As a first-time entrepreneur, learning the ins and outs of your market, the business, and determining an effective strategy are all important keys to success. One aspect that is often overlooked by many first-time entrepreneurs, however, is a successful wealth management strategy.

In order to remain competitive in the market that you are entering, you need to be financially ready.

The preparations a business makes in its financial management strategy in the early stages can often be the reason why some businesses succeed while others fail.

Proper wealth management is crucial to your success, so take the time now to become familiar with the concept and how you can apply best practices to your own business venture.

The first step in proper wealth management is becoming familiar and comfortable with your current personal and business financials.

Working with a financial adviser can be an important strategic step to take to make sure that you have everything in place in order to effectively start and operate a business.

They can also work with you to understand your credit score, future wealth projections, and strategies for overcoming unforeseen expenses.

When entrepreneurs go into business blindly without preparation, it can be difficult to overcome the debt that this forces individuals to incur.

Setting your sights on the future and preparing for them now will help you tackle emergencies and challenges as you are faced with them.

Read On: Brave New Life: How to Start an Agency After a Freelancing Career

A resourceful article from TimeClockWizard that operates an extremely popular employee time management tool for small businesses.

A successful entrepreneur should possess the ability to remain agile in any situation.

Adapting to changes in the market and being flexible with consumer demands are favorable traits that will help increase profits in the long run. In the presence of a situation, however, a business owner may be required to come up with cash quickly.

Finding solutions to meet the demands of the market and your customers often requires strategic thought processes around ways to better manage your current costs.

Read On: How To Start A Business In The UK?

An exceptionally valuable guide, which provides secrets from industry experts to starting a successful business in the UK .

Because costs are often unavoidable and may come during the most unexpected of times, it’s important that during these times you utilize the resources around you.

Making the right decision for your business could mean taking out a loan, seeking out an investor, or restructuring personal expenditures such as refinancing your home. Whichever decision you decide is right for you, know that there are many options to help you access the cash you need.

For your commercial insurance needs, Krywolt Insurance has the right answers.

Every entrepreneur has their own reasons for choosing to start a business. Likely reflective of their desire to do more with their personal passions and talents, becoming an entrepreneur is a goal that many hope to achieve.

Once you have successfully completed your goal of starting a business, it’s important to set goals for your business as well. Setting egocentric goals of “becoming a millionaire” or “becoming the best at …” won’t help drive your business forward.

Many entrepreneurs fall into the trap of thinking they will become rich or successful simply by starting their own venture. This can cause any business to fail as the most valuable stakeholders in a business venture often get forgotten.

Your investors, employees, and customers are all important to helping your business achieve its goals.

Working together with a cohesive vision that starts with smaller goals and leads to bigger ones will give you the best shot at achieving success.

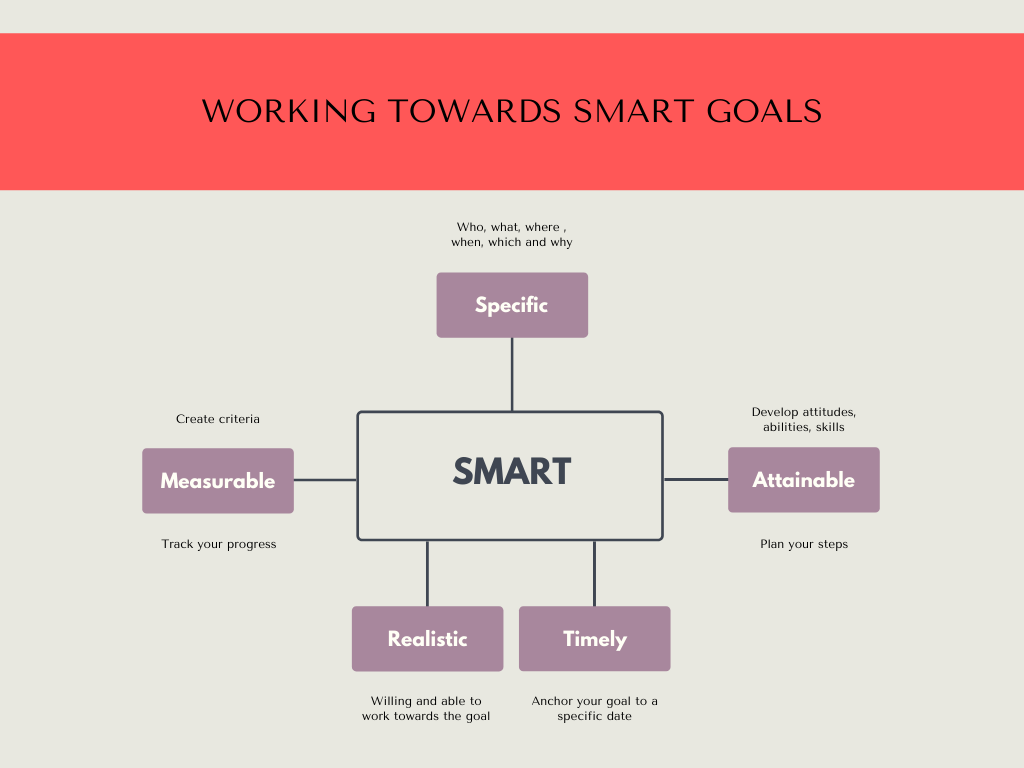

When setting these goals, be sure that they are specific, measurable, attainable, realistic, and timely – also known as SMART goals.

The path to strategic wealth management doesn’t have to be traveled alone.

Working with the resources available to you and with individuals who can support you on your journey is a smart methodology for achieving the dreams you set forth.

Reading case studies or talking to experts in your desired field who have experienced the process of managing a financial portfolio for a budding business can be useful as you will learn from their past.

Don’t be afraid to ask around – you may be surprised by those who are willing to share ideas and help you along the way.

For any entrepreneur, there can be a lot to learn about the financial demands of running a business.

When first starting out, research experts in your area for processes that you may not fully comprehend just yet. For example, you may want to lean on skilled accountants during tax season, call a lawyer to help you understand and negotiate contracts, or talk with a financial adviser to ensure everything is operating properly.

Wealth management as a first-time entrepreneur is a difficult task to take on. It’s not always going to be easy, but using your resources and remaining organized will help you reach the financial goals you wish to achieve. Give yourself time and patience to master all that it requires and you may soon find yourself becoming an expert.