Posted by Managementguru in Financial Management

on Jan 2nd, 2015 | 0 comments

OBJECTIVES OF FINANCIAL #management Before looking into the two main objectives of finance management, let us look at the lighter side of money. Some hilarious quotes that will make your day: “Money is like a sixth sense – and you can’t make use of the other five without it.” – William Somerset Maugham “The safest way to double your money is to fold it over and put it in your pocket.” – Kin Hubbard “Money is the best deodorant.” – Elizabeth Taylor “If you think nobody cares if you’re alive, try missing a couple of car payments.” – Earl Wilson “Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.“ ~Sam Ewing “Too many people spend money they haven’t earned, to buy things they don’t want, to impress people they don’t like.” – Will Smith “There’s a way of transferring funds that is even faster than electronic banking. It’s called marriage.” — James Holt McGavran Objectives of Financial Management may be broadly divided into two parts such as: 1. #Profit maximization 2. #Wealth maximization. Profit Maximization The main purpose of any kind of economic activity is earning profit. A business concern operates mainly for the purpose of making profit. Profit has become the yardstick to measure the business efficiency of a concern. Profit maximization is also the out-moded and narrow approach, which aims at, maximizing the profit of the concern. Profit maximization consists of the following important features. Favorable Arguments for Profit Maximization: The following important points are in support of the profit maximization objectives of the business concern: Main aim is earning profit. Profit is the parameter of the business operation. Profit reduces risk of the business concern. Profit is the main source of finance. ##profitability meets the #social needs also. Unfavorable Arguments for Profit Maximization: The following important points are against the objectives of profit maximization: Profit maximization leads to exploiting workers and consumers. Profit maximization may lead to unethical practices, unfair trade practice, etc. Profit maximization objectives leads to inequalities among the #stake holders such as #customers, #suppliers, #public #shareholders, etc. Drawbacks of Profit Maximization: Profit maximization objective consists of certain drawbacks also: It is vague: Profit is not defined precisely or correctly. It ignores the #time value of money: Profit maximization does not consider the time value of money or the net present value of the cash inflow. It leads to certain differences between the actual cash inflow and net present cash flow during a particular period. It ignores risk: Profit maximization does not consider risk of the business concern. Risks may be internal or external which will affect the overall operation of the business concern. Wealth Maximization Wealth maximization is one of the modern approaches, which involves latest innovations and improvements in the field of the business concern. The term wealth means shareholder wealth or the wealth of the persons those who are involved in the business concern. Wealth maximization is also known as value maximization or net present worth maximization. This objective is a universally accepted concept in the field of business. Favorable Arguments for Wealth Maximization: Wealth maximization is superior to the profit maximization because the main aim of the business concern under this concept is to improve the value or wealth of the shareholders. Wealth maximization considers the comparison of the value to cost associated with the business concern. Total value detected from the total cost incurred for the business operation. It provides exact value of the business concern. Wealth maximization considers both time and risk of the business concern. Wealth maximization provides efficient distribution of resources. It ensures...

Posted by Managementguru in Marketing, Quotes and Quotes Only

on Jul 14th, 2014 | 0 comments

1. “Good branding without a good business plan is like prettying up a duck with no feathers. It may look good but it ain’t gonna fly.” Paul Provost, August 2010 2. “For a business not to advertise is like winking at a girl in the dark. You know what you are doing but no one else does.” Stuartt H. Britt, US advertising consultant 3. “The objective of all advertising is to buy new customers at a profit. Learn what your customers cost and what they buy…spend all of your ammunition where it counts.” Claude Hopkins-Scientific Advertising (1923) 4. “Nobody counts the number of ads you run; they just remember the impression you make.”– Bill Bernbach 5. “Nobody reads ads. People read what interests them, and sometimes it’s an ad.”- Howard Luck Gossage 6. “The only people who care about advertising are the people who work in advertising”– George Parker 7. “In advertising, not to be different is virtually suicidal” – Bill Burnbach 8. “Don’t find customers for your product. Find products for your customers” – Seth Godin. 9. “Give them quality. That’s the best kind of advertising.” – Milton Hershey 10. “If you can’t explain it to a six year old, you don’t understand it well enough yourself” – Albert Einsteen 11. “If you want to understand how a lion hunts, don’t go to the zoo. Go to the jungle.” – Jim Stengal 12.“The aim of marketing is to know and understand the customer so well the product or service fits him and sells itself.”– Peter Drucker 13. “In our factory, we make lipstick. In our advertising, we sell hope.”-Peter Nivio Zarlenga 14. “I don’t know the rules of grammar… If you’re trying to persuade people to do something, or buy something, it seems to me you should use their language, the language they use every day, the language in which they think. We try to write in the vernacular.”– David Ogilvy 15. “Don’t tell me how good you make it; tell me how good it makes me when I use it.” – Leo Burnett 16. “On the average, five times as many people read the headline as read the body copy. When you have written your headline, you have spent eighty cents out of your dollar.” – David Ogilvy 17. “People spend money when and where they feel good” – Walt Disney 18. “Half the money I spend on advertising is wasted, and the problem is I do not know which half.” Lord Leverhulme, British founder of Unilever and philanthropist 19. “In marketing I’ve seen only one strategy that can’t miss — and that is to market to your best customers first, your best prospects second and the rest of the world last.” – John Romero 20. “The philosophy behind much advertising is based on the old observation that every man is really two men — the man he is and the man he wants to be.” – William Feather 21. “In order for you to profit from your mistakes, you have to go out and make some.”- Unknown 22. “Eighty percent of success is showing up.” – Woody Allen 23. “Vision without action is a daydream. Action without vision is a nightmare.” – Japanese Proverb 24. “They may forget what you said, but they will never forget how you made them feel.” – Carl W. Buechner 25. ”There is nothing more difficult for a truly creative painter than to paint a rose, because before he can do so he has first to forget all the roses that were ever painted.” – Henri Matisse 26. “Simplicity is the ultimate form of sophistication” – Leonardo Da Vinci 27. Business has only...

