Posted by Managementguru in Business Ethics, CSR, Marketing, Strategy

on Jan 9th, 2015 | 0 comments

Strategic Change-Beyond the Boxes The major focus of corporate strategy is to formulate a method by which any business can adapt to a changing environment enabling to improve its competitive advantage. The corporate strategy theory presents us with the following questions: Where are we now? Where do we want to be? How do we get there? Corporate Self-Analysis The logic is to examine the current status of the business. Areas that come under this self-analysis purview include: Is the business aware of who its stake-holders are? If you are not going to engage your customers or users, then your business becomes product-centric and not cutomer-centric. What are the long-term objectives of your concern? Without a definitive vision how will you ever design and achieve your short-term goals! Does your company have a mission statement? See the mission statement of Mc.Donalds – McDonald’s brand mission is to be our customers’ favorite place and way to eat and drink. Our worldwide operations are aligned around a global strategy called the Plan to Win, which center on an exceptional customer experience – People, Products, Place, Price and Promotion. What are your present business strategies? If your company’s presence is not felt in the market (forget being a market leader always, though that would be the dream spot of all big corporate companies), or your product is not selling by itself, then there has some serious thinking to be done about your present strategies. Focus on what went wrong, try to get inspired by your competitors’ moves (Ha! Its not copying my friend! ), gear up your advertising department to reach the audience. Also try to find out if there are any black sheep in your stay leaking confidential statistics and strategic business moves. Are they simple to understand and communicate to the workforce? If you are not able to pitch your idea to your workforce in a matter of just 15 minutes, then it is very well clear that you are not clear about what you’ve conceptualized. What is the marketplace scenario? Is it in the growth/decline phase? Sometimes it is better to start a business at bad times. Hiring will be easy, cost will be under control and you can experiment boldly because you have nothing to lose. Who might be your biggest competitors? This takes serious effort and planning and ask your core team to do their home-work properly. “Understand that a competitor is created because you are weak”. Review your business internally, look at your business-does it support growth and adaptability to change? This depends upon the leader who serves as the biggest inspiration for people down the line. The culture he has developed plays a big role in deciding this aspect wherein flexibility and employee engagement are part and parcel of it. How effective are your production processes? How well do sales/personnel/marketing/finance sections perform? How well does the business control its internal resources? This is a separate entity and the most crucial element of an enterprise. Expansion in accordance with the demand on one side and keeping up with the technology advance on the other side and what about the third side – the “WORKFORCE” in caps! Tending to the employee morale is the biggest challenge of modern times. HR MANAGERS have to have up-to-date knowledge on the labor laws and government policies on the security aspects of employees. A small case study on the Fast Food Giant McDonalds: U.S. CMO Deborah Wahl, who joined the fast food giant McDonalds company in early 2014, said in a video about the brand refresh that the company will move from a philosophy of “billions served” —...

Posted by Managementguru in Financial Management

on Jan 2nd, 2015 | 0 comments

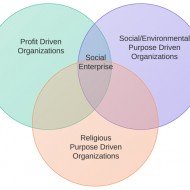

OBJECTIVES OF FINANCIAL #management Before looking into the two main objectives of finance management, let us look at the lighter side of money. Some hilarious quotes that will make your day: “Money is like a sixth sense – and you can’t make use of the other five without it.” – William Somerset Maugham “The safest way to double your money is to fold it over and put it in your pocket.” – Kin Hubbard “Money is the best deodorant.” – Elizabeth Taylor “If you think nobody cares if you’re alive, try missing a couple of car payments.” – Earl Wilson “Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.“ ~Sam Ewing “Too many people spend money they haven’t earned, to buy things they don’t want, to impress people they don’t like.” – Will Smith “There’s a way of transferring funds that is even faster than electronic banking. It’s called marriage.” — James Holt McGavran Objectives of Financial Management may be broadly divided into two parts such as: 1. #Profit maximization 2. #Wealth maximization. Profit Maximization The main purpose of any kind of economic activity is earning profit. A business concern operates mainly for the purpose of making profit. Profit has become the yardstick to measure the business efficiency of a concern. Profit maximization is also the out-moded and narrow approach, which aims at, maximizing the profit of the concern. Profit maximization consists of the following important features. Favorable Arguments for Profit Maximization: The following important points are in support of the profit maximization objectives of the business concern: Main aim is earning profit. Profit is the parameter of the business operation. Profit reduces risk of the business concern. Profit is the main source of finance. ##profitability meets the #social needs also. Unfavorable Arguments for Profit Maximization: The following important points are against the objectives of profit maximization: Profit maximization leads to exploiting workers and consumers. Profit maximization may lead to unethical practices, unfair trade practice, etc. Profit maximization objectives leads to inequalities among the #stake holders such as #customers, #suppliers, #public #shareholders, etc. Drawbacks of Profit Maximization: Profit maximization objective consists of certain drawbacks also: It is vague: Profit is not defined precisely or correctly. It ignores the #time value of money: Profit maximization does not consider the time value of money or the net present value of the cash inflow. It leads to certain differences between the actual cash inflow and net present cash flow during a particular period. It ignores risk: Profit maximization does not consider risk of the business concern. Risks may be internal or external which will affect the overall operation of the business concern. Wealth Maximization Wealth maximization is one of the modern approaches, which involves latest innovations and improvements in the field of the business concern. The term wealth means shareholder wealth or the wealth of the persons those who are involved in the business concern. Wealth maximization is also known as value maximization or net present worth maximization. This objective is a universally accepted concept in the field of business. Favorable Arguments for Wealth Maximization: Wealth maximization is superior to the profit maximization because the main aim of the business concern under this concept is to improve the value or wealth of the shareholders. Wealth maximization considers the comparison of the value to cost associated with the business concern. Total value detected from the total cost incurred for the business operation. It provides exact value of the business concern. Wealth maximization considers both time and risk of the business concern. Wealth maximization provides efficient distribution of resources. It ensures...