Posted by Managementguru in Management Accounting

on Mar 8th, 2015 | 0 comments

Gross Profit It is a required income statement entry that indicates total revenue minus cost of goods sold. It is the company’s profit before operating expenses, interest payment and taxes. It is also known as GROSS MARGIN. The gross profit on a product is computed as: Net Sales – Cost of Goods Sold (COGS) This concept is well understood if you are able to clearly distinguish between variable and fixed costs. VARIABLE COSTS: Materials used Direct labor Packaging Freight Plant supervisor salaries Utilities for a plant or a warehouse Depreciation expense on production equipment Machinery FIXED COSTS: Fixed costs generally are more static in nature. They include: Office expenses such as supplies, utilities, a telephone for the office, etc. Salaries and wages of office staff, salespeople, officers and owners Payroll taxes and employee benefits Advertising, promotional and other sales expenses Insurance Auto expenses for salespeople Professional fees Rent Variable expenses are logged as cost of goods sold. Fixed expenses are counted as operating expenses (sometimes called selling and general administrative expenses). While gross profit is a monetary entity, the margin is expressed as a percentage. It’s equally significant to track since it allows you to keep an eye on profitability trends. Gross Profit Ratio = Gross Profit / Net Sales The gross profit margin is computed as follows: When the ratio is expressed in percentage form, it is known as gross profit margin or percentage. Gross Profit / Net Sales *100 = Gross Profit Margin It is equal to the net sales minus cost of goods sold and net sales are equal to total gross sales less return inwards and discount allowed. Benefits of calculating gross profit: This ratio determines how efficiently the management utilizes labor and raw materials A company uses its gross income to fund activities such as research and development, marketing etc., which are vital for generating future sales. A prolonged decline in this margin is a cleat-cut indication of sales drop-down and ultimately earnings. Trends in this margin reflect basic pricing decisions and material costs of a company. This profit margin is an accounting measure designed to estimate the financial health of a business or industry. It may be noted that generating a profit margin alone cannot vouch for the financial health of a firm; rather the business must have sufficient cash flow in order to pay its bills and compensate employees. An entrepreneur might compare the return that would be available from a bank or another low-risk investment opportunity to that of his EXISTING profit-margin to gauge whether his startup is doing well. → Profitability...

Posted by Managementguru in Accounting, Decision Making, Management Accounting, Project Management

on Apr 1st, 2014 | 0 comments

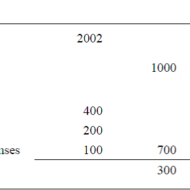

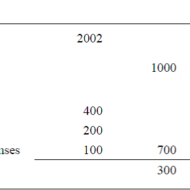

ACCOUNTING AND DECISION MAKING – IDENTIFYING THE PROBLEM SITUATION Learn accounting and finance basics so you can effectively analyze business data to make key management decisions. Business owners are faced with countless decisions every business day. Managerial accounting information provides data-driven input to these decisions, which can improve decision-making over the long term. Fig 1.1- ACCOUNTING INFORMATION FOR A SINGLE PRODUCT The above illustration clearly depicts that there has been a loss of Rs.100 in one year’s time for this particular product. The reason can be attributed to the increase in the “cost of goods” whereas other expenses have remained the same in both the years. For a single product manufactured, the problem is identifiable and solvable. But when the organization is producing a range of products, you need to apply some accounting technique by which the product losing money is identified and suitable measures are taken to cut down the escalating cost. Fig 1.2- Accouning Information for a Product Range The above illustration compares and contrasts the relationship of three products a company manufactures. It is seen that products P1 and P2 are doing well. Though the cost of sales has gone up for P1 and P2, the sales volume has also increased thus increasing the gross profit over the period of time. Here the product that has to be dealt with is P3 whose sales volume has drastically gone down, yet with the same cost of sales. When there is an increase in cost of sales, two things have to be considered. Identifying the problem-product Either cut down the production cost or increase the selling-price if the product has a real demand in the market. Uses of Accounting Data: Accounting information helps the management to arrive at make or buy decisions, to outsource production of certain components to cut down or control costs, to expand the production, to increase the sales volume or to downsize their project capacity. Techniques like Break-Even Analysis, Costing and Budgeting aid in going for the right production-mix, marketing-mix and sales target plans for the respective financial years. Aggregate Planning: As we all know planning is the key to the future and financial planning has to be given utmost importance for a production process. Aggregate planning involves translating long-term forecasted demand into specific production rates and the corresponding labor requirements for the intermediate term. It takes into consideration a period of 6 to 18 months, breaking it into work modules weekly or monthly and planning for the specific period in terms of men, material and...

