Posted by Managementguru in Accounting

on Aug 6th, 2016 | 0 comments

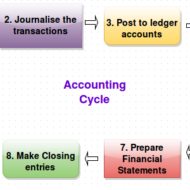

Financial statements have to be produced accurately at the end of the accounting period for tax purposes. An accounting period may be a month, a quarter of a year, or a whole year. The accounting cycle is the series of steps that take place in order to produce financial statements. A term that describes the steps when processing transactions (analyzing, journalizing, posting, preparing trial balances, adjusting, preparing financial statements) in a manual accounting system. Today many of the steps occur simultaneously when using accounting software. Following are the steps that complete an accounting cycle: Identify the transaction: This transaction could be the revenue from the sale of a product or a payment to another business for services. Analyze the transaction and how it is related to the accounting balance sheet. For example, determine which accounts are affected by the transaction and how they are affected. Record the transaction to a journal such as a sales journal. Journals are kept in chronological order and may be updated continuously, daily, or however often it is necessary. Record the transaction to the general ledger: Take all of your entries and categorize them by the account. Perform a trial balance: Debits and credits need to be equal at the end of an accounting cycle, so calculate the entries to ensure they match. Prepare adjustments: Just because entries are recognized, does not mean the work has been performed. Revenue can only be recognized when the work has been completed, so adjust the entries accordingly. Perform trial balance with adjustments: Take the adjustments from Step 6 and prepare a trial balance. If the debits and credits do not match, then you need to adjust them to make sure they do match. Prepare financial statements: From the adjusted trial balance, these corrected balances are used to prepare the financial statements. Close the accounts in preparation of the next accounting cycle. Revenues and expenses need to be closed out, which means they need to have zero balances. Balances are moved to the next cycle. Some Important Accounting Terms: Account A record in the general ledger that is used to collect and store similar information. For example, a company will have a Cash account in which every transaction involving cash is recorded. A company selling merchandise on credit will record these sales in a Sales account and in an Accounts Receivable account. Accounting Department Part of a company’s administration that is responsible for preparing the financial statements, maintaining the general ledger, paying bills, billing customers, payroll, cost accounting, financial analysis, and more. The head of the accounting department often has the title of controller. Accounting Equation Assets = Liabilities + Owner’s Equity. For a corporation the equation is Assets = Liabilities + Stockholders’ Equity. For a nonprofit organization the accounting equation is Assets = Liabilities + Net Assets. Because of double-entry accounting this equation should be in balance at all times. The accounting equation is expressed in the financial statement known as the balance sheet. Accounts Payable This current liability account will show the amount a company owes for items or services purchased on credit and for which there was not a promissory note. This account is often referred to as trade payables (as opposed to notes payable, interest payable, etc.) Accounts Receivable A current asset resulting from selling goods or services on credit (on account). Invoice terms such as (a) net 30 days or (b) 2/10, n/30 signify that a sale was made on account and was not a cash sale. Adjusting Entries Journal entries usually dated the last day of the accounting period to bring the balance sheet and income statement up to date on an accrual basis (as required by the matching principle and...

Posted by Managementguru in Financial Accounting, Financial Management

on Feb 20th, 2014 | 0 comments

What is fund ? Cash, total current assets, net current assets and net working capital are also interpreted as fund. So, it is necessary to clearly define the meaning of fund and demarcate its scope and function. To put it precisely, fund is nothing but, net working capital of a firm. The flow of fund occurs when a business transaction takes place that leads to an increase or decrease in the amount of fund. Firms prepare fund flow statement to explain the sources and applications of fund, which also serves as a technical tool to ascertain the financial condition of a business enterprise. Balance Sheet In a business firm, everyday numerous financial transactions take place. These are summarized into a balance sheet that gives an idea about the assets and liabilities at a specific point of time. When two balance sheets of consecutive periods are compared, we come to know about the inflow and outflow of funds and thereby the net working capital available is ascertained. This is step one. Profit and Loss Statement The next step would be to prepare an adjusted profit and loss account to determine fund inflow or fund lost from business operations. Accounts have to be prepared to ascertain hidden information (for all non-current items of assets and liabilities). Finally fund lost or gained from operations is arrived at and presented in a statement form. It is not that, only accountants could understand these operations and adjustments. Any person with logical reasoning and business acumen can understand the nuances of accounting, of course with some guidance. Few points that highlight the ways in which funds flow outside and inside a business enterprise will give you a better idea on the nature of fund flow: Sources of fund: Sale of fixed assets – sale of land, building, machinery, furniture etc. But you have to take into consideration a factor called “depreciation“. It is nothing but the wear and tear of the assets due to continuous usage, reduction in market value over a period of time, obsolescence, accidents etc. Remember, land is a non-depreciable asset in developing countries like India, whereas it may not be so in certain developed countries where the real estate values are nose diving. Issue of Equity shares – To raise capital free of interest, many big corporate firms go for equity capital from the general public. But the firms should make it a point to declare dividends if it happens to reap enormous profit to retain their market share. Their main aim should be to protect the interests of the equity share holders who are also the owners. Fund that comes into the firm through business operations – through sale of goods and services. Here the firm has to factorise its cost of production and economy of scale in order to make it cost-effective and fix a feasible profit margin. Borrowing of loans from banks and other financial institutions – Although it is a quick way of raising fund, care should be exercised in that, you should be in a comfortable position to “service the debt“. If not, there lurks the danger of bankruptcy where the firm might become insolvent, if it is unable to repay the interest and principal over a period of time. Issue of debentures – Debentures are also a form of equity but it comes with a price. The firm has to pay a percentage as interest on debentures and repayment period is also fixed in advance. The only solace for the firms would be the tax rebate that can be availed on loans and...