Posted by Managementguru in Operations Management, Project Management, Supply Chain Management, Technology

on Mar 27th, 2024 | 0 comments

In the current business environment, an efficient supply chain management process can be a key differentiator. Streamlining your supply chain reduces costs and enhances customer satisfaction and overall business performance. Here are some strategies to improve your supply chain management process. Embrace Technology Incorporating cutting-edge technologies like AI, IoT, and blockchain can revolutionize your supply chain. These technologies can enhance visibility, optimize inventory management, and automate processes, leading to improved efficiency and reduced costs. Leveraging technology allows businesses to adapt quickly to changing market conditions and customer demands. Enhance Collaboration Collaboration with suppliers, manufacturers, and distributors is essential for a smooth supply chain. Implementing collaborative tools and fostering strong relationships can lead to better coordination, faster problem resolution, and increased agility. Strong collaboration ensures that all parties are aligned with the overall supply chain goals, improving overall performance. Integrating Efficient Logistics Efficient logistics management is crucial for a streamlined supply chain. For example, platforms like Shiply connect shipping companies with clients, offering cost-effective and efficient shipping solutions. By leveraging Shiply and other advanced logistics technologies, such as transportation management systems (TMS) and warehouse management systems (WMS), businesses can optimize their logistics operations.Efficient transportation management leads to lower shipping costs and improved delivery times, while effective warehouse management minimizes inventory holding costs and ensures timely order fulfillment. Integrating logistics with other supply chain functions improves coordination and visibility, enhancing overall performance and customer satisfaction. Efficient logistics management also allows businesses to scale their operations as well as enter new markets more easily. Focus on Data Analytics Data analytics can offer valuable insights into the performance of your supply chain. By analyzing data, you can identify inefficiencies, forecast demand more accurately, and make informed decisions to optimize your supply chain operations. Data-driven decision-making helps businesses stay competitive and agile in the market. Implement Lean Principles Implementing lean principles, like just-in-time inventory management and continuous improvement, can eliminate waste and enhance efficiency. Lean practices can streamline processes, reduce lead times, and enhance overall productivity. Continuous improvement ensures that the supply chain is constantly evolving so that it can meet the changing needs of the business and customers.Implementing just-in-time inventory management reduces excess inventory, minimizing storage costs and the risk of obsolescence. Streamlining processes reduces waste and enhances flexibility, enabling the supply chain to quickly adapt to market changes. Continuous improvement nurtures a culture of innovation and efficiency, leading to ongoing enhancements in the supply chain’s performance. Prioritize Sustainability Adopting sustainable practices not only benefits the environment but also leads to cost savings and enhances brand reputation. Incorporating sustainable sourcing, packaging, and transportation methods can reduce carbon footprint and enhance supply chain resilience. Prioritizing sustainability ensures that the supply chain is resilient to external shocks and contributes positively to the environment. Businesses can achieve cost savings through reduced waste, energy efficiency, and lower resource consumption. Moreover, consumers increasingly prefer environmentally conscious brands, leading to enhanced brand reputation and customer loyalty. Embracing sustainability also future-proofs the supply chain, ensuring its viability in the face of changing regulations and market demands. Incorporating sustainable practices aligns with corporate social responsibility (CSR) goals, showcasing a dedication to environmental stewardship and social...

Posted by Managementguru in Business Management, Marketing, Operations Management, Project Management, Sales

on Feb 3rd, 2015 | 0 comments

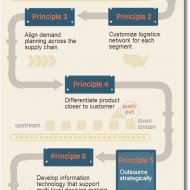

What is Supply Chain Management? Investopedia: Supply chain management (SCM) is the streamlining of a business’ supply-side activities to maximize customer value and to gain a competitive advantage in the marketplace. SCM represents an effort by suppliers to develop and implement supply chains that are as efficient and economical as possible. Wikipedia: Supply chain management (SCM) is “the systemic, strategic coordination of the traditional business functions and the tactics across these business functions within a particular company and across businesses within the supply chain, for the purposes of improving the long-term performance of the individual companies and the supply chain as a whole.” Business Dictionary: Management of material and information flow in a supply chain to provide the highest degree of customer satisfaction at the lowest possible cost. SCM requires the commitment of supply chain partners to work closely to coordinate order generation, order taking, and order fulfillment. They thereby create an extended enterprise spreading far beyond the producer’s location. 7 Principles of SCM Supply Chain Management in Simpler Terms: The EFFECTIVE movement and management of materials and information as they flow from their source to the end customer. Supply Chain encompasses purchasing, manufacturing, warehousing, transportation, customer service, demand planning and supply planning. SCM is a daunting task and calls for proper planning and execution. OBJECTIVES OF FORECASTING SCM is the control of the supply chain as a process from supplier to manufacturer to wholesaler to retailer to consumer. SCM does not only comprise the passage of a physical product through the chain but also any data that goes along with the product (such as order status information, payment schedules, and ownership titles) and the actual entities that handle the product from stage to stage of the supply chain. There are essentially three goals of SCM: To reduce inventoryTo increase the speed of transactions with real-time data exchange andTo increase revenue by satisfying customer demands more efficiently. When you think of the world’s most efficient and successful performance and supply chains, what comes to mind? For me it is not Wal-mart or Pepsi but Mumbai Dabbawalas – Watch this Video. The Success of Supply Chain of Dabbawalas in Mumbai –Said to be Six Sigma Compliant No over-reliance on technology, all manual operationsCreate an integrated performance chain, the chief, team leaders and delivery men.Acute visibilityKeep it simple. Real simple with a color coding to identify where the food has to be delivered and to whom.Timely Delivery as the shelf life of food is 4-5 hours. Why is it so important for companies to get products to their customers quickly? Faster product availability is significant to increasing sales and there’s a sizeable profit advantage for the extra time that you are in the market and your competitor is not. The earlier and faster you are in the market, the more orders and market share you enjoy. The ability to deliver a product faster also can make or break a sale. If two competitive products appear to be equal and one is immediately available and the other will be available in a week, which would you choose? Supply Chain Management is all about moving goods more quickly to their destination in a strategic and tactical manner. Supply Chain Management Tomorrow: The future for Supply Chain Management looks very bright. Two major trends are benefiting Supply Chain Management operations- Customer service focus and Information technology. Successful organisations must excel in both of these areas, the fundamental objective being to “ADD...

