Quantification of Objectives in the form of Budgets

Effective and efficient management of a business enterprise is facilitated, when a firm charts its course of action in advance.

The management function also includes decision-making supported by various managerial techniques and tools that integrate the activities of the employees of the organization. One such technique is having a budget planned that which is essential for a healthy future.

The systematic approach to profit planning is budgeting. The prime concern of budgeting is to make profits by regulating the flow of funds and allocating the controlling function to various responsibility centers.

Don’t know how to start budget planning ?

Do you need to know how to make a budget ?

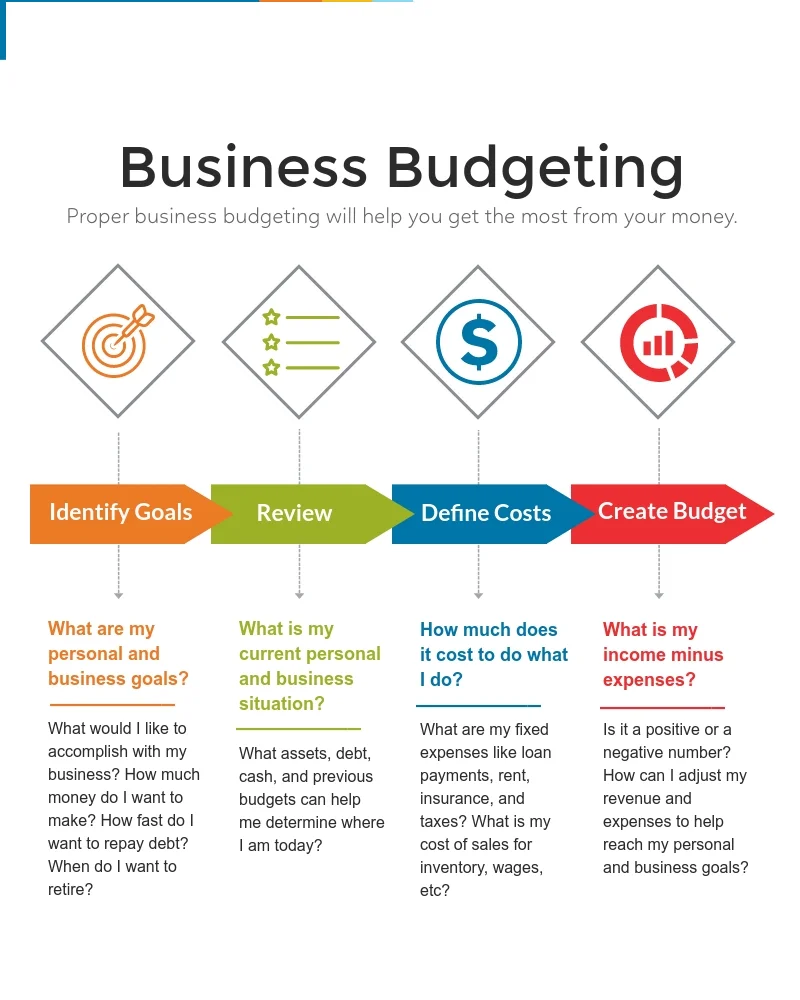

This infographic will provide personal budget categories you can use to help you categorize expenses for budgeting purpose.

This may or will save you time, money, and effort.

What is a Budget?

A budget is a comprehensive and coordinated financial plan, charted for a specific period of time in the future, but well in advance.

It facilitates to compare the actuals with the standards established and review or revise the plans accordingly in case of any deviations or variances.

A budget is a plan that is concerned not only about the resources of a firm, but also its operations.

It involves the control and manipulation of relevant variables-controllable and non-controllable, and reduces the impact of uncertainty.

Economic Constraints in Developing Countries

Problems of unemployment, inflation and crude oil prices touching a dangerous high, these countries can offer only piecemeal measures to sustain the momentum of economic growth.

Talking about organizations going for the master budget at the start of the year, it comprises budgets for various segments of the enterprise and it forms the primary step in budget planning.

Master Budget

The budget for a segment or department will not have much significance unless it is a part of the total budget-the master budget.

If the budgets for various segments are not prepared jointly and in harmony with each other, the master budget will lose much of its importance and may even prove to be harmful in realizing the firm’s expectations.

A budget is always expressed in financial terms, either in rupees, dollars or pounds, for operational purposes.

Say, in a production budget, you talk about units of raw material and finished product. In a labor budget, you talk about men and labor hours.

So there must be a common denominator, which can express all these variable quantities in a common language for the comprehensive budget to be meaningful. This purpose is solved by money, which undoubtedly serves as the common denominator.

Budget Mechanism

A budget is a mechanism to plan for the firm’s operations and activities.

It allocates resources as well as responsibilities to different operational centers like, revenue, cost, profit and investment centres.

Time dimension must also be added to a budget. For example, a production target of ten thousand units or a profit target of ten million dollars has no meaning unless and until it is related to a specific time period, in which these targets have to be met.

A firm may have its long-range and broad objectives, such as maximum sales, maximum profits, customer satisfaction, social responsibilities, etc.,

But, to achieve these qualitative objectives, a firm has to quantify the same in the form of short-term objectives or goals with a time period precisely specified.

A budget is basically a control technique which also facilitates to measure the performance of individuals on the basis of which, corrective action can be taken.

The crux of budgeting is to forecast for the future and plan to avoid losses, but more positively to maximize profits.