Posted by Managementguru in Economics, Financial Accounting, Financial Management

on Dec 14th, 2016 | 0 comments

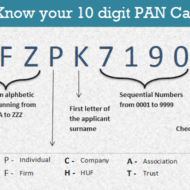

Income Tax and PAN Card Info What is meant by Income Tax? A percentage of income earned by an individual or a company (complying to Indian laws) is paid in the form of tax to the government. This is called Income Tax. This comes under Income Tax Act constituted by Parliament of India. Department of income tax operates under Department of Revenue, Ministry of Finance, Government of India. This is responsible for checking and collecting tax. Where should I pay Income Tax? Income tax should be paid to the I.T deparment. This is called income tax filing which is done at the end of July every year. What is the period for which a person’s income is taken into account for purpose of Income Tax? The income earned from April 1st to March 31st is considered for calculating income tax. This period is called a financial year. For example April 1, 2015 to March 31, 2016 is a financial year. This is also called previous year. What is an assessment year? The 12 month period that comes after the previous year is called an assessment year. This is the period to file income tax return for the previous year. For example, for the financial year 2015-16, the assessment year is 2016-17. During this period, a person files his return for the income earned in the previous year. How to file income-tax returns online What is PAN Number or Permanent Acount Number? PAN is a ten digit number issued by the Income Tax deparment. It also serves as a valid identity proof for an Indian citizen. PAN number is demanded at many places now-a-days. When you file income tax returns When you open a bank account or Demat account It is useful in applying telephone connection and credit card When you want to register for service tax and sales tax When you buy or sell a vehicle When you deposit or withdraw money to the tune of Rs.50,000 in the bank or post office, PAN is a must If you want to invest in mutual funds If you are buying a property worth more than 5 Lakhs When you exchange large volume of foreign currency (over and above Rs.25,000), you need to submit your PAN CARD. Even when you buy GOLD , giving your PAN number has become mandatory after the DEMONETIZATION EFFORTS taken by the government recently on November 8, 2016. PAN card Dont’s… Same person having more than one PAN card is an offence. You have to submit any one card to the income tax department and update your info. You can be charged a fine of upto Rs.10,000 if you are found to have more than one PAN card. If somebody puts the PAN card to mis-use he might be fined and subject to imprisonment too. You can view your PAN card details in their website. If you apply for PAN card through private agents, kindly check whether your details are updated in the government website. Issue of PAN card PAN card issuing has been made very simple. You will be asked to fill up FORM 49-A and attach your address proof (Aadhar card or Ration card). The form can be downloaded from the following addresses online: www.tin-nsdl.com http://www.incometaxindia.gov.in/Pages/form-pan.aspx Also you get these forms issued by the IT PAN and TIN service centres. Having a PAN card doesn’t mean that you have to pay Income Tax. It is to facilitate people to pay Income Tax when their income levels warrants for paying tax. A Complete Tutorial on Financial Markets and...

Posted by Managementguru in Accounting, Financial Accounting, Financial Management, Management Accounting, Project Management, Training & Development

on Jan 21st, 2015 | 0 comments

What Does a Career in Accounting Demands for? Are you vying for a career in accounting field? Everybody envy accountants for there is a misconception that they are Demi-Gods. Though a good accounts manager can act like one who can save you from a dire situation by manipulating the accounts skilfully, the demands and challenges in this field are too high to be savored. Purchase Your Copy of “Careers with a Degree in Accountancy and Finance” at Gumroad So what does it take to become a reputed accounts man in your circle and also enjoy what you do! Self analysis is the best way to understand what you really want to be. There are certain traits characteristic to people belonging to this community. See if you are gifted with those attributes; if not, you can always train yourself to gain expertise. 1. Are you good at numbers– Mathematics, Yuck! If this is your reaction please quit reading this article as numbers play an integral role in accountancy. Figures, Figures and more Figures determine the profit and loss status of a company. If you are passionate about playing with numbers it goes without saying you are already a half accountant. The thrill of taking control and handling numbers make or break a company. Jackie Mansion jocularly puts it – “Did you ever hear of a kid playing accountant – even if they wanted to be one?” 2. Are you a good listener and can you read between the lines? A good auditor will allow the client to talk and listen to what he says. Then he tries to extract the exact kind of information he needs to make the ends meet. Empathy is an innate quality and if you are not going to be a good listener then please revise your consideration of becoming an accountant. Sometimes the client may not know what you wish to seek; it is your responsibility to frame simple questions in a language that he understands and pull out answers. 3. Can you avoid being temperamental? 90% of the time your clients are going to say “No” to whatever you suggest. Alas, it is not their fault; the corporate Bosses and CEO’s always aim big and most probably will not be aware of the consequences of their impulsive actions. They always think about clinching a deal and conveniently overlook the effects of their financial and corporate decisions on the account and subsequently on the accountant. For example cash has to be handled very carefully and every penny has to be accounted for properly. A bank cashier will know the importance of cash handling as it is very important for them to balance the inflow and outflow at the end of the day. For corporate firms, it becomes mandatory to reduce the cash dealings and account every transaction in the form of a check or electronic transfers like RTGS or NEFT or EFT. The point is, you should have the nerve to talk to a company’s head if he is planning for a bad move and suggest what could be done for the good of the company (Income tax and Sales purposes). 4. Are you wise when it comes to choosing clients? Whether you are a part time practitioner, Full time accountant, Accounts manager or Free lancer, do your homework before accepting the offer. Ultimately you need to see your payments coming through and nobody works here for a song. Big practitioners take a big cut half yearly or annually but if you are a part time accountant, it is always better to go for monthly payments or get paid after the completion of individual project s....