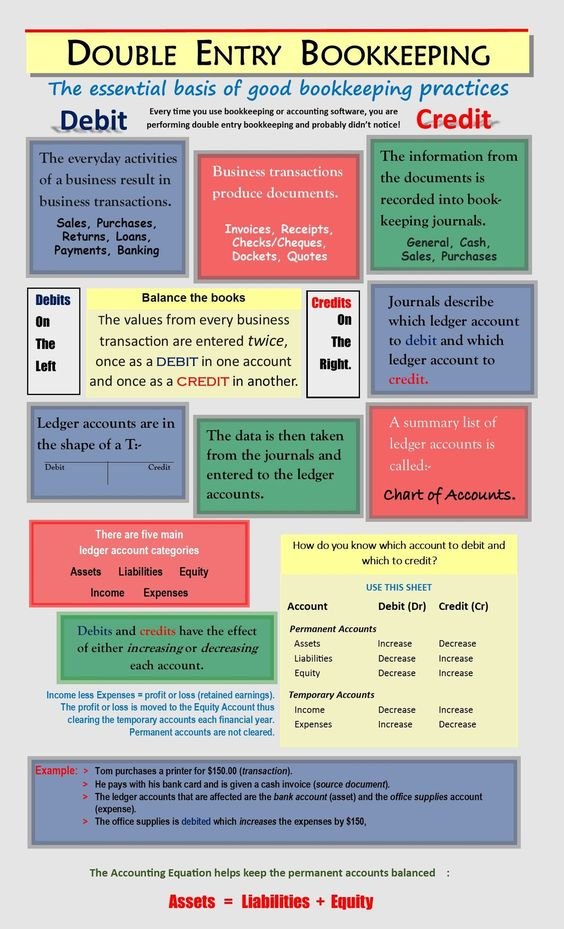

It is the art of recording the business transactions in a set of books systematically and is part of the process of accounting in business. The two systems in book-keeping are

In the simplest of terms, bookkeeping is responsible for the recording of financial transactions whereas accounting is responsible for interpreting, classifying, analyzing, reporting, and summarizing the financial data.

Bookkeeping and accounting may appear to be the same profession to an untrained eye.

Info Courtesy: Flatworldsolutions

Single entry system of book keeping is the method of maintaining accounts which does not exactly follow the principles of double-entry system.

Only the cash book and personal ledgers are maintained, i.e., the real and nominal accounts are not maintained under this system.

No fixed assets, purchases, sales, expenses, income accounts etc., can be found under this system. As trial balance cannot be prepared, the accuracy of accounts can’t be ascertained.

No final account and balance sheet preparation is possible. Therefore, this system is said to be unscientific and not generally followed for accounting purposes.

