Posted by Managementguru in Business Management, Financial Accounting

on Apr 25th, 2015 | 0 comments

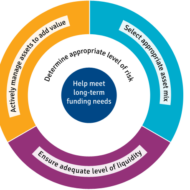

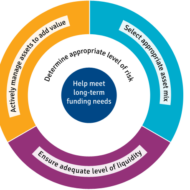

What is Long Term Financing? It is a form of financing that is provided for a period of more than a year to those business entities that face a shortage of capital. Before delving into the advantages of long term financing I would like to present you few fascinating facts on the economy that will blow your mind. Dell “has spent more money on share repurchases than it earned throughout its life as a public company,” writes Floyd Norris of The New York Times.According to Forbes, if a Google employee passes away, “their surviving spouse or domestic partner will receive a check for 50% of their salary every year for the next decade.”Start with a dollar. Double it every day. In 48 days you’ll own every financial asset that exists on the planet — about $200 trillion. Wow…According to Bloomberg, “Americans have missed out on almost $200 billion of stock gains as they drained money from the market in the past four years, haunted by the financial crisis.The “stock market” began in May 17th, 1792 when 24 stock brokers and merchants signed the Buttonwood Agreement.The Securities Exchange Act of 1934 creates the Securities and Exchange Commission, charged with the responsibility of preventing fraud and to require companies provide full disclosure to investors.Wall Street was laid out behind a 12-foot-high wood stockade across lower Manhattan in 1685. The stockade was built to protect the Dutch settlers from British and Native American attacks. Sources of Long Term Finance Long-term loans (External)Issue of shares or equitySale and leaseback (Internal)Retained profit Examples of long-term financing include – a 30 year mortgage or a 10-year Treasury note. Financial Markets and Securities Purpose of Long Term Finance To finance fixed assets.To finance the permanent part of working capital.Expansion of companies.Increasing facilities.Construction projects on a big scale.Provide capital for funding the operations. Factors determining Long-term Financial Requirements Nature of BusinessNature of Goods producedTechnology used Long term finance for businesses A Clear Perspective on Break Even Analysis Let us look at some of the Advantages of going for a Debt Financing Option Debt is the cheapest source of long-term financing. It is the least costly because interest on debt is tax-deductible, bondholders or creditors consider debt as a relatively less risky investment and require lower return.Debt financing provides sufficient flexibility in the financial/capital structure of the company. In case of over capitalization, the company can redeem the debt to balance its capitalization.Bondholders are creditors and have no interference in business operations because they are not entitled to vote.The company can enjoy tax saving on interest on debt. Disadvantages of Long Term Debt Financing Interest on debt is permanent burden to the company: Company has to pay the interest to bondholders or creditors at fixed rate whether it earns profit or not. It is legally liable to pay interest on debt.Debt usually has a fixed maturity date. Therefore, the financial officer must make provision for repayment of debt.Debt is the most risky source of long-term financing. Company must pay interest and principal at specified time. Non-payment of interest and principal on time take the company into bankruptcy.Debenture indentures may contain restrictive covenants which may limit the company’s operating flexibility in future.Only large scale, creditworthy firm, whose assets are good for collateral can raise capital from long-term debt. Financing through Debt Vs Equity There are a number of ways to finance a business using debt or equity. Though the first choice of many small-business owners would be equity, they may also prefer to utilize some type of debt to fund the business rather than take on additional investors. When done the right way, long-term debt financing provides a number of advantages to the business and its owner. Term Loans from Banks Most banks provide term loans,...

Posted by Managementguru in Business Management, Financial Management, Principles of Management, Project Management

on Feb 28th, 2014 | 0 comments

What is Business Risk? It is a term that explains the difference between the expectation of return on investment and actual realization. In CAPITAL BUDGETING, several alternatives of investments are examined before taking an investment decision and only then the Managing Director of the firm along with financial executives gear up for investing in a project that is sound and feasible. Even then the project may not become viable owing to the fluctuations in the economic environment. Money Manipulation So, the million dollar question arises, whether to invest and if invested, will it fetch me profit? See, you cannot have the cake and eat it too. Risk factor prevails in all kinds of environment and we try to over react in a business arena since it involves huge investments. But remember, MONEY WILL MULTIPLY IF YOU MANIPULATE IT WITH CARE. Business firms commit large sums of money each year for capital expenditure. It is therefore essential that a careful FINANCIAL APPRAISAL of each and every project which involves large investments is carried out before acceptance or execution of the project. These capital budgeting decisions generally fall under the consideration of highest level of management. Factors of risk to be considered before investing: Time value of money Pay back period Rate of return on investment(ROI) Uncertainties in the market Cost of debt Cost of equity Cost of retained earnings Factors to be monitored after investing: Maximising profit after taxes Maximizing earnings per share Maintaining the share prices Issue of dividends Ensuring management control Financial structuring Cost of capital refers to the opportunity cost of the funds to the firm I. e., the return on investment to the firm had it invested these funds elsewhere. Servicing the debt and Danger of Insolvency While making the decisions regarding investment and financing, the Finance Manager seeks to achieve the right balance between risk and return. If the firm borrows heavily to finance its operations, then the surplus generated out of operations should be sufficient to “SERVICE THE DEBT” in the form of interest and principal payments. The surplus would be greatly reduced to the owners as there would be heavy Debt Servicing. If things do not work out as planned, the situation becomes worse, as the firm will not be in a position to meet its obligations and is even exposed to the “DANGER OF INSOLVENCY“. Working Capital Management Considering all these factors, we have to come to the conclusion that FINANCIAL MANAGEMENT is like the BACKBONE of a business firm and WORKING CAPITAL MANAGEMENT will be the blood flow infused into the body. Risks are inherent in a business environment whose management is quite possible with the right kind of farsightedness and planning. Luck does not favor anybody who is poor in planning and lack hard...