Posted by Managementguru in Business Management, Economics, International Business, Principles of Management, Technology

on Mar 26th, 2014 | 0 comments

Transfer of Technology- Commercialisation Vs.Benefit The total influx of technology in underdeveloped countries is from the advanced capitalist countries for obvious reasons, which will be the highlight of this discussion. Multinational corporations play a vital part in technology transfer, the motive being profit maximization for the parent company through their subsidiaries. These corporations act as the principal instrument of technology transfer, either through their subsidiaries or through contractual agreements made with developing countries. The idea is to bring mechanized processes and equipments that are not locally available. Dominance of Technology Supplier: The technology supplier usually takes the upper hand owing to his monopolistic strength that arises from the patent protection for differentiated products and processes. Very often, the terms and conditions of transfer are arbitrarily settled under highly imperfect market conditions by the technology supplying multinationals. Advanced nations have the advantages of reduced population density, even distribution of national wealth, high standard of living, more infusion of capital into research and development, availability of skilled personnel inclined towards research etc. Dependency of Developing Nations: Developing nations on the other hand are subject to the pressures of high population density, uneven distribution of economic wealth (poor people become more poor and the rich even richer), moderate or low living standards etc. Capital drain occurs due to heavy borrowings from the World Bank which leads to increase in the social overheads. In such a situation, it is next to impossible for a developing nation to pump capital into activities concerning research. Bargaining Power of Developing Nations: The bargaining power of developing nations is weak, as they have no access to information about alternate technologies and their sources nor the necessary infrastructure to evaluate the appropriateness of equipments, intermediates and processes. Moreover, the large part of the influx of technology in developing countries is in response to the policy of industrialization through import substitution. Transfer of technology from the developed to the underdeveloped countries is made in a number of ways. They are classified into two broad categories, viz., direct mechanism and indirect mechanism. The direct mechanism includes transfer of technology through banks, journals, industrial fairs, technical co-operation, movement of skilled people etc. Here there is a choice for the developing nation to select the appropriate technology that best suits their requirement. However, this is not the principal form of technology transfer that advanced nations would prefer. Price of Technology: The indirect mechanism implies technology transfer in a “package” or a “bundle” containing technology-embodying equipments, industrial properties like patents and trademark, skill, equity capital, etc. In this system, a local enterprise negotiates with multinational corporations for transport of the required elements of technology, and the terms and conditions are settled through a process of commercial transaction. Since the trading partners are unequal, the terms of contract are invariably restrictive and the price extended for the technology unreasonably high. All the underdeveloped countries, which have opted for growth along the classical path of capitalist development, are in a position to invite multinational corporations, if for no other reason than at least for the diffusion of...

Posted by Managementguru in Business Management, Marketing, Organisational behaviour, Principles of Management, Strategy

on Mar 22nd, 2014 | 0 comments

PORTER’S FIVE FORCES Porter’s five forces analysis-draws upon industrial organization (IO) economics to derive five forces that determine the competitive intensity and therefore attractiveness of a market. Survival of the Fittest: True to Darwin’s theory “Survival of the fittest”, only competitive firms survive in the business market, provided, they have made the right strategic choice by comprehensively analyzing their position in the industry. Every organization is part of the industry and almost all of them face competition. Thus, industry and competition are the vital considerations for making a strategic choice. All the firms in a particular industry vie for the same set of customers by offering identical or similar products with minor variations. The analysis of the external environment in relation to the context of industry attractiveness thus becomes essential. A Critical Evaluation of Michael Porter’s Five Forces Framework Industrial Analysis: Industry analysis helps a firm to also fix long range plans, by gauging long term growth opportunities present if any. Strategic choice is nothing but, to screen all possible strategic alternatives followed by narrowing down the choice to the best suited and feasible alternatives and ultimately choosing an optimum strategy. To explain it in more clear terms, let us look at this example. Say, if there are three big players of car manufacturers in an automobile industry. Each follows their own strategic style to capture the market. What are the threat factors? Threat can be in the form of four-wheeler manufacturers like trucks and jeeps, but these cannot be competitively priced. Threat can be in the form of suppliers who dominate the industry by having a grip on the supply of components, sub-assemblies and accessories. Threat in the form of new entrants, but the growth might be restricted due to government regulations. A thorough analysis of the automobile industry thus made can make things clear to the firm, as to where they stand in terms of market share, what are their strengths and weaknesses, who pose a threat, what are the potential opportunities for growth and to tap market segments whose needs are unidentified. Still, it will be a seller’s market where the buyers have no bargaining power. On the other hand, if the weather does not favor its growth, the firm has to immediately decide on its next course of action, calling for diversification. The possible threats for a firm can come from five directions as mentioned below: Potential threat from new firms entering the market Threat from substitutes available in the market Threat from competitors Bargaining power of the suppliers Bargaining power of the buyers The structure and dynamics of an industry has to be analyzed in order to determine the intensity of competition and profitability. As the market is very dynamic, it becomes mandatory for firms to evolve strategies embracing a modern approach, with emphasis on reappraisal of existing strategy in the light of changing external conditions and formulation of alternative...