Posted by Managementguru in Financial Management

on Jan 2nd, 2015 | 0 comments

OBJECTIVES OF FINANCIAL #management Before looking into the two main objectives of finance management, let us look at the lighter side of money. Some hilarious quotes that will make your day: “Money is like a sixth sense – and you can’t make use of the other five without it.” – William Somerset Maugham “The safest way to double your money is to fold it over and put it in your pocket.” – Kin Hubbard “Money is the best deodorant.” – Elizabeth Taylor “If you think nobody cares if you’re alive, try missing a couple of car payments.” – Earl Wilson “Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.“ ~Sam Ewing “Too many people spend money they haven’t earned, to buy things they don’t want, to impress people they don’t like.” – Will Smith “There’s a way of transferring funds that is even faster than electronic banking. It’s called marriage.” — James Holt McGavran Objectives of Financial Management may be broadly divided into two parts such as: 1. #Profit maximization 2. #Wealth maximization. Profit Maximization The main purpose of any kind of economic activity is earning profit. A business concern operates mainly for the purpose of making profit. Profit has become the yardstick to measure the business efficiency of a concern. Profit maximization is also the out-moded and narrow approach, which aims at, maximizing the profit of the concern. Profit maximization consists of the following important features. Favorable Arguments for Profit Maximization: The following important points are in support of the profit maximization objectives of the business concern: Main aim is earning profit. Profit is the parameter of the business operation. Profit reduces risk of the business concern. Profit is the main source of finance. ##profitability meets the #social needs also. Unfavorable Arguments for Profit Maximization: The following important points are against the objectives of profit maximization: Profit maximization leads to exploiting workers and consumers. Profit maximization may lead to unethical practices, unfair trade practice, etc. Profit maximization objectives leads to inequalities among the #stake holders such as #customers, #suppliers, #public #shareholders, etc. Drawbacks of Profit Maximization: Profit maximization objective consists of certain drawbacks also: It is vague: Profit is not defined precisely or correctly. It ignores the #time value of money: Profit maximization does not consider the time value of money or the net present value of the cash inflow. It leads to certain differences between the actual cash inflow and net present cash flow during a particular period. It ignores risk: Profit maximization does not consider risk of the business concern. Risks may be internal or external which will affect the overall operation of the business concern. Wealth Maximization Wealth maximization is one of the modern approaches, which involves latest innovations and improvements in the field of the business concern. The term wealth means shareholder wealth or the wealth of the persons those who are involved in the business concern. Wealth maximization is also known as value maximization or net present worth maximization. This objective is a universally accepted concept in the field of business. Favorable Arguments for Wealth Maximization: Wealth maximization is superior to the profit maximization because the main aim of the business concern under this concept is to improve the value or wealth of the shareholders. Wealth maximization considers the comparison of the value to cost associated with the business concern. Total value detected from the total cost incurred for the business operation. It provides exact value of the business concern. Wealth maximization considers both time and risk of the business concern. Wealth maximization provides efficient distribution of resources. It ensures...

