Posted by Managementguru in Business Management, Financial Accounting, Management Accounting

on Apr 21st, 2014 | 0 comments

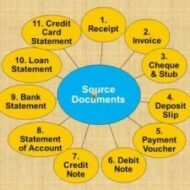

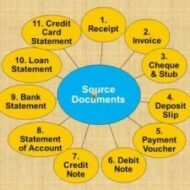

What are the Various Source Documents in Accounting? What is meant by source document? A source document is one used to record the transactions in the books of account. These documents stand as evidence for business transactions. These include Cash Memo Invoice Receipt Debit Note Credit Note Voucher Pay in Slip Cheque etc. 1. Cash Memo: When goods are sold or purchased for cash, the firm gives or receives cash memos with details regarding cash transactions. These documents become the basis for recording these transactions in the books of accounts. 2. Invoice: Invoice is prepared when goods are sold or purchased on credit. It contains the name of the party, quantity, price per unit and the total amount payable. The original copy is sent to the buyer and the duplicate copy is kept as proof of sale and for future reference. Types of Invoice: Inland Invoice – An invoice which is used in internal trade transaction is called as an Inland Invoice. When the goods are sold within a country, the invoice relating to such a transaction is called as an Inland Invoice. Foreign Invoice – An invoice which is prepared for covering an international trade transaction is called as a Foreign Invoice. A number of copies are prepared, maybe even 10 to 12, because a number of authorities require it. Inward Invoice – Inward invoice is received by the buyer from the seller, on receipt of invoice; the buyer stamps it with date of receipt. The inward invoice number is entered in the purchase journal. Outward Invoice – Outward Invoice is a seller’s bill. An invoice which is inward to the buyer is an outward for a seller. It is called outward invoice, because it is sent to the buyer. At least one copy of the invoice is retained by the seller for necessary action and reference. Proforma Invoice – Proforma Invoice is not a real invoice. It is prepared to give a clear idea regarding the amount that would be paid by the buyer if he places an order. This is prepared at the request of the buyer. 3. Receipt: When a firm receives cash from a customer it issues a receipt as a proof of receiving cash. The original copy is handed over to the party making payment and the duplicate is kept for future reference. This document contains date, amount, name of the party and the nature of payment. 5 Kinds of Receipts Small Businesses Should Take Extra Care to Keep Meal & Entertainment Receipts Receipts from Out of Town Business Travels Vehicle Related Receipts Receipts for Gifts Home Office Receipts 4 & 5. Debit and Credit Notes: These are prepared when goods are returned to supplier or when an additional amount is recoverable from a customer. When the purchaser returns the goods to the seller the Purchaser sends a Debit Note to the seller (i.e. the purchaser debits the seller in his books. Purchasers Books) and the Seller sends a Credit Note to the purchaser (i.e. the seller credits the Purchaser in his Books. Sellers Books). Following are the JVs to be passed:- Sales Return inward A/c Dr. To Debtor A/c (Being goods returned by the customer) Creditor A/c Dr. To Goods Return A/c (Being goods sent back to the seller) 6. Voucher: It is a written document in support of a transaction. It is a proof of a particular transaction taking place for the value stated in the voucher. This is necessary to audit the account. In book keeping, voucher is the first document to record an entry. Normally three types of vouchers are used. Receipt voucher Payment voucher Journal voucher RECEIPT VOUCHER Receipt voucher...