Currently Browsing: Business Management

Posted by Managementguru in Business Management, Financial Management, How To, Personal Finance

on Dec 13th, 2023 | 0 comments

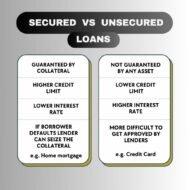

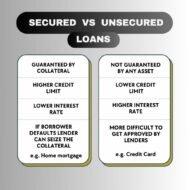

In today’s dynamic and fast-paced world, financial flexibility is often a key factor in achieving personal and professional goals. Loans play a crucial role in providing individuals and businesses with the necessary capital to make significant purchases, invest in education, or start and expand businesses. Understanding the nuances of loans is essential for making informed financial decisions. In this comprehensive guide, we’ll delve into everything you need to know about loans, from types and terms to the application process and the impact on credit. Types of Loans Loans come in various forms, each tailored to specific needs and circumstances. The two primary categories are secured and unsecured loans. Secured loans require collateral, such as a home or a car, which serves as a guarantee for the lender. Unsecured loans, on the other hand, don’t involve collateral but often come with higher interest rates. Types of loans include: Personal Loans: Unsecured loans are used for a wide range of purposes, from debt consolidation to unexpected expenses. They are typically based on the borrower’s creditworthiness. Mortgages: Secured loans for real estate purchases, with the property serving as collateral. Mortgages have varying terms and interest rates, and borrowers often make monthly payments over an extended period. Auto Loans: Secured loans for purchasing vehicles, where the vehicle itself acts as collateral. Auto loans have fixed or variable interest rates and terms. Student Loans: Designed for financing education expenses, student loans often have deferred payment options until after graduation. Interest rates may vary, and some loans are subsidized by the government. Business Loans: Tailored to meet the financial needs of businesses, these loans can cover startup costs, expansion, or operational expenses. Collateral requirements and terms depend on the type of business loan. Hard Money Loans: Often considered a niche within the lending landscape, they provide an alternative financing option for borrowers who may not qualify for traditional bank loans. Loan Terms Understanding loan terms is crucial for assessing the overall cost and feasibility of borrowing. Interest Rates: The cost of borrowing money, displayed as a percentage. Rates can be fixed or variable, with fixed rates providing stability and variable rates fluctuating based on market conditions. Loan Duration (Term): The period over which the borrower repays the loan. Shorter terms often come with higher monthly payments but lower overall interest costs. Amortization: The process of paying off a loan through regular payments that include both principal and interest. Amortization schedules show the breakdown of each payment over time. Application Process Applying for a loan involves several steps, and understanding the process can increase your chances of approval. Credit Score: Lenders assess your creditworthiness through your credit score. A higher score generally leads to better loan terms. Regularly check your credit report for accuracy and take steps to improve your score if needed. Documentation: Prepare necessary documents, such as proof of income, employment history, and details about existing debts. Lenders use this information to evaluate your ability to repay the loan. Comparison Shopping: Explore loan options from multiple lenders to find the best terms and interest rates. Online tools and platforms make it easier than ever to compare loan offers. Impact on Credit Borrowing money through loans can impact your credit in several ways. Individuals often wonder, ‘Do hard money loans show up on credit?‘ It’s worth noting that hard money loans typically do appear on credit reports, as lenders may conduct credit checks during the application process, impacting the borrower’s credit history. Credit Inquiries: Each loan application may result in a hard inquiry on your credit report, which can temporarily lower your score. Payment History: Timely payments contribute to a positive credit history, while late or missed payments can have adverse effects. Loans are powerful financial tools that...