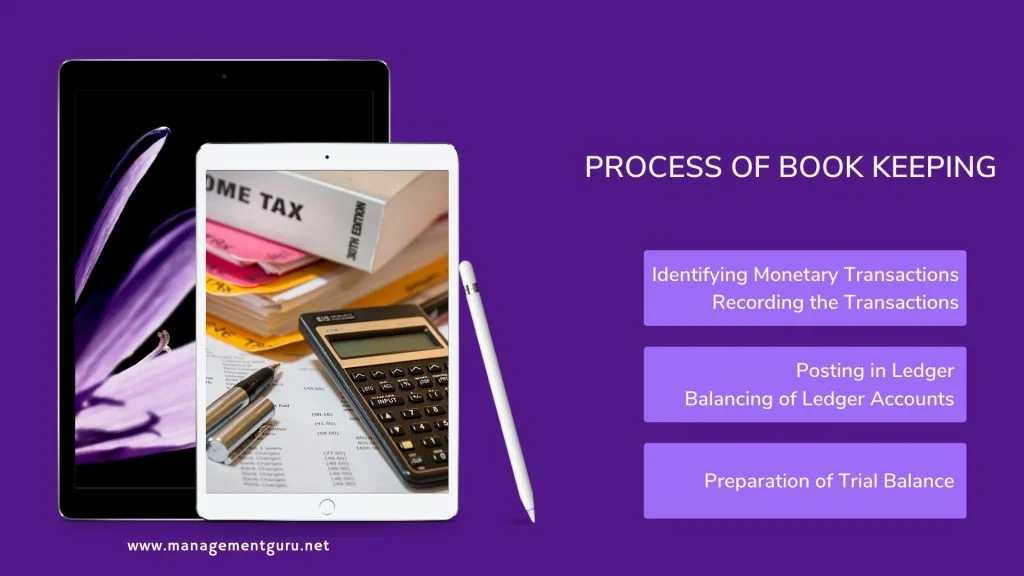

1. Journal

2. Subsidiary books

3. Ledger

4. Trial Balance and

5. Final Accounts.

Dealings of the business with the customers, another business, Government, other third parties and with itself.

For example

A transaction may be a credit or cash transaction. The cash transaction involves cash (incoming or outgoing) whereas credit transaction does not involve cash (no cash comes in or goes out).

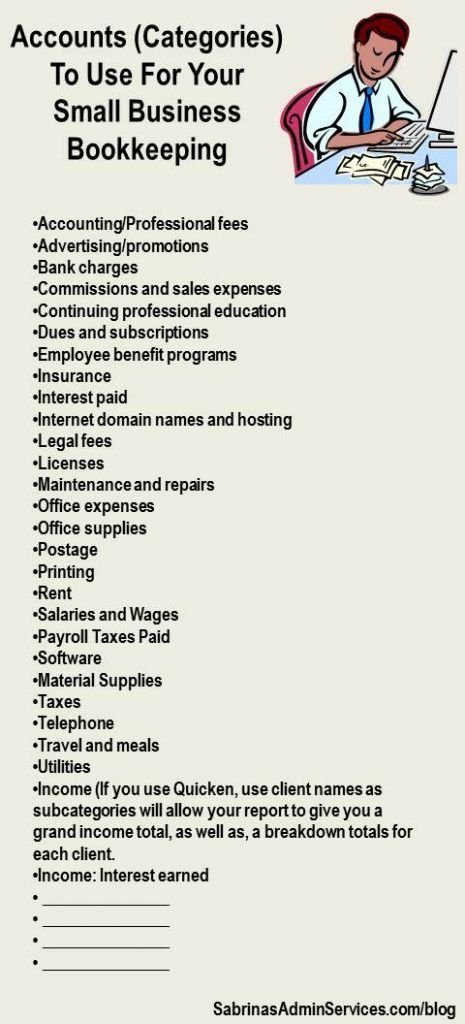

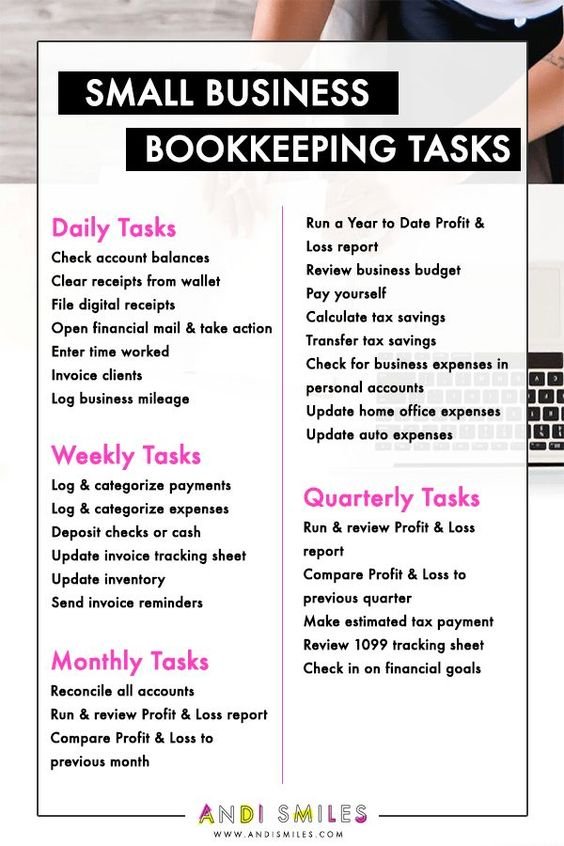

Check out some of these intersting infographic images from Pinterest to improve your understanding of book keeping and associated accounting activities.