Posted by Managementguru in Video Lecturers

on Apr 20th, 2014 | 0 comments

Strategic Management Video Lecture by David Kryscynski This is the introduction lecture for Strategic Management. Very Innovative and Informative video. A List of Strategic Management Terms Business – A strategy that pertains to single departments or units within a company.Combination – A type of grand strategy that employs several different grand strategies at once.Concentration – A growth strategy that extends the sale of current products or services to a company’s current market.Differentiation – A business strategy that strives to make the company’s product or service unique.Diversification – A growth strategy that moves a company into a similar kind of business with new or different products or services.Divestiture – A type of defensive strategy in which a company sells some part of its business, often an unprofitable part.Evaluating – The process of continuously monitoring the company’s progress toward its long-range goals and mission.Focus – A business strategy that directs marketing and sales towards a small segment of the market.Formal – The type of planning that involves systematic studying of an issue and the preparation of a written document to deal with the problem.Formulating strategy – Developing the grand- and business-level strategies to be used by the company.Functional – A strategy which involves short-range operational plans which support business strategies by emphasizing practical implementation.Goal – A concise statement that provides direction for employees and set standards for achieving the company’s strategic planGrand – A type of strategy that provides overall direction for the company.Growth – A type of grand strategy developed when a company tries to expand sales, products, or number of employees.Implementing – Putting a strategy to work after it has been formulated.Intermediate – Covers the time span between short-range and long-range, usually 1-3 years or 1-5 yearsLiquidation – A type of defensive strategy in which the entire company is sold or dissolved.Long Term– A three-to-five year period of time, but possibly as far as 20 years into the future.Mission Statement – A brief summary explaining why a company exists.Operational – Short-range planning that focuses on forming ideas for dealing with specific functions in the company.Overall Cost Leadership – A business strategy that is designed to produce and deliver a product or service for a lower cost than the competition.Planning – The process that businesses use to decide the company’s goals for the future and the ways to achieve those goals.Policy – A broad general guide to action that establishes boundaries within which employees must operate.Procedure – A detailed series of related steps of tasks written to implement a policy.Retrenchment – A type of strategy that aims to reverse negative trends in a company, such as losses in sales.Rule – A specific and definite corporate action that employees must follow.Short Term– A one-year period of time.Stability – A type of strategy that aims to keep the company operating at the same level that it has for several years.Strategic – Long-range planning done by the highest management levels in the company.Strategic Management – The application of the basic planning process at the highest levels of the company.Strategy – An outline of the basic steps management is going to take to achieve a goal.SWOT Analysis – The most utilized process for determining a company’s overall health; it involves analyzing internal strengths, internal weaknesses, external opportunities, and external threats.Turnaround – A type of defensive strategy that is used to regain success.Vertical Integration – A growth strategy that moves a company into a market it previously served either as a supplier or as a customer. Take The Test to Check Your Strategic...

Posted by Managementguru in Business Management, Decision Making, Human Resource, Organisational behaviour, Principles of Management

on Apr 19th, 2014 | 0 comments

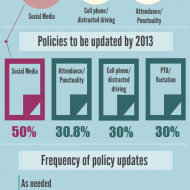

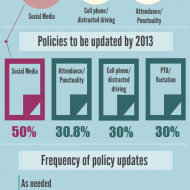

Business Policies – Framing and Execution Business policies are the keystone in the arch of management and the life-blood for the successful functioning of business, because without well-laid down policies, there cannot be lasting improvements in the economic condition of the firm and labor-management relations. A policy is a positive declaration and a command to its followers. It translates the goals of an organization into selected routes and provides the general guidelines that prescribe and proscribe programmes, which in turn, dictate practices and procedure. Attainment of Objectives: Buisness policies are general statement of principles for the attainment of objectives which serve as a guide to action for the executives at different levels of management. They pave a broad way in which the sub-ordinates tread along towards accomplishing their objectives. Hierarchy: For each set of objectives at each level, there is a corresponding set of policies. The Board of Directors determine the basic overall corporate policiesThe top management decides on the executive corporate policiesManagers decide on the departments / divisional policiesMiddle managers handle the sectional policies Consistent Decisions contributing to the Objectives: The policies delimit the area within which a decision has to be made; however, they do allow some discretion on the part of the man on the firing line, otherwise, they would be mere rules. At the same time too much of discretion in policy matters may prove harmful to the accomplishment of organizational objectives and hence it is generally within limits. Mutual Application: Policies in general are meant for mutual application by sub ordinates. They are fabricated to suit a specific situation in which they are applied, for they cannot apply themselves. Unified Structure: Policies tend to predefine issues, avoid repeated analysis and give a unified structure to other types of plans, thus permitting managers to delegate authority while maintaining control. Policies for all Functional Areas: In a well-structured and managed organization, policies are framed for all functional levels of management. Corporate planningMarketingResearch and DevelopmentEngineeringManufacturingInventoryPurchasePhysical DistributionAccountingFinanceCostingAdvertisingPersonal SellingSpecial Promotion, are some areas that require clear-cut policies. Clear-Cut Guidelines: Policies serve an extremely useful purpose in that they avoid confusion and provide clear-cut guidelines. This enables the business to be carried on smoothly and often without break. They lead to better and maximum utilization of resources, human, financial and physical, by adhering to actions for...

