Posted by Managementguru in Financial Management, How To, How to make money online

on Sep 29th, 2016 | 0 comments

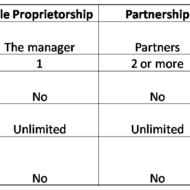

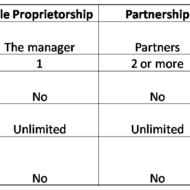

An organization is formed in two ways: 1. When an individual makes an investment to start a business – it is called private business or sole proprietorship. 2. When a group of people (two or more) come together, make investment to run a business, it is called a partnership. What is a Company? The above said partnership is formed with known faces. When unknown people or the general public is incorporated into the partnership, it is called a company. Companies are registered under “Registrar of Companies”. The company is held accountable for the entire liabilities and not the stock holders. What is meant by Stock? The shares released by the companies for the general public to buy is called stock. What is meant by Stock Market? The place where shares are bought and sold is a stock market. Small traders, commission agents/brokers, big traders form the core of this market. The popular stock markets in India are the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). Worldwide, New York Stock Exchange, London Stock Exchange, NASDAQ and Hong Kong Stock Exchange are extremely popular. What are the different types of Stock Market? 1. Primary Market: When a company issues its first stock to the general public, it is called IPO – Initial Public Offering. 2. Secondary Stock Market: To purchase or sell an existing stock a secondary market has to be approached. After IPO a company’s share is listed in the stock market. After this the investors can sell the shares in the market. The current stock value determines the demand for that company’s share. Who is a Share Holder? The shares released by the companies have a face value determined. Investors who buy these shares at the face value or more are called shareholders. Who are Stock Brokers? The members of the stock market are called stock brokers. The power to buy/sell a share, trade on behalf of an individual/company is vested upon these stock brokers. If you plan to buy a share, you need a stock broker and a DEMAT account. How Stock Market Works? View this post on Instagram A post shared by ManagementGuru (@managementguru) Price of the Stock How Traders Make Money?...

Posted by Managementguru in Business Management, Operations Management

on Feb 18th, 2015 | 0 comments

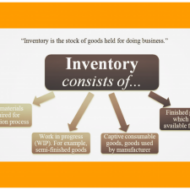

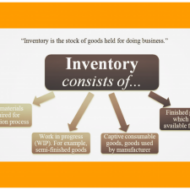

Inventory Control Learning Objective: To know the meaning, types and functions of inventories Meaning of Inventory: The word inventory refers to any kind of resource having economic value and is maintained to fulfil the present and future needs of an organization. Fred Hansman has defined Inventory as “An idle resource of any kind provided such a resource has economic value”. Such resources may be classified into three categories: A. Physical resources such as raw materials, semi-finished goods, finished goods, spare parts, lubricants etc. B. Human resources such as unused labor (man power) and C. Finance resources such as working capital etc. Inventory of resources is held to provide desirable service to customers and to achieve sales turnover target. At the same time holding big inventory severely affects the cash flow and working capital of an organization if the production vs demand cycle is not stream-lined. Because inventory often represents more than 25% of total assets and therefore it becomes very essential to maintain an optimal level of inventory in each resource so that the total inventory cost is near its minimum. Functions of Inventory: Inventory serves several important functions that add flexibility to the operations of a firm. Provides stock of goods to meet the anticipated demand of customers. In the case of consumer goods with a seasonal demand, the establishment of inventories in distribution and production warehouses also ensures that production can run continuously at full capacity despite swings in seasonal demand. De-Coupling function: The down time in one manufacturing stage should not affect the whole manufacturing process and this vital purpose is solved by holding inventory which acts as a buffer between successful stages of production. Quantity Discounts: Many suppliers offer QD’s for large orders of inventory. Procurement warehouses can result from a company’s desire to get volume discounts from a supplier or more favorable conditions from a carrier. Price speculation – Inventory also helps to hedge against inflation and price changes. Inventories of procurement and distribution warehouses are increased if the price of a good is expected to rise. In such a situation, the purchasing company aims to amass the good at the current low price. The supplier may speculate that supply shortages will drive the prices higher, and he uses the warehouse to store the good. Shortages can occur regularly due to irregular supply of raw materials, weather, quality problems or improper deliveries. Inventory shall act as “safety stock’ – extra goods on hand which reduce the risk of stock-outs. Helps to permit operations to continue smoothly with the use of “work in process” inventory. This is because it takes time to make goods and because a pipeline inventory is stocked through-out the process. JUST IN TIME MANUFACTURING CONCEPT Types of Inventory: Inventory can be classified according to the basis of type of material maintained in the firms and also on the basis of the functions they tend to perform in an organization. On the basis of type of material, the firms maintain four types of inventories: Raw material inventory Work in process inventory Maintenance/operating supply (MRO) inventory and Finished goods inventory Raw material inventory is the one which has been purchased and yet to be processed. The work in process material has undergone some change but is not completed. Work in process exists because of the time it takes for a product to be made which is called the “CYCLE TIME.” MRO inventory is devoted to maintenance/repair/operating supplies. They exist because the need and timing for maintenance and repair of some equipment are unknown. Products completed and waiting for shipment are called finished goods inventory. Finished goods may be inventoried because customer demand for...

