Posted by Managementguru in Accounting, Business Management, Financial Accounting

on Jul 2nd, 2014 | 0 comments

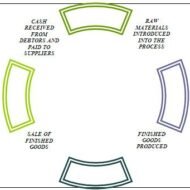

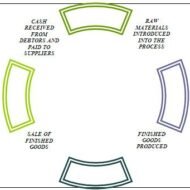

Understanding Working Capital: It is the life blood of business. Funds needed for the purchase of raw materials, payment of wages and other day-to-day expenses are known as working capital. It is part of the firm’s capital, which is being used for financing short-term operations. Hence, it may also be termed as Circulating Capital or Short-Term capital. “Working capital means current assets” –Mead, Malott and Field. “Any acquisition of funds which the current asset increases working capital, for, they are one and the same.” – J.S.mill Financial troubles and issues arise only when this entity called ‘working capital’ is not properly managed. Every successful company will hire a financial manager to deal with issues relating to finance while the CEO can look into matters relating to promotion of the product or service and the position of the company in the market. The ‘Sales Turnover or Sales Volume’ is the key issue you have to look into to gauge whether you have sufficient working capital to manage that big a volume for that particular period. You have to rotate your funds wisely keeping in mind the credit policies your company offers and the credits you may enjoy with your supplier, bank interest for the short-term loans etc. Concept of WC: Working capital implies excess of current assets over current liabilities. Funds invested in current assets is known as “Gross Working Capital.” The difference between current assets and current liabilities is known as “Net Working Capital.” What are the two types? Permanent or fixed: It is the minimum amount of current assets required for conducting the business operation. This capital will remain permanent in current assets and should be financed out of long-term funds. The amount varies from year to year, depending upon the growth of a company. Temporary or Variable: It is the amount of additional current assets required for a short period. It is needed to meet the seasonal demands at different times during a year. The capital can be temporary and should be financed out of short-term funds. The working capital starts decreasing when the peak season is over. Various Factors Influencing WC: Nature of business: Service oriented concerns like electricity; water supplies need limited working capital while a manufacturing concern requires sufficient working capital, since they have to maintain stock and debtors. Credit Policies: A company which allows credit to its customers shall need more amount while a company enjoying credit facilities from its suppliers will need lower amount of working capital. Manufacturing Process: Conversion of raw materials into finished goods is called manufacturing or production. Longer the process, higher the requirement of working capital. Rapidity of turnover: High rate of turnover requires low amount and lower and slow moving stocks need a larger amount of working capital. Say, jewelry shops have to maintain different types of designs calling for high working capital. Fast moving goods like grocery requires low working capital. Business cycle: Changes in economy has a say over the requirement of working capital. When a business is prosperous, it requires huge amount of capital; also during depression huge amount is needed for unsold stock and uncollected debts. Seasonal variation: Industries which are manufacturing and selling goods seasonally require large amount of working capital. Fluctuation of supply: Firms have to maintain large reserves of raw material in stores, to avoid uninterrupted production which needs large amount of working capital. Dividend policy: If a conservative dividend policy is followed by the management, the need for working capital can be met with the retained earnings, it consequently drains off large amounts from working capital pool. ...

Posted by Managementguru in Financial Accounting, Financial Management

on Feb 21st, 2014 | 0 comments

Applications of fund Purchase of fixed assets – leads to outflow of funds, but at the same time adding assets to your organization always improves the financial position of your firm. You can also use these assets as “collaterals” for availing loans in banks. Redemption of preference shares – you have to apportion your operating profit in order to satisfy the preference share holders with interest. This will give you a clear idea of the earnings available for the equity share holders. Fund that is lost during business operations – Due to wrong investments and credit policies, sometimes your funds get sticky and recovery becomes next to impossible. Repayment of loans – although the fund goes out, you free yourself from further interest burden and reduce your credit limit with the bank. Remember,it is better to repay the loans from your profit. Redemption of debentures – It is easy to raise money from debentures, because people are rest assured of their payment at a fixed date. But the cost of servicing the debt might sometime exceed the concessional advantages on raising such securities. https://gumroad.com/l/wqbu A systematic study of fund flow facilitates in ascertaining the soundness of your firm’s financial condition and it also helps to formulate the right kind of dividend policies. Net working capital is the life line of a firm’s day-to-day operations and we can surely say that a company is prosperous if it has a surplus of net working capital at any given point of time. The financial manager of your company should have the vision to predict changes in the stock market and play the cards accordingly. It needs an in-depth understanding and analysis of the market conditions with a wider...