Posted by Managementguru in Business Management, Marketing, Principles of Management

on Mar 4th, 2014 | 0 comments

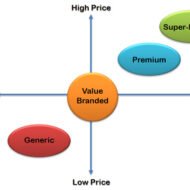

Factors to be Considered for Product Pricing: Price is one of the crucial components of the marketing-mix and plays an important role to bring about product market integration. It is the only factor that generates revenue, the reason why much research is done before fixing the basic price of a product. In a narrow sense, price is the amount of money charged for a product or a service. But in a broader perspective, it is the sum of all values that a customer gain by exchanging money for using a product or enjoying a service; now, what do you mean by values? It may denote customer satisfaction, endurance, efficiency, effectiveness of the purchase etc. Establish the Pricing Objectives: How does a business firm go about fixing the price? The first step would be establishing the pricing objectives based on the factors that govern the price and ascertaining their relevance and importance in the light of prevailing economic conditions. The firm must provide the customers with the value worth the money paid for. Thus determining the product value in monetary terms and formulating pricing policies and strategies accordingly is very important. Price is influenced by both external and internal factors. The internal factors that influence pricing may be, Corporate objectives and marketing objectives of the firm-Obviously a firm would like to survive in the market by maximizing its profit followed by retention of market share. To retain the existing customers and to attract new customers, a firm has to focus on “quality” and “customer service”. If you lose an existing customer, it is equivalent to losing ten new customers, as loyal customers increase your customer listing. Where do you want to stand in the market is another question you have to ask yourself! The desirable market positioning of a firm is also dependent on price fixation mechanisms. The characteristics of a product also influence the pricing, as the nature decides the mode and cost of production. Price elasticity or demand of the product-A hardcore business person will never try to penetrate a new market with his existing product or introduce a new product in existing markets without substantial marketing research, since the demand for the product may very form market to market and only by “test marketing” does a firm can acquire some insight about the nature of demand. Cost of marketing-Without proper canvassing you cannot expect your product to hit the right note. There should be sufficient financial planning that well falls in line with your marketing plan. The external factors that influence pricing may be, Market characteristics-Here, industry analysis is needed, to gauge the trend of the products of similar nature and the stage of the industry in its life cycle-whether it has reached the saturation point. If so, how can you expect to make a mark in an industry that is already falling back? Sometimes, the industry might be thriving, leaving behind certain firms that cannot meet the expectations of the industry. In such cases too, caution is to be exercised to predict your chances of success based on your merits and shortcomings. Bargaining power of the customers-you cannot expect to sell premium products in a market where the potential buyers belong to the middle class category. Even such markets are captured by intelligent marketers who follow the strategy of price skimming. Competitor’s pricing policy-Constant updates about your competitor’s pricing strategy keeps you at bay and also helps you in deciding your game plan. Big corporate firms very rarely come for a compromise in pricing terms, brushing aside their prejudices, if it proves to be win-win situation for both. Government’s regulations on pricing-When you plan to expand...