Posted by Managementguru in Decision Making, Entrepreneurship, International Business, Organisational behaviour, Principles of Management

on Apr 29th, 2014 | 0 comments

Sole Proprietorship – Features and Advantages Sole Proprietorship is a business owned and controlled by only one person. The proprietor who sows, reaps and harvests the output of his labor owns all the assets in his firm. This form of business organization is one of the most popular forms in India and the reason being the advantages it offers. Here, business can be started simply after obtaining necessary manufacturing license and permit. Setting up Process: Setting up a sole proprietorship entity is trouble-free as compared to other form of companies. Unlike Limited Liability Partnership (LLP) or any other private or public companies; in sole proprietorship you do not need to file an application to ROC- Registrar of Companies. You need to choose a name for your business, open a bank account and take license for varied services including Service Tax, VAT, IEC, Shops & Establishment license, PAN, Importer Exporter Code, ESI, Professional Tax, Central Excise Duty, CST Registration, Employee Provident Fund Registration etc. After acquiring the respective licenses one can commence with his her sole proprietorship firm in India. Some important licenses you may need for starting a sole proprietorship firm in India: PAN CARD Permanent Account Number (PAN) is a ten-digit alphanumeric number, issued in the form of a laminated card, by the Income Tax Department. It is mandatory to quote PAN on return of income, all correspondence with any income tax authority. A typical PAN is AABPS1205E. A complete overview of pancard can be seen at – http://www.incometaxindia.gov.in/pan/overview.asp New PAN CARD application – https://tin.tin.nsdl.com/pan/ TAN CARD Tax Deduction Account Number (TAN) is an alphanumeric number issued to individuals who are required to deduct tax on payments made by them under the Indian Income Tax Act, 1961. The Tax Deducted at Source on payments made by assessees has to be deposited under the following number to enable the assessees who have received the payments to claim the tax deducted in their income tax return. So TAN is the abbreviation for Tax deduction and collection Account Number. Application for tan card – https://tin.tin.nsdl.com/tan/ SERVICE TAX REGISTRATION Service tax has to be paid to the Government of India by the service provider who collects the same form his customers. As on 1st May, 2006, 95 services are identified as taxable services in India. Section 64 of the Finance Act, 1994, extends the levy of service tax to the whole of India, except the State of Jammu & Kashmir. The current rate is 12.36 % on the gross value of the service. Service tax can be paid online – https://www.aces.gov.in/ VAT AND CST VAT (Value Added Tax) is a form of indirect tax imposed only on goods sold within a particular state, which essentially means that the buyer and the seller exist in the same state. Only when tangible goods and products are sold, VAT can be imposed. VAT (Value Added Tax) is governed by respective state Acts. Every state has a separate and distinct VAT act reserved for their state. CST (Central Sales Tax) is a form of indirect tax imposed only on goods sold from one state to another state, which particularly takes into account that the buyer and the seller exist in two different states. CST (Central Sales Tax) is governed by Central Sales Tax Act, 1956. This tax is governed by a single central act, though the chargeability is state specific. Registration for VAT AND CST IN Tamil Nadu – http://www.tnvat.gov.in/English/NewDealerRegist.aspx THE BUSINESS VIABILITY CHECKLIST FOR ENTREPRENEURS IMPORT EXPORT CODE: DGFT – Directorate General of Foreign Trade runs various schemes for trade promotion and facilitation. Using this facility you may file, prepare and track online application in...

Posted by Managementguru in Business Management, Change management, Entrepreneurship, Human Resource

