Posted by Managementguru in Financial Management

on Jan 2nd, 2015 | 0 comments

OBJECTIVES OF FINANCIAL #management Before looking into the two main objectives of finance management, let us look at the lighter side of money. Some hilarious quotes that will make your day: “Money is like a sixth sense – and you can’t make use of the other five without it.” – William Somerset Maugham “The safest way to double your money is to fold it over and put it in your pocket.” – Kin Hubbard “Money is the best deodorant.” – Elizabeth Taylor “If you think nobody cares if you’re alive, try missing a couple of car payments.” – Earl Wilson “Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.“ ~Sam Ewing “Too many people spend money they haven’t earned, to buy things they don’t want, to impress people they don’t like.” – Will Smith “There’s a way of transferring funds that is even faster than electronic banking. It’s called marriage.” — James Holt McGavran Objectives of Financial Management may be broadly divided into two parts such as: 1. #Profit maximization 2. #Wealth maximization. Profit Maximization The main purpose of any kind of economic activity is earning profit. A business concern operates mainly for the purpose of making profit. Profit has become the yardstick to measure the business efficiency of a concern. Profit maximization is also the out-moded and narrow approach, which aims at, maximizing the profit of the concern. Profit maximization consists of the following important features. Favorable Arguments for Profit Maximization: The following important points are in support of the profit maximization objectives of the business concern: Main aim is earning profit. Profit is the parameter of the business operation. Profit reduces risk of the business concern. Profit is the main source of finance. ##profitability meets the #social needs also. Unfavorable Arguments for Profit Maximization: The following important points are against the objectives of profit maximization: Profit maximization leads to exploiting workers and consumers. Profit maximization may lead to unethical practices, unfair trade practice, etc. Profit maximization objectives leads to inequalities among the #stake holders such as #customers, #suppliers, #public #shareholders, etc. Drawbacks of Profit Maximization: Profit maximization objective consists of certain drawbacks also: It is vague: Profit is not defined precisely or correctly. It ignores the #time value of money: Profit maximization does not consider the time value of money or the net present value of the cash inflow. It leads to certain differences between the actual cash inflow and net present cash flow during a particular period. It ignores risk: Profit maximization does not consider risk of the business concern. Risks may be internal or external which will affect the overall operation of the business concern. Wealth Maximization Wealth maximization is one of the modern approaches, which involves latest innovations and improvements in the field of the business concern. The term wealth means shareholder wealth or the wealth of the persons those who are involved in the business concern. Wealth maximization is also known as value maximization or net present worth maximization. This objective is a universally accepted concept in the field of business. Favorable Arguments for Wealth Maximization: Wealth maximization is superior to the profit maximization because the main aim of the business concern under this concept is to improve the value or wealth of the shareholders. Wealth maximization considers the comparison of the value to cost associated with the business concern. Total value detected from the total cost incurred for the business operation. It provides exact value of the business concern. Wealth maximization considers both time and risk of the business concern. Wealth maximization provides efficient distribution of resources. It ensures...

