Posted by Managementguru in Accounting

on Aug 6th, 2016 | 0 comments

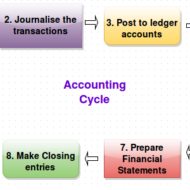

Financial statements have to be produced accurately at the end of the accounting period for tax purposes. An accounting period may be a month, a quarter of a year, or a whole year. The accounting cycle is the series of steps that take place in order to produce financial statements. A term that describes the steps when processing transactions (analyzing, journalizing, posting, preparing trial balances, adjusting, preparing financial statements) in a manual accounting system. Today many of the steps occur simultaneously when using accounting software. Following are the steps that complete an accounting cycle: Identify the transaction: This transaction could be the revenue from the sale of a product or a payment to another business for services. Analyze the transaction and how it is related to the accounting balance sheet. For example, determine which accounts are affected by the transaction and how they are affected. Record the transaction to a journal such as a sales journal. Journals are kept in chronological order and may be updated continuously, daily, or however often it is necessary. Record the transaction to the general ledger: Take all of your entries and categorize them by the account. Perform a trial balance: Debits and credits need to be equal at the end of an accounting cycle, so calculate the entries to ensure they match. Prepare adjustments: Just because entries are recognized, does not mean the work has been performed. Revenue can only be recognized when the work has been completed, so adjust the entries accordingly. Perform trial balance with adjustments: Take the adjustments from Step 6 and prepare a trial balance. If the debits and credits do not match, then you need to adjust them to make sure they do match. Prepare financial statements: From the adjusted trial balance, these corrected balances are used to prepare the financial statements. Close the accounts in preparation of the next accounting cycle. Revenues and expenses need to be closed out, which means they need to have zero balances. Balances are moved to the next cycle. Some Important Accounting Terms: Account A record in the general ledger that is used to collect and store similar information. For example, a company will have a Cash account in which every transaction involving cash is recorded. A company selling merchandise on credit will record these sales in a Sales account and in an Accounts Receivable account. Accounting Department Part of a company’s administration that is responsible for preparing the financial statements, maintaining the general ledger, paying bills, billing customers, payroll, cost accounting, financial analysis, and more. The head of the accounting department often has the title of controller. Accounting Equation Assets = Liabilities + Owner’s Equity. For a corporation the equation is Assets = Liabilities + Stockholders’ Equity. For a nonprofit organization the accounting equation is Assets = Liabilities + Net Assets. Because of double-entry accounting this equation should be in balance at all times. The accounting equation is expressed in the financial statement known as the balance sheet. Accounts Payable This current liability account will show the amount a company owes for items or services purchased on credit and for which there was not a promissory note. This account is often referred to as trade payables (as opposed to notes payable, interest payable, etc.) Accounts Receivable A current asset resulting from selling goods or services on credit (on account). Invoice terms such as (a) net 30 days or (b) 2/10, n/30 signify that a sale was made on account and was not a cash sale. Adjusting Entries Journal entries usually dated the last day of the accounting period to bring the balance sheet and income statement up to date on an accrual basis (as required by the matching principle and...

Posted by Managementguru in Financial Accounting

on Feb 24th, 2015 | 0 comments

What are known as Final Accounts? Trading, profit & loss account and balance sheet, all these three together, are called as final accounts. Final result of trading is known through Profit and Loss Account. Financial position is reflected by Balance Sheet. These are, usually, prepared at the close of the year hence known as final accounts. They serve the ultimate purpose of keeping accounts. Their purpose is to investigate the consequence of various incomes and expenses during the year and the resulting profit or loss. 1. Trading and Profit and Loss A/c is prepared to find out Profit or Loss. 2. Balance Sheet is prepared to find out financial position of a concern. Trading Account Trading refers buying and selling of goods. Trading A/c shows the result of buying and selling of goods. This account is prepared to find out the difference between the Selling prices and Cost price. Profit and Loss Account Trading account discloses Gross Profit or Gross Loss. Gross Profit is transferred to credit side of Profit and Loss A/c. Gross Loss is transferred to debit side of the Profit Loss Account. Thus Profit and Loss A/c is commenced. This Profit & Loss A/c reveals Net Profit or Net loss at a given time of accounting year. Trading Profit And Loss CMD from knoxbusiness Balance Sheet Trading A/c and Profit & Loss A/c reveals G.P. or G.L and N.P or N.L respectively; besides the Proprietor wants i. To know the total Assets invested in business ii. To know the Position of owner’s equity iii. To know the liabilities of business. Definition of Balance Sheet The Word ‘Balance Sheet’ is defined as “a Statement which sets out the Assets and Liabilities of a business firm and which serves to ascertain the financial position of the same on any particular date.” On the left hand side of this statement, the liabilities and capital are shown. On the right hand side, all the assets are shown. Therefore the two sides of the Balance sheet must always be equal. Capital arrives Assets exceeds the liabilities. BUY “ACCOUNTING CONVENTIONS AND CONCEPTS” OBJECTIVES OF BALANCE SHEET: 1. It shows accurate financial position of a firm. 2. It is a gist of various transactions at a given period. 3. It clearly indicates, whether the firm has sufficient assents to repay its liabilities. 4. The accuracy of final accounts is verified by this statement 5. It shows the profit or Loss arrived through Profit & Loss A/c. PREPARATION OF FINAL ACCOUNTS Preparation of final account is the last stage of the accounting cycle. The basic objective of every firm maintaining the book of accounts is to find out the profit or loss in their business at the end of the year. Every businessman wishes to find out the financial position of his business firm as a whole during the particular period. In order to accomplish the objectives for the firm, it is essential to prepare final accounts which include Trading, Profit and Loss Account and Balance Sheet. It is mandatory that final accounts have to be prepared, every year, in every business. Trading and profit & loss accounts are prepared, after all the accounts have been completely written and trial balance is extracted. Before preparing final accounts, it becomes obligatory to scritinize whether all the expenses and incomes for the year for which accounts are prepared have been duly provided for and included in the accounts. Form of Final Accounts: There is a standard format of final accounts only in the case of a limited company. There is no fixed prescribed format of financial accounts in the case of a proprietary concern and partnership...