Posted by Managementguru in Financial Management

on Jan 2nd, 2015 | 0 comments

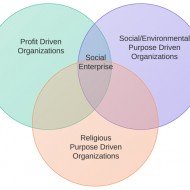

OBJECTIVES OF FINANCIAL #management Before looking into the two main objectives of finance management, let us look at the lighter side of money. Some hilarious quotes that will make your day: “Money is like a sixth sense – and you can’t make use of the other five without it.” – William Somerset Maugham “The safest way to double your money is to fold it over and put it in your pocket.” – Kin Hubbard “Money is the best deodorant.” – Elizabeth Taylor “If you think nobody cares if you’re alive, try missing a couple of car payments.” – Earl Wilson “Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.“ ~Sam Ewing “Too many people spend money they haven’t earned, to buy things they don’t want, to impress people they don’t like.” – Will Smith “There’s a way of transferring funds that is even faster than electronic banking. It’s called marriage.” — James Holt McGavran Objectives of Financial Management may be broadly divided into two parts such as: 1. #Profit maximization 2. #Wealth maximization. Profit Maximization The main purpose of any kind of economic activity is earning profit. A business concern operates mainly for the purpose of making profit. Profit has become the yardstick to measure the business efficiency of a concern. Profit maximization is also the out-moded and narrow approach, which aims at, maximizing the profit of the concern. Profit maximization consists of the following important features. Favorable Arguments for Profit Maximization: The following important points are in support of the profit maximization objectives of the business concern: Main aim is earning profit. Profit is the parameter of the business operation. Profit reduces risk of the business concern. Profit is the main source of finance. ##profitability meets the #social needs also. Unfavorable Arguments for Profit Maximization: The following important points are against the objectives of profit maximization: Profit maximization leads to exploiting workers and consumers. Profit maximization may lead to unethical practices, unfair trade practice, etc. Profit maximization objectives leads to inequalities among the #stake holders such as #customers, #suppliers, #public #shareholders, etc. Drawbacks of Profit Maximization: Profit maximization objective consists of certain drawbacks also: It is vague: Profit is not defined precisely or correctly. It ignores the #time value of money: Profit maximization does not consider the time value of money or the net present value of the cash inflow. It leads to certain differences between the actual cash inflow and net present cash flow during a particular period. It ignores risk: Profit maximization does not consider risk of the business concern. Risks may be internal or external which will affect the overall operation of the business concern. Wealth Maximization Wealth maximization is one of the modern approaches, which involves latest innovations and improvements in the field of the business concern. The term wealth means shareholder wealth or the wealth of the persons those who are involved in the business concern. Wealth maximization is also known as value maximization or net present worth maximization. This objective is a universally accepted concept in the field of business. Favorable Arguments for Wealth Maximization: Wealth maximization is superior to the profit maximization because the main aim of the business concern under this concept is to improve the value or wealth of the shareholders. Wealth maximization considers the comparison of the value to cost associated with the business concern. Total value detected from the total cost incurred for the business operation. It provides exact value of the business concern. Wealth maximization considers both time and risk of the business concern. Wealth maximization provides efficient distribution of resources. It ensures...

Posted by Managementguru in Accounting, Financial Management, Management Accounting, Principles of Management

