage Human Capital. Human Resource Outsourcing ( HRO) has become necessary TO NOT ONLY HIRE BEST TALENT but also to RETAIN THEM. Human Resource Management Courses Let me first list some courses on HUMAN RESOURCE CERIFICATE COURSES 👈 Follow this link These courses include, PMP certification exam prep Payroll management Vendor relations Scrum master certification Employment regulations and programs These courses give you the ease of learning from the comfort of your home at very reasonable prices and also give you an opportunity for passive income by publishing video lectures on Udemy. If you happen to be very successful, this platform might become your main source of income, since people are always hungry for more information and knowledge. Don’t Miss Out On This Course HR Analytics using MS Excel for Human Resource Management Use Excel for HR Analytics, calculate HR metrics, build HR dashboards & ML models for Human Resource & People Analytics To Choose from over 210,000 online video courses with new additions published every month 👈 Follow this link Hope you enjoyed this post, and come back with your valuable feedback if you were benefited by enrolling in any one of these courses. Online learning has become the ‘ORDER OF THE DAY‘ and lot of universities and educational institutions are digitizing their teaching approach and if you happen to be an expert in your niche, ‘YOU ARE MOST WANTED‘. Disclosure: Please note that some are affiliate links, and at no additional cost to you, I will earn a commission if you decide to make a purchase. Please understand that I have experience with all of these companies, and I recommend them because they are helpful and useful, not because of the small commissions I make if you decide to buy...

Posted by Managementguru in Business Management, Financial Accounting, Financial Management, Principles of Management

on Apr 10th, 2014 | 0 comments

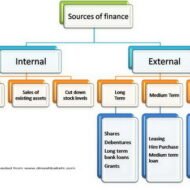

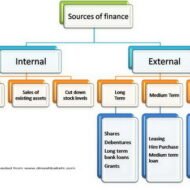

Unsecured and Secured Short Term Sources Unsecured Non-Bank Short Term Sources Commercial Paper: Short-term, unsecured promissory notes, generally issued by large corporations, with maturities of a few days to 270 days. Usually issued in multiples of $100,000 or more. Commercial paper market is composed of the (1) dealer and (2) direct-placement markets. Advantage: Cheaper than a short-term business loan from a commercial bank. Dealers require a line of credit to ensure that the commercial paper is paid off. Private Loans: A short term unsecured loan may be taken from a wealthy shareholder, a major supplier, or other parties interested in assisting the firm through a short term difficulty. Cash Advances for Customers: A customer may pay for all or a portion of future purchases before receiving the goods. This aids the firm to purchase raw materials and produce the final goods. This form of financing is a special arrangement for expensive or custom-made items that would strain the financial resources of the manufacturing company. Secured Short-term Sources: Security (collateral) — Asset (s) is pledged by a borrower to ensure repayment of a loan. If the borrower defaults, the lender may sell the security to pay off the loan. Collateral value depends on: Marketability Life Riskiness Types of Inventory Backed Loans: Field Warehouse Receipt — A receipt for goods segregated and stored on the borrower’s premises (but under the control of an independent warehousing company) that a lender holds as collateral for a loan. Terminal Warehouse Receipt — A receipt for the deposit of goods in a public warehouse that a lender holds as collateral for a loan. Trust Receipt – This loan is secured by specific and easily identified collateral that remains in the control or physical possession of the borrower. A security device acknowledging that the borrower holds specifically identified inventory and proceeds from its sale in trust for the lender. Example: When automobile dealers use this kind of financing for the cars in their showrooms or in stock, it is called floor planning. As implied by the name, this kind of loan requires a considerable degree of trust in the honesty and integrity of the borrower. Once the inventory is sold or the receivable is collected, payment must be remitted to the lender. If there is a default, the loan is said to be secured by bogus collateral. These loans are common when the collateral is easily identified by description or serial number and then each item of collateral has relatively large dollar value. Floating Lien — A general, or blanket, lien against a group of assets, such as inventory or receivables, without the assets being specifically identified Chattel Mortgage — A lien on specifically identified personal property (assets other than real estate) backing a loan. Financial Institutions: Primary sources of secured short term financing are banks and financial institutions, including insurance companies, finance companies, and the financial subsidiaries of major corporations. The best mix of short-term financing depends on: Cost of the financing method Availability of funds Timing Flexibility Degree to which the assets are encumbered It is always better to go for bank loans or loans from established and long standing private institutions because there is a leverage for the debtors to sit for discussions to sort out issued in case of defaults. All banks in India are trying to close accounts labeled under NPA- Non Performing assets either by recovering the money through one time settlement (OTS) or by auctioning the collaterals pledged during the time of loan sanctioning. If you happen to take loans from individuals or third-parties, you cannot enjoy this comfort or breather. Some Finance Quotes and Sayings for You: A...

Posted by Managementguru in Accounting, Financial Accounting, Management Accounting

on Feb 13th, 2014 | 0 comments

Accounting Concepts and Principles are a set of broad conventions that have been devised to provide a basic framework for financial reporting. Accounting concepts are postulates, assumptions or conditions upon which accounting records and statement are based.

Posted by Managementguru in Accounting, Financial Accounting, Financial Management

on Feb 13th, 2014 | 0 comments

The purpose of accounting is to provide the information that is needed for sound economic decision making. The main purpose of financial accounting is to prepare financial reports that provide information about a firm’s performance to external parties such as investors, creditors, and tax authorities.

Posted by Admin in Accounting, Management Accounting

on Jan 29th, 2014 | 0 comments

Management accounting combines accounting, finance and management with the leading edge techniques needed to drive successful businesses. The process of preparing management reports and accounts that provide accurate and timely financial and statistical information required by managers to make day-to-day and short-term decisions