Posted by Managementguru in Accounting, Financial Management, Management Accounting, Principles of Management

on Mar 29th, 2014 | 0 comments

Profitability ratios are metrics that assess a company’s ability to generate income relative to its revenue, operating costs, balance sheet assets, or shareholders’ equity. Profitability ratios show how efficiently a company generates profit and value for shareholders. Accounting Basics for Success in Business and in Life! In general two groups of profitability ratios are calculated. Profitability in relation to sales.Profitability in relation to investments. Profitability Ratios can be Classified into five types Gross profit margin or ratioNet profit margin or ratioOperating profit margin or ratioReturn on AssetsReturn on Equity 1. GROSS PROFIT MARGIN OR RATIO It measures the relationship between gross profit and sales. It is calculated by dividing gross profit by sales. Gross profit margin or ratio = Gross profit X 100 / Net salesGross profit is the difference between sales and cost of goods sold. 2. NET PROFIT MARGIN OR RATIO It measures the relationship between net profit and sales of a firm. It indicates management’s efficiency in manufacturing, administrating, and selling the products. It is calculated by dividing net profit after tax by sales. Net profit margin or ratio = Earning after tax X 100 / Net Sales 3. OPERATING PROFIT MARGIN OR RATIO It establishes the relationship between total operating expenses and net sales. It is calculated by dividing operating expenses by the net sales. Operating profit margin or ratio = Operating costs X 100 / Net sales (0r) Cost of goods sold + Operating expenses * 100 / Net sales Operating expenses includes cost of goods produced/sold, general and administrative expenses, selling and distributive expenses. 4. RETURN ON ASSETS Return on assets is the ratio that is used to measure the company’s ability to generate profit by using its whole resource, the assets. It shows the percentage of the net income or net profit comparing to the average total assets. Return on assets shows how efficient the company is in using the assets to generate profits in a period of time. The high return on assets usually shows that the company performs well in making a profit from the assets it has. Return on assets can be calculated by comparing net income or net profit after interest and tax in the period to average total assets. Return on Assets = Net Profit / Average Total Assets 5. RETURN ON EQUITY Return on equity is the ratio that is used to measure the company’s ability to generate profit by using its investors’ money. It shows the percentage of the net income or net profit comparing to the average total equity. Return on equity shows how efficient the company is in using the investor’s money to generate profits in a period of time. The high return on equity usually shows that the company performs well in making profits from its investors’ money. Return on equity can be calculated by comparing net income or net profit after interest and tax in the period to average total equity. Return on Equity = Net Profit / Average Total...

Posted by Managementguru in Accounting, Financial Management, Management Accounting, Principles of Management

on Mar 27th, 2014 | 0 comments

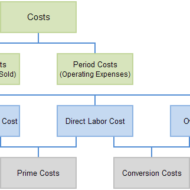

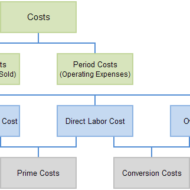

Costing is the technique and process of ascertaining cost whereas cost accounting is the application of costing and cost accounting principles, methods and techniques to the science, art and practice of cost control and ascertainment of profitability.