Posted by Managementguru in E Commerce, Employee Safety

on Dec 11th, 2023 | 0 comments

In the dynamic landscape of industry, staying ahead of the curve is not just a preference; it’s a necessity. Specialized certifications play a pivotal role in enhancing professionals’ skills, ensuring compliance with industry standards, and fostering a culture of continuous improvement. Among the plethora of certifications available, some stand out as particularly beneficial for individuals and companies in the industrial sector. ISNetworld: Elevating Safety and Compliance In the realm of industrial certifications, ISNetworld stands tall as a comprehensive platform that connects companies with safe and reliable contractors. Tailored specifically for the industrial sector, ISNetworld emphasizes safety, compliance, and performance. The ISN certification is instrumental in streamlining the contractor qualification process, providing a centralized database for essential documentation, and facilitating collaboration among industry stakeholders. One of the primary advantages of ISNetworld is its ability to enhance safety performance. Through rigorous evaluation and benchmarking, the certification ensures that contractors adhere to the highest safety standards. This not only minimizes the risk of accidents and injuries but also contributes to the overall well-being of the workforce. Moreover, ISNetworld serves as a valuable tool for maintaining regulatory compliance. As regulations in the industrial sector are constantly evolving, having a certification that keeps pace with these changes is invaluable. By staying compliant, companies can avoid costly penalties, legal complications, and reputational damage. AWS Certified Welding Inspector: Ensuring Structural Integrity In the industrial landscape, welding plays a crucial role in ensuring the structural integrity of various components. The American Welding Society (AWS) offers a certification program specifically designed for welding inspectors. Becoming an AWS Certified Welding Inspector demonstrates a professional’s proficiency in assessing the quality and safety of welded structures. This certification is beneficial for individuals involved in welding inspection, quality control, and supervision. It covers a range of essential topics, including welding processes, metallurgy, and inspection techniques. By earning this certification, professionals contribute to the overall reliability of industrial structures, reducing the likelihood of structural failures and associated risks. Six Sigma Certifications: Driving Process Excellence Process efficiency is a cornerstone of success in industrial settings. Six Sigma certifications, offered by organizations such as the International Association for Six Sigma Certification (IASSC) and the American Society for Quality (ASQ), empower professionals with the tools and methodologies to streamline processes and eliminate defects. Whether it’s the Yellow Belt, Green Belt, or Black Belt certification, each level of Six Sigma signifies a deeper understanding and application of process improvement principles. These certifications are particularly beneficial for industrial professionals involved in production, quality control, and operational excellence. By adopting Six Sigma practices, organizations can enhance productivity, reduce waste, and ultimately improve their bottom line. In the competitive landscape of industrial industries, specialized certifications are not just credentials; they are investments in excellence. ISNetworld, AWS Certified Welding Inspector, and Six Sigma certifications represent just a glimpse into the myriad of opportunities available for professionals and organizations to elevate their performance, ensure safety and compliance, and drive continuous improvement. As technology advances and industry standards evolve, staying abreast of the latest certifications will be key to navigating the complexities of the industrial sector...

Posted by Managementguru in Financial Management, How To, Personal Finance

on Nov 25th, 2023 | 0 comments

In a world where financial stability often feels like an elusive dream, achieving true financial freedom remains a priority for many. This journey is a combination of disciplined personal finance, strategic debt management, prudent investment, and mindful savings. Key steps to help you pave the way towards financial independence. 1️⃣ Understanding and Managing Debt: The first step towards financial freedom involves addressing and managing existing debts. Begin by creating a detailed list of all outstanding debts, including credit cards, loans, and other financial obligations. Develop a realistic repayment plan, prioritizing high-interest debts to minimize long-term financial strain. Utilize debt consolidation strategies where appropriate and consider negotiating with creditors for more favorable terms. 2️⃣ Mastering Personal Finance: Successful financial management starts with a clear understanding of personal income and expenses. Create a comprehensive budget that outlines your monthly income, fixed expenses, and discretionary spending. Identify areas where you can cut back and allocate the surplus towards debt repayment or savings. Regularly review and adjust your budget to accommodate changes in income or expenses. 3️⃣ Strategic Financial Management: Explore ways to optimize your financial management by leveraging tools and resources. Consider automating bill payments to avoid late fees and penalties. Embrace digital financial apps that offer insights into your spending habits and help you stay on track with your financial goals. Establish an emergency fund to cover unforeseen expenses, providing a financial safety net. 4️⃣ The Power of Investment: Financial freedom is not solely about cutting expenses; it’s also about growing your wealth. Explore different investment avenues, such as stocks, bonds, real estate, and retirement accounts. Diversify your investment portfolio to mitigate risks and maximize returns over the long term. Take advantage of compound interest to accelerate wealth accumulation. 5️⃣ Prioritizing Savings: Cultivating a savings mindset is crucial on the road to financial freedom. Allocate a portion of your income towards savings, whether for short-term goals or long-term plans. Establish specific savings goals, such as an education fund, a home purchase, or retirement. Automate contributions to your savings accounts to ensure consistency and discipline. 6️⃣ Building and Managing Credit: A healthy credit history is fundamental to financial freedom. Regularly monitor your credit score and report, addressing any discrepancies promptly. Use credit responsibly, paying off balances in full and on time. Understand the terms of credit agreements, and be cautious about taking on new debt unless absolutely necessary. Relatable stories that highlight the struggles, triumphs, and lessons learned by individuals striving for financial independence. 1. Debt Liberation Journey: Meet Sarah, a young professional burdened by student loans and credit card debt. Determined to break free, she adopted the “snowball method” advocated by financial guru Dave Ramsey. Starting with the smallest debt, she made extra payments while maintaining minimum payments on others. The psychological boost from paying off the smallest debt fueled her motivation, creating a momentum that eventually led to debt liberation. The ultimate Notion dashboard to track all your finances Juggling your finances can feel like a full-time job. Our Notion template makes it easy to manage all your finances in one place. Grab It Today !⏳ Anecdote: Sarah celebrated each debt payoff by treating herself to a modest reward, turning a challenging process into a series of small victories. 2. Budgeting Wisdom from the Elders: John and Emily, a retired couple, share a timeless lesson. In their early years, they struggled with finances until a wise elder in their community advised them to create a budget. Armed with envelopes labeled for various expenses, they diligently allocated cash. This simple yet effective budgeting method transformed their financial landscape, providing a stable foundation for the future. Get Your Life Organized with a...

