Venture capital is a new form of financing that has come as a boon for young entrepreneurs and it plays a strategic role in financing small scale enterprises and high technology and risky ventures.

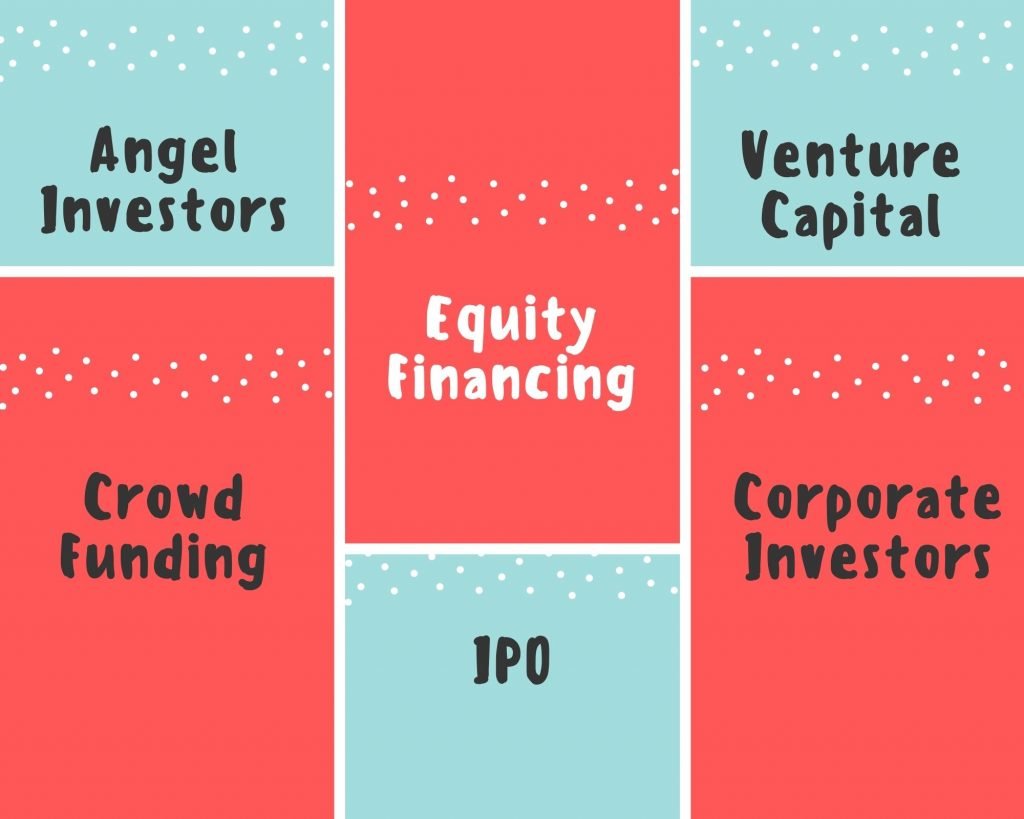

In all the developed and developing nations it has made its mark by providing equity capital, so, they are more like equity partners rather than financiers and they are benefited through capital gains.

Young and growing businesses need capital at the right time, not only to float their company in the market but also to survive in the long run.

When financial institutions like banks and other private financial organizations hesitate to take the risk of early stage financing, since the credibility of the budding firm is not established, venture capital firms comes into the foray to fund the project in the form of equity which can be termed as “high risk capital”.

