Posted by Managementguru in Accounting, Business Management, Financial Accounting

on Jul 2nd, 2014 | 0 comments

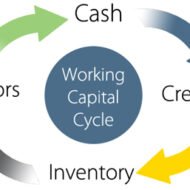

Understanding Working Capital: It is the life blood of business. Funds needed for the purchase of raw materials, payment of wages and other day-to-day expenses are known as working capital. It is part of the firm’s capital, which is being used for financing short-term operations. Hence, it may also be termed as Circulating Capital or Short-Term capital. “Working capital means current assets” –Mead, Malott and Field. “Any acquisition of funds which the current asset increases working capital, for, they are one and the same.” – J.S.mill Financial troubles and issues arise only when this entity called ‘working capital’ is not properly managed. Every successful company will hire a financial manager to deal with issues relating to finance while the CEO can look into matters relating to promotion of the product or service and the position of the company in the market. The ‘Sales Turnover or Sales Volume’ is the key issue you have to look into to gauge whether you have sufficient working capital to manage that big a volume for that particular period. You have to rotate your funds wisely keeping in mind the credit policies your company offers and the credits you may enjoy with your supplier, bank interest for the short-term loans etc. Concept of WC: Working capital implies excess of current assets over current liabilities. Funds invested in current assets is known as “Gross Working Capital.” The difference between current assets and current liabilities is known as “Net Working Capital.” What are the two types? Permanent or fixed: It is the minimum amount of current assets required for conducting the business operation. This capital will remain permanent in current assets and should be financed out of long-term funds. The amount varies from year to year, depending upon the growth of a company. Temporary or Variable: It is the amount of additional current assets required for a short period. It is needed to meet the seasonal demands at different times during a year. The capital can be temporary and should be financed out of short-term funds. The working capital starts decreasing when the peak season is over. Various Factors Influencing WC: Nature of business: Service oriented concerns like electricity; water supplies need limited working capital while a manufacturing concern requires sufficient working capital, since they have to maintain stock and debtors. Credit Policies: A company which allows credit to its customers shall need more amount while a company enjoying credit facilities from its suppliers will need lower amount of working capital. Manufacturing Process: Conversion of raw materials into finished goods is called manufacturing or production. Longer the process, higher the requirement of working capital. Rapidity of turnover: High rate of turnover requires low amount and lower and slow moving stocks need a larger amount of working capital. Say, jewelry shops have to maintain different types of designs calling for high working capital. Fast moving goods like grocery requires low working capital. Business cycle: Changes in economy has a say over the requirement of working capital. When a business is prosperous, it requires huge amount of capital; also during depression huge amount is needed for unsold stock and uncollected debts. Seasonal variation: Industries which are manufacturing and selling goods seasonally require large amount of working capital. Fluctuation of supply: Firms have to maintain large reserves of raw material in stores, to avoid uninterrupted production which needs large amount of working capital. Dividend policy: If a conservative dividend policy is followed by the management, the need for working capital can be met with the retained earnings, it consequently drains off large amounts from working capital pool. ...

Posted by Managementguru in Accounting, Decision Making, Financial Management, Management Accounting, Principles of Management