Posted by Managementguru in Business Management, How To, Social Media, Startups

on Oct 28th, 2023 | 0 comments

Business networking events are an integral part of expanding your professional network and allowing your business to grow. However, many such events can feel forgettable and unproductive. To stand out and make a lasting impression, it’s crucial to go the extra mile in creating memorable experiences. This article will explore effective strategies to make your business networking event unforgettable. Define Your Purpose Before diving into event planning, define the purpose and objectives of your networking event. Are you aiming to introduce new products, foster collaboration, or simply build relationships? Knowing your goals will guide every decision you make in the planning process. Choose the Right Venue The venue helps to set the tone for your event. Opt for a location that aligns with your objectives and will appeal to your target audience. A unique or historical venue can leave a lasting impression and provide excellent conversation starters. Create A Theme A well-thought-out theme can add a layer of interest to your event. Consider a theme that resonates with your industry or business. For example, if you’re in the tech industry, a futuristic theme could be a great fit. Thematic decorations, food, and activities can make your event more memorable. Engaging Activities A memorable networking event incorporates interactive and engaging activities. Icebreakers, workshops, or panel discussions can help attendees to connect and learn. Additionally, consider incorporating technology such as event apps to facilitate networking and interaction. Food and Beverages Delicious food and beverages can be a significant draw for attendees. Consider offering a diverse range of options, including dietary accommodations. A well-catered event that includes delicious dessert catering can be memorable for all the right reasons. Unique Giveaways Branded giveaways can be a powerful tool for making your event unforgettable. Choose items that are not only useful but also align with your brand and theme. Personalized, high-quality items like custom notebooks, tech gadgets, or eco-friendly products can leave a lasting impression. Stellar Speakers Invite influential speakers who can provide valuable insights to your attendees. High-quality presentations can be a major draw for participants and make your event memorable. Networking Opportunities The main aim of a networking event is to connect people. Encourage networking by providing ample opportunities for one-on-one and group interactions. Mixers, speed networking sessions, and designated networking areas can be instrumental in making meaningful connections. Entertainment Incorporating entertainment can set your event apart from the rest. Live music, interactive performances, or even a photo booth can add some fun and excitement to the proceedings. Entertainment can also break the ice and help attendees to relax. Follow Up To make sure that your event has a lasting impact, follow up with attendees after the event. Send thank-you emails, connect on social media, and ask for feedback. This shows that you value their participation and are interested in continuing the relationship. Post-Event Content Create content that captures the highlights of your event, such as videos, photos, and blog posts. Share these across your social media channels and website to keep the memory alive and promote future events. Sustainability In this environmentally conscious world, demonstrating a commitment to sustainability can leave a lasting impression. Consider eco-friendly event practices, such as recycling, minimal waste, and sustainable transportation...

Posted by Managementguru in Branding, How To, Marketing, Sales

on Sep 26th, 2023 | 0 comments

It can be exceptionally difficult for small businesses to gain a foothold in their chosen target markets in the early years of trading. Customers may prefer to make purchases from more established firms who they have dealt with previously or may not even be aware of your company’s existence. As such, it can be a significant success for any small company to successfully navigate through the first few years of operation and to begin to generate meaningful levels of revenue and profitability. However, it is important to recognize the power of brand image in fueling the ongoing success of a firm. Small businesses with a strong and positive brand image will often be favored by customers who may choose their goods and services over the offerings of competitors. In this article, some unique ways in which small businesses can improve their brand image will be explored. Fundraising for charities A key way to improve the brand image of any small business is by supporting charitable organizations. This helps to demonstrate to consumers that your company has positive goals for the wider society (and is not purely focused on its own profitability) and is aiming to help support local communities. Ideally the goals and mission of the chosen charity will resonate with the values of your target market, so it is important to have a clear understanding of your customers’ beliefs and perceptions. Once you have chosen the charity you will be supporting, it is important to set a goal for the amount of funds you plan to raise. Consider adding a fundraising thermometer to your company website, which will indicate the progress that is being made towards the target amount. This will help to publicize the ongoing fundraising that is taking place and will increase the goodwill from your customer base. This charitable activity can also help to drive sales of the company’s products. If you donate a small proportion of your sales revenues from each item to the charity, customers may be inspired to purchase your products more often, so they help to support the fundraising initiative. This type of sales-linked fundraising benefits both your business and the charity—and is a key way to create a positive brand image with your target market and the wider community. Adopting Sustainable Practices In 2023, there is a growing need for all businesses to adopt sustainable practices. Evidence suggests that modern consumers will prefer to trade with organizations that can demonstrate they are lowering their carbon footprint, reducing waste, or using sustainable or recycled materials in their products, to name a few examples. In fact, research indicates that 87% of consumers have a more positive image of a company that can demonstrate sustainable business practices. In addition, the millennial generation is particularly concerned with sustainability and will actively choose brands that take steps to protect the environment and limit any adverse impacts on the planet from their business processes. As millennials will soon account for that majority of consumers, it is vitally important to be able to demonstrate sustainable practices to appeal to this important demographic and cultivate a positive brand...