Posted by Managementguru in Financial Management, How To, How to make money online

on Sep 29th, 2016 | 0 comments

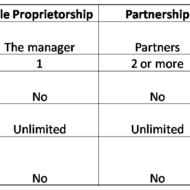

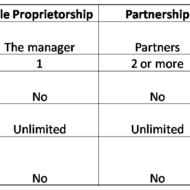

An organization is formed in two ways: 1. When an individual makes an investment to start a business – it is called private business or sole proprietorship. 2. When a group of people (two or more) come together, make investment to run a business, it is called a partnership. What is a Company? The above said partnership is formed with known faces. When unknown people or the general public is incorporated into the partnership, it is called a company. Companies are registered under “Registrar of Companies”. The company is held accountable for the entire liabilities and not the stock holders. What is meant by Stock? The shares released by the companies for the general public to buy is called stock. What is meant by Stock Market? The place where shares are bought and sold is a stock market. Small traders, commission agents/brokers, big traders form the core of this market. The popular stock markets in India are the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). Worldwide, New York Stock Exchange, London Stock Exchange, NASDAQ and Hong Kong Stock Exchange are extremely popular. What are the different types of Stock Market? 1. Primary Market: When a company issues its first stock to the general public, it is called IPO – Initial Public Offering. 2. Secondary Stock Market: To purchase or sell an existing stock a secondary market has to be approached. After IPO a company’s share is listed in the stock market. After this the investors can sell the shares in the market. The current stock value determines the demand for that company’s share. Who is a Share Holder? The shares released by the companies have a face value determined. Investors who buy these shares at the face value or more are called shareholders. Who are Stock Brokers? The members of the stock market are called stock brokers. The power to buy/sell a share, trade on behalf of an individual/company is vested upon these stock brokers. If you plan to buy a share, you need a stock broker and a DEMAT account. How Stock Market Works? View this post on Instagram A post shared by ManagementGuru (@managementguru) Price of the Stock How Traders Make Money?...

Posted by Managementguru in Accounting, Financial Accounting, Financial Management, Principles of Management

on Feb 28th, 2014 | 0 comments

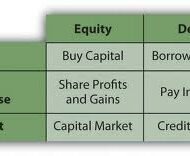

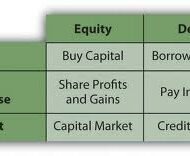

What is your Capital Structure Make up A company in course of charting out its financial schema has to take into account two things. 1) The amount of capital to be raised. 2) Make-up of the capital. Decisions regarding the composition or capitalization are reflected in capital structure. Capital structure of a firm is a combination of debt and equity, which supports long term financing of the firm. The pattern of capital structure has to be planned very carefully by the finance manager in such a way that it minimizes the cost of capital and maximizes value of stocks, thus protecting the interest of the share holders. What is the right capital mix? There needs to be a right mix of different securities in total cpaitalisation that facilitates control, flexibility and maneuverability. From a broad perspective, following are the three fundamental ways in which the schema of capital structure is finalized: Financing purely or exclusively by equity Financing by equity and preferred stock Financing by equity, preferred stocks and bonds. Which of the above most suits a firm depends on multifarious internal and external factors within which a firm operates. Equity: A firm can raise substantially large amount of fund by issuing different types of shares. The money thus raised is a permanent source of resource and without any obligation to refund to the respective owners. Small and growing companies go for equity fund raising as no banks or other financial institutions are prepared to fund these firms in lieu of poor credit worthiness. Even big corporate firms opt for issuing equities when there is a need to raise large sums. But smaller firms, whose major share of capital comprises of common stock, have to be careful, in that, some large concerns might become interested in controlling these stocks. Picture Courtesy : GrowthFunders The one big advantage of equity shareholders is that they are free to trade the shares in the market. They can sell the shares to anybody at any time and if the market warrants, at a higher price. One has really nothing to lose, if he is planning to invest in equities. On the other hand, if the company goes bankrupt, the share holders stand a chance to receive only the residual amount, after the creditors’ claims are cleared and satisfied. What’s in it for Investors? Debt: Debt has a maturity date upon which the stipulated sum of principal is repaid. It places the burden of obligation on the shoulders of the company in the form of periodical interest settlements and principal repayments. Creditors can go for legal action if the company defaults in payment of the assured sum on the specific date. That’s why companies think twice before they go for issuing debentures and other bonds. One good thing for the company is that, it can avail tax rebate on the securities of debt, but at the other end it has to satisfy the interest payments and factorise the cost of capital. Cost and Control Principles Cost principle supports induction of additional doses of debt, but it might prove risky, if the company is not able to service the additional debt. Control principle supports the issue of bonds in order to tighten the rein of ownership, but maneuverability principle discounts this and favors issue of common stock to reduce the interest burden. Four factors are important in the purview of the finance manager, cost, risk, control and timing. He should be able to evolve a pattern that satisfactorily brings a compromise among these conflicting factors, which are then assigned weights in the wake of economic and industrial...

Posted by Managementguru in Financial Accounting, Financial Management

on Feb 21st, 2014 | 0 comments

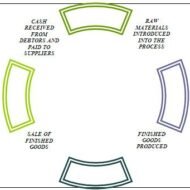

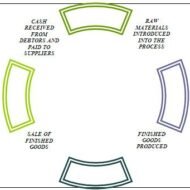

Applications of fund Purchase of fixed assets – leads to outflow of funds, but at the same time adding assets to your organization always improves the financial position of your firm. You can also use these assets as “collaterals” for availing loans in banks. Redemption of preference shares – you have to apportion your operating profit in order to satisfy the preference share holders with interest. This will give you a clear idea of the earnings available for the equity share holders. Fund that is lost during business operations – Due to wrong investments and credit policies, sometimes your funds get sticky and recovery becomes next to impossible. Repayment of loans – although the fund goes out, you free yourself from further interest burden and reduce your credit limit with the bank. Remember,it is better to repay the loans from your profit. Redemption of debentures – It is easy to raise money from debentures, because people are rest assured of their payment at a fixed date. But the cost of servicing the debt might sometime exceed the concessional advantages on raising such securities. https://gumroad.com/l/wqbu A systematic study of fund flow facilitates in ascertaining the soundness of your firm’s financial condition and it also helps to formulate the right kind of dividend policies. Net working capital is the life line of a firm’s day-to-day operations and we can surely say that a company is prosperous if it has a surplus of net working capital at any given point of time. The financial manager of your company should have the vision to predict changes in the stock market and play the cards accordingly. It needs an in-depth understanding and analysis of the market conditions with a wider...