on Mar 30th, 2014 | 0 comments

TURNOVER RATIO OR ACTIVITY RATIO or ASSET MANAGEMENT RATIO Turnover ratios are also known as activity ratios or efficiency ratios with which a firm manages its current assets. The following turnover ratios can be calculated to judge the effectiveness of asset use. Inventory Turnover Ratio Debtor Turnover Ratio Creditor Turnover Ratio Assets Turnover Ratio 1. INVENTORY TURNOVER RATIO This ratio indicates whether investment in stock is efficiently used or not, in other words, the number of times the inventory has been converted into sales during the period. Thus it evaluates the efficiency of the firm in managing its inventory. It helps the financial manager to evaluate the inventory policy. It is calculated by dividing the cost of goods sold by average inventory. Inventory Turnover Ratio = Cost of goods sold / Average Inventory (or) Net Sales / Average Stock Cost of goods sold = Sales-Gross profit Average Stock =Opening stock + Closing stock/2 2. DEBTOR TURNOVER RATIO Debtors play a vital role in current assets and to a great extent determines the liquidity of a firm. This indicates the number of times average debtors have been converted into cash during a year. It is determined by dividing the net credit sales by average debtors. Debtor Turnover Ratio = Net Credit Sales / Average Trade Debtors (or) Net Credit Sales / Average Debtors – Average Bills Receivable Net credit sales = Total sales – (Cash sales + Sales return) Total debtors = [ Op.Dr. + Cl.Dr. / 2 + Op.B/R + Cl. B/R / 2] When the information about credit sales, opening and closing balances of trade debtors is not available then the ratio can be calculated by dividing total sales by closing balances of trade debtor Debtor Turnover Ratio = Total Sales / Trade Debtors Note: Bad and doubtful doubts and their provisions are not deducted from the total debtors. The higher ratio indicates that debts are being collected promptly. 3. CREDITOR TURNOVER RATIO This is also known as “Creditors Velocity”. It indicates the number of times sundry creditors have been paid during a year. It is calculated to judge the requirements of cash for paying sundry creditors. It is calculated by dividing the net credit purchases by average creditors. Creditor Turnover Ratio = Net Credit Purchases / Average Trade Creditor (or) Net Credit Purchases / Average Creditors + Average Bills Payable Net credit purchases = Total purchases – (Cash purchase + Purchase return) Total Creditors = [Op.Cr. + Cl.Cr. / 2 + Op. B/P + Cl. B/P / 2] The higher ratio should indicate that the payments are made promptly. Net credit purchases consist of gross credit purchases minus purchase return. When the information about credit purchases, opening and closing balances of trade creditors is not available then the ratio is calculated by dividing total purchases by the closing balance of trade creditors. Creditor Turnover Ratio = Total purchases / Total Trade Creditors 4. ASSETS TURNOVER RATIO The relationship between assets and sales is known as assets turnover ratio. Several assets turnover ratios can be calculated depending upon the groups of assets, which are related to sales. a) Total asset turnover. b) Net asset turnover c) Fixed asset turnover d) Current asset turnover e) Net working capital turnover ratio a. TOTAL ASSET TURNOVER This ratio shows the firms ability to generate sales from all financial resources committed to total assets. It is calculated by dividing sales by total assets. Total asset turnover = Total Sales / Total Assets b. NET ASSET TURNOVER This is calculated by dividing sales by net assets. Net asset turnover =Total Sales / Net Assets Net assets represent total assets minus current liabilities. Intangible and fictitious assets like goodwill, patents, accumulated losses, deferred expenditure may be excluded for...

Posted by Managementguru in Financial Accounting, Financial Management

on Feb 20th, 2014 | 0 comments

What is fund ? Cash, total current assets, net current assets and net working capital are also interpreted as fund. So, it is necessary to clearly define the meaning of fund and demarcate its scope and function. To put it precisely, fund is nothing but, net working capital of a firm. The flow of fund occurs when a business transaction takes place that leads to an increase or decrease in the amount of fund. Firms prepare fund flow statement to explain the sources and applications of fund, which also serves as a technical tool to ascertain the financial condition of a business enterprise. Balance Sheet In a business firm, everyday numerous financial transactions take place. These are summarized into a balance sheet that gives an idea about the assets and liabilities at a specific point of time. When two balance sheets of consecutive periods are compared, we come to know about the inflow and outflow of funds and thereby the net working capital available is ascertained. This is step one. Profit and Loss Statement The next step would be to prepare an adjusted profit and loss account to determine fund inflow or fund lost from business operations. Accounts have to be prepared to ascertain hidden information (for all non-current items of assets and liabilities). Finally fund lost or gained from operations is arrived at and presented in a statement form. It is not that, only accountants could understand these operations and adjustments. Any person with logical reasoning and business acumen can understand the nuances of accounting, of course with some guidance. Few points that highlight the ways in which funds flow outside and inside a business enterprise will give you a better idea on the nature of fund flow: Sources of fund: Sale of fixed assets – sale of land, building, machinery, furniture etc. But you have to take into consideration a factor called “depreciation“. It is nothing but the wear and tear of the assets due to continuous usage, reduction in market value over a period of time, obsolescence, accidents etc. Remember, land is a non-depreciable asset in developing countries like India, whereas it may not be so in certain developed countries where the real estate values are nose diving. Issue of Equity shares – To raise capital free of interest, many big corporate firms go for equity capital from the general public. But the firms should make it a point to declare dividends if it happens to reap enormous profit to retain their market share. Their main aim should be to protect the interests of the equity share holders who are also the owners. Fund that comes into the firm through business operations – through sale of goods and services. Here the firm has to factorise its cost of production and economy of scale in order to make it cost-effective and fix a feasible profit margin. Borrowing of loans from banks and other financial institutions – Although it is a quick way of raising fund, care should be exercised in that, you should be in a comfortable position to “service the debt“. If not, there lurks the danger of bankruptcy where the firm might become insolvent, if it is unable to repay the interest and principal over a period of time. Issue of debentures – Debentures are also a form of equity but it comes with a price. The firm has to pay a percentage as interest on debentures and repayment period is also fixed in advance. The only solace for the firms would be the tax rebate that can be availed on loans and...