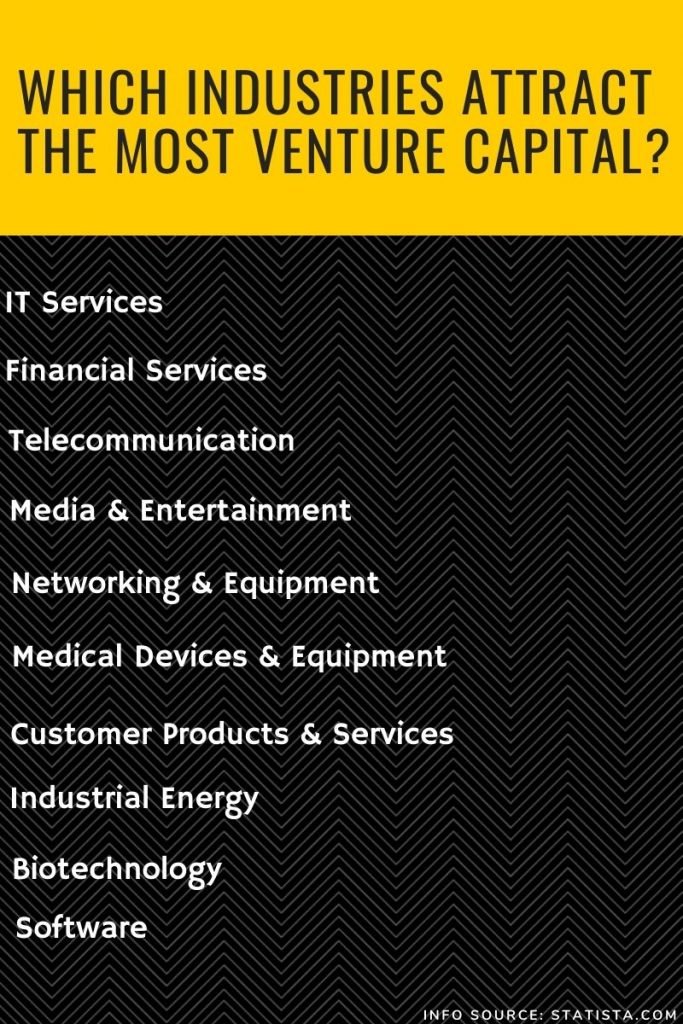

Although there is a misconception that the interest of venture capital firms is mainly driven by cutting edge technology in the industry, it is not always the case with all venture capital firms.

A venture capitalist associates high risk with huge profits; of course after thoroughly analyzing the prospects and consequences and the viability of the project.

The venture capitalist becomes a partner with the entrepreneur in his business.

True venture capital financing need not confine itself to high end technology products. Any risky idea with great potential can be financed and venture capital is an all powerful mechanism to promote and institutionalize entrepreneurship.

Mainly venture capital focuses on growth. A venture capitalist is very much interested to see a small business growing into a larger one.

He assists in setting up the business, funding it and travels all along to see the firm grow. If it is potential equity participation, the venture capitalist can come out of the partnership once the company becomes profitable and take back his money by selling the shares or convertible securities.

If the firm opts for a long term investment from the venture capital finance, the financier has to develop an investment attitude for a long term, say five or ten years to allow the company to make large profits.

Another form of financing is that the venture capitalist has his hands on management by which he becomes an active participant in the operations of the firm and his thinking is streamlined as to how to multiply and make quick money which is a win-win situation for both sides.

Not only finance, the venture capitalist also contributes to marketing, technology upgradation and management skills to the benefit of the new firm.

The venture capitalist’s management approach is significantly different from that of a banker whose prime concern is collaterals and securities in the form of assets.

He keeps his hands off the management and plays safe. The venture capitalist can also not behave like a stock market investor who invests money without having thorough knowledge about the company’s business and management.

He combines the qualities of a banker, stock market investor and an entrepreneur in one.

Latest trend is that popular and giant software companies promote their content through the budding enterprises, by providing with the latest technology, training and expertise apart from financing.

This spreads the geographical area of operations of the parent company and also expand their territory to scale greater heights.

Venture capital firms should focus on fostering growth and development of the enterprise and need not confine their interests only to finance technology, infrastructure, information technology services and the like.

They need to diversify their investment in various sectors and even revival of sick units can be thought of as one of the options if there is potential in the business.