Posted by Managementguru in Management Accounting

on Mar 24th, 2015 | 0 comments

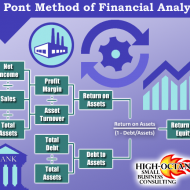

What are the advantages and limitations of ratio analysis? Advantages: It is an important and useful tool to determine the efficiency with which working capital is being managed in a business organization. It is a ‘health test‘ for a business firm in that it can gauge whether the firm is financially healthy or not. It aids the management of business concern in evaluating its financial position and performance efficiency. It clearly shows the trend of changes in the market position (upward, downward or static), as it covers a number of previous accounting (financial) periods. The progress or downfall of a firm is clearly indicated by this analysis. It assists in preparing financial estimates for the future (financial forecasting). It facilitates the task of managerial control to a great extent. It helps the credit suppliers and investors in deciding upon a business firm as a potential investment outlet or desirable debtor. Ideal or Standard ratios can be established which can be used as reference points of comparison for a firm’s progress over a period of time. It communicates important information with relation to financial strength, earning capacity, debt (borrowing) capacity, liquidity position, capacity to meet fixed commitments, solvency, capital gearing, working capital management, future prospects etc. of a business concern. This analysis is also useful for bench marking purpose- to compare the working result and efficiency of performance of a business enterprise with that of other firms engaged in the same industry (inter-firm comparison). It helps the management to discharge their basic functions of planning, coordinating, controlling etc. It serves as an instrument for testing management efficiency too. It acts as a useful tool for deciding on certain policy matters. Limitations: Accounting ratios calculated based on ratio analysis will be correct only if the accounting data on which they are based are correct. It is only an analysis of past financial data. In certain cases ratio analysis might prove to be misleading with regard to profits. Continuous fluctuation in price levels ( or, purchasing power of money) seriously affect the validity or comparison of accounting ratios calculated for different accounting periods and make such comparisons very difficult. Comparisons become difficult also on account of difference in the definition of several financial (accounting) terms like gross profit, operating profit, net profit etc. There is lot of diversity in practice as regards to the measurement of ratios. Different firms use different accounting methods and the validity of comparison is severely affected by window dressing in the basic financial statements. A single ratio will not be able to convey much information. This analysis only gives part of the total information required for proper decision-making. This should not be taken as a substitute for sound judgement. It should not be overlooked that business problems cannot be solved mechanically through ratio analysis or other types of financial analysis. Follow ManagementGuru Net’s board Accounting – Financial and Management Accounting on...

Posted by Managementguru in Business Management, Decision Making, Organisational behaviour, Principles of Management, Strategy

on Mar 23rd, 2014 | 0 comments

Strategic Evaluation: concerns mainly the analysis and judgment of interventions at the level of strategic goals. One of the noteworthy aspects of strategic evaluation consists of the verification of the adopted strategy with respect to the current and likely social and economic situation. How a firm has performed over time and relatively to its competitors, can be determined with the help of the following quantitative measures. Market price of the sharesMarket shareEarnings on capital employedDividend ratesReturn on equityGrowth in sales volumeProduction costs and efficiencyDistribution costs and efficiencyEmployee turnover, absenteeism, and satisfaction indices. Since there is a high correlation between progress and these indicators, we can say that a firm is successful if majority of the factors show a positive signal. But in reality, one cannot expect a business firm to satisfy all the above mentioned criteria, as performance is also affected by unexpected variations in the external environment. One has to trade-off between the positive and negative indicators and find suitable ways to enhance the performance levels. Effectiveness of a Strategy: The strategic importance of any particular criterion may not remain the same at different points of time. The short run and long run effectiveness of strategy cannot be evaluated using the same criteria. There may be difficulties in computation and different methods of computation that may be encountered in measurement. These factors serve as the bases for firms to identify the elements of success. Yet another way of performance evaluation is to identify critical factors that may be regarded as symptoms of decline and can be treated as early warning signals during the implementation of strategy. If they indicate the necessity of a turnaround or retrenchment strategy, the firm should definitely go for a suitable action without further delay. Such factors may be: Declining profit marginDeclining market shareRapidly increasing debtDeclining working capitalIncreasing managerial turnover What is the Need for Strategic Evaluation? You might be curious to know, what is the need for a strategic evaluation at all in the first instance? See, business firms and corporate companies are always in a position to execute their action plans in the wake of severe competition and retention of market share. A plan without a strategy is like life without a soul and decision making is solely dependent upon strategic inputs. Turnaround Strategy The need for feedback, appraisal and reward, check on the validity of strategic choice congruence between decisions and intended strategy all these help in successful culmination of strategic management process and create inputs for new strategic planning. What’s the difference between Strategy and Tactic? The evaluation need not be based only on quantitative terms, but also on qualitative aspects such as: internal consistency, consistency with the environment, appropriateness of the strategy in the light of available resources, acceptability of the degree of risk involved in the strategy, appropriateness of the time horizon of the strategy...