Posted by Managementguru in Business Management, Financial Accounting, Financial Management, Principles of Management

on Apr 8th, 2014 | 0 comments

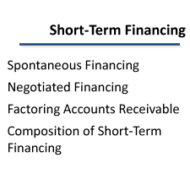

Interest Free Sources and Unsecured Interest Bearing Sources A firm obtains its funds from a variety of sources. Some capital is provided by suppliers, creditors, and owners, while other funds arise from earnings retained in business. In this segment, let me explain to you the sources of short-term funds supplied by creditors. Characteristics of short-term financing: Cost of Funds: Some forms of short-term financing may prove to be expensive than that of intermediate and long-term financing while some short-term sources like Accruals and Payables provide funds at no cost to the firm. Rollover Effect: Short-term finance as the name indicates must be repaid within a period of one year – though some sources provide funds that are constantly rolled over. The funds provided by payables, may remain relatively constant because, as some accounts are paid, other accounts are created. Clean-up: This happens when commercial banks or other lenders demand the firm to pay-off its short term obligation at one point in a financial year. Goals of Short-Term Financing: Funds are needed to finance inventories during a production period. Short term funds facilitate flexibility wherein, it meets the fluctuating needs for funds over a given cycle, commonly 1 year. To achieve low-cost financing due to interest free loans. Cash flow from operations may not be sufficient to keep up with growth-related financing needs Interest Free Sources: Accounts Payable Accounts payable are created when the firm purchases raw material, supplies, or goods for resale on credit terms without signing a formal note for the liability. These purchases on “open account” are, for most firms, the single largest source of short-term financing. Payables represent an unsecured form of financing since no specific assets are pledged as collateral for the liability. Even though no formal note is signed, an accounts payable is a legally binding obligation of a firm. Postponing payment beyond the end of the net (credit) period is known as “stretching accounts payable” or “leaning on the trade.” Possible costs of “stretching accounts payable” are Cost of the cash discount (if any) forgone Late payment penalties or interest Deterioration in credit rating Accruals: These are short term liabilities that arise when services are received but payment has not yet been made. The two primary accruals are wages payable and taxes payable. Employees work for a week, 2 weeks or a month before receiving a paycheck. The salaries or wages, plus the taxes paid by the firm on those wages, offer a form of unsecured short-term financing for the firm. The Government provides strict rules and procedures for the payment of withholding and social security taxes, so that the accrual of taxes cannot be readily manipulated. It is however, possible to change the frequency of paydays to increase or decrease the amount of financing through wages accrual. Wages — Benefits accrue via no direct cash costs, but costs can develop by reduced employee morale and efficiency. Taxes — Benefits accrue until the due date, but costs of penalties and interest beyond the due date reduce the benefits. Unsecured Interest Bearing Sources: Self-Liquidating Bank Loans The bank provides funds for a seasonal or cyclic business peak and the money is used to finance an activity that will generate cash to pay off the loan. Borrowed Funds → Finance Inventory → Peak Sales Season → Receivables → Cash → Pay Off the Loan. Three types of unsecured short-term bank loans: Single payment note – A short-term, one-time loan made to a borrower who needs funds for a specific purpose for a short period of time. Line of Credit – An informal arrangement between a bank and its customer specifying the maximum amount of...

Posted by Managementguru in Business Management, Marketing, Organisational behaviour, Principles of Management, Strategy

on Mar 22nd, 2014 | 0 comments

PORTER’S FIVE FORCES Porter’s five forces analysis-draws upon industrial organization (IO) economics to derive five forces that determine the competitive intensity and therefore attractiveness of a market. Survival of the Fittest: True to Darwin’s theory “Survival of the fittest”, only competitive firms survive in the business market, provided, they have made the right strategic choice by comprehensively analyzing their position in the industry. Every organization is part of the industry and almost all of them face competition. Thus, industry and competition are the vital considerations for making a strategic choice. All the firms in a particular industry vie for the same set of customers by offering identical or similar products with minor variations. The analysis of the external environment in relation to the context of industry attractiveness thus becomes essential. A Critical Evaluation of Michael Porter’s Five Forces Framework Industrial Analysis: Industry analysis helps a firm to also fix long range plans, by gauging long term growth opportunities present if any. Strategic choice is nothing but, to screen all possible strategic alternatives followed by narrowing down the choice to the best suited and feasible alternatives and ultimately choosing an optimum strategy. To explain it in more clear terms, let us look at this example. Say, if there are three big players of car manufacturers in an automobile industry. Each follows their own strategic style to capture the market. What are the threat factors? Threat can be in the form of four-wheeler manufacturers like trucks and jeeps, but these cannot be competitively priced. Threat can be in the form of suppliers who dominate the industry by having a grip on the supply of components, sub-assemblies and accessories. Threat in the form of new entrants, but the growth might be restricted due to government regulations. A thorough analysis of the automobile industry thus made can make things clear to the firm, as to where they stand in terms of market share, what are their strengths and weaknesses, who pose a threat, what are the potential opportunities for growth and to tap market segments whose needs are unidentified. Still, it will be a seller’s market where the buyers have no bargaining power. On the other hand, if the weather does not favor its growth, the firm has to immediately decide on its next course of action, calling for diversification. The possible threats for a firm can come from five directions as mentioned below: Potential threat from new firms entering the market Threat from substitutes available in the market Threat from competitors Bargaining power of the suppliers Bargaining power of the buyers The structure and dynamics of an industry has to be analyzed in order to determine the intensity of competition and profitability. As the market is very dynamic, it becomes mandatory for firms to evolve strategies embracing a modern approach, with emphasis on reappraisal of existing strategy in the light of changing external conditions and formulation of alternative...