Posted by Managementguru in Business Management, Financial Accounting

on Apr 25th, 2015 | 0 comments

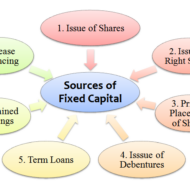

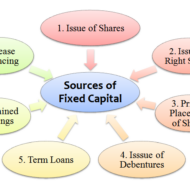

What is Long Term Financing? It is a form of financing that is provided for a period of more than a year to those business entities that face a shortage of capital. Before delving into the advantages of long term financing I would like to present you few fascinating facts on the economy that will blow your mind. Dell “has spent more money on share repurchases than it earned throughout its life as a public company,” writes Floyd Norris of The New York Times.According to Forbes, if a Google employee passes away, “their surviving spouse or domestic partner will receive a check for 50% of their salary every year for the next decade.”Start with a dollar. Double it every day. In 48 days you’ll own every financial asset that exists on the planet — about $200 trillion. Wow…According to Bloomberg, “Americans have missed out on almost $200 billion of stock gains as they drained money from the market in the past four years, haunted by the financial crisis.The “stock market” began in May 17th, 1792 when 24 stock brokers and merchants signed the Buttonwood Agreement.The Securities Exchange Act of 1934 creates the Securities and Exchange Commission, charged with the responsibility of preventing fraud and to require companies provide full disclosure to investors.Wall Street was laid out behind a 12-foot-high wood stockade across lower Manhattan in 1685. The stockade was built to protect the Dutch settlers from British and Native American attacks. Sources of Long Term Finance Long-term loans (External)Issue of shares or equitySale and leaseback (Internal)Retained profit Examples of long-term financing include – a 30 year mortgage or a 10-year Treasury note. Financial Markets and Securities Purpose of Long Term Finance To finance fixed assets.To finance the permanent part of working capital.Expansion of companies.Increasing facilities.Construction projects on a big scale.Provide capital for funding the operations. Factors determining Long-term Financial Requirements Nature of BusinessNature of Goods producedTechnology used Long term finance for businesses A Clear Perspective on Break Even Analysis Let us look at some of the Advantages of going for a Debt Financing Option Debt is the cheapest source of long-term financing. It is the least costly because interest on debt is tax-deductible, bondholders or creditors consider debt as a relatively less risky investment and require lower return.Debt financing provides sufficient flexibility in the financial/capital structure of the company. In case of over capitalization, the company can redeem the debt to balance its capitalization.Bondholders are creditors and have no interference in business operations because they are not entitled to vote.The company can enjoy tax saving on interest on debt. Disadvantages of Long Term Debt Financing Interest on debt is permanent burden to the company: Company has to pay the interest to bondholders or creditors at fixed rate whether it earns profit or not. It is legally liable to pay interest on debt.Debt usually has a fixed maturity date. Therefore, the financial officer must make provision for repayment of debt.Debt is the most risky source of long-term financing. Company must pay interest and principal at specified time. Non-payment of interest and principal on time take the company into bankruptcy.Debenture indentures may contain restrictive covenants which may limit the company’s operating flexibility in future.Only large scale, creditworthy firm, whose assets are good for collateral can raise capital from long-term debt. Financing through Debt Vs Equity There are a number of ways to finance a business using debt or equity. Though the first choice of many small-business owners would be equity, they may also prefer to utilize some type of debt to fund the business rather than take on additional investors. When done the right way, long-term debt financing provides a number of advantages to the business and its owner. Term Loans from Banks Most banks provide term loans,...

