Posted by Managementguru in Accounting, Financial Accounting, Management Accounting

on Jun 25th, 2014 | 0 comments

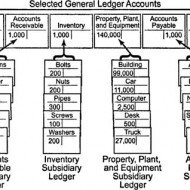

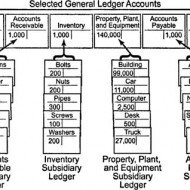

Ledger is a register with pages numbered consecutively. Each account is allotted one or more pages in the Ledger. If one page is completed, the account will be continued in the next page. An index of various accounts opened in the Ledger is given at the beginning of the Ledger for the purpose of easy reference. A general ledger is a complete record of financial transactions that holds account information needed to prepare financial statements, and includes accounts for assets, liabilities, owners’ equity, revenues and expenses. What is meant by Posting? Transactions recorded in the Journal and Subsidiary journal are transferred to the concerned accounts in the Ledger in a summarized and classified form. This process is called posting. “Interesting Statistics on Accounting The first book on double-entry accounting was written in 1494 by Italian mathematician and Franciscan friar Luca Bartolomeo de Pacioli. Although double-entry bookkeeping had been around for centuries, Pacioli’s 27-page treatise on the subject has earned him the title “The Father of Modern Accounting. Accounting plays a major role in law enforcement. The FBI counts more than 1,400 accountants among its special agents. The state of New York gave its first certified public accountant (CPA) exam in 1896. Rules for posting: Separate account should be opened in the Ledger for posting transactions relating to separate persons, assets, expenses or losses as shown in the journal. The account concerned which has been debited in the journal should also be debited in the Ledger. However, a reference must be made of the other account which is to be credited in the journal. In other words, in the account to be debited, the name of the other account to be credited is entered in the debit side for giving a meaning to this posting. The debit posting is prefixed by the word ‘To’. Similarly, the account concerned which has been credited in the journal has to be credited in the Ledger, but a reference should be made to the other account which has been debited in the journal. This posting is prefixed by the word ‘By’. Advantages of keeping a Ledger: Ledger provides information regarding all transactions of a particular account whether it is personal a/c, Real a/c or nominal a/c. The final effect, of a series of transactions of a certain customer or a certain property or a certain expense is known at a glance. Ledger provides immediately the totality of certain dealings. E.g., total purchases, Total sales, total expenditure, on a specified head. What is a Ledger account? Give a Proforma of a Ledger account. A Ledger account is nothing but a summary statement of all transactions relating to a person, asset, expense or income, which have taken place during a given period of time showing their net effect. Proforma of a Ledger account: What are the methods of balancing the Ledger account? At the end of the each month or year or any specific day it is essential to determine the balance in an account. To do that, add the totals of both sides (Debit and credit sides) and find out the difference in both the sides. The difference in both the sides is ‘Balance’. If the Debit is greater than the credit side, it is a Debit balance or vice-versa. There are two methods: The bigger total is taken first and is written on both sides of the account. On the smaller side, the balance is Witten above the total next to the last entry on that side. This method is more commonly used. In another method, the totals are written on both sides, one side showing smaller amount and the other showing bigger amount. The difference is...

Posted by Managementguru in Video Lecturers

on Feb 16th, 2014 | 0 comments

The accounting equation is the basis of accounting. However, the formal equation can be confusing. In this lecture you will learn the simplified equation (What=Who) and how it is the foundation of the accounting profession. By the end of the lecture you will understand the more formal accounting...

Posted by Managementguru in Accounting, Financial Accounting, Management Accounting

