Posted by Managementguru in Financial Management

on Jan 2nd, 2015 | 0 comments

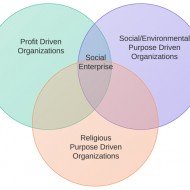

OBJECTIVES OF FINANCIAL #management Before looking into the two main objectives of finance management, let us look at the lighter side of money. Some hilarious quotes that will make your day: “Money is like a sixth sense – and you can’t make use of the other five without it.” – William Somerset Maugham “The safest way to double your money is to fold it over and put it in your pocket.” – Kin Hubbard “Money is the best deodorant.” – Elizabeth Taylor “If you think nobody cares if you’re alive, try missing a couple of car payments.” – Earl Wilson “Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.“ ~Sam Ewing “Too many people spend money they haven’t earned, to buy things they don’t want, to impress people they don’t like.” – Will Smith “There’s a way of transferring funds that is even faster than electronic banking. It’s called marriage.” — James Holt McGavran Objectives of Financial Management may be broadly divided into two parts such as: 1. #Profit maximization 2. #Wealth maximization. Profit Maximization The main purpose of any kind of economic activity is earning profit. A business concern operates mainly for the purpose of making profit. Profit has become the yardstick to measure the business efficiency of a concern. Profit maximization is also the out-moded and narrow approach, which aims at, maximizing the profit of the concern. Profit maximization consists of the following important features. Favorable Arguments for Profit Maximization: The following important points are in support of the profit maximization objectives of the business concern: Main aim is earning profit. Profit is the parameter of the business operation. Profit reduces risk of the business concern. Profit is the main source of finance. ##profitability meets the #social needs also. Unfavorable Arguments for Profit Maximization: The following important points are against the objectives of profit maximization: Profit maximization leads to exploiting workers and consumers. Profit maximization may lead to unethical practices, unfair trade practice, etc. Profit maximization objectives leads to inequalities among the #stake holders such as #customers, #suppliers, #public #shareholders, etc. Drawbacks of Profit Maximization: Profit maximization objective consists of certain drawbacks also: It is vague: Profit is not defined precisely or correctly. It ignores the #time value of money: Profit maximization does not consider the time value of money or the net present value of the cash inflow. It leads to certain differences between the actual cash inflow and net present cash flow during a particular period. It ignores risk: Profit maximization does not consider risk of the business concern. Risks may be internal or external which will affect the overall operation of the business concern. Wealth Maximization Wealth maximization is one of the modern approaches, which involves latest innovations and improvements in the field of the business concern. The term wealth means shareholder wealth or the wealth of the persons those who are involved in the business concern. Wealth maximization is also known as value maximization or net present worth maximization. This objective is a universally accepted concept in the field of business. Favorable Arguments for Wealth Maximization: Wealth maximization is superior to the profit maximization because the main aim of the business concern under this concept is to improve the value or wealth of the shareholders. Wealth maximization considers the comparison of the value to cost associated with the business concern. Total value detected from the total cost incurred for the business operation. It provides exact value of the business concern. Wealth maximization considers both time and risk of the business concern. Wealth maximization provides efficient distribution of resources. It ensures...

Posted by Managementguru in Business Management, Entrepreneurship, Marketing, Principles of Management

on May 15th, 2014 | 0 comments

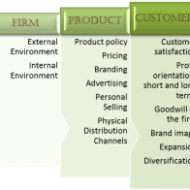

Market Assessment Framework Industries whether small or large function in an environment of controllable and uncontrollable variables. A small enterprise has to constantly interact with the market in which it has to operate and is also exposed to the risk of other environmental factors. Its marketing efforts must stay fine-tuned to suit the requirements of the market in general and the needs and wants of the customers in particular. They have to develop an exceptional market orientation in light of Intensified industrial activity Increased competition and Increased discerning capacity of customers. Need for Market Assessment: The marketing orientation outlook will drive an entrepreneur to seek answers to many questions relating to market segments, marketing inputs, product quality, price structure, technology of manufacture etc., before setting up the venture. This exercise will facilitate him/her to move ahead with greater degree of confidence and tackle the problems that may arise during the later stages, in a professional manner. Market Composition: Analysis of market demand, the competitive situation and trade practices are vital for a sound market assessment. The market is composed of a large variety of customers who differ in their likes and dislikes, options, preferences, education, employment, income and status. The location of customers also differ, some may be located nearer and others in distant places. Here are 30 Great Marketing Ideas to Increase Sales for Your Small Business: Factors that help a firm to decide the target segment which is of special interest: Resource availability Scale of operation and its Impact on profitability The identification of the customer groups aids in making an estimate of the market demand for the product chosen. Look for Competitive Situation: Once the market demand has been estimated, one has to look for the competitive situation prevailing in the market as a firm cannot just pursue its own policies without considering what the competitors are up to. The nature and extent of competition will place several constraints on the marketing policies of a firm and a thorough analysis of the same will help in pricing and also in identifying the gaps and opportunities that will be available for exploitation. Opportunity Evaluation: An intelligent and experienced entrepreneur would weigh an opportunity as follows: How large is the gap between demand and supply in the market and what is the nature of competition in the market for the product? Whether the product is covered under any of the promotional policies of the government, so that, either entry into business or competition in the market is facilitated. Whether there is any special product/service specific problem that he/she will face and can avail of any part of promotional policies, to soften the impact of these problems. Based on such product-market-policy, policy-product-market type of analysis, the entrepreneur will finally conclude if the opportunity is worth investing...