Posted by Managementguru in Accounting, Financial Management, Management Accounting, Principles of Management

on Mar 30th, 2014 | 0 comments

SOLVENCY OR LEVERAGE RATIOS Long-term solvency ratios analyze the long-term financial position of the organization. Bankers and creditors are interested in the liquidity of the firm, whereas shareholders, debenture holders and financial institutions are concerned with the long term prosperity of the firm. There are thus two aspects of the long-term solvency of a firm. Ability to repay the principal amount when due Regular payment of the interest. The ratio is based on the relationship between borrowed funds and owner’s capital it is computed from the balance sheet, the second type is calculated from the profit and loss a/c. The various solvency ratios are Debt equity ratio Debt to total capital ratio Proprietary (Equity) ratio Fixed assets to net worth ratio Fixed assets to long term funds ratio Debt service (Interest coverage) ratio 1. DEBT EQUITY RATIO OR EXTERNAL – INTERNAL EQUITY RATIO Debt equity ratio shows the relative claims of creditors (Outsiders) and owners (Interest) against the assets of the firm. The relationship between borrowed fund and capital is shown in debt-equity ratio. It can be calculated by dividing outsider funds (Debt) by shareholder funds (Equity) Ebt equity ratio = Outsider Funds (Total Debts) / Shareholder Funds or Equity (or) Long-term Debts / Shareholders funds Shareholders fund = Preference capital + Equity capital + Reserves & Surplus – Goodwill & Preliminary expenses Outsiders funds = Current liabilities + Debentures + Loans The ideal ratio is 2:1. High ratio means, the claim of creditors is greater than owners and vice-versa 2. DEBT TO TOTAL CAPITAL RATIO Debt to total capital ratio = Total Debts / Total Assets 3. PROPRIETARY (EQUITY) RATIO This ratio indicates the proportion of total assets financed by owners. It is calculated by dividing proprietor (Shareholder) funds by total assets. Proprietary (equity) ratio = Shareholder funds / Total Tangible assets The ideal ratio is 1:3. A ratio below 50% may be alarming for creditors, because they incur loss during winding up. 4. FIXED ASSETS TO NET WORTH RATIO This ratio establishes the relationship between fixed assets and shareholder funds. It is calculated by dividing fixed assets by shareholder funds. Fixed assets to net worth ratio = Fixed Assets X 100 / Net Worth The shareholder funds include equity share capital, preference share capital, reserves and surplus including accumulated profits. However fictitious assets like accumulated deferred expenses etc should be deducted from the total of these items to shareholder funds. The shareholder funds so calculated are known as net worth of the business. 5. FIXED ASSETS TO LONG TERM FUNDS RATIO Fixed assets to long term funds ratio establishes the relationship between fixed assets and long-term funds and is calculated by dividing fixed assets by long term funds. Fixed assets to long term funds ratio = Fixed Assets X 100 / Long-term Funds 6. DEBT SERVICE (INTEREST COVERAGE) RATIO This shows the number of times the earnings of the firms are able to cover the fixed interest liability of the firm. This ratio therefore is also known as Interest coverage or time interest earned ratio. It is calculated by dividing the earnings before interest and tax (EBIT) by interest charges on loans. Debt Service Ratio = Earnings before interest and tax (EBIT) / Interest...