on Feb 14th, 2014 | 0 comments

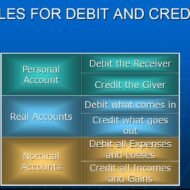

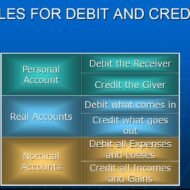

Classification of Accounts Accounts are classified as follows: •Accounts in the names of persons are known as “Personal Accounts” •Accounts in the names of assets are known as “Real Accounts” •Accounts in respect of expenses and incomes are known as “Nominal Accounts” Personal Accounts: It deals with accounts relating to persons, firms, companies and man-made institutions. It is further classified into three categories as shown below. PERSONAL ACCOUNTS NATURAL PERSON’S A/C : e.g- David, Customer ARTIFICIAL PERSON’S A/C : e.g- Banks, firms, companies REPRESENTATIVE’S A/C : e.g- Capital, Drawings Real Accounts These are accounts of assets or properties. Assets may be tangible or intangible. Real accounts are impersonal which are tangible or intangible in nature. Eg:- Cash a/c, Building a/c, etc are Real Accounts related to things which we can feel, see and touch. Goodwill a/c, Patent a/c, etc Real Accounts which are of intangible in nature. Nominal Accounts These accounts are impersonal, but invisible and intangible. Nominal accounts are related to those things which we can feel, but can not see and touch. All “expenses and losses” and all “incomes and gains” fall in this category. Eg:- Salaries A/C, Rent A/C, Wages A/C, Interest Received A/C, Commission Received A/C, Discount A/C, etc. DEBIT AND CREDIT Each accounts have two sides – the left side and the right side. In accounting, the left side of an account is called the “Debit Side” and the right side of an account is called the “Credit Side”. The entries made on the left side of an account is called a “Debit Entry” and the entries made on the right side of an account is called a “Credit Entry”. Golden Rules of Book-Keeping Personal Accounts : DEBIT THE RECEIVER & CREDIT THE GIVER Real Accounts : DEBIT WHAT COMES IN & CREDIT WHAT GOES OUT Nominal Accounts : DEBIT ALL EXPENSES AND LOSSES & CREDIT ALL INCOME AND GAINS What is an accounting equation? It is a statement of equality between the debits and the credits. It explains that the assets of a business are always equal to the total of liabilities and capital. It is also called the balance sheet eqaution. Assets = Liabilities + Capital A = L + C ASSETS ARE THE TOTAL VALUE OF PROPERTIES OWNED BY THE BUSINESS LIABILITIES ARE THE RIGHTS OF THE THIRD PARTIES TO THE PROPERTIES OF THE BUSINESS OR THE AMOUNT DUE BY THE BUSINESS TO THE THIRD PARTIES. Basics of accounting – Accounting Equations Made Simple With Solid Clarity from Shyama...

Posted by Managementguru in Accounting, Financial Accounting

on Feb 14th, 2014 | 0 comments

Double Entry System of Book Keeping Accounting is not to be feared Accounting is a subject that is intertwined with our day-to-day lives yet people think it is quite a complicated subject to deal with. The fancy of the subject is such, that many of us fail to understand that it is quite simple, un-complicated and all it talks about is balance. Rather than barging into equations that make us grip with fear, let us start with the basic question of WHAT=WHO? “What” deals with whatever we have in hand or otherwise ASSETS and “Who” deals with the claims, both other’s claims and our own claims on the product we have in hand. Other people’s claims are known as LIABILITIES and our own claim on the product is called Owner’s equity. Now if we take “WHAT=WHO”, it can be translated into the following equation ASSETS= LIABILITIES+OWNER’S EQUITY Accounting: Get Hired Without Work Experience UNDERSTAND WHAT = WHO What = Who Stuff = Who Assets = Who Assets = Who Has Claim Assets = Claims Assets = Other People’s Claims + My Claims Assets = Liabilities + My Claims Assets = Liabilities + My Equity Assets = Liabilities + Owner’s Equity Simple Equation to Remember There are two types of claims: other people’s claims and my claims. Assets = Other People’s Claims + My Claims Claims are also referred to as equities. Assets = Other People’s Equities + My Equity. Accountants have a fancy word for other people’s equities. These are known as liabilities. Assets = Liabilities + My Equity Because I am the owner, we will call My Equity Owner’s Equity. Assets = Liabilities + Owner’s Equity This is the formal equation of accounting. The structure of accounting is based on this one perspective. Accounting students memorize it. And try to decipher it. You are way ahead of the game because you understand that what = who! WHAT ARE ASSETS AND LIABILITIES Assets are on the left of the Big T. Asset accounts increase with debits. Liabilities and Owner’s Equity are on the right of the Big T. They increase with credits. Income ultimately increases owner’s equity so it behaves like owner’s equity: it increases with a credit. Expenses increase with debits. The best way to improve your expertise in accounting procedure is to practice; in due course your hand movement and thought process start synchronizing. Examples of Asset accounts – Vehicles, Furniture, Cash Examples of Liabilities accounts- Accounts payable, Owner’s equity Purchasing a TV- Example ASSETS (what) = LIABILITIES + OWNER’S EQUITY (who) Say if you invest Rs.5,000 as down payment from your end and take a loan of Rs.20,000 from the bank to purchase the product. Now, the bank has a claim on your asset to the extent of Rs.20,000 and your claim is Rs.5000. Here liability is Rs.20,000 and Owner’s equity is Rs.5,000. On the asset side we have a TV worth Rs.25,000 You can see that the value of the asset is equal to the value of liabilities, i.e., what = who. ASSETS = LIABILITIES + OWNER’S EQUITY 25,000 = 20,000 + 5,000 Just how you see a hand with five fingered palm on one side and five fingered nails on the other side, this accounting equation has two different perspectives to strike a balance between assets and liabilities. The Big Balancing ‘T’ The Big Balancing ‘T’ BIG “T” FOR PRODUCT PURCHASE WHAT (ASSET) VEHICLES (Rs.25,000) = WHO (LIABILITIES) ACCOUNTS PAYABLE (Rs.20,000) + PAID IN CAPITAL (Rs.5,000) Do I Debit or Credit? When we receive cash for completing a consulting job we know that cash has increased so we debit cash. The corresponding account...