Posted by Managementguru in Business Management, Decision Making, Financial Management, Human Resource, Principles of Management, Strategy

on Mar 30th, 2014 | 0 comments

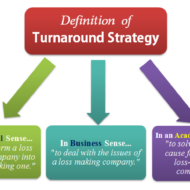

What is Turnaround Strategy Distress signals start flying around when a particular company, whether multinational, corporate or medium sized, is subjected to financial pressure and is at the brink of bankruptcy. What was happening all along? No body knows and nobody wants to be held responsible. The CEO has to bear the brunt and alas, extermination! Aim of Turn-around Strategy: The overall aim of a turn around strategy is to bring back a firm to normalcy which has been under distress in terms of acceptable levels of profitability, solvency, liquidity and cash flow. Turn around strategies should be very carefully formulated so as to stabilize the firm in distress, i.e., to bring the company out of the hole and then go for long term planning. Turn around can be in the form of operational efficiency management, financial restructuring, marketing management or savings in the form of cost reduction or liquidity in the form of asset reduction. Facebook Marketing: A Step-by-Step to Your First 1000 Fans! Turn around to see what is around: We have seen so many such occurrences at the global level and micro level. Some companies rejuvenate like a phoenix bird from the ashes, some go haywire, and some dissolve into thin air. It all depends how well you handle the situation with either the help of an external expert consultant or you might want to go for joint venture or collaboration in order to save you skin from mounting interest payments or you right royally sell the company if somebody is ready to takeover. Either way you have to do something! “Turn around to see what is around”. Don’t see what you want to see See what has to be seen Change the CEO (He is the Ideal Victim!) Resurrect your employees’ confidence Cut down costs Look for Alternatives Lie low for Sometime(till the situation favors) Slowly capture the market by innovative Campaigns and ads Paint a new picture about your company Review your Mission and Vision statements Work on targets Bang on the right target customers and clients Strengthen your Channel of Distributors Go smooth with the bankers (You need them always!) Have confidence in yourself Crisis management is necessary Stress busters like yoga and meditation mandatory Evolve Strategies One step at a time (Slow and steady) Fear and Panic grips the organization in situations of crisis. So the first step would be to stay cool to assess the situation by calmly reviewing the damage with all the concerned people. The next step would be to stop the bleeding by cutting all unwanted costs, unnecessary overheads, and the final stage would be renaissance, recovery, renewal or by whatever name you want to call it, even if it means negative investment or profit. Proper Planning, Inventory Control, Strategic prepositions, Renewal of old strategies in accordance with the situation, Tightening finance controls, Defining the credit management limits, all these are precautionary measures which will hold you from falling into the danger of handling a crisis situation, as” recovery of damaged integrity is going to cost you more than ploughing back your profits....

Posted by Managementguru in Business Management, Marketing, Organisational behaviour, Principles of Management, Strategy

on Mar 22nd, 2014 | 0 comments

PORTER’S FIVE FORCES Porter’s five forces analysis-draws upon industrial organization (IO) economics to derive five forces that determine the competitive intensity and therefore attractiveness of a market. Survival of the Fittest: True to Darwin’s theory “Survival of the fittest”, only competitive firms survive in the business market, provided, they have made the right strategic choice by comprehensively analyzing their position in the industry. Every organization is part of the industry and almost all of them face competition. Thus, industry and competition are the vital considerations for making a strategic choice. All the firms in a particular industry vie for the same set of customers by offering identical or similar products with minor variations. The analysis of the external environment in relation to the context of industry attractiveness thus becomes essential. A Critical Evaluation of Michael Porter’s Five Forces Framework Industrial Analysis: Industry analysis helps a firm to also fix long range plans, by gauging long term growth opportunities present if any. Strategic choice is nothing but, to screen all possible strategic alternatives followed by narrowing down the choice to the best suited and feasible alternatives and ultimately choosing an optimum strategy. To explain it in more clear terms, let us look at this example. Say, if there are three big players of car manufacturers in an automobile industry. Each follows their own strategic style to capture the market. What are the threat factors? Threat can be in the form of four-wheeler manufacturers like trucks and jeeps, but these cannot be competitively priced. Threat can be in the form of suppliers who dominate the industry by having a grip on the supply of components, sub-assemblies and accessories. Threat in the form of new entrants, but the growth might be restricted due to government regulations. A thorough analysis of the automobile industry thus made can make things clear to the firm, as to where they stand in terms of market share, what are their strengths and weaknesses, who pose a threat, what are the potential opportunities for growth and to tap market segments whose needs are unidentified. Still, it will be a seller’s market where the buyers have no bargaining power. On the other hand, if the weather does not favor its growth, the firm has to immediately decide on its next course of action, calling for diversification. The possible threats for a firm can come from five directions as mentioned below: Potential threat from new firms entering the market Threat from substitutes available in the market Threat from competitors Bargaining power of the suppliers Bargaining power of the buyers The structure and dynamics of an industry has to be analyzed in order to determine the intensity of competition and profitability. As the market is very dynamic, it becomes mandatory for firms to evolve strategies embracing a modern approach, with emphasis on reappraisal of existing strategy in the light of changing external conditions and formulation of alternative...