on Apr 16th, 2014 | 0 comments

Entrepreneurs are the mechanism by which our economy turns demand into supply. They create new ventures that provide new, improved products and services. Here we list some of the principal qualities of entrepreneurs and how those qualities help in shaping up our economy. Productivity Accelerators: Entrepreneurship raises productivity through technical and other forms of innovation. Entrepreneurs as risk bearers find resources and fill market gaps that would be missed by larger, more bureaucratic organizations. They allow a country to extract every last bit of marginal capacity out of whatever resources exist within the society. Brilliant Tips on Productivity by some Popular Entrepreneurs: Focus on one thing at a time: It may seem like a no-brainer, but multitasking can actually cut back on your productivity. Instead of juggling multiple projects at once, schedule out blocks of time — or even entire days — during which you only focus on one task or one project. Steph Auteri, @stephauteri, Word Nerd Pro Outsource, outsource, outsource: Everything may be a priority, but you are not equally brilliant at everything. Eliminate the unnecessary tasks and outsource your weaknesses so your time and focus is directed to where you’ll make the biggest impact for the business. Kelly Azevedo, @krazevedo, She’s Got Systems Define roles and divide work: Make sure everyone on the team has distinct roles defined, and divide work accordingly. Everyone on a proactive team will want to do everything, and clearly defined roles make it clear who should do what. David Gardner, @david_gardner, ColorJar Job Creators: It is a powerful tool of job creation –Entrepreneurship as a whole contributes to social wealth by creating new markets, new industries, new technology, new institutional forms, new jobs and net increases in real productivity. The jobs constructed through their activities in turn lead to equitable distribution of income which leads to higher standards of living for the population. Entrepreneurship facilitates the transfer of technology. Entrepreneurs play a strategic role in commercializing new inventions and products. They play a critical role in the restructuring and transformation of economy. Their behavior breathes vitality into the life of large corporations and governmental enterprises. Market Competitiveness: They make the markets more competitive and thereby reduce both static and dynamic market inefficiencies. Micro-preneurs working in the informal sector circumvent established government authority when governments and their programmes inhibit economic development. They stimulate redistribution of wealth, income and political power within societies in ways that are economically positive and without being politically disruptive. Social Welfare: They improve social welfare of a country harnessing dormant, previously overlooked talent. They create new markets and help in expansion into international markets. The unique feature of entrepreneurship – that it is a low cost strategy of economic development, job creation and technical innovations. Technology Innovation: Technology entrepreneurship is also important for sustainable development as Nobel Prize Laureate prof. Dan Schechtman puts it: “Technological entrepreneurship is a key to the well-being of the world”. India has been the first among the few developing countries to have assigned a significant and categorical state role to small scale industries from the first Five Year Plan itself, and the small scale sector has emerged as a dynamic and vibrant sector of the economy during the eighties. If the country develops pucca infrastructure and removes the hurdles in the operative environment politically and legally, no doubt the Indian economy will be scaling to greater heights. Surplus manpower (educated and un-educated), which has been a great liability can become an asset once those with potential are selectively groomed for self-employment and enterprise formation, leading to further job...

Posted by Managementguru in Business Management, Financial Accounting, Financial Management, Principles of Management