Posted by Managementguru in Accounting

on Feb 21st, 2014 | 0 comments

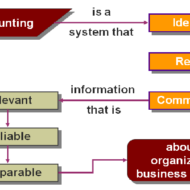

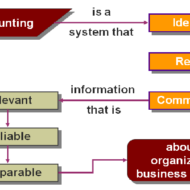

Functions of Accounting: a. Recording: Accounting records business transactions in terms of money. It is essentially concerned with ensuring that all business transactions of financial nature are properly recorded. Recording is done in journal, which is further subdivided into subsidiary books from the point of view of convenience. b. Classifying: Accounting also facilitates classification of all business transactions recorded in journal. Items of similar nature are classified under appropriate heads. The work of classification is done in a book called the ledger. c. Summarizing: Accounting summarizes the classified information. It is done in a manner, which is useful to the internal and external users. Internal users interested in these informations are the persons who manage the business. External users of information are the investors, creditors, tax authorities, labor unions, trade associations, shareholders, etc. d. Interpreting: It implies analyzing and interpreting the financial data embodied in final accounts. Interpretation of the data helps the management, outsiders and shareholders in decision making. Limitations of Accounting: Accounting information is expressed in terms of money. Non monetary events or transactions, however important, are completely omitted. Fixed assets are recorded in the accounting records at the original cost, that is, the actual amount spent on them plus all incidental charges. In this way the effect of inflation (or deflation) is not taken into consideration. The direct result of this practice is that balance sheet does not represent the true financial position of the business. Accounting information is sometimes based on estimates; estimates are often inaccurate. Accounting information cannot be used as the only test of managerial performance on the basis of more profits. Profit for a period of one year can readily be manipulated by omitting such costs as advertisement, research and development, depreciation and so on. Accounting information is not neutral or unbiased. Accountants calculate income as excess of revenues over expenses. But they consider only selected revenues and expenses. They do not, for example, include, cost of such items as water or air pollution, employee’s injuries, etc. Accounting Made Easy Accounting like any other discipline has to follow certain principles, which in certain cases are contradictory. For example current assets (e.g., stock of goods) are valued on the basis of cost or market price whichever is less following the principle of conservatism. Accordingly the current assets may be valued on cost basis in some year and at market price in another year. In this manner, the rule of consistency is not followed...

Posted by Managementguru in Financial Accounting, Financial Management

on Feb 20th, 2014 | 0 comments

What is fund ? Cash, total current assets, net current assets and net working capital are also interpreted as fund. So, it is necessary to clearly define the meaning of fund and demarcate its scope and function. To put it precisely, fund is nothing but, net working capital of a firm. The flow of fund occurs when a business transaction takes place that leads to an increase or decrease in the amount of fund. Firms prepare fund flow statement to explain the sources and applications of fund, which also serves as a technical tool to ascertain the financial condition of a business enterprise. Balance Sheet In a business firm, everyday numerous financial transactions take place. These are summarized into a balance sheet that gives an idea about the assets and liabilities at a specific point of time. When two balance sheets of consecutive periods are compared, we come to know about the inflow and outflow of funds and thereby the net working capital available is ascertained. This is step one. Profit and Loss Statement The next step would be to prepare an adjusted profit and loss account to determine fund inflow or fund lost from business operations. Accounts have to be prepared to ascertain hidden information (for all non-current items of assets and liabilities). Finally fund lost or gained from operations is arrived at and presented in a statement form. It is not that, only accountants could understand these operations and adjustments. Any person with logical reasoning and business acumen can understand the nuances of accounting, of course with some guidance. Few points that highlight the ways in which funds flow outside and inside a business enterprise will give you a better idea on the nature of fund flow: Sources of fund: Sale of fixed assets – sale of land, building, machinery, furniture etc. But you have to take into consideration a factor called “depreciation“. It is nothing but the wear and tear of the assets due to continuous usage, reduction in market value over a period of time, obsolescence, accidents etc. Remember, land is a non-depreciable asset in developing countries like India, whereas it may not be so in certain developed countries where the real estate values are nose diving. Issue of Equity shares – To raise capital free of interest, many big corporate firms go for equity capital from the general public. But the firms should make it a point to declare dividends if it happens to reap enormous profit to retain their market share. Their main aim should be to protect the interests of the equity share holders who are also the owners. Fund that comes into the firm through business operations – through sale of goods and services. Here the firm has to factorise its cost of production and economy of scale in order to make it cost-effective and fix a feasible profit margin. Borrowing of loans from banks and other financial institutions – Although it is a quick way of raising fund, care should be exercised in that, you should be in a comfortable position to “service the debt“. If not, there lurks the danger of bankruptcy where the firm might become insolvent, if it is unable to repay the interest and principal over a period of time. Issue of debentures – Debentures are also a form of equity but it comes with a price. The firm has to pay a percentage as interest on debentures and repayment period is also fixed in advance. The only solace for the firms would be the tax rebate that can be availed on loans and...