Posted by Managementguru in Business Management, Change management, Entrepreneurship, Human Resource

on Apr 16th, 2014 | 0 comments

Entrepreneurs are the mechanism by which our economy turns demand into supply. They create new ventures that provide new, improved products and services. Here we list some of the principal qualities of entrepreneurs and how those qualities help in shaping up our economy. Productivity Accelerators: Entrepreneurship raises productivity through technical and other forms of innovation. Entrepreneurs as risk bearers find resources and fill market gaps that would be missed by larger, more bureaucratic organizations. They allow a country to extract every last bit of marginal capacity out of whatever resources exist within the society. Brilliant Tips on Productivity by some Popular Entrepreneurs: Focus on one thing at a time: It may seem like a no-brainer, but multitasking can actually cut back on your productivity. Instead of juggling multiple projects at once, schedule out blocks of time — or even entire days — during which you only focus on one task or one project. Steph Auteri, @stephauteri, Word Nerd Pro Outsource, outsource, outsource: Everything may be a priority, but you are not equally brilliant at everything. Eliminate the unnecessary tasks and outsource your weaknesses so your time and focus is directed to where you’ll make the biggest impact for the business. Kelly Azevedo, @krazevedo, She’s Got Systems Define roles and divide work: Make sure everyone on the team has distinct roles defined, and divide work accordingly. Everyone on a proactive team will want to do everything, and clearly defined roles make it clear who should do what. David Gardner, @david_gardner, ColorJar Job Creators: It is a powerful tool of job creation –Entrepreneurship as a whole contributes to social wealth by creating new markets, new industries, new technology, new institutional forms, new jobs and net increases in real productivity. The jobs constructed through their activities in turn lead to equitable distribution of income which leads to higher standards of living for the population. Entrepreneurship facilitates the transfer of technology. Entrepreneurs play a strategic role in commercializing new inventions and products. They play a critical role in the restructuring and transformation of economy. Their behavior breathes vitality into the life of large corporations and governmental enterprises. Market Competitiveness: They make the markets more competitive and thereby reduce both static and dynamic market inefficiencies. Micro-preneurs working in the informal sector circumvent established government authority when governments and their programmes inhibit economic development. They stimulate redistribution of wealth, income and political power within societies in ways that are economically positive and without being politically disruptive. Social Welfare: They improve social welfare of a country harnessing dormant, previously overlooked talent. They create new markets and help in expansion into international markets. The unique feature of entrepreneurship – that it is a low cost strategy of economic development, job creation and technical innovations. Technology Innovation: Technology entrepreneurship is also important for sustainable development as Nobel Prize Laureate prof. Dan Schechtman puts it: “Technological entrepreneurship is a key to the well-being of the world”. India has been the first among the few developing countries to have assigned a significant and categorical state role to small scale industries from the first Five Year Plan itself, and the small scale sector has emerged as a dynamic and vibrant sector of the economy during the eighties. If the country develops pucca infrastructure and removes the hurdles in the operative environment politically and legally, no doubt the Indian economy will be scaling to greater heights. Surplus manpower (educated and un-educated), which has been a great liability can become an asset once those with potential are selectively groomed for self-employment and enterprise formation, leading to further job...

Posted by Managementguru in Business Management, Financial Accounting, Financial Management, Principles of Management