Posted by Managementguru in Financial Accounting, Management Accounting, Principles of Management

on Mar 27th, 2014 | 0 comments

Management Vs. Financial Accounting Management Accounting : The process of preparing management reports and accounts that provides accurate and timely financial and statistical information to the management Financial Accounting : The purpose of accounting is to provide the information that is needed for sound economic decision making concerned with classifying, measuring and recording the transactions of a business. What is Management Accounting: Management accounting is the updated version of what you call financial accounting and the most circulated term in corporate business arena. Management involves planning, organizing, staffing, leading and controlling the resources available in an organization, namely the physical and human resources. Much importance is given to personnel management as they are the priceless assets of any organisation.But it is equally important for a firm to record all its business transactions for future reference and tax audits. Thus the necessity of accounting comes into the fray. Financial Statements Made Easy Functional Difference: Well, accounting means something to do with finance. So, what is the big difference, if it is financial or management accounting? One difference is in the title, and the other in their function. The rationale behind financial accounting is statutory, done for the benefit of shareholders, customers, government regulatory agencies, other external agencies, potential investors and the like. It records all business transactions that are purely monetary in nature and no further analysis is done. Essential for Management Planning: Management accounting is voluntary and reports are prepared to meet the internal needs of management. We talked about planning, for which interpretation and analysis of such quantitative data and other inputs becomes necessary to plan for future needs of management. The main functions being attention direction and problem solving, management accounting is primarily concerned with providing information relating to the various aspects of a business, like cost or profit associated with some portions of business operations. It employs techniques such as standard costing, budgeting, marginal costing, break- even analysis and so on., Inputs also stem from industry data, competitor data, published reports by public and private agencies and research studies findings, thus widening its scope for improvement in business operations. Financial Accounting: Financial accounting is restricted to deal only with “generally accepted accounting principles” and any deviation is considered to be errors for correction. Though it provides valid and authentic information, it lacks timeliness. The former restricts the accountant to a mere book-keeper while the latter transcends the role of the accountant to that of total business information technologist. Here he becomes an evaluator of different functional areas like marketing, production, purchase and personnel. As modern business is huge in size, complex, diversified and decentralized in terms of operations, financial accounting just does not fill the bill, as information is required as when an event happens at various hierarchical levels of an organisation. This infographic from Goodaccountants.com details the industries that employ the most accountants and auditors, and the results are very interesting! Management accounting is inter disciplinary in character and derives inspiration from organizational theory, economics, behavioral sciences, statistics and management. Although the paraphernalia required for management reporting is complex and expensive, it is worth the try, as it tries to compare and contrast the actuals with the standards and bring out variances if any. This is quite useful in determining the cost-effectiveness of a particular project or to be prepared for suitable action. Management accounting is nothing but a management information system where the managers have to be techno-savvy in order to handle the total information resource and project it suitably to the management to take timely actions for the increase in growth, profit and sustainability of the...

Posted by Managementguru in Business Management, Marketing, Organisational behaviour, Principles of Management, Strategy