Posted by Managementguru in Change management, Human Resource, Principles of Management, Project Management, TQM, Training & Development

on Mar 22nd, 2014 | 0 comments

Zero defect achievement – Striving towards perfection! What is TQM: Quality management is all about being proactive and concepts like total quality management and six sigma of recent origin reiterate the fact that hundred percent error free performance is possible the first time and every time. This is what is called as zero defect achievement which most of the companies at corporate level are headed for. The intention is to strive for perfection in work, the way an archer aims for the bull’s eye on a target. It is time for people to cast off their conservative and archaic business practices and think out of the box to enjoy a sustainable competitive advantage driven by quality. Zero defects seek top performance standards the first time and every time. Management scholars offer several suggestions to improve the zero defects programme: The idea of zero defects programme has to be communicated through out the organization right from the top to the bottom level including managers, supervisors and workers. This would harmonize the functions of line and staff. Prerequisites needed for the programme have to be determined and made available. The culture and climate of the firm should be conducive to accomplish the programme. Explain in simple terms about the functions to be accomplished. Design some solid system of recognition. Set up a time schedule as time lines are very important when it comes to product delivery. Spot all the bottlenecks and remove them. Training is absolutely essential– the skill set and mind set of the employees have to be attuned to the goals of the venture. Mock training and rehearsals are helpful. Standardization is the key to the success of this programme. Bench Marking: Total quality management is a process contributing towards quality and bench marking is a means to achieve high quality performance by setting some top notch industry performers as reference points or standards. It is a continuous systematic process employed by a business enterprise to develop business and working processes that integrate the best practices available in the industry. Bench marking is a crucial element in the process of quality management. Quality is one field of production, which reflects the ethical viewpoint and approach of business firms towards the society and other investors or stakeholders. Bench marking is a modus operandi used to: Identify and define customer requirements Plan and establish effective goals and objectives Develop time measures of productivity Become more competitive Determine industry’s best practice The initial step is to decide what is to be bench marked-the product, services, customers or business processes in various departments. The second phase of action is to identify and select your competitors who will set the necessary precedence. With that as reference, decide on your company’s strategies by making meaningful and valid comparisons. Judge the competitor strengths and weaknesses and compare them with that of your own to get a clear picture of your current performance levels and capabilities. This will give you a clear indication on the action plans to be developed and implemented in a phased manner by your organization. Quality management is likely to happen only when all the employees of the organization work as a team with unified principles. Quality demands deep commitment and responsibility from the members of organizations. It calls for intense training to imprint the perception of quality in the minds of...

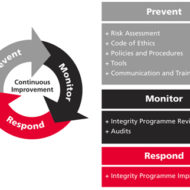

Posted by Managementguru in Business Ethics, Business Management, Human Resource, Principles of Management

on Mar 15th, 2014 | 0 comments

What is Social Audit? A formal review of a company’s endeavors in social responsibility. A social audit is a method of assessing, comprehending, reporting on, and eventually improving an organization’s social and ethical performance. A social audit assists in closing gaps between vision/goal and reality, as well as between efficiency and effectiveness. Social Obligations of Business Organizations: Every business organization has certain social obligations to be duly discharged to employees, government, owners, buyers, public, environment etc. It is a good thing that businesspersons of today have understood their obligations and have been discharging them ably. Social audit scans the scope of the social responsibilities of a business enterprise and evaluates an organization’s social performance. Introduction to 3D Modeling Measure of Social Performance There are no specific measures established to rate the social performance standards of a business enterprise. Nevertheless, business enterprises do not seem to understand the relevance of social audit because much importance is attached with the economic aspects of a business. The features of social audit are listed down for better understanding of the process: The focus is on the social aspect of a business organization rather than its economic aspect. The activities of a firm that has an impact on the society, such as, environmental quality, consumerism, opportunities for women and other disadvantaged people in the society are taken into consideration for analytical purpose. How to measure social performance of companies? Social audit is confined to the process rather than concentrating on the results of social action. It is quite difficult to measure social performance in quantitative terms. How do you quantify social philosophy of management and human values? Qualitative measurement is also relative, as, what appears right to one person may not be so for another. So a combination of quantitative and qualitative data must be used for the purpose of this audit. If an internal auditor does the assessment, there is this problem of loyalty, which will outweigh all the other shortcomings present in the business. If an external consultant is made to assess the situation, he can analyze the situation with no bias but he will not be familiar with the business activity of that particular firm. Therefore, a combination of both can work out well to carry out the assessment as they can complement each other. A New but Necessary Concept Social audit is a new concept, so there are not much standard procedures available to follow. Most companies are at the beginning of the learning curve with this process. When companies do begin audit procedures, they tend to find that the process is more complex than originally contemplated. However, every aspect of business and its management has to be explored and analyzed for the benefit of future generations, so as to take proactive measures to tackle problem situations. Business firms obtain their resources from the society and are dependent on the society to sell their produce too. Hence, it becomes their moral responsibility of caring for the society, within their scope and potential....