Posted by Managementguru in Accounting, Decision Making, Financial Management, Management Accounting, Principles of Management

on Mar 30th, 2014 | 0 comments

TURNOVER RATIO OR ACTIVITY RATIO or ASSET MANAGEMENT RATIO Turnover ratios are also known as activity ratios or efficiency ratios with which a firm manages its current assets. The following turnover ratios can be calculated to judge the effectiveness of asset use. Inventory Turnover Ratio Debtor Turnover Ratio Creditor Turnover Ratio Assets Turnover Ratio 1. INVENTORY TURNOVER RATIO This ratio indicates whether investment in stock is efficiently used or not, in other words, the number of times the inventory has been converted into sales during the period. Thus it evaluates the efficiency of the firm in managing its inventory. It helps the financial manager to evaluate the inventory policy. It is calculated by dividing the cost of goods sold by average inventory. Inventory Turnover Ratio = Cost of goods sold / Average Inventory (or) Net Sales / Average Stock Cost of goods sold = Sales-Gross profit Average Stock =Opening stock + Closing stock/2 2. DEBTOR TURNOVER RATIO Debtors play a vital role in current assets and to a great extent determines the liquidity of a firm. This indicates the number of times average debtors have been converted into cash during a year. It is determined by dividing the net credit sales by average debtors. Debtor Turnover Ratio = Net Credit Sales / Average Trade Debtors (or) Net Credit Sales / Average Debtors – Average Bills Receivable Net credit sales = Total sales – (Cash sales + Sales return) Total debtors = [ Op.Dr. + Cl.Dr. / 2 + Op.B/R + Cl. B/R / 2] When the information about credit sales, opening and closing balances of trade debtors is not available then the ratio can be calculated by dividing total sales by closing balances of trade debtor Debtor Turnover Ratio = Total Sales / Trade Debtors Note: Bad and doubtful doubts and their provisions are not deducted from the total debtors. The higher ratio indicates that debts are being collected promptly. 3. CREDITOR TURNOVER RATIO This is also known as “Creditors Velocity”. It indicates the number of times sundry creditors have been paid during a year. It is calculated to judge the requirements of cash for paying sundry creditors. It is calculated by dividing the net credit purchases by average creditors. Creditor Turnover Ratio = Net Credit Purchases / Average Trade Creditor (or) Net Credit Purchases / Average Creditors + Average Bills Payable Net credit purchases = Total purchases – (Cash purchase + Purchase return) Total Creditors = [Op.Cr. + Cl.Cr. / 2 + Op. B/P + Cl. B/P / 2] The higher ratio should indicate that the payments are made promptly. Net credit purchases consist of gross credit purchases minus purchase return. When the information about credit purchases, opening and closing balances of trade creditors is not available then the ratio is calculated by dividing total purchases by the closing balance of trade creditors. Creditor Turnover Ratio = Total purchases / Total Trade Creditors 4. ASSETS TURNOVER RATIO The relationship between assets and sales is known as assets turnover ratio. Several assets turnover ratios can be calculated depending upon the groups of assets, which are related to sales. a) Total asset turnover. b) Net asset turnover c) Fixed asset turnover d) Current asset turnover e) Net working capital turnover ratio a. TOTAL ASSET TURNOVER This ratio shows the firms ability to generate sales from all financial resources committed to total assets. It is calculated by dividing sales by total assets. Total asset turnover = Total Sales / Total Assets b. NET ASSET TURNOVER This is calculated by dividing sales by net assets. Net asset turnover =Total Sales / Net Assets Net assets represent total assets minus current liabilities. Intangible and fictitious assets like goodwill, patents, accumulated losses, deferred expenditure may be excluded for...