Maybe you are just starting your business and choosing a new car for it. Perhaps your company is so big that it needs multiple vehicles, requiring a fleet management company for your business. The same question arises – is it better to lease or to buy the cars you need?

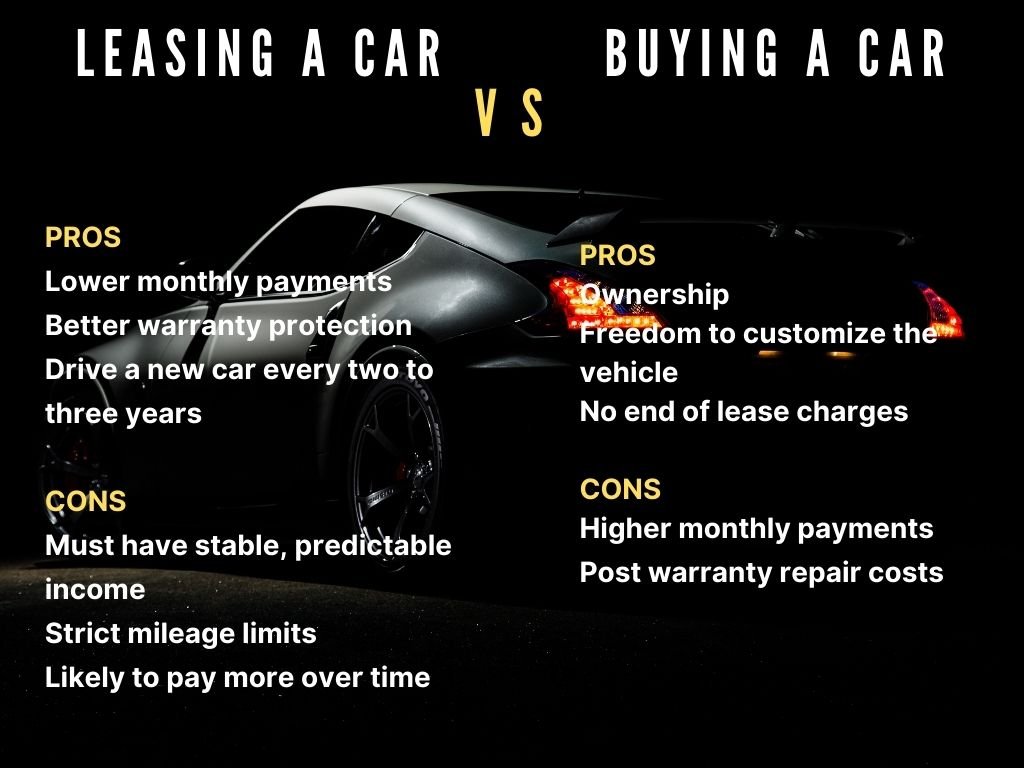

Both options have their benefits, but there are many things to consider before making a choice. These include tax implications, financial commitment, and also the question of ownership.

Let us look at all of these elements that can be deciding factors when choosing between buying or leasing a car for your company’s needs.

Business car leasing is a form of a financial agreement between a business and a finance company where the business owner can essentially rent a vehicle for an extended period. This can be anywhere from one to five years, depending on the contract.

When the lease term is complete, the lessee may either purchase the car or return it.

When choosing the option to lease, your monthly payments are typically lower than they would be if you were buying a car.

For a relatively low initial fee, followed by regular monthly payments, you get all of the benefits of running a brand-new vehicle. This includes the full manufacturer’s warranty cover, which typically lasts for two to five years.

Leasing can be an attractive option because many businesses can claim back part, or all, of the VAT. Exact figures depend on the VAT scheme that your company falls under but as a general rule, companies can claim back 50 percent of the VAT if a car is used for private and business purposes.

Also, you don’t have to pay any up-front sales tax because you’re not purchasing the vehicle.

At the end of the lease, you usually get to choose between purchasing the vehicle outright, refinancing, or simply handing it back.

When you lease a car, there will be a limit on how many miles you’ll be permitted to drive throughout the lease. If you were to exceed that limit, you would face fees that can be pretty hefty.

Since you will have been the one to sign the lease agreement, only you would be permitted to drive that vehicle. While that doesn’t sound so bad, it may complicate business matters if you’re not around to operate the car.

While the lease lasts, you do not own the vehicle. This means you won’t be able to sell it if the times get tough or do even smaller things like making modifications.

A vehicle that you buy becomes an asset. Because of that, you can decide to sell or trade it at any time. You are not tied into running the vehicle for a specific period as you are with leasing.

Buying a car is a substantial investment. But, the longer you own the vehicle, the lower your long-term cost.

You can sell your vehicle anytime you want to or make modifications to the car. Also, you are not bound to a mileage limit.

If you choose to buy a car for business, you’ll typically pay higher up-front costs because you’ll owe sales tax, title fees, etc. Also, our monthly loan payments will probably be higher than the lease payments.

Your car starts losing value as soon as it leaves the forecourt. A new car will have lost around 40 percent of its value by the end of the first year alone. Half its value may be lost within the first three years.

When the manufacturer’s warranty expires, you’ll have to pay for significant repairs. Also, the dealership doesn’t cover vehicle maintenance costs when you purchase a vehicle.

If you buy a car, it will be your job to sell it. This means a lot of hassle, wasted time, and chasing for all the necessary paperwork.

When you weigh all the pros and cons listed above, only you can provide the ultimate answer and decide between buying or leasing a car for your business.

In the end, it all boils down to how many miles you drive per year, and if you are OK with the limitations that come with a lease.

Another critical question is how long you plan to keep your car – if you are the type of person who wants a new ride every couple of years, then leasing is the right option for you, and vice versa.

Finally, decide how much you want to spend on your monthly payment and if you prefer the liberties that come with owning a car.

Michael has been working in marketing for almost a decade and has worked with a huge range of clients, which has made him knowledgeable on many different subjects. He has recently rediscovered a passion for writing and hopes to make it a daily habit.

You can read more of Michael’s work at Qeedle.