on Apr 8th, 2014 | 0 comments

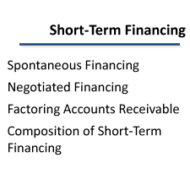

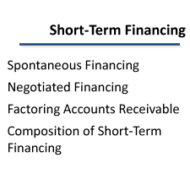

Interest Free Sources and Unsecured Interest Bearing Sources A firm obtains its funds from a variety of sources. Some capital is provided by suppliers, creditors, and owners, while other funds arise from earnings retained in business. In this segment, let me explain to you the sources of short-term funds supplied by creditors. Characteristics of short-term financing: Cost of Funds: Some forms of short-term financing may prove to be expensive than that of intermediate and long-term financing while some short-term sources like Accruals and Payables provide funds at no cost to the firm. Rollover Effect: Short-term finance as the name indicates must be repaid within a period of one year – though some sources provide funds that are constantly rolled over. The funds provided by payables, may remain relatively constant because, as some accounts are paid, other accounts are created. Clean-up: This happens when commercial banks or other lenders demand the firm to pay-off its short term obligation at one point in a financial year. Goals of Short-Term Financing: Funds are needed to finance inventories during a production period. Short term funds facilitate flexibility wherein, it meets the fluctuating needs for funds over a given cycle, commonly 1 year. To achieve low-cost financing due to interest free loans. Cash flow from operations may not be sufficient to keep up with growth-related financing needs Interest Free Sources: Accounts Payable Accounts payable are created when the firm purchases raw material, supplies, or goods for resale on credit terms without signing a formal note for the liability. These purchases on “open account” are, for most firms, the single largest source of short-term financing. Payables represent an unsecured form of financing since no specific assets are pledged as collateral for the liability. Even though no formal note is signed, an accounts payable is a legally binding obligation of a firm. Postponing payment beyond the end of the net (credit) period is known as “stretching accounts payable” or “leaning on the trade.” Possible costs of “stretching accounts payable” are Cost of the cash discount (if any) forgone Late payment penalties or interest Deterioration in credit rating Accruals: These are short term liabilities that arise when services are received but payment has not yet been made. The two primary accruals are wages payable and taxes payable. Employees work for a week, 2 weeks or a month before receiving a paycheck. The salaries or wages, plus the taxes paid by the firm on those wages, offer a form of unsecured short-term financing for the firm. The Government provides strict rules and procedures for the payment of withholding and social security taxes, so that the accrual of taxes cannot be readily manipulated. It is however, possible to change the frequency of paydays to increase or decrease the amount of financing through wages accrual. Wages — Benefits accrue via no direct cash costs, but costs can develop by reduced employee morale and efficiency. Taxes — Benefits accrue until the due date, but costs of penalties and interest beyond the due date reduce the benefits. Unsecured Interest Bearing Sources: Self-Liquidating Bank Loans The bank provides funds for a seasonal or cyclic business peak and the money is used to finance an activity that will generate cash to pay off the loan. Borrowed Funds → Finance Inventory → Peak Sales Season → Receivables → Cash → Pay Off the Loan. Three types of unsecured short-term bank loans: Single payment note – A short-term, one-time loan made to a borrower who needs funds for a specific purpose for a short period of time. Line of Credit – An informal arrangement between a bank and its customer specifying the maximum amount of...

Posted by Managementguru in Business Management, Human Resource, Organisational behaviour, Principles of Management, Training & Development

on Apr 5th, 2014 | 0 comments

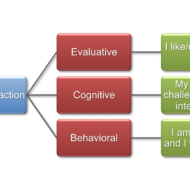

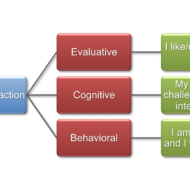

Attitude and Job Satisfaction What is attitude? Attitudes are evaluative statements or judgments concerning objects, people or events –Stephen Robbin. They also represent an ‘affective orientation towards an object.’ It simply means what one feels and thinks about something. Elements of attitude: Cognitive components – opinion or belief Affective components – emotion or feeling Behavioral components – intention to behave The interaction of these three components determines the way in which an individual develops an attitude towards something. Sources: Society Friends Teachers Family Members It also forms on the basis of the level of admiration we have over an object or persons. People also try to imitate others and attitudes are gradually formed on that basis also. In some attitudes formed are less stable, in some they even dominate the whole life. Types: Organizational behavior uses the concept of attitudes in relation to nature of the job and its influence on the performance of the persons. Accordingly, Job Satisfaction Job Involvement and Organizational Commitment, are the three kinds of attitude a person could have with respect his / her job or organization. Job Satisfaction: In “Job Satisfaction “, Stephen P. Robbins writes about five factors which make a person satisfied with his or her job. These factors are Mentally challenging work Equitable rewards Supportive working conditions Supportive colleagues and Personality-job fit. Cranny, Smith and Stone define job satisfaction as employees’ emotional state concerning the job, considering what they anticipated and what they actually got out of it. In fact, an employee with low expectations can be more satisfied with a certain job than someone who has high expectations. If one’s expectations are met or surpassed by the job, then one is happy and satisfied with the job. Job Involvement: Job involvement has been defined as an individual’s psychological identification or commitment to his / her job. As such individuals who display high involvement in their jobs consider their work to be a very important part of their lives- In other words for highly involved individuals performing well on the job is important for their self esteem. Organizational Commitment: Three important elements of a committed individual would be Identification with the organization’s goals and/or mission Long-term membership in the organization and intention to remain with the organization, often termed loyalty High levels of extra role behavior- behavior beyond required performance- Often denoted to as citizenship behavior or pro-social behavior. Cognitive Dissonance Theory: Leon Festinger developed this theory which explains the relationship between attitude and behavior. It refers to”any incompatibility that an individual might perceive between two or more of his or her attitudes, or between his or her behavior and attitudes.” Attitude Surveys: This is a tool that helps to collect information about the levels of attitude among the people. In most companies these kinds of surveys are conducted with the help of different rating scales like Likert scale offering five or seven alternative choices for each of the statement developed for attitude measurement. Summary: Research conducted on attitude and job satisfaction in Indian workers has made clear certain points as given below: Attitude is positively correlated with efficiency Absenteeism will bring down satisfaction levels Unions, negatively affect the employee attitude and job satisfaction Attitude researches and surveys will improve...