Posted by Managementguru in Accounting

on Aug 6th, 2016 | 0 comments

Financial statements have to be produced accurately at the end of the accounting period for tax purposes. An accounting period may be a month, a quarter of a year, or a whole year. The accounting cycle is the series of steps that take place in order to produce financial statements. A term that describes the steps when processing transactions (analyzing, journalizing, posting, preparing trial balances, adjusting, preparing financial statements) in a manual accounting system. Today many of the steps occur simultaneously when using accounting software. Following are the steps that complete an accounting cycle: Identify the transaction: This transaction could be the revenue from the sale of a product or a payment to another business for services. Analyze the transaction and how it is related to the accounting balance sheet. For example, determine which accounts are affected by the transaction and how they are affected. Record the transaction to a journal such as a sales journal. Journals are kept in chronological order and may be updated continuously, daily, or however often it is necessary. Record the transaction to the general ledger: Take all of your entries and categorize them by the account. Perform a trial balance: Debits and credits need to be equal at the end of an accounting cycle, so calculate the entries to ensure they match. Prepare adjustments: Just because entries are recognized, does not mean the work has been performed. Revenue can only be recognized when the work has been completed, so adjust the entries accordingly. Perform trial balance with adjustments: Take the adjustments from Step 6 and prepare a trial balance. If the debits and credits do not match, then you need to adjust them to make sure they do match. Prepare financial statements: From the adjusted trial balance, these corrected balances are used to prepare the financial statements. Close the accounts in preparation of the next accounting cycle. Revenues and expenses need to be closed out, which means they need to have zero balances. Balances are moved to the next cycle. Some Important Accounting Terms: Account A record in the general ledger that is used to collect and store similar information. For example, a company will have a Cash account in which every transaction involving cash is recorded. A company selling merchandise on credit will record these sales in a Sales account and in an Accounts Receivable account. Accounting Department Part of a company’s administration that is responsible for preparing the financial statements, maintaining the general ledger, paying bills, billing customers, payroll, cost accounting, financial analysis, and more. The head of the accounting department often has the title of controller. Accounting Equation Assets = Liabilities + Owner’s Equity. For a corporation the equation is Assets = Liabilities + Stockholders’ Equity. For a nonprofit organization the accounting equation is Assets = Liabilities + Net Assets. Because of double-entry accounting this equation should be in balance at all times. The accounting equation is expressed in the financial statement known as the balance sheet. Accounts Payable This current liability account will show the amount a company owes for items or services purchased on credit and for which there was not a promissory note. This account is often referred to as trade payables (as opposed to notes payable, interest payable, etc.) Accounts Receivable A current asset resulting from selling goods or services on credit (on account). Invoice terms such as (a) net 30 days or (b) 2/10, n/30 signify that a sale was made on account and was not a cash sale. Adjusting Entries Journal entries usually dated the last day of the accounting period to bring the balance sheet and income statement up to date on an accrual basis (as required by the matching principle and...

Posted by Managementguru in Accounting, Financial Accounting, Management Accounting

on Jun 25th, 2014 | 0 comments

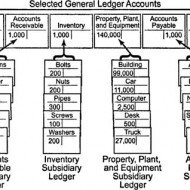

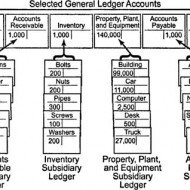

Ledger is a register with pages numbered consecutively. Each account is allotted one or more pages in the Ledger. If one page is completed, the account will be continued in the next page. An index of various accounts opened in the Ledger is given at the beginning of the Ledger for the purpose of easy reference. A general ledger is a complete record of financial transactions that holds account information needed to prepare financial statements, and includes accounts for assets, liabilities, owners’ equity, revenues and expenses. What is meant by Posting? Transactions recorded in the Journal and Subsidiary journal are transferred to the concerned accounts in the Ledger in a summarized and classified form. This process is called posting. “Interesting Statistics on Accounting The first book on double-entry accounting was written in 1494 by Italian mathematician and Franciscan friar Luca Bartolomeo de Pacioli. Although double-entry bookkeeping had been around for centuries, Pacioli’s 27-page treatise on the subject has earned him the title “The Father of Modern Accounting. Accounting plays a major role in law enforcement. The FBI counts more than 1,400 accountants among its special agents. The state of New York gave its first certified public accountant (CPA) exam in 1896. Rules for posting: Separate account should be opened in the Ledger for posting transactions relating to separate persons, assets, expenses or losses as shown in the journal. The account concerned which has been debited in the journal should also be debited in the Ledger. However, a reference must be made of the other account which is to be credited in the journal. In other words, in the account to be debited, the name of the other account to be credited is entered in the debit side for giving a meaning to this posting. The debit posting is prefixed by the word ‘To’. Similarly, the account concerned which has been credited in the journal has to be credited in the Ledger, but a reference should be made to the other account which has been debited in the journal. This posting is prefixed by the word ‘By’. Advantages of keeping a Ledger: Ledger provides information regarding all transactions of a particular account whether it is personal a/c, Real a/c or nominal a/c. The final effect, of a series of transactions of a certain customer or a certain property or a certain expense is known at a glance. Ledger provides immediately the totality of certain dealings. E.g., total purchases, Total sales, total expenditure, on a specified head. What is a Ledger account? Give a Proforma of a Ledger account. A Ledger account is nothing but a summary statement of all transactions relating to a person, asset, expense or income, which have taken place during a given period of time showing their net effect. Proforma of a Ledger account: What are the methods of balancing the Ledger account? At the end of the each month or year or any specific day it is essential to determine the balance in an account. To do that, add the totals of both sides (Debit and credit sides) and find out the difference in both the sides. The difference in both the sides is ‘Balance’. If the Debit is greater than the credit side, it is a Debit balance or vice-versa. There are two methods: The bigger total is taken first and is written on both sides of the account. On the smaller side, the balance is Witten above the total next to the last entry on that side. This method is more commonly used. In another method, the totals are written on both sides, one side showing smaller amount and the other showing bigger amount. The difference is...