on Mar 22nd, 2014 | 0 comments

PORTER’S FIVE FORCES Porter’s five forces analysis-draws upon industrial organization (IO) economics to derive five forces that determine the competitive intensity and therefore attractiveness of a market. Survival of the Fittest: True to Darwin’s theory “Survival of the fittest”, only competitive firms survive in the business market, provided, they have made the right strategic choice by comprehensively analyzing their position in the industry. Every organization is part of the industry and almost all of them face competition. Thus, industry and competition are the vital considerations for making a strategic choice. All the firms in a particular industry vie for the same set of customers by offering identical or similar products with minor variations. The analysis of the external environment in relation to the context of industry attractiveness thus becomes essential. A Critical Evaluation of Michael Porter’s Five Forces Framework Industrial Analysis: Industry analysis helps a firm to also fix long range plans, by gauging long term growth opportunities present if any. Strategic choice is nothing but, to screen all possible strategic alternatives followed by narrowing down the choice to the best suited and feasible alternatives and ultimately choosing an optimum strategy. To explain it in more clear terms, let us look at this example. Say, if there are three big players of car manufacturers in an automobile industry. Each follows their own strategic style to capture the market. What are the threat factors? Threat can be in the form of four-wheeler manufacturers like trucks and jeeps, but these cannot be competitively priced. Threat can be in the form of suppliers who dominate the industry by having a grip on the supply of components, sub-assemblies and accessories. Threat in the form of new entrants, but the growth might be restricted due to government regulations. A thorough analysis of the automobile industry thus made can make things clear to the firm, as to where they stand in terms of market share, what are their strengths and weaknesses, who pose a threat, what are the potential opportunities for growth and to tap market segments whose needs are unidentified. Still, it will be a seller’s market where the buyers have no bargaining power. On the other hand, if the weather does not favor its growth, the firm has to immediately decide on its next course of action, calling for diversification. The possible threats for a firm can come from five directions as mentioned below: Potential threat from new firms entering the market Threat from substitutes available in the market Threat from competitors Bargaining power of the suppliers Bargaining power of the buyers The structure and dynamics of an industry has to be analyzed in order to determine the intensity of competition and profitability. As the market is very dynamic, it becomes mandatory for firms to evolve strategies embracing a modern approach, with emphasis on reappraisal of existing strategy in the light of changing external conditions and formulation of alternative...

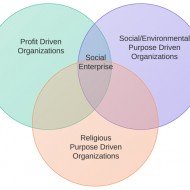

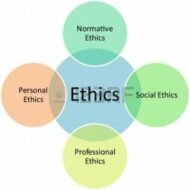

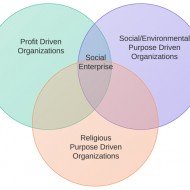

Posted by Managementguru in Business Ethics, Business Management, CSR, Human Resource, Principles of Management

on Mar 12th, 2014 | 0 comments

What is the relationship between Corporate Social Responsibility and Business Ethics Business ethics can be defined as the principles and standards that establish acceptable conduct in business organizations. The acceptability of behaviour in business is determined by customers, competitors, government regulators, interest groups, and the public, as well as each individual’s personal moral principles and values. Can Ethics be Taught? I feel that ethics cannot be taught: it is an inbuilt entity and in countries like India where religion is all pervasive in business or any other discipline, this quality is imbibed in every individual right from his birth. The power of money and authority plays a major role in changing a man’s perspective and bureaucratic hurdles and red tapism mar the pace of business development. Businessmen should never compromise ethical principles with short-sighted objectives of amassing material wealth but should develop a spirit of altruism. Management education should focus also on training the individuals to be ethic-savvy apart from being mere decision making authorities satisfied with their designation and power of authority. Employees have the same kind of ethical responsibility towards their organisation and should not misuse time and property and should not place their interests before the enterprise objectives. What is Corporate Social Responsibility? Many consumers and social advocates reckon that businesses should not only make a profit but also consider the social implications of their activities. We define social responsibility as a business’s obligation to maximize its positive impact and minimize its negative impact on society. Although many people use the terms social responsibility and ethics interchangeably, they do not mean the same thing. Business ethics relates to an individual’s or a work group’s decisions that society evaluates as right or wrong, whereas social responsibility is a broader concept that concerns the impact of the entire business’s activities on society. There are good business reasons for a strong commitment to ethical values: 1. Ethical companies have been shown to be more profitable. 2. Making ethical choices results in lower stress for corporate managers and other employees. 3. Our reputation, good or bad, endures. 4. Ethical behaviour enhances leadership. 5. The alternative to voluntary ethical behaviour is demanding and costly regulation. Points to Ponder relating to behavioral ethics. 1. What conflicts of interest have you personally experienced in personal or professional roles? 2. If you perceive a potential conflict for yourself, what are some ways you might ensure that this conflict doesn’t lead to unethical behavior for you and others? 3. When have others’ conflicts of interest impacted how you or those you know were treated? 4. What types of policies can or do organizations implement to try to reduce conflicts of interest or their costs? 5. Why do you believe conflicts of interest are so pervasive in society? Why don’t we take more steps to avoid them? 6. Why is it so hard for individuals to recognize their own conflicts of interest, and how is this impacted by behavioral biases? Unethical behavior,conflicts,personal interests,responsibility What is Conflict of Interest? Conflict of interest arises when there is a clash between responsibility and reward. Say, if a doctor decides to be more business-like, if a judge decides to favor one party, if a ruling party favors a decision not good for the masses, what will happen? A conflict of interest exists when a person must choose whether to advance his or her own personal interests or those of others. Wal-Mart Stores, Inc., may have the toughest policy against conflict of interest in the retail industry. Sam Walton, the late founder of Wal-Mart, disallowed company buyers from accepting so much as a cup of coffee from suppliers. The Wal-Mart policy is black...