Posted by Managementguru in Entrepreneurship, Project Management

on Mar 6th, 2014 | 0 comments

How can we define Business? Business is an important institution in the society. Be it for the supply of goods and services; Creation of employment opportunities; Offering better quality of life; Contribution to the economic growth of a country; the role of business is crucial. The subject of business is as interesting as its role in society. The more one reads about it, more interesting does business become. To be successful, you have to have your heart in your business, and your business in your heart. – Thomas Watson Sr. Entrepreneurial activities The increasing number of business schools and institutions signify the importance and the need for training the students on rudiments of business management. Developing countries encourage entrepreneurial activities and view it as a strategy to improve the GDP (Gross Domestic Product). More business activity means increased per capita income and increased standard of living. A business must make profit to succeed. Profit is income minus outgo. It is the main incentive for starting a business. Business people weigh each of their decisions in terms of making profit and avoiding loss. In a corporate environment, business has to aim for wealth maximization apart from profit maximization to increase the shareholder’s wealth in the long run. The scope of business is indeed vast. It all depends on how well you have analyzed and understood the nuances of your business activity, in order to survive and sustain in the market. Supply Chain The supply chain in a business activity involves numerous links in the form of manufacturers, supplier of raw materials to the manufacturer, dealers, logistics, intermediaries, consumers, bankers, advertising agencies, insurance agencies and so on. All these elements have to function in a coordinated manner for the benefit of the consumer. Now days, business has become customer-centric rather than product-centric. This serves both the purpose of product development in lieu of customer needs and customer satisfaction. The multitudinous activities involved in bringing raw materials to the factory and the end product from there to the market constitute business. In addition, a business activity has to comply with legal restrictions and government regulations. A business is also expected to discharge its social obligations to consumers, employees, owners and to other interest groups, which have stakes in business directly or indirectly. Planning and organization Planning and organization are two key principles in running a business enterprise as planning sets up a concrete premise on which action plans can be developed and organized activities assures definite success. Modern business is dynamic. Future business will be knowledge based and brainpower will be in greater demand. Organizations have become flat. Eight to twelve organizational layers have been reduced to two or three. Gone are the days of sheltered markets, subsidies, licenses, quotas and restrictions. Businesspersons are asked to stand on their feet, to eliminate inefficiencies, cut down costs and improve productivity. LoL! It might be said that it is the ideal of the employer to have production without employees and the ideal of the employee is to have income without work. –E. F....

Posted by Managementguru in Financial Management, Principles of Management

on Feb 28th, 2014 | 0 comments

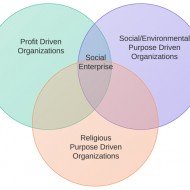

There is no Business Success Without Risk What is the Risk of Taking a Chance in a Business Activity? Business is often viewed as a game or a gamble in which success is always at risk. Think about it, risk is present in every sphere and aspect of our lives and even when you are not running a business. So why the fuss? A thorough knowledge and research of the business activity you are about to perform will give you the needed confidence to go about it. A true business man is an entrepreneur who treats risk as an opportunity rather than a challenge. Business organizations are started with a single purpose, to make profit and then more profit. Only when the organizations grow, there comes the awareness and necessity to think about stakeholders’ interest and working towards a social cause. Initial stages definitely pose threats for the very survival of the organization. Risk is an inherent part of a business as you are not sure about the outcome of your business activity. What are the Chances or Probability? We talk more about probability and chance outcomes when you deal with a particular product. Retail segment is one area where the risk of duplication is high and people have to be cautious and careful in order to protect their copyrights and symbols from being replicated. Mild inflations can benefit the market but recessions put you in doldrums especially if you are dependent on a wholesaler or a manufacturer. Risk can aspect itself in the following ways: Economically- Attrition and effects of global economy Legally- Labor laws and enactments Socially- Expectations from the public in general Government rules and regulations- Government policies and export duties Stakeholder expectations- Wealth maximization and assured profits Environmental – Need to comply with changing standards like waste affluent treatment plants Political scenario- Effects due to changing governments Risk and Uncertainty Risk and uncertainty go hand in hand and you need a risk management template or a model for your reference to solve or manage risks. The first and foremost step would be to identify the risks in your sphere of business activity. Risk documentation or creating a risk profile is an inevitable move for a new organization. This prepares the organization mentally to face challenges in a structured manner and reduces disorientation. It is very important to keep in mind the organisation’s objectives while documenting the risk profile to keep your focus unaltered. Risks evolve continuously and it is the responsibility of the top management to be in line with the market economy to manage the adverse conditions that come in the way. How to Manage Risks? Risk management is an ongoing and continuous process and it cannot be looked upon as a distinct area to be managed by a set of individuals. In a small and upcoming organization the responsibility lies on the shoulders of each and every individual to self assess, evaluate and manage risks and find the right kind of solution that will not be detrimental to the core objectives of the organization. Bigger organizations can afford to have expert opinion by commissioning PROFESSIONALS to identify, assess and manage risks. An overall and broad perspective of risk is what has been analysed here. There are numerous possibilities of risks, whether big or small in magnitude, affecting an organization. A thorough study of the field you are about to venture into, the pros and cons of the business activity, time of launch are few things that will help you to analyse what the market niche warrants for and act accordingly. In further segments, let us look into the factors of risk, identifying and...