on Apr 10th, 2014 | 0 comments

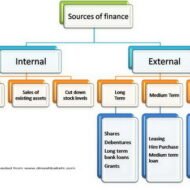

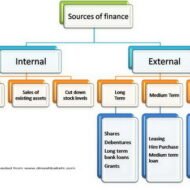

Unsecured and Secured Short Term Sources Unsecured Non-Bank Short Term Sources Commercial Paper: Short-term, unsecured promissory notes, generally issued by large corporations, with maturities of a few days to 270 days. Usually issued in multiples of $100,000 or more. Commercial paper market is composed of the (1) dealer and (2) direct-placement markets. Advantage: Cheaper than a short-term business loan from a commercial bank. Dealers require a line of credit to ensure that the commercial paper is paid off. Private Loans: A short term unsecured loan may be taken from a wealthy shareholder, a major supplier, or other parties interested in assisting the firm through a short term difficulty. Cash Advances for Customers: A customer may pay for all or a portion of future purchases before receiving the goods. This aids the firm to purchase raw materials and produce the final goods. This form of financing is a special arrangement for expensive or custom-made items that would strain the financial resources of the manufacturing company. Secured Short-term Sources: Security (collateral) — Asset (s) is pledged by a borrower to ensure repayment of a loan. If the borrower defaults, the lender may sell the security to pay off the loan. Collateral value depends on: Marketability Life Riskiness Types of Inventory Backed Loans: Field Warehouse Receipt — A receipt for goods segregated and stored on the borrower’s premises (but under the control of an independent warehousing company) that a lender holds as collateral for a loan. Terminal Warehouse Receipt — A receipt for the deposit of goods in a public warehouse that a lender holds as collateral for a loan. Trust Receipt – This loan is secured by specific and easily identified collateral that remains in the control or physical possession of the borrower. A security device acknowledging that the borrower holds specifically identified inventory and proceeds from its sale in trust for the lender. Example: When automobile dealers use this kind of financing for the cars in their showrooms or in stock, it is called floor planning. As implied by the name, this kind of loan requires a considerable degree of trust in the honesty and integrity of the borrower. Once the inventory is sold or the receivable is collected, payment must be remitted to the lender. If there is a default, the loan is said to be secured by bogus collateral. These loans are common when the collateral is easily identified by description or serial number and then each item of collateral has relatively large dollar value. Floating Lien — A general, or blanket, lien against a group of assets, such as inventory or receivables, without the assets being specifically identified Chattel Mortgage — A lien on specifically identified personal property (assets other than real estate) backing a loan. Financial Institutions: Primary sources of secured short term financing are banks and financial institutions, including insurance companies, finance companies, and the financial subsidiaries of major corporations. The best mix of short-term financing depends on: Cost of the financing method Availability of funds Timing Flexibility Degree to which the assets are encumbered It is always better to go for bank loans or loans from established and long standing private institutions because there is a leverage for the debtors to sit for discussions to sort out issued in case of defaults. All banks in India are trying to close accounts labeled under NPA- Non Performing assets either by recovering the money through one time settlement (OTS) or by auctioning the collaterals pledged during the time of loan sanctioning. If you happen to take loans from individuals or third-parties, you cannot enjoy this comfort or breather. Some Finance Quotes and Sayings for You: A...

Posted by Managementguru in Financial Accounting, Financial Management, Management Accounting

on Apr 3rd, 2014 | 0 comments

Ratio Calculation From Financial Statement Profit and Loss a/c of Beta Manufacturing Company for the year ended 31st March 2010. Exercise Problem1 Kindly download this link to view the exercise. Given in pdf format. You are required to find out: a) #Gross Profit Ratio b) #Net Profit Ratio c) #Operating Ratio d) Operating #Net Profit to Net Sales Ratio a. GROSS FORFIT RATIO = Gross profit ÷ #Sales × 100 = 50,000 ÷ 1,60,000 × 100 = 31.25 % b. #NET PROFIT RATIO = Net profit ÷ Sales × 100 = 28,000 ÷ 1,60,000 × 100 = 17.5 % c. OPERATING RATIO = #Cost of goods sold + Operating expenses ÷ Sales × 100 Cost of goos sold = Sales – Gross profit = 1,60,000 – 50,000 = Rs. 1,10,000 Operating expenses = 4,000 + 22,800 + 1,200 = Rs. 28,000 Operating ratio = 1,10,000 + 28,000 ÷ 1,60,000 × 100 = 86.25 % d. OPERATING NET PROFIT TO NET SALES RATIO = Operating Profit ÷ Sales × 100 Operating profit = Net profit + Non-Operating expenses – Non operating income = 28,000 + 800 – 4,800 = Rs. 32,000 Operating Net Profit to Net Sales Ratio = 32,000 ÷ 1,60,000 × 100 = 20 % What is a Financial statement? It is an organised collection of data according to logical and consistent #accounting procedure. It combines statements of balance sheet, income and retained earnings. These are prepared for the purpose of presenting a periodical report on the program of investment status and the results achieved i.e., the balance sheet and P& L a/c. Objectives of Financial Statement Analysis: To help in constructing future plans To gauge the earning capacity of the firm To assess the financial position and performance of the company To know the #solvency status of the firm To determine the #progress of the firm As a basis for #taxation and fiscal policy To ensure the legality of #dividends Financial Statement Analysis Tools Comparative Statements Common Size Statements #Trend Analysis #Ratio Analysis Fund Flow Statement Cash Flow Statement Types of Financial Analysis Intra-Firm Comparison Inter-firm Comparison Industry Average or Standard Analysis Horizontal Analysis Vertical Analysis Limitations Lack of Precision Lack of Exactness Incomplete Information Interim Reports Hiding of Real Position or Window Dressing Lack of Comparability Historical...