Posted by Managementguru in Financial Management, How To, How to make money online

on Sep 29th, 2016 | 0 comments

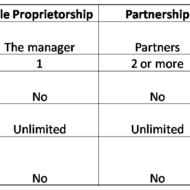

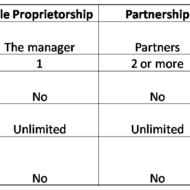

An organization is formed in two ways: 1. When an individual makes an investment to start a business – it is called private business or sole proprietorship. 2. When a group of people (two or more) come together, make investment to run a business, it is called a partnership. What is a Company? The above said partnership is formed with known faces. When unknown people or the general public is incorporated into the partnership, it is called a company. Companies are registered under “Registrar of Companies”. The company is held accountable for the entire liabilities and not the stock holders. What is meant by Stock? The shares released by the companies for the general public to buy is called stock. What is meant by Stock Market? The place where shares are bought and sold is a stock market. Small traders, commission agents/brokers, big traders form the core of this market. The popular stock markets in India are the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). Worldwide, New York Stock Exchange, London Stock Exchange, NASDAQ and Hong Kong Stock Exchange are extremely popular. What are the different types of Stock Market? 1. Primary Market: When a company issues its first stock to the general public, it is called IPO – Initial Public Offering. 2. Secondary Stock Market: To purchase or sell an existing stock a secondary market has to be approached. After IPO a company’s share is listed in the stock market. After this the investors can sell the shares in the market. The current stock value determines the demand for that company’s share. Who is a Share Holder? The shares released by the companies have a face value determined. Investors who buy these shares at the face value or more are called shareholders. Who are Stock Brokers? The members of the stock market are called stock brokers. The power to buy/sell a share, trade on behalf of an individual/company is vested upon these stock brokers. If you plan to buy a share, you need a stock broker and a DEMAT account. How Stock Market Works? View this post on Instagram A post shared by ManagementGuru (@managementguru) Price of the Stock How Traders Make Money?...

Posted by Managementguru in Business Management, Financial Management, Principles of Management

on Feb 21st, 2014 | 0 comments

Every business organisation’s aim is to make profit and more profit. Does it end there? What should be the real motive behind running an organization? Profit maximization alone does not help the organization to firmly plant its feet in the business environment, as the success of an organization in the long run is decided by many critical factors like, market share, value of the company shares, market stand, image etc. So, shall we say, let wealth maximization be the goal of any organization, which focuses on increasing the “earnings per share” of the share holders. What is Profit Maximization? Profit maximization does not take into consideration, the interest of share holders or stake holders, who ought to be the ultimate beneficiaries. Concentrating on short term profits confines a firm and limits its scope and growth whereas; value creation is something that the management should aim for, as it helps to increase the “net worth” of a company. Mere price versus output calculations make firms to operate in a profitable manner, but it should never be the only objective of a firm, as it has the moral and social responsibility to patronize its shareholders by increasing the net worth of the company. Underlying Logic While maximizing profit, a firm either produces maximum output for a given amount of input, or uses minimum input for producing a given output. Thus the underlying logic for profit maximization is efficiency. Under perfect competitive market conditions, profit serves as a perfect measure for the performance of a firm. If profit is the motive of a firm, it fails to consider the time value of money which is an important criterion that decides the success of a firm, and also it values benefits received today and after a period as the same. Moreover the uncertainty factor is there to be considered too. Firms always prefer to have smaller but surer profits rather than larger benefits but less certain. Impact of Taxes When we talk about profits, the next indispensable factor will be the taxes that demand a portion of your profit. Maximizing profits after the payment of taxes facilitates the firm to increase the net profit ratio to serve the best interests of the owners. But, this also fails to maximize the economic welfare of the owners, as it does not take into account, the timing and uncertainty of the benefits. Wealth maximization is the ideal alternative that is consistent with the survival goal and also with the personal objectives of managers such as recognition, power, status and personal wealth. The Right Balance between Risk and Return Mangers while deciding on investment options, seek to achieve a right balance between risk and return. If the firm borrows heavily to finance its operations, care should be taken to ensure that, the rate of return on investment should be sufficient enough to support the payment of interests on borrowings and also to repay the principal. If the firm is not able to “service the debt” there is a danger of the firm becoming bankrupt or insolvent. The firm’s investment and financing decisions are unavoidable and continuous. In order to make rational decisions, the firm must have a goal, which is nothing but the “shareholder’s wealth maximization” which is theoretically logical and operationally...