on Mar 27th, 2014 | 0 comments

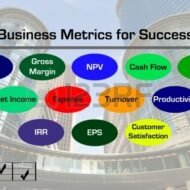

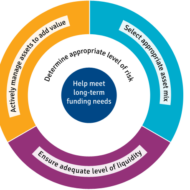

Understanding Net Present Value One method of deciding or not a firm should accept an investment project is to determine the net present value of the project. The net present value (NPV) of a project is equal to the present value of the expected stream of net cash flows from the project, discounted at the firm’s cost of capital, minus the initial cost of the project. The value of the firm will increase if the NPV of the project is positive and decline if the NPV is negative. Thus, the firm should undertake the project if the net present value is positive and reject proposals whose values are negative. This method is considered the best, as it takes into account, the initial investment, and cost of capital and cash inflow over a period. Estimation of Future Cash Flow: One of the most important and difficult aspects of capital budgeting is the estimation of the net cash flow from the project. It is the difference between cash receipts and cash payments over the life of a project. Projected cash flow statement is an important criterion for banks to decide on sanctioning medium and long-term loans to prospective clients. Since cash receipts and expenditures occur in the future, a great deal of uncertainty is involved in their estimation. Some general guidelines are to be followed while estimating cash flows. First; cash flows should be measured on an incremental basis. That is, measurement of the firm’s cash flows with and without the project must be ascertained. Any increase in expenditure or reduction in the receipts of other divisions of the firm resulting from the adoption of a given project must be considered. Effect of Depreciation: Second thing is that, net cash inflow must be estimated on an after-tax basis, using the firm’s marginal tax rate.Third, as a non-cash expense, depreciation affects the firm’s cash flow only through its effect on taxes. The initial investment to add a new product line may include the cost of purchasing and installing new equipment, reorganizing the firm’s production process, providing additional working capital for inventory and accounts receivable and so on. The monetary flows generated by this kind of investment include, the incremental sales revenue form the project, salvage value of the equipment at the end of its economic life, if any and recovery of working capital at the end of the project. The outflow will be in the form of taxes, fixed costs and incremental variable costs. Internal Rate of Return or IRR: Another method of determining the acceptance rate of a project proposal is internal rate of return method (IRR).This is nothing but the discount rate that equates the present value of the net cash flow from the project to the initial cost of the project. The firm should undertake a project if the IRR on the project exceeds or is equal to the marginal cost of capital. Capital Rationing and Pay Back Period: More techniques are available for evaluating the feasibility of investment proposals, like, capital rationing, profitability index, pay back period and others. It is always a good thing to analyze the rate of return on investment before the start of the project. If it happens to be satisfactory, then the firm can take a step forward to finalize the proposal. The cost of capital climbs up when the investment return declines, and the firm is subjected to undue pressures of mounting interest rates and capital depletions....

Posted by Managementguru in Business Management, Financial Management, Principles of Management, Project Management

on Feb 28th, 2014 | 0 comments

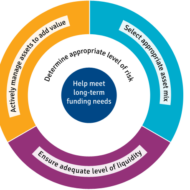

What is Business Risk? It is a term that explains the difference between the expectation of return on investment and actual realization. In CAPITAL BUDGETING, several alternatives of investments are examined before taking an investment decision and only then the Managing Director of the firm along with financial executives gear up for investing in a project that is sound and feasible. Even then the project may not become viable owing to the fluctuations in the economic environment. Money Manipulation So, the million dollar question arises, whether to invest and if invested, will it fetch me profit? See, you cannot have the cake and eat it too. Risk factor prevails in all kinds of environment and we try to over react in a business arena since it involves huge investments. But remember, MONEY WILL MULTIPLY IF YOU MANIPULATE IT WITH CARE. Business firms commit large sums of money each year for capital expenditure. It is therefore essential that a careful FINANCIAL APPRAISAL of each and every project which involves large investments is carried out before acceptance or execution of the project. These capital budgeting decisions generally fall under the consideration of highest level of management. Factors of risk to be considered before investing: Time value of money Pay back period Rate of return on investment(ROI) Uncertainties in the market Cost of debt Cost of equity Cost of retained earnings Factors to be monitored after investing: Maximising profit after taxes Maximizing earnings per share Maintaining the share prices Issue of dividends Ensuring management control Financial structuring Cost of capital refers to the opportunity cost of the funds to the firm I. e., the return on investment to the firm had it invested these funds elsewhere. Servicing the debt and Danger of Insolvency While making the decisions regarding investment and financing, the Finance Manager seeks to achieve the right balance between risk and return. If the firm borrows heavily to finance its operations, then the surplus generated out of operations should be sufficient to “SERVICE THE DEBT” in the form of interest and principal payments. The surplus would be greatly reduced to the owners as there would be heavy Debt Servicing. If things do not work out as planned, the situation becomes worse, as the firm will not be in a position to meet its obligations and is even exposed to the “DANGER OF INSOLVENCY“. Working Capital Management Considering all these factors, we have to come to the conclusion that FINANCIAL MANAGEMENT is like the BACKBONE of a business firm and WORKING CAPITAL MANAGEMENT will be the blood flow infused into the body. Risks are inherent in a business environment whose management is quite possible with the right kind of farsightedness and planning. Luck does not favor anybody who is poor in planning and lack hard...